Why Major Emerging Markets Are Turning to Crypto Assets ─ Japan is also a strange move[Column]| coindesk JAPAN | Coindesk Japan

With the United States in a political stalemate, other regions are building regulatory frameworks for crypto assets (virtual currencies). Now, it would be important to consider the evolution and prospects of citizen demand for crypto assets.

As big nations suffer from inflation, fiat currency instability and monopoly control over financial access, citizens are becoming more familiar with crypto assets and growing distrust of centralized mechanisms.

Crypto Asset Situation in Pakistan

The government of Pakistan (population over 239 million, 5th largest in the world) recently announced that cryptocurrencies would not be legalized in the country to avoid penalties from the FATF (Financial Action Task Force on Money Laundering). Never,” he was quoted as saying.

On the surface, it may look like an overreaction to the FTAF’s position. The FATF chair recently released a letter titled “An end to the laws of crypto space,” calling for regulation rather than outright bans on crypto assets.

However, Pakistan has a somewhat tense relationship with the FTAF, and was removed from the “grey list” (designated as a country with “deficiencies” in anti-money laundering controls and restricted from participating in international finance) in October last year. I just got it.

Moreover, it is not difficult to see the influence of the IMF (International Monetary Fund) here. Pakistan is currently negotiating with the IMF over a relief program. But negotiations have stalled, and concerns about Pakistan’s political and economic problems are beginning to spill over into its neighbors. The IMF has made no secret of its distrust of the cryptocurrency market, and several months ago it included clauses in its negotiations with Argentina to curb its use of cryptocurrencies.

Nevertheless, crypto assets are actively used in Pakistan. Citizens are reportedly replacing their salaries with stablecoins out of fear that the fiat currency will depreciate. The legal tender Pakistani rupee has fallen more than 20% against the US dollar since the beginning of the year, and more than 30% in the past year.

on the other hand,Bitcoin (BTC) price in Pakistani rupees rises 103% since the beginning of the year (63% in US dollars). It is no coincidence that a 2022 report from blockchain analytics firm Chainalysis ranks Pakistan as sixth in the world in terms of cryptocurrency penetration.

Nigeria, Türkiye and even Japan

Nigeria (population of over 218 million, 6th in the world) is also active in cryptocurrency use. If a new president takes office, the country is likely to devalue its currency to address trade imbalances and a shortage of dollars.

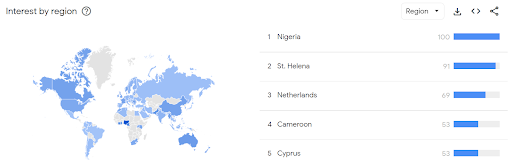

According to Chainalysis, Nigeria ranks 11th in global cryptocurrency penetration. Looking back over the past 90 days on Google Trends,The search term “crypto” was the most frequently used search term in the world, and “bitcoin” was the second most frequently used search term..

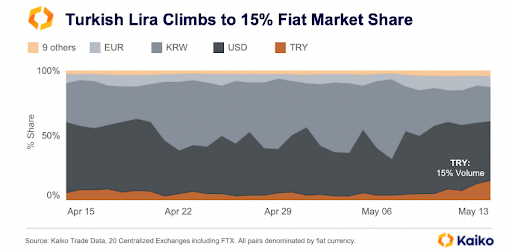

The Turkish lira, the country’s 18th-largest country with a population of more than 85 million, recently hit a record low as markets braced for the prospect of Erdogan’s re-election.

According to the chart released by Kaiko, a crypto asset market data company,Cryptocurrency trading in the lira soars, outpacing trading in euros. In the aforementioned Chainalysis 2022 report, Turkey was ranked 22nd in terms of cryptocurrency penetration, but currency troubles and the need for hedging and diversification in preparation for such troubles are probably the reasons for its high ranking.

Japan is an unexpected addition to my list of “watch for penetration”. With a population of more than 124 million, it ranks 11th in the world and 3rd in nominal GDP.

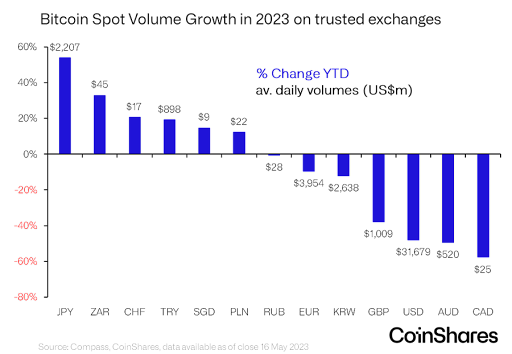

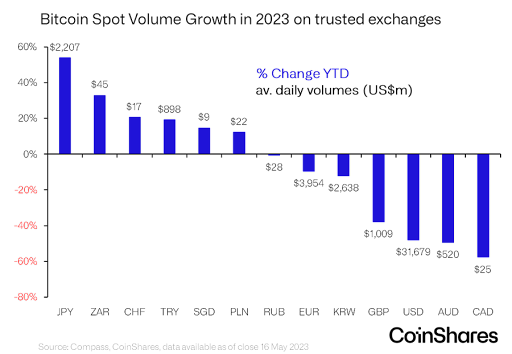

James Butterfill, head of research at cryptocurrency manager CoinShares, recently shared a chart showing spot volume growth on cryptocurrency exchanges.Japan came in first, followed by the world’s second-largest average daily trading volume (first in the United States), and the highest growth rate by far (about 55% since the beginning of the year)..

Given Japan’s low inflation rate and relatively stable fiat currency, it may be primarily for speculative purposes. Or it could be a sign investors are preparing for rising inflation and currency instability.

But higher inflation is likely to lead to rate hikes, which should strengthen the yen. If so, it’s not clear what bitcoin is a hedge for in Japan.

Crypto assets as a hedge

There are many other examples of citizens around the world relying on Bitcoin as a hedge against the volatility and depreciation of their currencies, including Ukraine, Argentina and Lebanon.

Many suffer from the lack of a reliable on-ramp and the difficulty of custody. But few are even remotely concerned about hostility from US regulators.

What these facts make us keenly aware is that the purpose of crypto assets goes far beyond the speculation offered by financial markets. Moreover, many emerging economies are accustomed to regulators’ overreach in restricting financial freedom, and citizens of such countries are more likely than those living under more open governments. It is easy to understand the decentralized nature of many crypto-assets, and it tends to be easy to evaluate their merits.

Furthermore, considering the increasing possibility of major currency turmoil expected in emerging countries in the future, inflationary pressure, the strength of the dollar, the possibility of political turmoil, etc., Bitcoin and stablecoins You can understand why the “insurance” and “hedging” nature of cryptoassets is even more attractive.

Currency liquidity may be a big headwind, but the crypto market is not all about it.

Mr. Noelle Acheson: Former head of research at CoinDesk and Genesis Trading.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Lahore, Pakistan’s second largest city (Katja Tsvetkova / Shutterstock.com)

|Original: Why the Biggest Emerging Markets Are Turning to Crypto

The post Why Major Emerging Markets Are Turning to Crypto Assets ─ Japan is also a strange move[Column]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @Damien Martin, @Khareem Sudlow