Lower-Tier Crypto Exchanges Still Dominate Market, Research

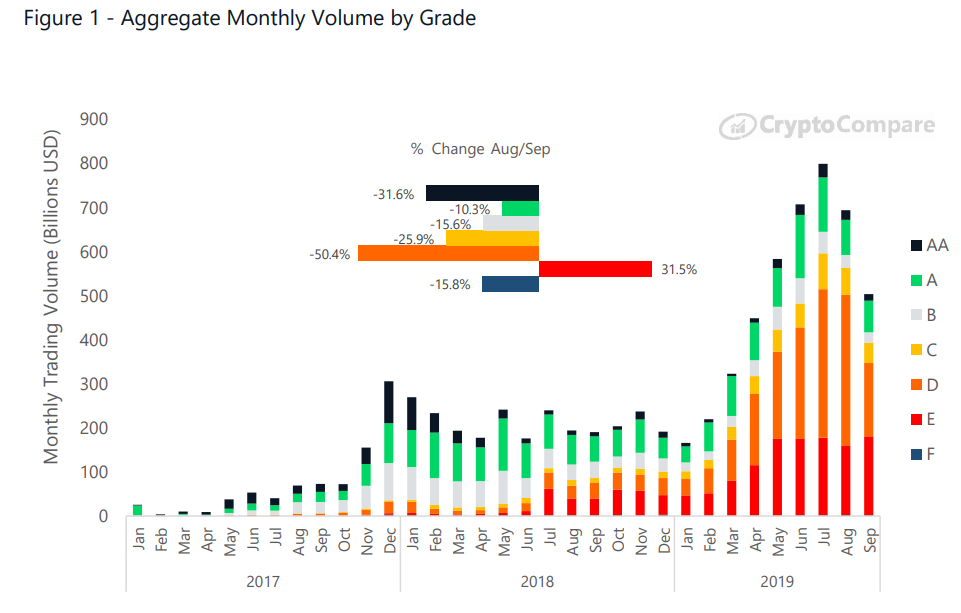

CryptoCompare recently published its September review of crypto exchanges’ activity. The platforms with lower ratings still dominate the market, accounting for over 70% or $347.2 billion.

Volume of E-Rated Crypto Exchanges Surge 31.5%

Interestingly, the aggregate monthly volume of E-rated crypto exchanges jumped 31.5% while the rest of the groups saw negative figures. Thus, volume figures of exchanges graded AA, A, and B tumbled 31.6%, 10.3%, and 15.6%, respectively.

This demonstrates that crypto traders were more willing to use services like CoinEx, Kuna, and IDEX instead of platforms like Coinbase and Binance.

Nevertheless, E-rated crypto exchanges didn’t help lower-tier exchange avoid a decline in volumes. Thus, on aggregate, lower-tier services (C, D, E, and F-rated) saw their September volume falling by 29.7%. On the other side, aggregate top-tier exchange (AA, A, and B) volume declined by 15%.

Still, lower-tier crypto exchanges account for a larger share of the market, with almost 80%. Elsewhere, aggregate top-tier exchange volume accounts for 21.9% of the market, with $111 billion, up 1% compared to August. In July, top-tier platforms represented 32% of the market, with AA and A-rated services accounting for a quarter of the total volume on all exchanges.

It’s worth mentioning that trading volumes in general declined in September to the lowest levels since May.

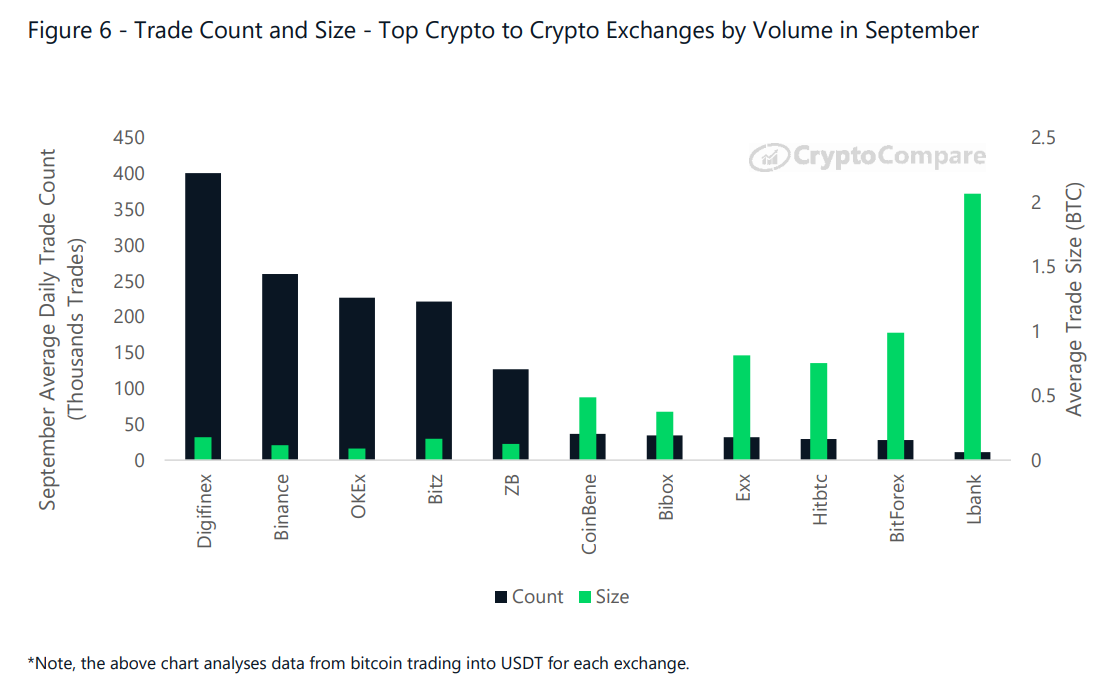

Digifinex Processed Largest Number of Trades

Among top exchanges, Digifinex (D-rated) saw the largest average number of daily trades, with 400,000 trades amid a low average trade size of 0.177 BTC. Binance handled about 300,000 trades per day with 0.114 BTC per trade on average.

Among fiat crypto exchanges, Liquid noted the largest number of average daily trades, with 575,000 trades amid a low average trade size of 0.038 BTC. Elsewhere, platforms like itBit, Gemini, and Coinone saw a much lower daily trade count, with 1,680, 5,200, and 13,900 trades respectively, combined with larger trade sizes – 0.4, 0.27, and 0.12 BTC respectively.

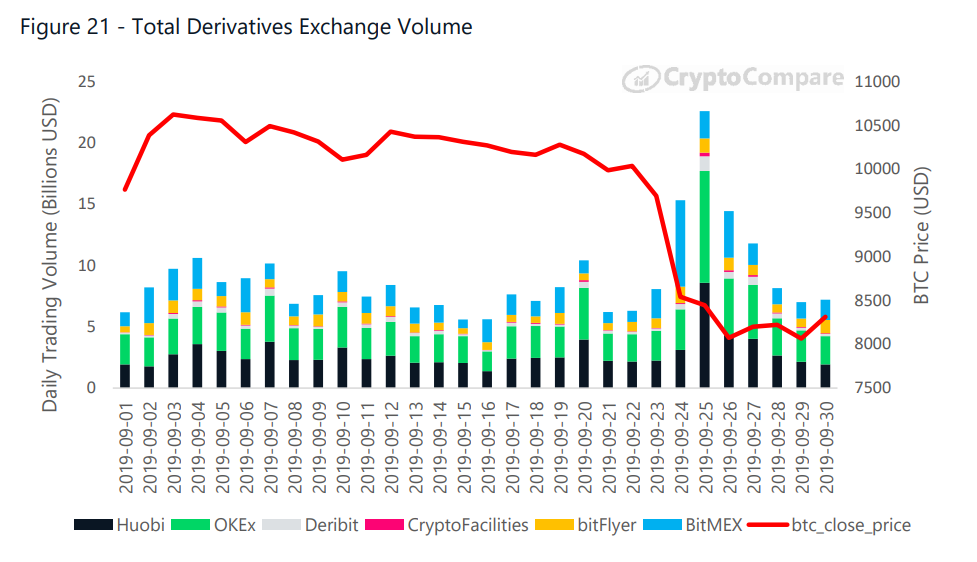

Institutional Products and Derivatives

According to CryptoCompare, Bitcoin products aimed at institutional investors are still dominated by Chicago-based CME, whose total trading volume for the month declined 18.3% from August, to $4.82 billion.

Elsewhere, Grayscale’s bitcoin trust product (GBTC) saw its trading volume declining by 37.5% from August, to $713.6 million.

When it comes to crypto derivatives, OKEx leads the market with $90.34 billion in volumes, down 14.9% from August. Huobi comes next with $84.52 billion, down 7.3% from August.

Do you think we should regard crypto trading volume as an accurate measure or is most of it fake? Share your thoughts in the comments section!

Images via Shutterstock, CryptoCompare

The post Lower-Tier Crypto Exchanges Still Dominate Market, Research appeared first on Bitcoinist.com.

OhNoCryptocurrency via https://ift.tt/2PblI7a @Anatol Antonovici, @Khareem Sudlow