Goldman Sachs is Hosting a Call to Discuss Bitcoin Among Other Economic Issues

May 26, 2020 at 09:34 //

News

Goldman Sachs, the leading global investment banking management multinational firm, is set to host a client call to discuss Bitcoin, inflation, and gold on Wednesday, May 27, at 10:30 am EST according to a leaked invitation letter shared on twitter.

It’s happening.@GoldmanSachs: “Implications of Current Policies for Inflation, Gold and Bitcoin” pic.twitter.com/kjTGYSE9za

— Mike Dudas (@mdudas) May 22, 2020

As per the report from Forbes, Goldman Sachs, in its upcoming call themed “US Economic Outlook & “Implications of Current Policies for Inflation, Gold and Bitcoin” has BTC on the

list of important issues to be discussed, although not clear about the details of the agenda. The fact that the whole of Goldman Sachs is now interested in talking about crypto means it is attracting the attention of the entire global financial sector.

BTC is a significant shield against tough financial policies

It is not yet well known what the event will cover specifically. Nevertheless, it is expected that the bank will discuss how the central bank’s (CB) quantitative easing policy and inflation concerns due to the financial crisis caused by Coronavirus could affect valuable assets, for example, BTC and Gold.

During the period of Covid-19 pandemic, BTC has been performing better than Gold because many venture capitalists and newcomers have been investing massively in the world’s first digital currency than Gold. The global BTC and Gold market has been subjected to a serious test since this crisis started, and the cracks are continuing to show.

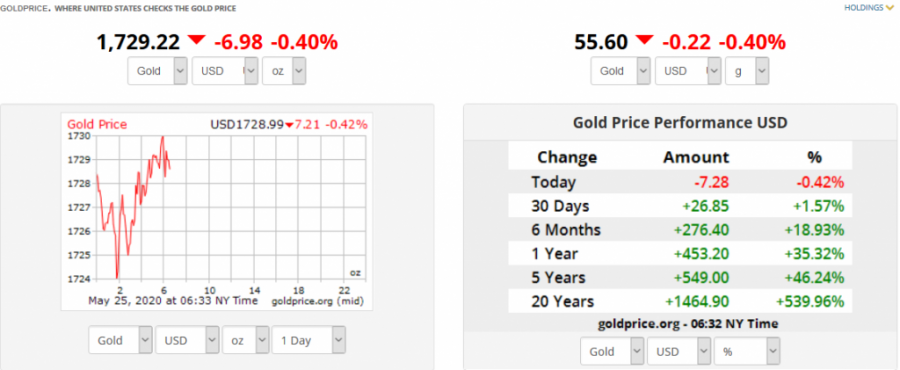

Even as we talk now, the price of BTC/USD ($8,890) is higher than that of Gold/USD ($1,726), according to the data from GoldPrice and CoinMarketCap.

Many experts such as Travis Kling, CIO and founder Ikigai Asset Management, believe that Bitcoin can be a hedge against the risk of currency inflation and inflation due to the CB’s quantitative easing policy. Since its inception, venture capitalists have been using digital currency as an alternative bet against traditional fiscal policy.

Paul Tudor Jones, a renowned American billionaire hedge fund investor and philanthropist recently described Bitcoin as “fastest flying” horse in this environment. Many business leaders predict nasty inflation brought about by the COVID-19 pandemic and think cryptocurrencies present a perfect solution.

Coronavirus caused a big economic regime change

Meanwhile, Goldman Sachs’ inclusion of Bitcoin as the main agenda for the conference call shows a change in the bank’s attitude toward digital currency. As of now, institutional investors including major banking institutions, are increasingly interested in Bitcoin and other cryptocurrencies.

Lately, as coinidol.com, a world blockchain news outlet, reported, Raiffeisen Bank International is carrying out a tokenization pilot in blockchain-based digital fiat currency. JPMorgan, one of the largest investment banks in the world, has also started providing financial services to cryptocurrency exchanges.

In the time of economic uncertainties, central banks, philanthropists, large corporations as well as the general public are becoming more conscious of the role cryptocurrencies play in the global financial ecosystem.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @coinidol.com By Coin Idol, @Khareem Sudlow