Data Snippet - Increased interest in out-of-the-money Bitcoin options echoes uncertainty surrounding halving effect

Unlike futures, options have an asymmetric payoff profile. This means that changes in the price of the underlying asset do not necessarily cause a proportional change in the value of the option.

This characteristic means that options can be used in a variety of strategies to cap downside risk or profit from high volatility, regardless of the wider market direction. If managed properly, options can be used to target a very specific risk profile and create more predictable returns.

The price of an option is a combination of:

- Intrinsic value, or “moneyness”; the difference between the strike price and the underlying spot price. Out of the money options do not have any intrinsic value.

- Extrinsic value: other factors such as the options time value and implied volatility.

Let’s look at the Bitcoin (BTC) June Quarterly Contracts on Deribit and OKEx through the month of April.

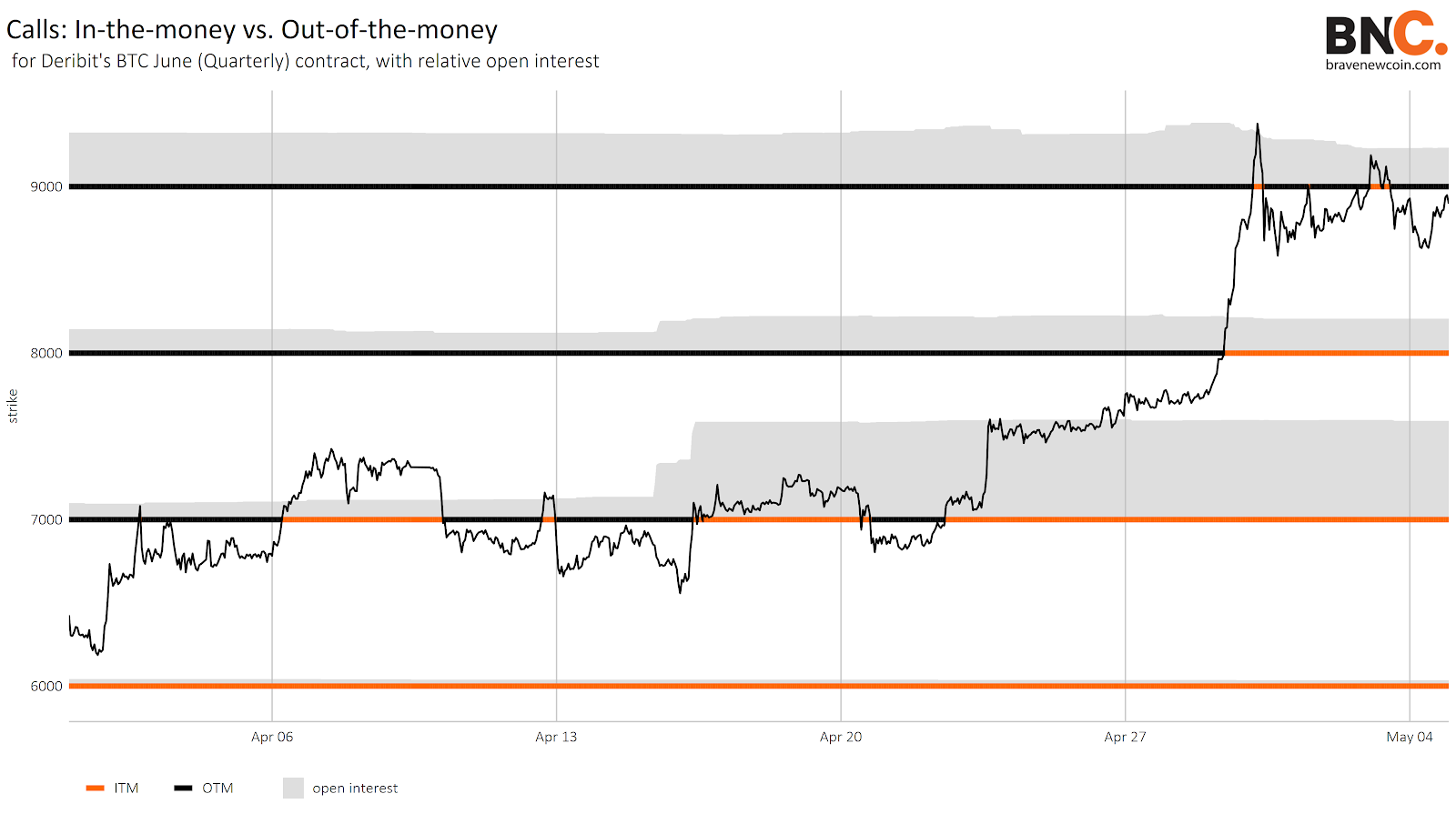

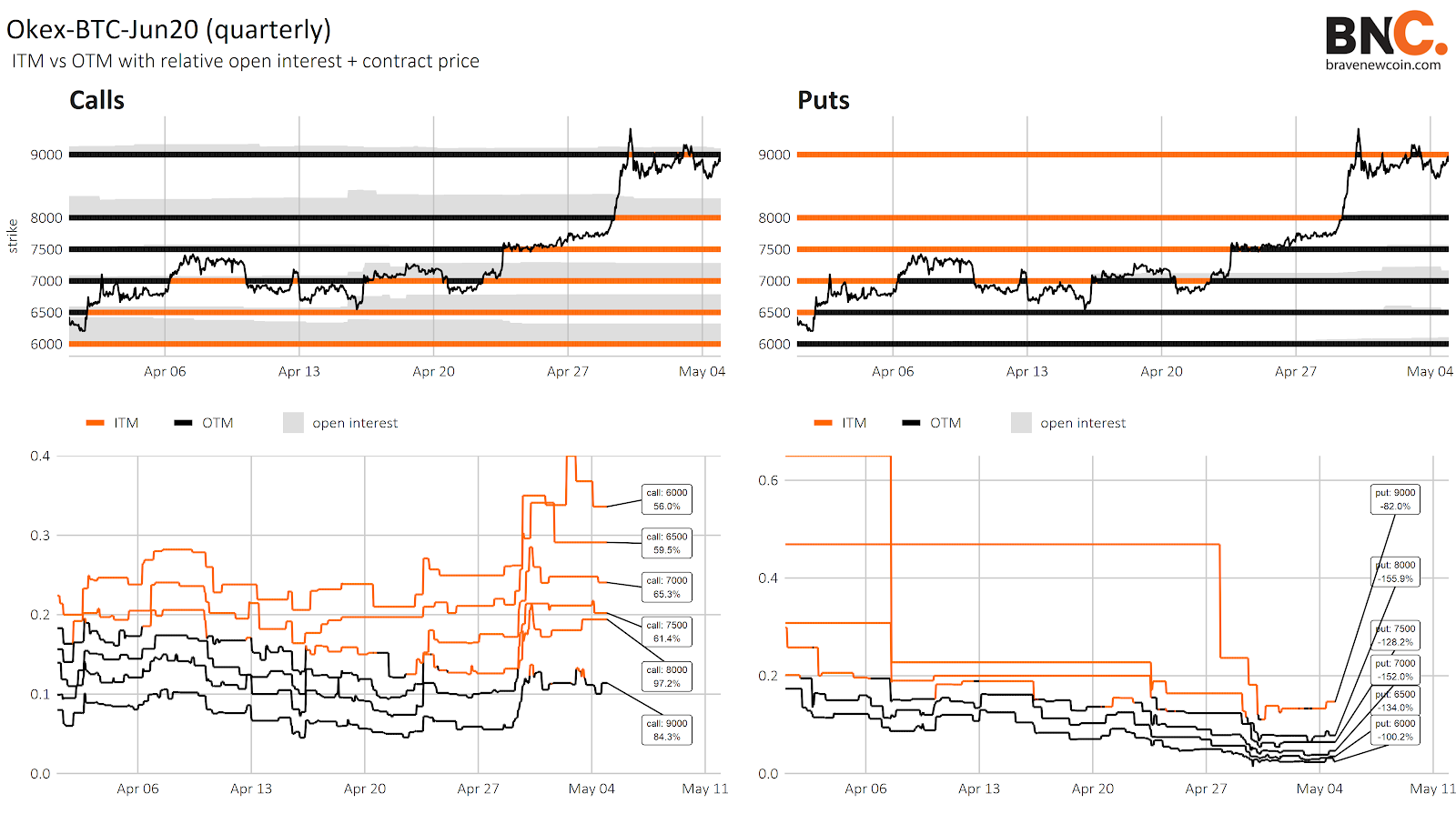

CHART FEATURES

- Bitcoin price and Strikes prices for nearest to the money call options on Deribits BTC June Quarterly expiry.

- Moneyness is depicted by line color; orange being in-the-money (ITM), the strike price is below the underlying price; and black being out-of-the-money (OTM), the strike price is above the underlying price.

- The grey area reflects the relative open interest of that strike.

- The price of each of these near-the-money calls over the same period is shown below.

TAKE-AWAYS:

- Options are priced in order of their moneyness. The in-the-money strikes are priced the highest since they possess intrinsic value and would be profitable if exercised immediately.

- The strikes further from the money performed better throughout the period owing to their low initial price and extrinsic value (time value: over a month till expiry, implied volatility: preceding the BTC halving event).

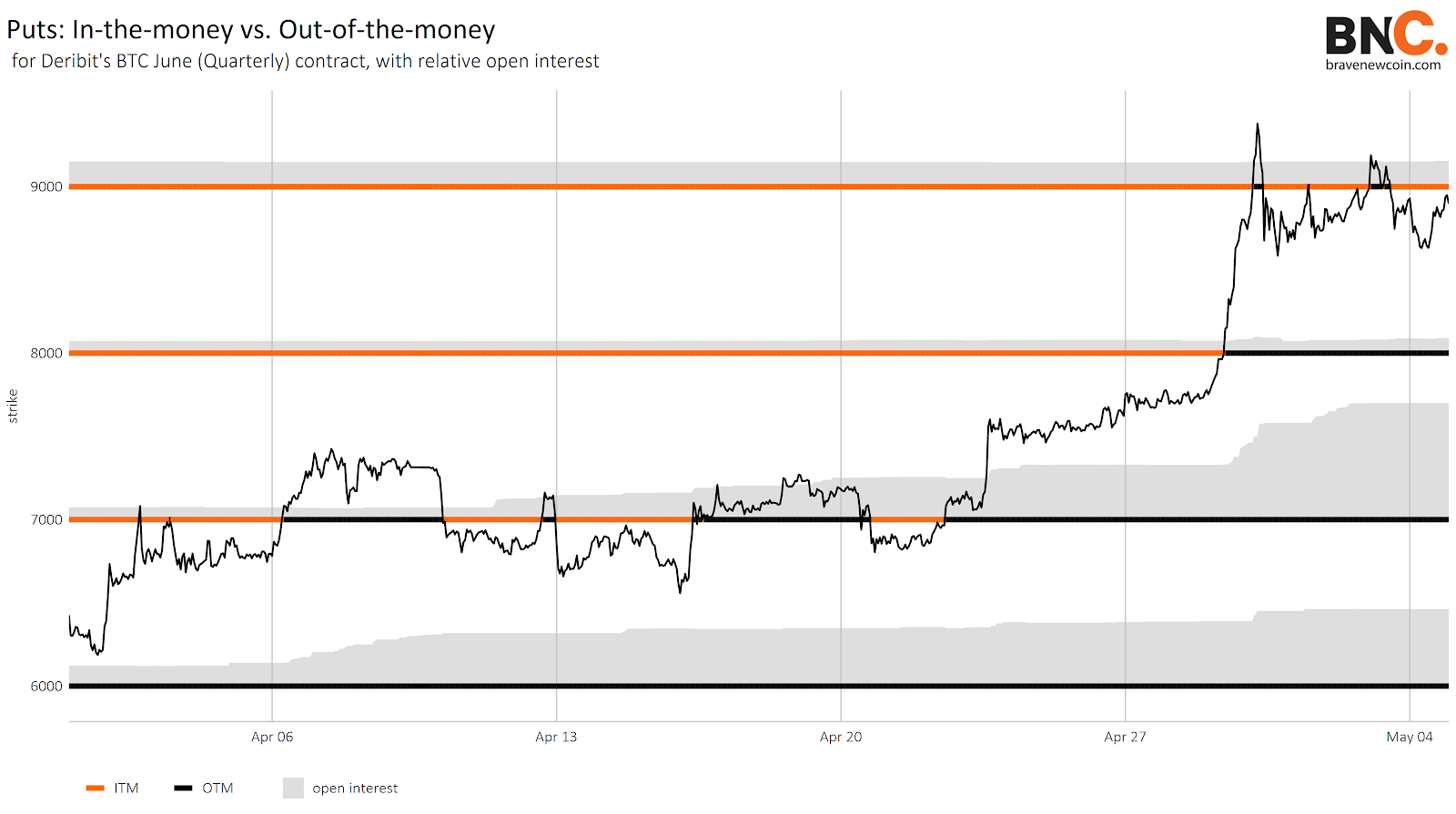

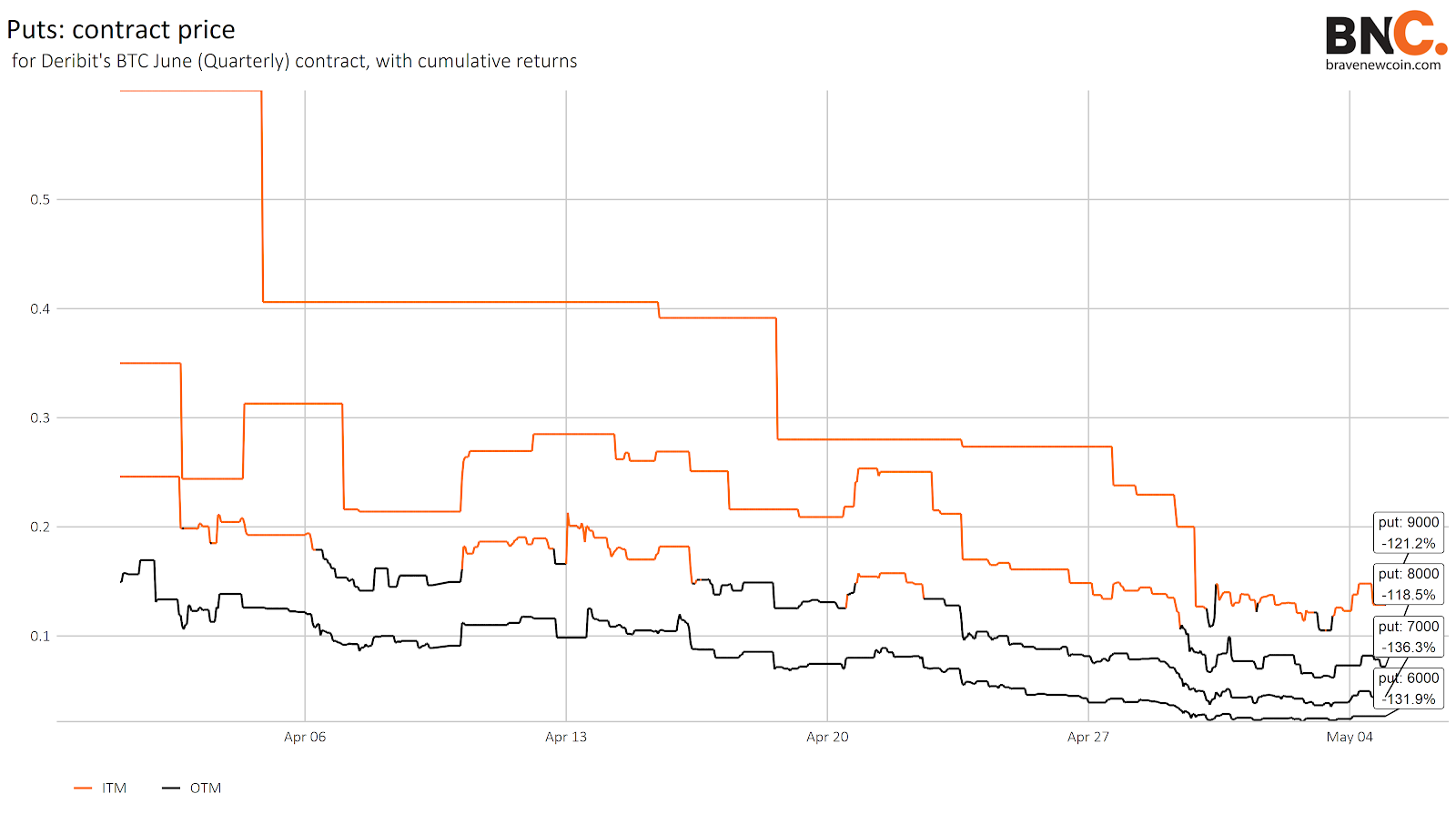

PUTS GAIN INTEREST AS THEY LOSE VALUE

INSIGHT BREAKDOWN

- Whilst the calls all outperformed the underlying asset throughout the period, put prices approached zero.

- We can see from the open interest on these options that this only made them more attractive. Even as the BTC spot price stormed higher, more and more OTM put contracts were being opened, as they became an inexpensive hedge against a market pullback.

- Even traders who are bullish on bitcoin, can be drawn to cheap OTM puts to limit their downside, especially given the uncertainty of the halving. A protective put combines a long position in the underlying asset with a put at a strike near the current price.

~ ~

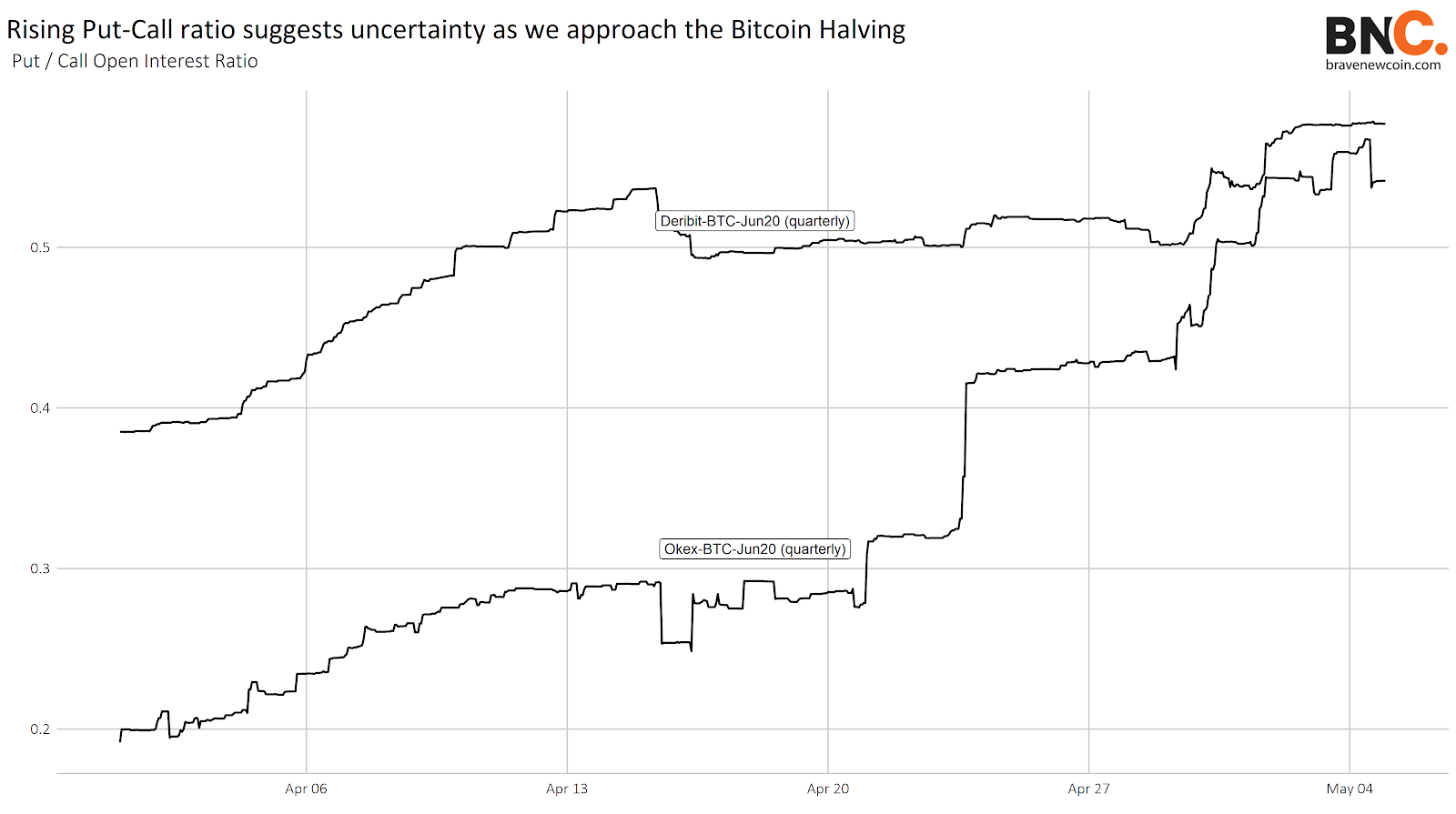

A rise in demand for puts is demonstrated in Deribits Put-Call open interest ratio, which rose throughout April as market participants question whether bitcoins performance was sustainable.

DEEP DIVE INTO OPEN INTEREST DISTRIBUTION

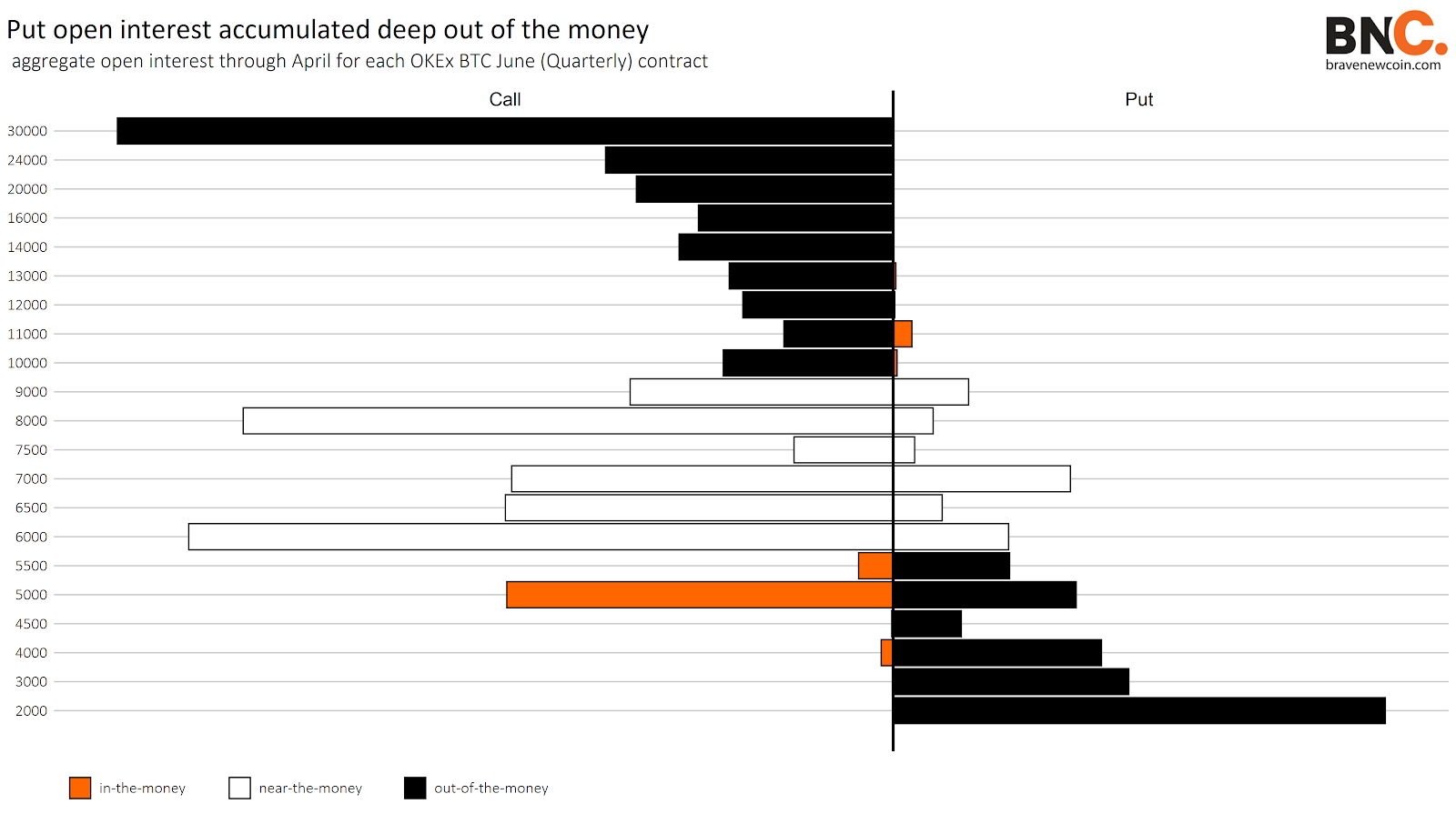

OKEx’s June contract had an even greater rise in its put to call ratio. As you can see in the distribution of open interest across all strikes, this was mostly owing to those puts deep out-of-the-money.

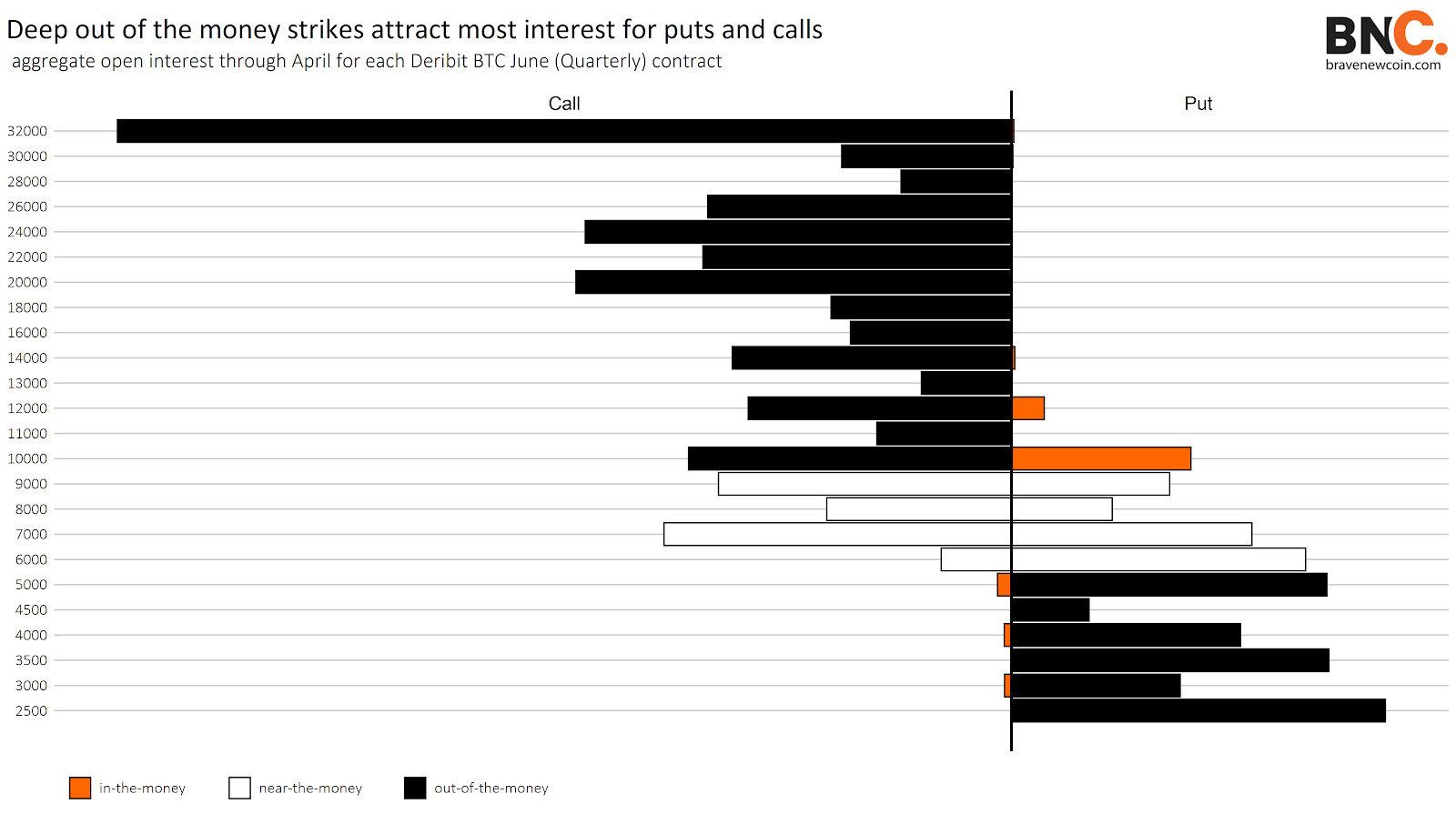

Deribit presents a similar structure. Interestingly, for both exchanges, the strikes with the highest average open interest through April were those furthest out-of-the-money.

This preference for OTM options in the weeks preceding a major volatility event is not unusual, and closely resembles an earnings call in equity markets. Volatility is high, the market expects a large price movement, but there is a lack of agreement as to which direction. Options provide a mechanism to profit from such situations.

WHY IS OPEN INTEREST CONCENTRATED IN CHEAP OTM OPTIONS?

- The majority of the holders of these 20 - 30K calls are not necessarily expecting bitcoin to reach this price before the end of June.

- In the days surrounding the Bitcoin Halving, implied volatility rises, as it does prior to an earnings call, pushing the value of these calls higher.

- In this way, purchasers of deep out-of-the-money calls can profit from the volatility spike, and close their positions before the halving to avoid any directional risk. The same applies to OTM puts.

- The oversized interest in the deepest out-of-the-money calls (32k) and puts (25k) is likely a result of their low premium compared to strikes closer to the money, making them easily accessible.

Brave New Coin collects valuable data from the largest cryptocurrency derivative platforms for options and futures. Access Brave New Coin data as well as insights into the full asset class and industry trends using BNC-Pro. If you aren’t already using the industry’s #1 Digital Wealth Management platform, sign up for a free trial to learn more about the BNC-Pro Platform today.

OhNoCrypto

via https://www.ohnocrypto.com

Ryan Greaves, Khareem Sudlow