Can Bitcoin become a global payment method when it cannot keep up with the popularity of memecoins?[Column]| coindesk JAPAN | Coindesk Japan

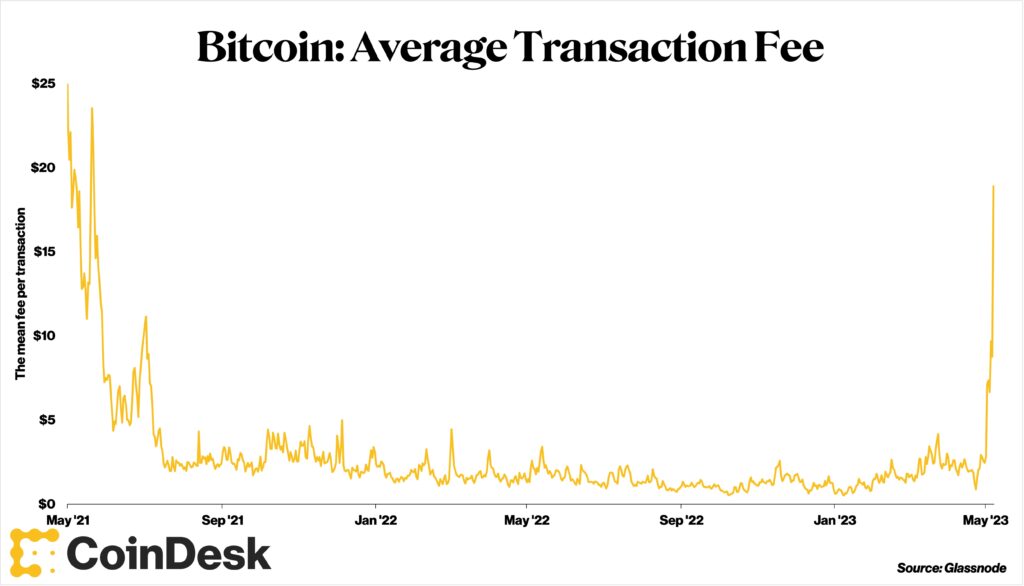

Many bitcoiners are frustrated by rising fees due to a surge in transactions on the bitcoin blockchain. Fees are determined through a competitive bidding process, but on May 8, a simple Bitcoin (BTC) transaction soared to a staggering $30.19 (about 4000 yen). Prior to that, it had been hovering around $2 (about ¥270) for almost two years since July 2021.

BRC-20 boom

The situation has become so tense that some bitcoiners, especially those known as “maximalists,” have proposed censoring BRC-20 tokens and other tokens using a new issuance scheme called “Ordinals.”

These assets are said to be the cause of soaring fees due to the new ability to write data in bitcoin transactions. There’s a lot to talk about about the ethical aspects of issuing a BRC-20 token, but Michael Saylor, a maximalist leader and former CEO of MicroStrategy, was surprised. , The rise of BRC-20 tokens was declared a “bullish” element.

Leaving aside the question of what Bitcoin is for, there is a very clear point here. In other words, Bitcoin is not scaling, and criticizing the Ordinals does not change that reality.

If Bitcoin were to be used for money transactions on a much larger scale around the world than it is now, Bitcoin would face the same scaling problems. So, ironically, the BRC-20 turmoil is ultimately a blow to the “maximalist” vision currently resisting Bitcoin’s non-monetary uses.

Congestion in Mempur

Explosive interest in the BRC-20 token on the Bitcoin blockchain has led to a surge in transactions on the base layer network and soaring transaction fees. There are many ways to analyze congestion, but one very good indicator is Bitcoin mempool congestion.

The mempool is where transactions wait to be verified, and the order of verification is determined according to the fees offered for the transactions. If the mempool is busy, the competition to get the next block to enter the deal will increase.

A look at the data surprises us in a number of ways. I used a simple but excellent mempool visualization tool by Certora researcher Jochen Hoenicke, who works on smart contract security.

First, when looking at the number of transactions, it seems that Mempur has never been this crowded. At the previous peak in April 2021, there were 200,000 pending transactions. But on May 8 it was 450,000.

And it should be noted that many of the transactions are small. According to bitinfocharts, the average Bitcoin transaction size has shrunk significantly in recent years.

The explosion in retail trading is attributed to speculators (and future rag-pullers) rushing to issue tokens using the experimental BRC-20 standard. seems to back it up. BRC-20 tokens are hot right now, and traders seem desperate to get their hands on Pepecoin and other casino tokens now instead of 12 or 14 blocks away.

Since most of these tokens are “memetic coins” that are little different from gambling, the rise in fees is likely to be short-lived. In fact, by May 10th, fees were slightly lower than their peak on May 8th.

Can you handle the increase in retail transactions?

According to Coinmarketcap, a staggering 8,500 new tokens were issued just a few weeks after the BRC-20 standard was published. But most of them are “memecoins,” and the surge in transaction fees is likely to end in a short period of time. In fact, on May 10th, fees were down slightly from their peak on May 8th.

But the problem remains. So if millions of people tried to use bitcoin for peer-to-peer (P@P) transfers on a regular basis, they would find themselves in exactly the same situation. Moreover, in this case, it is not a temporary problem, but a permanent one.

Maximalist calls for trade censorship are inconsistent for many philosophical reasons, but this practical contradiction is the most striking. Bitcoiners, outraged by traders’ temporary spikes in fees, have focused their energies on solving the immediate problem of long-term fee spikes for everyday Bitcoin users. would be better.

As CoinDesk columnist Nic Carter pointed out, “high prices are high price solutions.” Binance, for example, has integrated its Layer 2 Lightning Network into its bitcoin withdrawal flow.

Related article: Bitcoin transaction fees cannot be “too high”[Column]

Lightning was created to take the burden of retail transactions off the base layer, but using P2P requires a fairly complex set-up. At the same time, it’s like suddenly there’s more demand for Lightning services companies like David Marcus’ Lightspark to make Lightning easier for the average consumer.

happiness in misfortune

In this respect, the surge in transaction fees brought about by BRC-20 can be said to be a blessing in disguise. It should be a warning to prepare for continued trading growth.

Another possible development is also possible. The feasibility of Ordinals and NFTs on the Bitcoin blockchain is still highly uncertain. For example, recently a serious bug was found in Ordinal Inscriptions, the so-called Bitcoin NFT.

But technologies like Ordinals could enable entirely new approaches to scaling Bitcoin. That would include Layer 2 technology enabled on the Ethereum blockchain.

Such a development would be more uncomfortable for Bitcoin maximalists than sharing mempools with Bitcoin NFTs and traders looking to cash in on the BRC-20 boom. But if you’re really thinking about scaling the Bitcoin blockchain, it might be time to think bigger.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

| Original: If Bitcoin Can’t Handle a Few JPEGs, How Can It Handle the World?

The post Can Bitcoin become a global payment method when it cannot keep up with the popularity of memecoins?[Column]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @Damien Martin, @Khareem Sudlow