Whalepool script may identify fake volume on crypto exchanges

Whalepool is a multi-platform community of bitcoin traders. The core of the community is on the Teamspeak audio and text conferencing server, which consistently has over 300 users. The discussions on the server cover all aspects of bitcoin, such as the technology, politics, philosophy, and economics in general. The focus of the group is bitcoin trading, and thus the main topic that dominates the discourse is market action on Bitcoin spot and futures markets.

Whalepool was founded on the same principles that drive bitcoin: freedom, transparency, and connectivity. Users are rarely banned from groups, as they look for every side of an issue, and offer a platform for anyone who has a passion to get involved and contribute. The group offers a place to discuss serious price-focused topics but also facilitates more free and open discussions.

The traders on Whalepool have a wide variety of backgrounds: some are young students, others are veteran traders with legacy finance backgrounds. Some trade on the weekends, others trade daily for a living. While most trade bitcoin and other cryptocurrencies like Litecoin and Ethereum, they also have a significant portion of the community trading Forex, stocks, and commodities. Many traders use charts and technical analysis to figure out when to trade, others focus on news and fundamental analysis.

The group does not charge to become a member and is entirely free. It’s entirely supported by users signing up for exchanges using Whalepool’s affiliate links and donations to the groups BTC address.

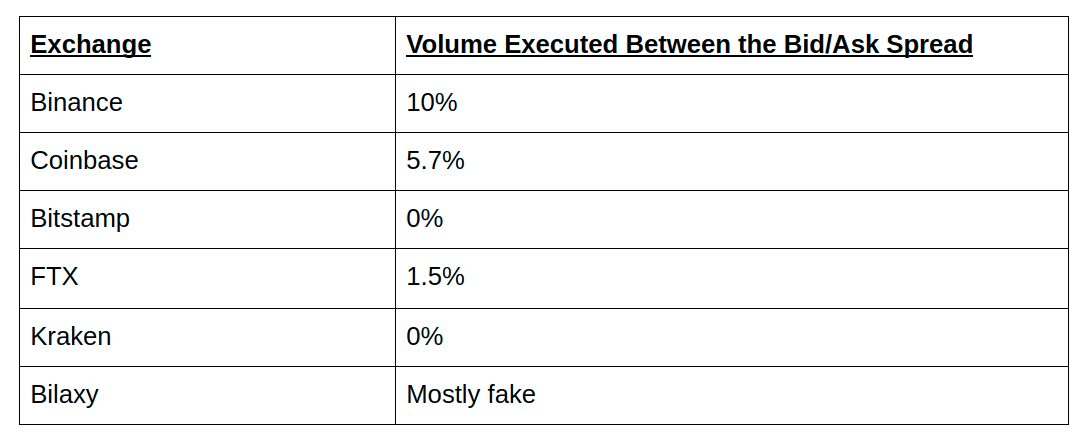

The group recently released the Whalepool Bitcoin Volume Validator, an open-source tool used for analyzing trade volume on exchanges and for identifying potentially fake volume. In the logic used by exchange orderbooks, every trade execution must have both a “maker” and a “taker.”

The maker adds liquidity to the orderbook by placing a limit order, either on the buy or sell side, which does not fill immediately and sits in the orderbook. Conversely, the taker removes liquidity from the orderbook by taking the other side, either on the buy or sell side, of a limit order, allowing orders to be executed immediately.

The Volume Validator works by monitoring the best bid/ask offers in the orderbook, i.e. the highest buy limit order and the lowest sell limit order, and the feed of recent trades that have occurred.

What the tool looks for is recent trades that have occurred between the bid/ask spread, i.e. trades where there has been no apparent limit order for a taker to buy or sell into. It is possible that some exchanges trade feeds and orderbooks are just not in synch, in which case recent trades may appear to have filled at a price not quoted on the orderbook.

This is likely not the case with large exchanges however as their systems are typically advanced enough to synchronize the two events.

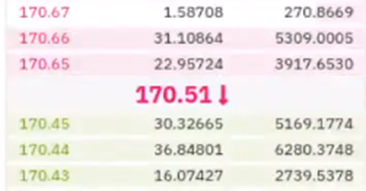

This phenomenon of a trade filling at a price between the best bid/ask offer can be observed in the screenshot of the Bilaxy orderbook for Ethereum below. In this example, the best ask offer is $170.65 and the best bid offer is $170.45. However, the most recent trade (as indicated by the middle number) filled at $170.51, a price that is not quoted on either side of the orderbook.

Whilst the results are not necessarily conclusive due to the possibility of the orderbook and trade feed being out of synchronization, they are more or less consistent with other studies that have aimed to track fake volume. All tests were conducted over a period of between twelve and sixteen hours.

The code for the Volume Validator can be found on Github, so users can test for anomalous trades themselves if they are interested.

OhNoCrypto

via https://www.ohnocrypto.com

Bryce Galbraith, Khareem Sudlow