Crypto Market Forecast: 13th April

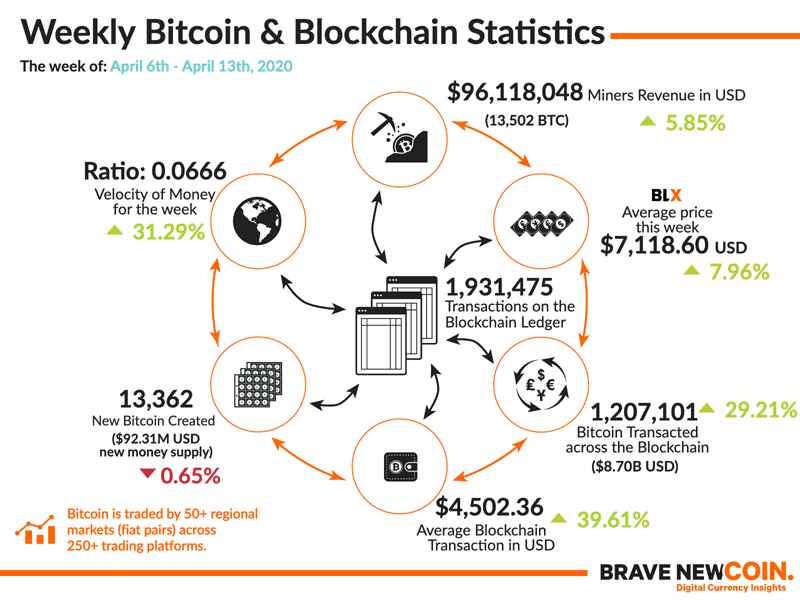

It was a week of pullbacks in the crypto markets with Bitcoin (BTC) ending the week just under ~US$7,000 having fallen ~6% over the last 7 days. This ends a strong multi-week run for the Bitcoin and digital asset markets, with BTC still up ~28% for the month and the total crypto market cap up ~19%. The number two and three crypto assets Ethereum (ETH) and XRP, (XRP) ended the week down ~4% and ~3% respectively.

Despite the bearish price action, reports of growing retail interest in crypto exchange platforms continue, as world economies continue to suffer under the strain of COVID-19 driven resource and policy demands. This appears to be leading many traders towards trying out internet-based digital currencies in the short term, as an alternative to traditional investments like equity in US stock markets which are more likely to be affected by macro economic headwinds and business cycles.

Over a series of tweets on April 12th, Cameron Winklevoss, co-owner of the Gemini exchange, underscored his bullish assessment of current market conditions for Bitcoin and cryptographic assets. He suggests that, “this pandemic will be an inflection point for Bitcoin and the Metaverse”, that the community should “HODL Bitcoins”, and the American retail sector will continue to struggle because of issues around the US dollar fiat system given its need to rely on perpetual money printing.

In Russia, a country that has been hit late by the COVID-19 epidemic, there are reports of a sharp increase in DDOS attacks against cryptocurrency exchanges and e-commerce platforms over the last month. According to Alexei Parfentiev, head of the Searchinform analytics department, the attacks are being led by a desire to obtain confidential user information through services that became popular during the epidemic. Popular video conferencing and calling app Zoom, that has exploded in popularity during the COVID outbreak, has also been the target of malicious attacks to snatch confidential user data in recent months.

Despite this bullish retail narrative, many in the Bitcoin community are still skeptical about the cryptographic currency’s value as a safe haven asset during times of economic uncertainty. Writing in his popular Crypto Trader Digest, Bitmex CEO Arthur Hayes suggested that Bitcoin could go as far as down as ~US$3,000 in the near term because of continued chaos in traditional investment markets.

In his words, “As the SPX rolls over and tests 2,000, expect all asset classes to puke again.” Hayes also suggests that market conditions in which traders react to bailout and stimulus announcements are prone to short term fakeouts over the course of a larger bear trend.

This week in crypto

18th April- Bitcoin Gold block reward halving event

Halving mania continues this week, following events for the Bitcoin Cash (BCH) and Bitcoin SV (BSV) chains the week before. There is another fork in 4 days time. Bitcoin Gold (BTG) has a controversial history, has been delisted by major cryptocurrency exchanges, and has been noted as a difficult project to work with.

It was a difficult week for large-cap crypto assets apart from new entrant to the top 10, Chainlink (LINK). The LINK token has been a standout ‘alpha’ asset for some time and continues to show signs that it is ‘decoupling’ from Bitcoin, making it a key hedging tool for digital asset traders.

A bearish Easter holiday period has ended up erasing BTC’s steady early-week price performance. Based on weekly volume patterns, there is a bullish technical pattern for BTC forming. This may suggest a short term bottom has been hit and the spot price will move upwards from here.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow