Pacific DeFi: Expanding DeFi-Based Yield Capabilities

[Featured Content]

Throughout the past couple of years, we witnessed a tectonic shift in global finance. It was propelled by the COVID19 pandemic – a black swan event that nobody saw coming.

Major economies tumbled as industries across the board experienced tremendous challenges, with mogul companies on the brink of bankruptcy. Faced with millions of unemployment files and growing uncertainty, central banks across the world started doing the one thing that cryptocurrencies defy – print money out of thin air.

This caused other issues in turn – interest rates are trending towards zero, urging many to seek alternatives for earning yields on their spare capital.

Not surprisingly, throughout this period, the field of Decentralized Finance (DeFi) saw tremendous growth.

There are plenty of products that investors can take advantage of, but when it comes to earning yield through DeFi, Pacific DeFi aims to make things easier and more streamlined.

What is Pacific DeFi

Pacific DeFi brings forward yield-enhancement products for altcoins and stablecoins, offering its users the ability to earn returns with properly adjusted risk.

The platform will initially operate on the popular Binance Smart Chain (BSC) but has also included cross-chain interoperability throughout Polygon and Ethereum in its roadmap.

The project integrates the following principles in its aim to provide users with a single point of access to various yield earning instruments:

- A complete DeFi ecosystem

- Simple and easy-to-use UI/UX

- Built on BSC for efficiency and speed

The platform includes auto-compounding features which are built into its single token vaults. This results in high yields with adjusted risk thanks to protocol diversification.

In general, the entire user interface is promised to be very simple, aimed at retail users while also providing more experienced investors with sufficient capabilities to fulfill their own investment strategies.

In terms of products, the platform aims to bring forward:

- Staking and Farming

- Stablecoin Yield Vaults

- High-Yield Vaults

- Lending and Borrowing

According to the roadmap, users should expect staking and farming on BSC via PACIFIC and PACIFIC-BNB pools to become live in the current fourth quarter of 2021.

The PACIFIC Token

The entire ecosystem of Pacific DeFi is underpinned by the functionalities and utilities of its native asset – the PACIFIC token.

Users are given the opportunity to participate in the overall development of the project while also earning fees from the various business lines by holding the token.

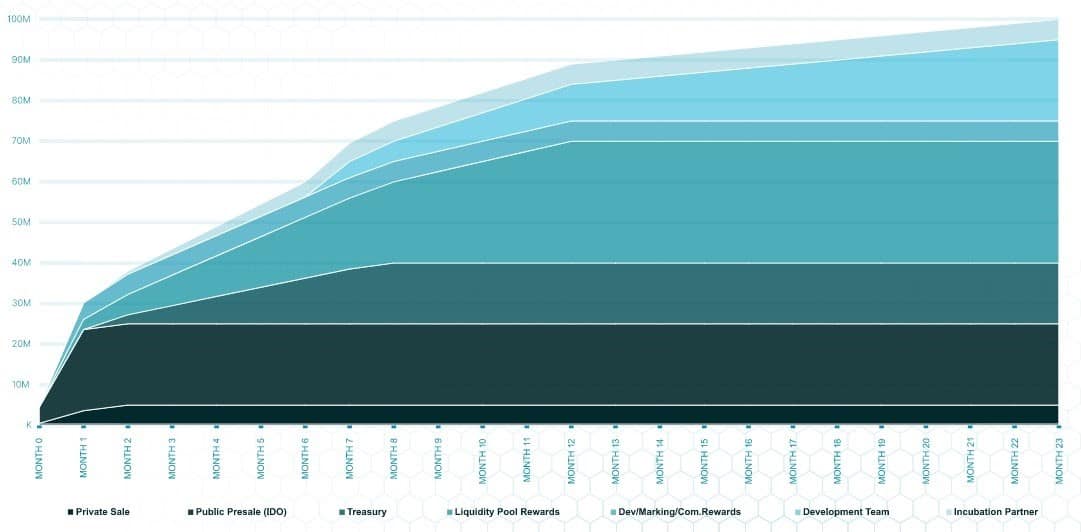

The PACIFIC token is built using the BEP-20 protocol standard on the Binance Smart Chain and has a total supply of 100,000,000. 2% of the profit is to go towards Ocean Conservation Causes. The vesting schedule of the token is based on the following chart:

In terms of utility, the token aims to democratize aspects of the platform, providing holders with a set of benefits and rights. It will have multiple use cases throughout the entire ecosystem.

As an example, some of them include:

- Trading

The trading fees which are generated when users swap between tokens through the Swap & Trade platform will benefit token holders.

- Staking

Users are able to stake PACIFIC to receive various rewards during the 1-year minting period of the token. Over $600K has already been staked on the platform as part of the team’s first BSC staking and farming programs – this comes ahead of the much-anticipated Polygon staking and farming which should be live next month.

- Lending and Borrowing

Token holders are able to participate in high-yield vaults, which enables them to increase their yield capabilities. Other features include governance and token holder rights, buyback and burns, participation in high-yield vaults, and so forth.

In Conclusion

Pacific DeFi aims to bring a lot of investment tools under one roof and create a comprehensive ecosystem where participants can benefit in a range of different ways.

It’s worth noting, though, that a lot of the important developments are still to come. According to their roadmap, users should expect staking and farming on BSC to become active in Q4 2021, as well as the Polygon and Ethereum bridge and subsequent farming capabilities on these two additional networks.

OhNoRipple via https://www.ohnocrypto.com/ @Danish Yasin, @Khareem Sudlow