Web3 major Animoca Brands aims to raise more than 100 billion yen with Metaverse Fund

Animoka Brands Metaverse Fund

Animoca Brands, a major Web3 company in Hong Kong, is aiming to raise about 130 billion yen ($1 billion) in the first quarter of 2023 through the Metaverse Fund, it was revealed on the 5th.

Animoca Capital, which was announced in November 2010 for the purpose of investing in Metaverse operators, initially set a target fund size of $2 billion. It looks like it has shrunk to $ 1 billion due to the slump in the crypto asset (virtual currency) industry.

association:Animoka plans a 200 billion yen metaverse fund

“It’s certainly a tough market environment, but there’s a lot of interest,” Yat Siu, co-founder and executive chairman of Animoka Brands, said in an interview with Bloomberg on Twitter Space.

Animoca Capital is in talks with a number of investors, he said. One point of reference is during the first quarter, and if the market becomes more volatile, “we may end up falling short of our target,” Siu added. The funds raised will be used to support blockchain and metaverse startups.

Following the bankruptcy of the virtual currency exchange FTX in November 2010, many companies and projects suffered from liquidity shortages, leading to a chain of bankruptcies.

Animoka, which owns Blowfish Studios, Grease Monkey Games, Eden Games, etc., and has more than 380 external investment companies, is no exception. is.

According to Siu, 12 companies in the company’s portfolio have been affected by the FTX bankruptcy, notably ATMTA, the company behind the Solana blockchain strategy game Star Atlas, losing half of its working capital deposited with FTX. It became irretrievable and greatly reduced the runway (remaining period).

association:Star Atlas’ working capital hit by FTX bankruptcy

Fundraising has become difficult due to the global recession, but Mr. Siu is optimistic, saying, “We are still able to raise funds even after the FTX bankruptcy.”

Decrease in VC investment

Venture capital investment has been declining due to the bear market of the cryptocurrency market.

According to the virtual currency media Wu Blockchain, the number of VC investment projects in the same month was only 50, a decrease of 23% from the previous month (65). 68% less than December 2021 (154 cases).

The breakdown by category is the largest in the infrastructure field at about 22%, DeFi (decentralized finance) at about 18%, NFT (non-fungible token) / GameFi at about 16%, and CeFi (centralized finance) at about 8%. %.

The total investment of 50 projects was 87.4 billion yen ($660 million), down 21.5% from the previous month and down 82.5% from the same month last year. The total amount raised in December 2021 was about 500 billion yen ($3.76 billion).

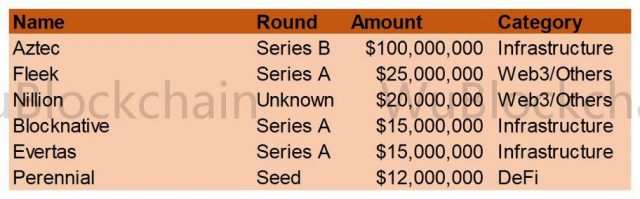

Among the 50 projects in December (excluding CeFi) that raised more than 1.3 billion yen ($10 million), the following are: Aztec stands out with its $100 million Series B funding.

Source: Wu Blockchain

Aztec is a project that uses zero-knowledge proof (ZKP) to solve financial privacy challenges. Major VC firm a16z Crypto led the $100 million investment round.

With the new funding, Aztec will develop a cryptographic architecture that will allow individuals to properly use the blockchain without exposing their identity. It also plans to double its current team of 40 people.

Aztec Connect developers, rejoice!

Aztec Connect has launched a stable developer testnet.

Here’s everything you need to know about Aztec Connect Testnet v1: pic.twitter.com/4hFfS99FqW

— Aztec (@aztecnetwork) November 29, 2022

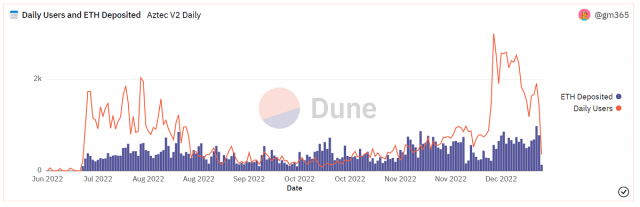

Aztec released a testnet (Aztec V2) in November 2010. According to Dune Analytics, the total deposit amount of Aztec V2 is more than 73,000 ETH (12 billion yen), and the number of unique addresses is 99,779.

Source: DUNE

association:Ethereum L2 “Aztec” raises $100 million from a16z and more

The post Web3 major Animoca Brands aims to raise more than 100 billion yen with Metaverse Fund appeared first on Our Bitcoin News.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @Kurt Ebenzer, @Khareem Sudlow