US stocks rose slightly Debt ceiling talks scheduled to be held today | 16th Financial Tankan

5/16 (Tue) morning market trends (compared to the previous day)

- NY Dow: $33,348 +0.1%

- Nasdaq: $12,365 +0.6%

- Nikkei Stock Average: ¥29,626 +0.8%

- USD/JPY: 136 -0.01%

- USD Index: 102.4 -0.2%

- 10-year US Treasury yield: 3.5 +1.2% per annum

- Gold Futures: $2,021.2 0.0%

- Bitcoin: $27,360 +1.7%

- Ethereum: $1,827 +1.6%

traditional finance

crypto assets

NY Dow today

Today’s NY Dow rose slightly to +47.9 dollars. The Nasdaq was +80.4. In addition to the May New York Fed’s manufacturing index released last night, it seems that the Fed’s remarks and expectations for the resolution of the US debt ceiling problem have also become observational factors.

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

New York Fed Business Index

The NY Fed economic index for May announced last night was -31.8, down 42.6 points from +10.8 in the previous month. It was the first major drop in about three years, suggesting a deterioration in economic activity.

The sharp drop in the index was mainly due to the decline in the index of orders and shipments. The Employment Index showed a decline in employment, but not by a significant drop compared to the previous month.

Meanwhile, the outlook for the future economy was relatively bright, hitting a three-month high. The dollar temporarily sold off following this result.

Source: Yahoo! Finance

remarks by dignitaries

Minneapolis Federal Reserve Bank President Neel Kashkari made hawkish remarks about rate hikes on Wednesday night. He said inflation was “still too high” and that the Fed should not be fooled by the positive data in recent months.

In addition, Atlanta Federal Reserve Bank President Raphael Bostic did not anticipate an interest rate cut within the year on the same day, and had a hawkish view that “rather, it must be raised” in order to curb the high inflation rate. showed that.

Fears of a recession scenario due to the Fed’s long-term rate hikes have fueled investor anxiety, but he said that even if the economy were to fall into recession, it would not be prolonged and worse.

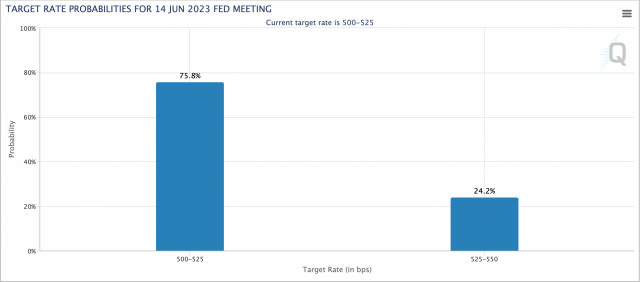

The US Federal Open Market Committee (FOMC) decided to raise interest rates by 0.25 points two weeks ago, raising the target range for the Federal Funds (FF) interest rate to “5.00-5.25%”. With indicators such as the CPI and PPI announced last week suggesting disinflation, expectations for a halt to rate hikes at the next FOMC meeting in June are high, but have fallen to 75% from last week’s 93%.

connection: US CPI falls below 5% for the first time in 2 years, IT and virtual currency related stocks rise

Source: CME

Resolution of the U.S. debt problem

Regarding the US debt issue, which is a concern for the market, US President Biden said on the 14th that he would meet again on the 16th with Speaker of the House McCarthy and other congressional leaders, saying, “The opposition is also willing to reach an agreement, and we can agree. I think,” he said with an optimistic attitude.

Meanwhile, House Speaker McCarthy said on Monday that little progress had been made in talks about avoiding a default. The signals from President Biden and Chairman McCarthy appear to be at odds.

U.S. Treasury Secretary Janet Yellen again warned on Monday that the Treasury Department risks running out of money as early as June 1 unless Congress raises or suspends the federal debt ceiling.

Economic data from this week onwards

- May 18, 21:30 (Thursday): Number of continuous recipients of unemployment insurance and number of new applications for unemployment insurance for the previous week

- Friday, May 19, 24:00: Chairman Powell of the Federal Reserve Board remarks

- May 23, 22:45 (Tuesday): US May Manufacturing Purchasing Managers Index (PMI, preliminary figures)

- May 25, 3:00 (Thursday): Federal Open Market Committee (FOMC) Minutes

- May 25, 21:30 (Thursday): U.S. January-March Quarterly GDP Personal Consumption (revised value)

connection: What is a real estate investment trust “REIT?” Explaining the main advantages and disadvantages

US stocks

IT Tech stocks compared to the previous day: NVIDIA +2.1%, c3.ai +23.4%, Tesla -0.9%, Microsoft +0.1%, Alphabet +0.8%, Amazon -0.8%, Apple -0.2%, Meta + 2.1%.

c3.ai, which develops artificial intelligence applications for companies, rose sharply from the previous day. Prior to the start of trading, the company announced provisional financial results for the period from February to April, and forecasted sales of 72.1 million to 72.4 million dollars, exceeding the forecast of 71.1 million dollars. “The interest in applying predictive analytics to business processes has never been greater,” the company said in a statement. Clients of c3.ai include Bank of America, 3M and the US Air Force.

connection: Advantages and disadvantages of apartment investment that even beginners can understand

Cryptocurrency-related stocks high

- Coinbase|$60.7 (+5.9%/+5.9%)

- MicroStrategy | $282.5 (+4.2%/+4.2%)

- Marathon Digital | $9.5 (+6.9%/+6.9%)

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post US stocks rose slightly Debt ceiling talks scheduled to be held today | 16th Financial Tankan appeared first on Our Bitcoin News.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @Kurt Ebenzer, @Khareem Sudlow