Did not buy the dip? Dollar Cost Average Bitcoin your way back into the market

People from all walks of life who are interested in making money wonder, “When would be the best time to buy stocks, securities, bonds, a house, Bitcoin, etc?”

However, when it is time to invest, they falter.

While Bitcoin traded around the $3,000 level a few days ago, very few invested. Even now, most people are waiting for the price to dip again. What if it never dips again…

So, what is the best time to buy Bitcoin or any crypto-asset for that matter?

During a recession, when Wall Street is bleeding. Yes, recession, in general, is the best time to buy an asset. Warren Buffett’s popular, yet very important quote, sums it all up.

“Be fearful when others are greedy, and be greedy when others are fearful”

In fact, Buffett’s article during the Great Recession [2008-09] explained his thought process on how to navigate through these times.

Millennials’ 2nd recession

With the 2020 recession around the corner, the millennials will bear witness to two of the worst recessions in their lifetimes. The yet-to-be-announced recession is unlike any other recession observed before. Unlike the Recession of 2008-09, the drop in the stock market is happening at explosive levels; unemployment rates are skyrocketing, and the Fed is printing money with no curbs in sight.

Maybe, the recession was dormant and Coronavirus pushed it over the edge. Maybe, a decade had passed and a recession was due. Nobody knows, but one thing is clear – the world economies are in deep trouble and the credibility of fiat is in danger.

Perhaps, this could be the second-coming of Bitcoin, the prophecized rescuer of Finance 1.0.

Millennials are not big on cash and traditional finance. They are, however, long on Bitcoin. A survey conducted by Harris Poll on behalf of Blockchain Capital highlighted that there is increasing awareness of Bitcoin, with the growing likelihood of owning it.

According to this survey, Bitcoin awareness has increased since 2017. People aged between 18 and 34, people who were “somewhat familiar” with Bitcoin, grew in size from 42% to 60%. Most importantly, the respondents who believed that people would use Bitcoin in the next 10 years rose from 28% to 33%. Further, in another survey done by Charles Schwab, it was found that millennials are more likely to buy Bitcoin than Tesla, Netflix, or Disney stocks.

Investing in Bitcoin

As mentioned in a previous article about investing in Bitcoin,

“Time is the single most important factor for building wealth through investing”

In Bitcoin’s case, “volatility is a fickle mistress” and the price could go either way to a huge extent. Hungry for more profits, people tend to wait for “the next dip” and FOMO when the price is almost topped out. The same happened in 2017 and the same will happen during the next bull run. To prevent this and stopping greed from getting the better of us, this article goes through a well-known investing strategy – Dollar Cost Average.

Speaking to AMBCrypto in an interview, River Financial’s COO and Co-founder Andrew Benson summed a successful investment strategy, which has two elements – “value creation and value capture.”

“First, identifying where value is created in an economic system allows you to evaluate an industry, market, service, or production technique through a broad lens… Once the value creation has been identified, the focus is on pinpointing where that value is captured. The diligent investor analyzes the different investment opportunities and invests in the opportunity that is best positioned to win in the marketplace. “

Dollar-Cost Average Bitcoin

By purchasing Bitcoin in equal dollar amounts at regular intervals (once a week or monthly), the average cost of the share of BTC purchased reduces. Dollar-cost average [DCA] strategy doesn’t need to span across years, but can be compressed over shorter spans to yield profits.

Nobody knows where Bitcoin will be in the next week, month, and quarter; however, over a longer period of time, it is certain that Bitcoin will climb higher. Its decade-long history is proof of that.

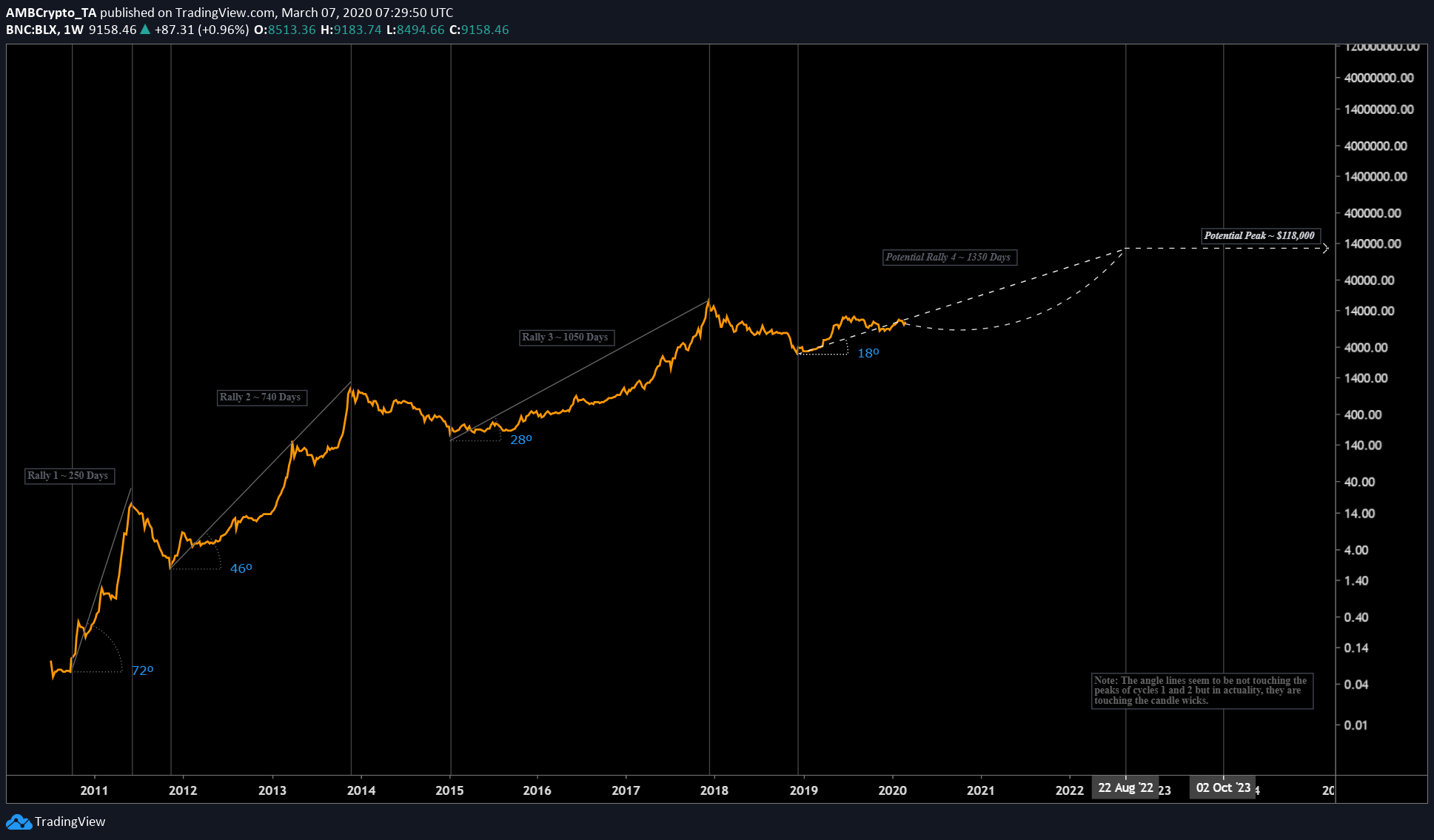

According to a previous article, the price of Bitcoin based on RoI cycles will be worth in the six digits – $118,000 by 2022. From this article, it can be possible to approximately deduce the price of Bitcoin by the end of 2020 and 2021.

Source: BLX Trading View

This chart for Bitcoin indicates that the price of Bitcoin by the end of 2020 would be ~$21,699, clearly, higher than the 2017 peak. Since we know the price of Bitcoin, let’s take a look at the investment strategies to see which ones would be more profitable.

Dollar-cost averaging is a simple and intuitive method of investment with low risk. In fact, this is the best investment method for newcomers since it doesn’t require a deep understanding of the market.

Speaking of which, Benson added,

“River Financial clients are setting up a recurring buy order on the platform of a smaller amount to ensure that they are continuously increasing their Bitcoin position. This provides the investor with a varied cost basis. The most common interval for recurring buy orders is weekly but we’ve also seen an increasing number of clients set up recurring buys on a daily interval. In addition to setting up smaller recurring buy orders, most of the volume is coming from large one-time orders during periods of increased price action.”

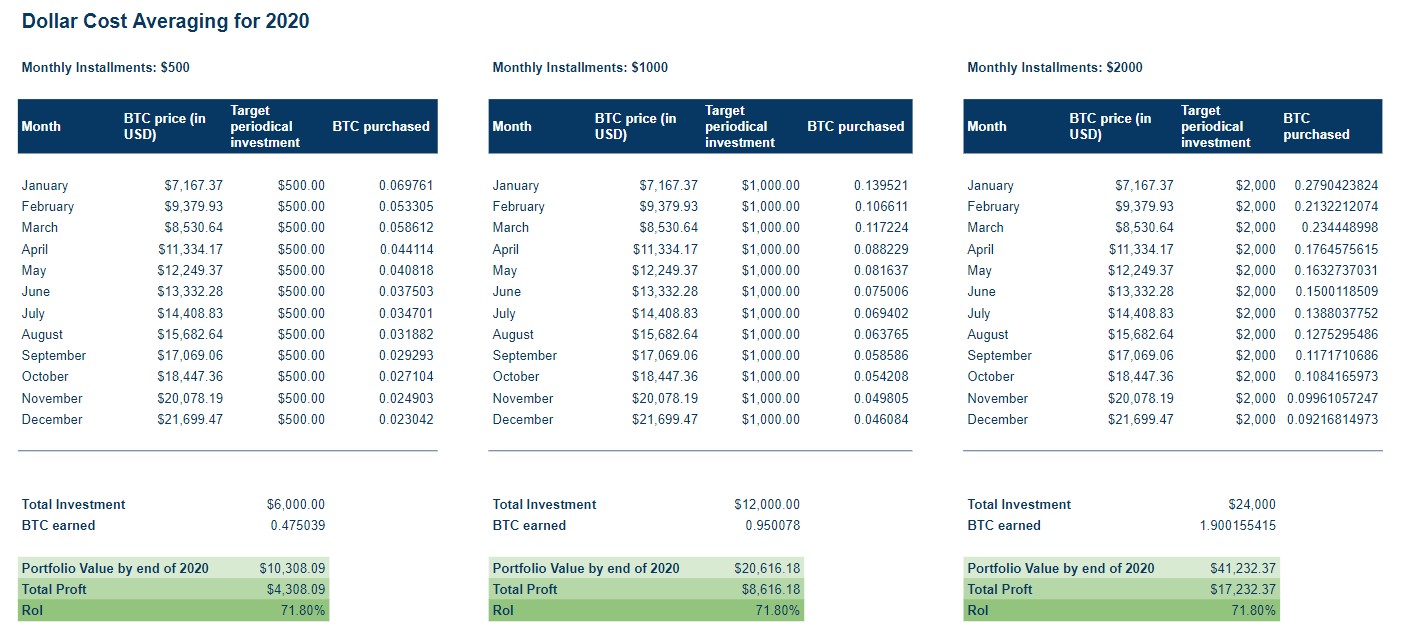

Based on the price of Bitcoin by the end of 2020, the following shows the profits an investor would stand to gain if they invested $500, $1000, or $2,000, every month.

From the above, it is clear that regardless of the periodic investment amount, one would stand to make 71% on their investment in only 12 months.

DCA is the formation of a recurring investment strategy but the investor still needs to time the market correctly. As mentioned above, a recession is the best time to buy assets, since they are available at a discount. For Bitcoin, the bear market would be the best time to invest.

December 2018 to June 2019 would have been the best time to invest. DCA during the bull market would be less profitable when compared to investing lump sum during a dip. Hence, some argue that investing a lump sum would be profitable, in comparison to DCA.

With regard to the recent dip, Benson stated that River Financial clients saw a huge surge in volume.

“In March when Bitcoin briefly dipped under $4,000, we saw record volume on our platform as our clients were buying the dip.”

However, lump-sum investing can also be critiqued since it requires investing a huge amount at once, something that typically comes with huge risks. Unlike a lump sum investment strategy, DCA is much more reliable since cryptocurrencies are a risky asset class due to their inherent volatility.

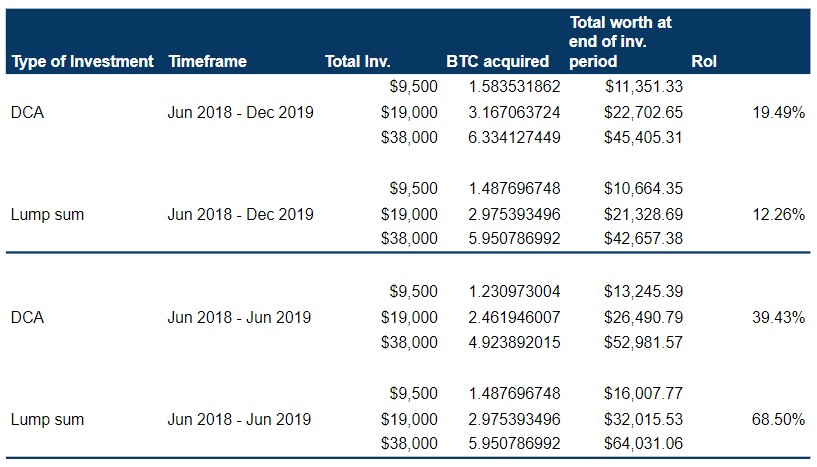

The table shows a comparison between DCA and lump sum investment for Bitcoin over two timeframes – one from June 2018 to December 2019 and the other from June 2018 to June 2019.

From mid-2018 to December 2019, DCA-ing would have been more profitable, ~7% more profitable. However, this time frame would have been a bad one, since we know that Bitcoin rallied to a local top in Jun 2019 and collapsed by December 2019.

Hence, the perfect comparison would be for the investment period ranging from June 2018 to June 2019. For this timeframe, it was clear that the lump sum investment method out-yielded the DCA method due to obvious reasons.

However, it should be known that there was blood in the Bitcoin and crypto-markets following November 2018. People were scared and Bitcoin witnessed a massive sell-off. Hence, people investing during this bloodshed would be very low. More people would have invested in the month of April due to FOMO as prices started to rally.

Conclusion

The investment strategy, be it lump sum or Dollar-cost average for Bitcoin, depends solely on individual investing. If it’s an average millennial, then DCA would be a better one, since the investment amount would be low. Since cryptocurrency is generally a risky asset, for people willing to mitigate that extra risk, DCA would be the most feasible strategy.

If one is willing to risk the volatility and wait for dips, then the return on initial investment would also be higher, provided, there is enough initial investment. However, both investment strategies require a basic understanding of market cycles and investing lump sum or through DCA would not make sense.

Perhaps, choosing one from the other is the wrong way to go about investing. Investment in Bitcoin should be long term, especially considering its history and its surge from a few cents to thousands of dollars. Nobody knew that Bitcoin would succeed and few people who bought Bitcoin out of curiosity are now millionaires, however, considering where Bitcoin is headed [$100,000], investing now would yield similar results as investing at the start.

Changpeng Zhao aka CZ, CEO and co-founder of one of the biggest cryptocurrency exchanges in the world, has tweeted on multiple occasions about how he sold his house to buy BTC in 2014 – 2015.

Perhaps, that would be too risky an idea, however, as Benson mentioned, a “2-fold strategy: dollar cost average and buy the dip” would better serve individuals trying to invest in Bitcoin.

OhNoCrypto

via https://www.ohnocrypto.com

Akash Girimath, Khareem Sudlow