81% of Bitcoin positions remain profitable as Hodlers continue to remain confident

From 29th April to 7th May, Bitcoin’s valuation has risen from $7714 to briefly touching $10074. That is a hike of 30 percent in a concise window, but it is not something we haven’t seen before.

However, the bullish sentiment in Bitcoin’s market is undeniable at the moment, and there is a sense of urgency shown by the investors before the halving.

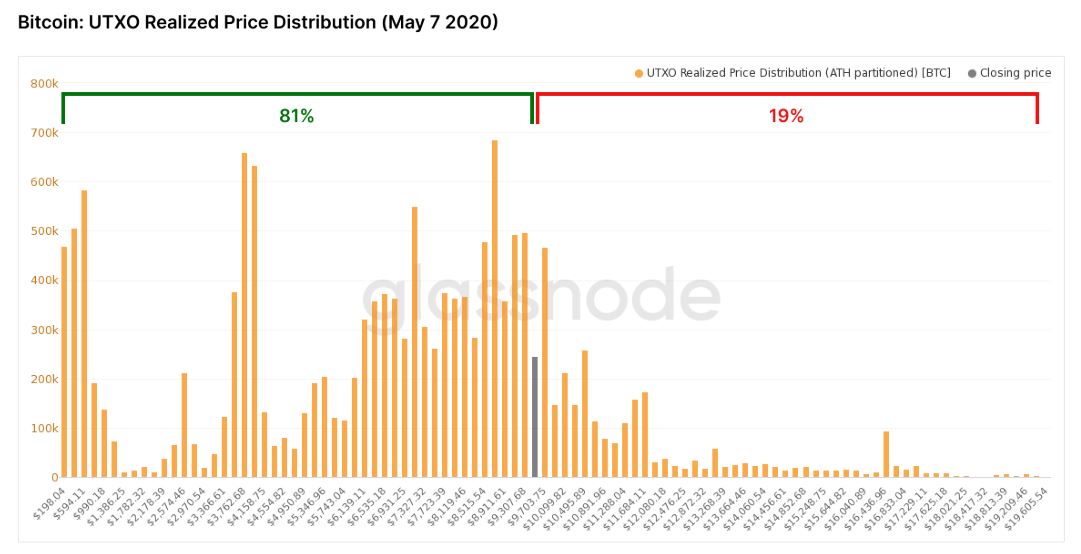

Source: Glassnode

Now, according to Glassnode’s recent tweet, it was indicated that 81 percent of the total BTC in circulation were incurring a profit in the current market state. The above chart illustrates Bitcoin’s UTXO Realized Price Distribution which exhibits that the quantity of Bitcoin last moved at a certain price range.

It can be analyzed that the quantity of Bitcoin last moved between $6100 and $9700 is very high, which meant that after these price points were reached, the amount of BTCs was not moved anymore afterward.

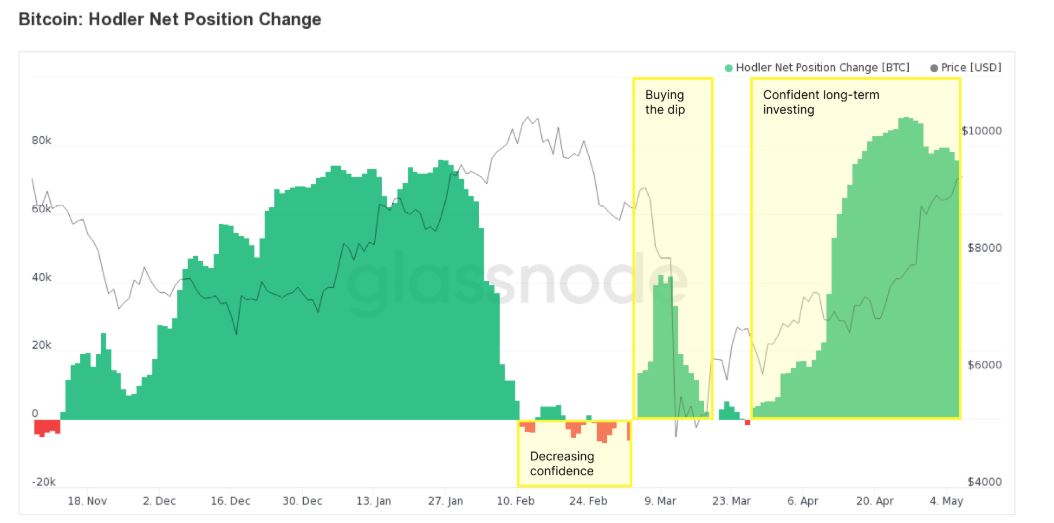

Source: Glassnode

Such a sentiment completely falls in line with the improving hodling approach of recent investors. The Hodler Net Position Change has remained positive over the past 8 weeks and indicated optimistic longer-term confidence before the halving event.

The chart above clearly exhibits the confidence of long-term investments in Bitcoin, which has surged drastically since the start of April and continued in the month of May.

A significant increase in the accumulation of BTC over the past few weeks can also be explained by the fact that the market is viewing Bitcoin as a safe haven option at the moment amidst uncertain traditional asset class.

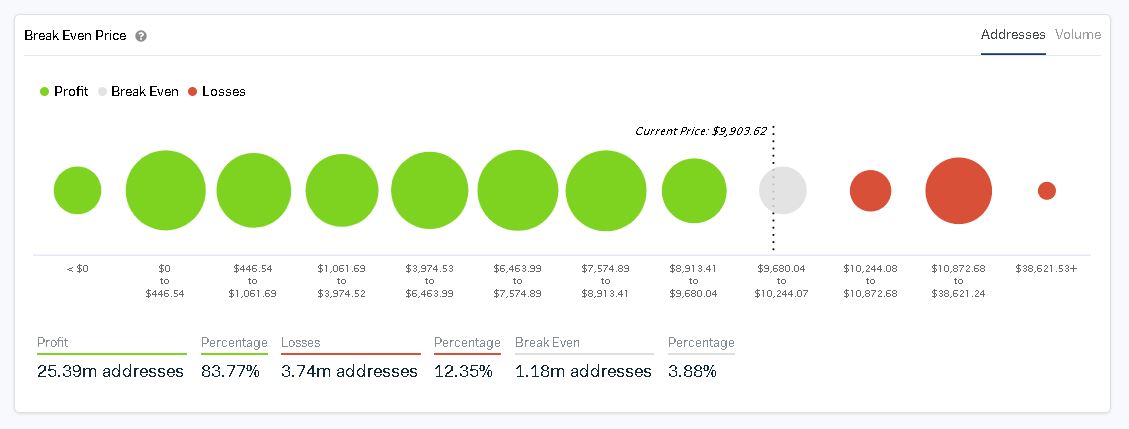

Source: intotheblock

The UTXO RPD chart can also be verified by the number of addresses that are currently profitable in the industry. According to data from intotheblock.com, a total of 25.39 million had profitable positions in the market, whereas only 12.35 percent of the total addresses were at a state of loss. 1.18 million addresses remained at break-even valuation.

However, we could possibly see a shift in these metrics after the halving. It can be speculated that the hodling sentiment might remain high or reduce considering the re-adjustment of Bitcoin‘s difficulty is bound to drop the prices. With depreciation in value, historically post-halving, it has taken Bitcoin a longer period of time to incur profits, hence the 30 percent rise in 8-days, may not happen for a long period.

OhNoCrypto

via https://www.ohnocrypto.com

Biraajmaan Tamuly, Khareem Sudlow