Data Snippet - Bitcoin Hash Rate

#crypto #bitcoin

OhNoCrypto

via https://www.ohnocrypto.com

Sumathi Pandi, Khareem Sudlow

TODAY WE’RE LOOKING INTO THE BITCOIN HASH RATE:

CHART FEATURES

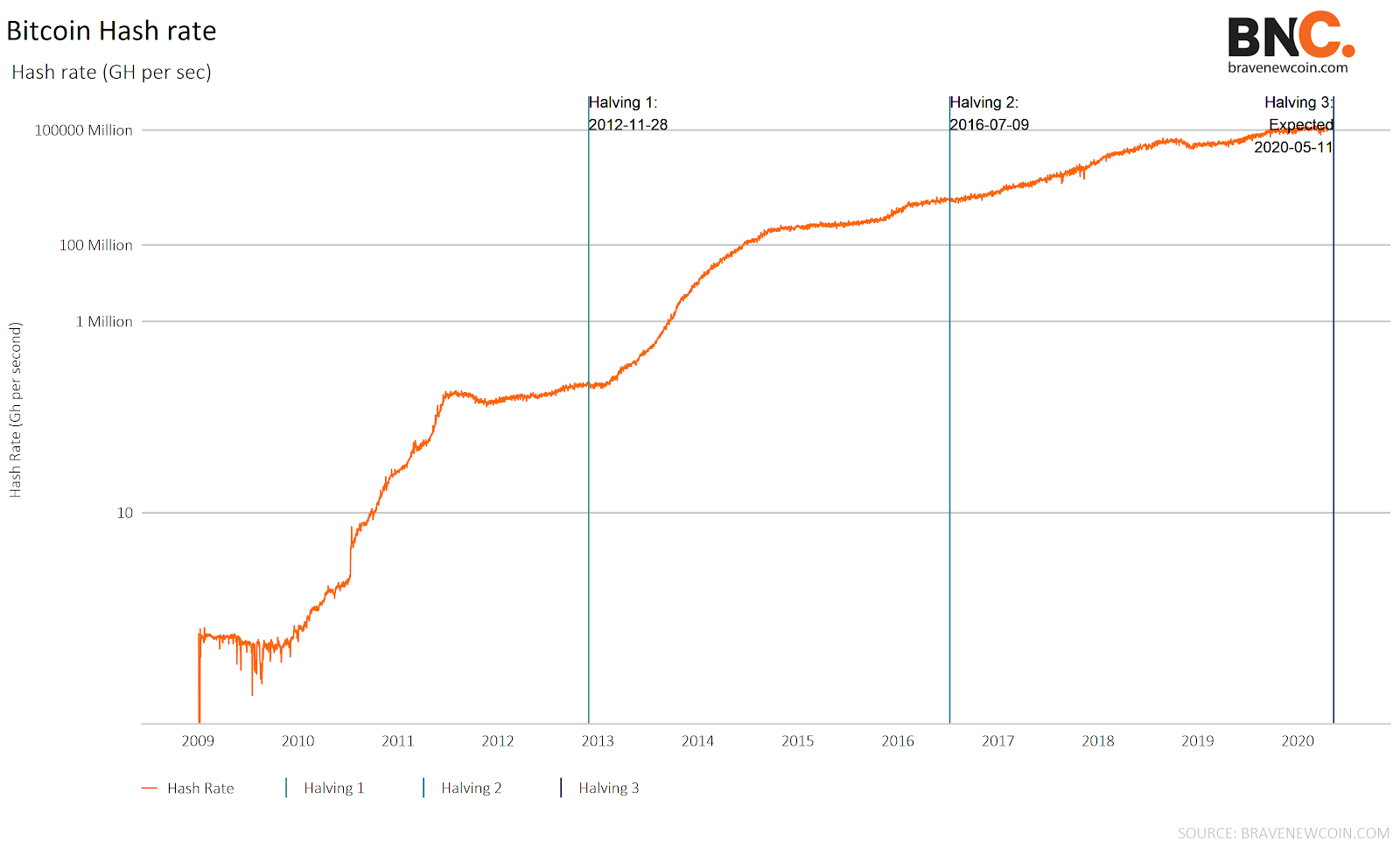

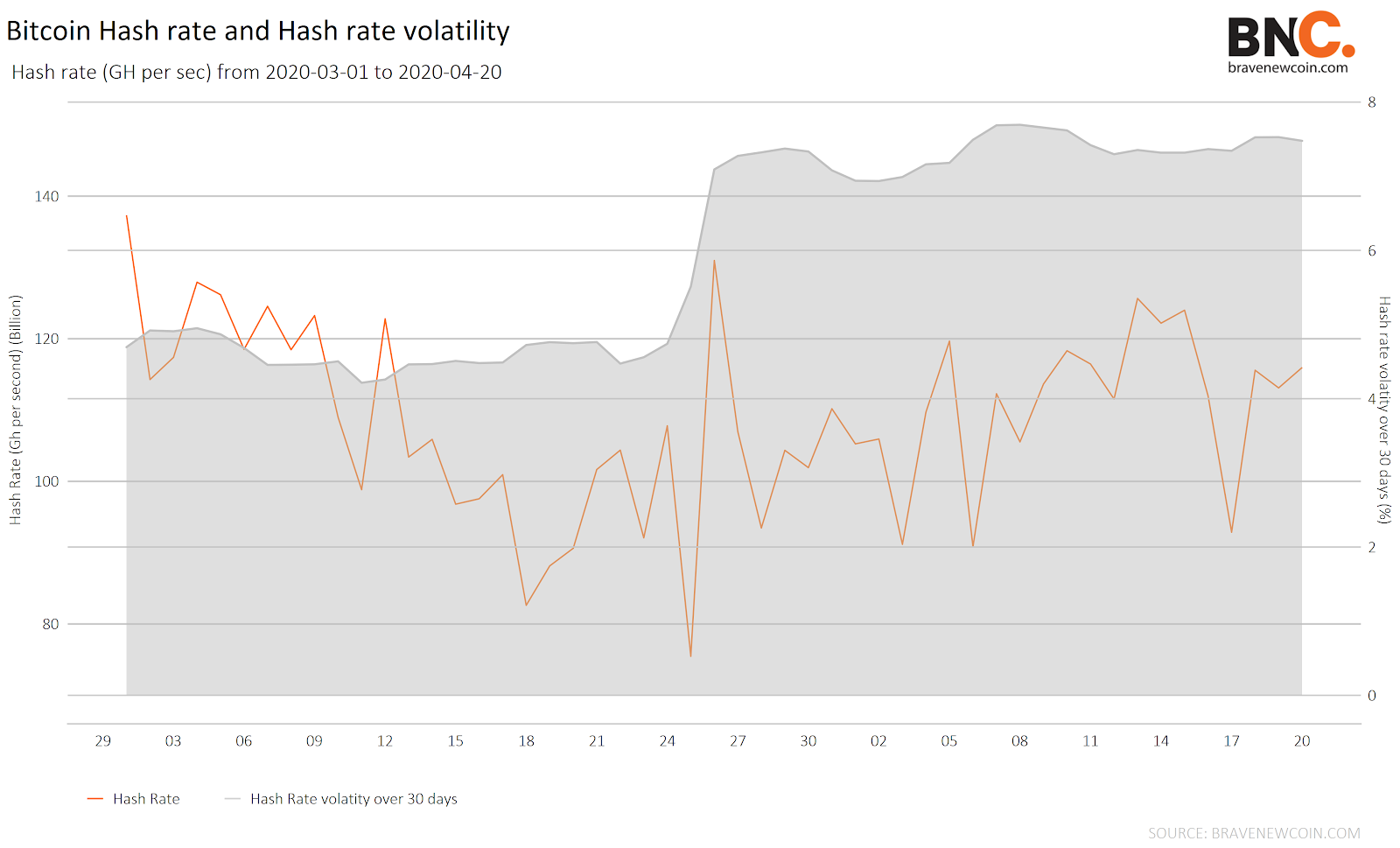

- Hash Rate: The computational power of the bitcoin network, per second.

- Hash Rate = (Expected hashes to mine) * total blocks) / block time

INSIGHTS BREAKDOWN

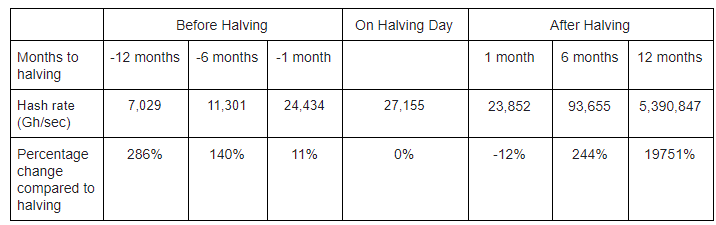

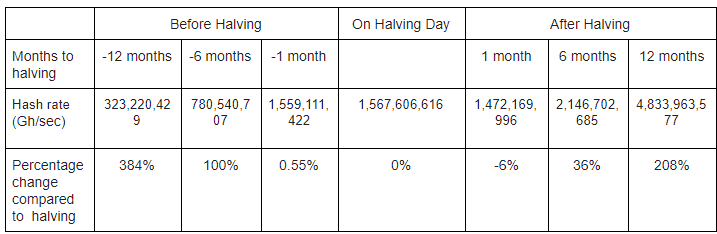

The Bitcoin block reward halves every 210000 blocks, or roughly every 4 years. The current block reward is 12.5BTC, and the next halving is due on the 12th of May 2020. Taking a look at the hash rate before and after the last two halvings, we can identify a positive growth trend, with ups and downs along the way.

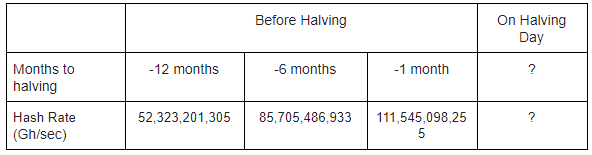

DIVING DEEPER INTO THE HASH RATE FOR MARCH, 2020 AND APRIL, 2020:

TAKE-AWAYS:

Looking at the above graph, which details the bitcoin networks performance, we can see that:

- The network hash rate has descended rapidly, dropping ~45.04% from 1st March 2020 to 25th March 2020 due to a drop in mining activities.

- There were only 92 blocks executed on March 25 with 75465806452.0454 Giga hashes per second.

- On the next day, March 26th, there was a ~73.6% increase in network performance with 160 blocks executed on to the blockchain.

- Hash rate volatility over 30 days has continued to be high since March 25.

- As the hash rate has become less predictable compared to the start of the year and this is due to the high volatility in all global markets.

- Besides high volatility in network performance, we are approaching nearer to bitcoin halving and we can expect that the miners will compete to be in the race of executing the block of transactions to get the 12.5 BTC reward.

- As the supply of Bitcoins decreases and demand increases after halving, we can expect that miners will still compute on the bitcoin blockchain

- But with the current scenarios, it’s hard to predict whether the hash rate will grow rapidly as per two halvings before.

OhNoCrypto

via https://www.ohnocrypto.com

Sumathi Pandi, Khareem Sudlow