Bitcoin Price Analysis - Key fundamentals increase

Bitcoin (BTC) is a decentralized digital currency released by Satoshi Nakamoto in 2009, shortly after the Global Financial Crisis. The market cap is currently US$130.5 billion, with US$4.36 billion traded in the past 24 hours. The current spot price is down 63% from the all-time high established in December 2017, but up over 50% in the past month.

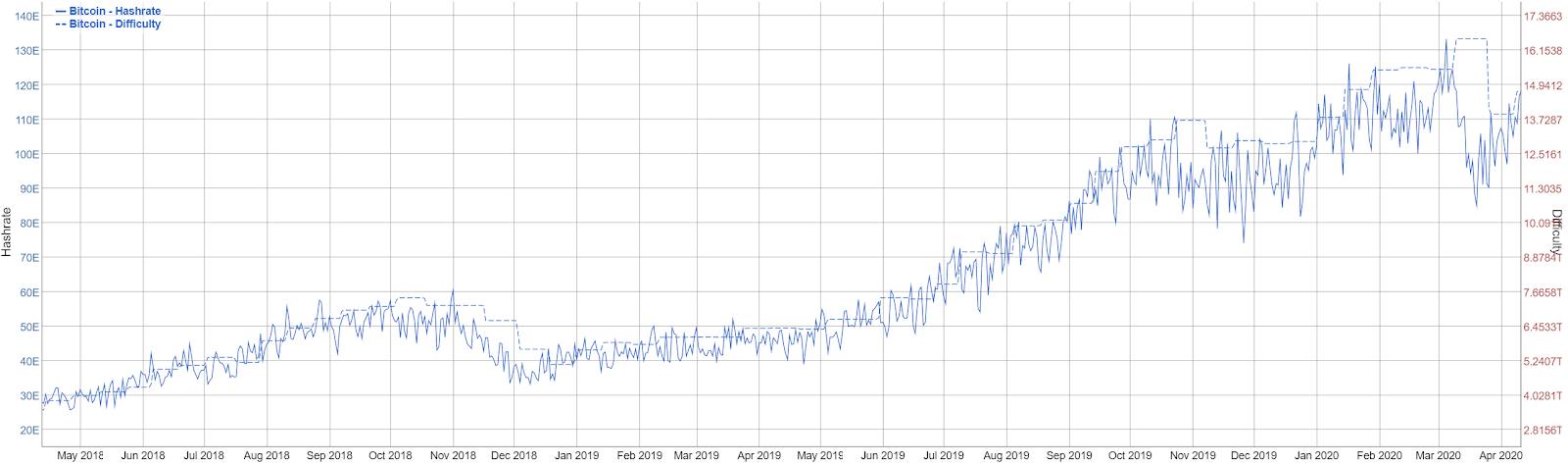

The BTC network is secured by the SHA-256 consensus algorithm. Both the network hash rate and network difficulty repeatedly posted record highs in 2019 and 2020. The increases were likely due to both new ASICs being manufactured as well as relatively cheap electricity available in China, and elsewhere, enabling older ASICs to again become profitable.

As BTC spot prices began to decline in late 2019, hash rate plateaued. From March 5th to March 20th, hash rate decreased 36%. If BTC spot prices continue to decline in 2020, more and more miners will likely turn off their ASICs or mining operations, until mining profitability increases.

Average block times are currently nine minutes, suggesting a projected increase in difficulty in the next two weeks. Network difficulty adjusts every 2,016 blocks. As hash rate decreases before a difficulty adjustment, block times increase. As hash rate increases before a difficulty adjustment, block times decrease. The adjustment will target a 10 minute blocktime.

BTC inflation stands at 3.88% and is set to decrease in a stepwise fashion over time. The next block reward halving is estimated to be 27 days from now, around May 10th, when annual inflation will decrease to 1.80%. If miners continue to add hash rate to the network, and maintain a block time less than 10 minutes, the estimated time until the next halving will continue to slowly decrease.

Twenty-three new SHA-256 ASICs were released in 2019, with two released by Bitmain in December. Four more ASICs are set to be released this year, which may explain the continued rise in hash rate in early 2020. The most profitable miners are currently the; Bitmain Antminer S17+ and 17e, ASICminer 8 Nano Pro, and the MicroBT Whatsminer M20S.

Renewable energy sources around the world, including hydroelectric and geothermal power, bring electricity prices for most mining farms to US$0.04 cents/KWh or lower. Currently, only 12 of the available SHA-256 ASICs are not profitable. If electricity prices suddenly rise or if BTC prices continue to drop, more and more ASICs become unprofitable and the hashrate will likely continue to decline.

After the block reward halving, many of these ASICs will likely become unprofitable completely if price does not increase dramatically. Other network factors that influence mining profitability include; price, block times, difficulty, block reward, and transaction fees.

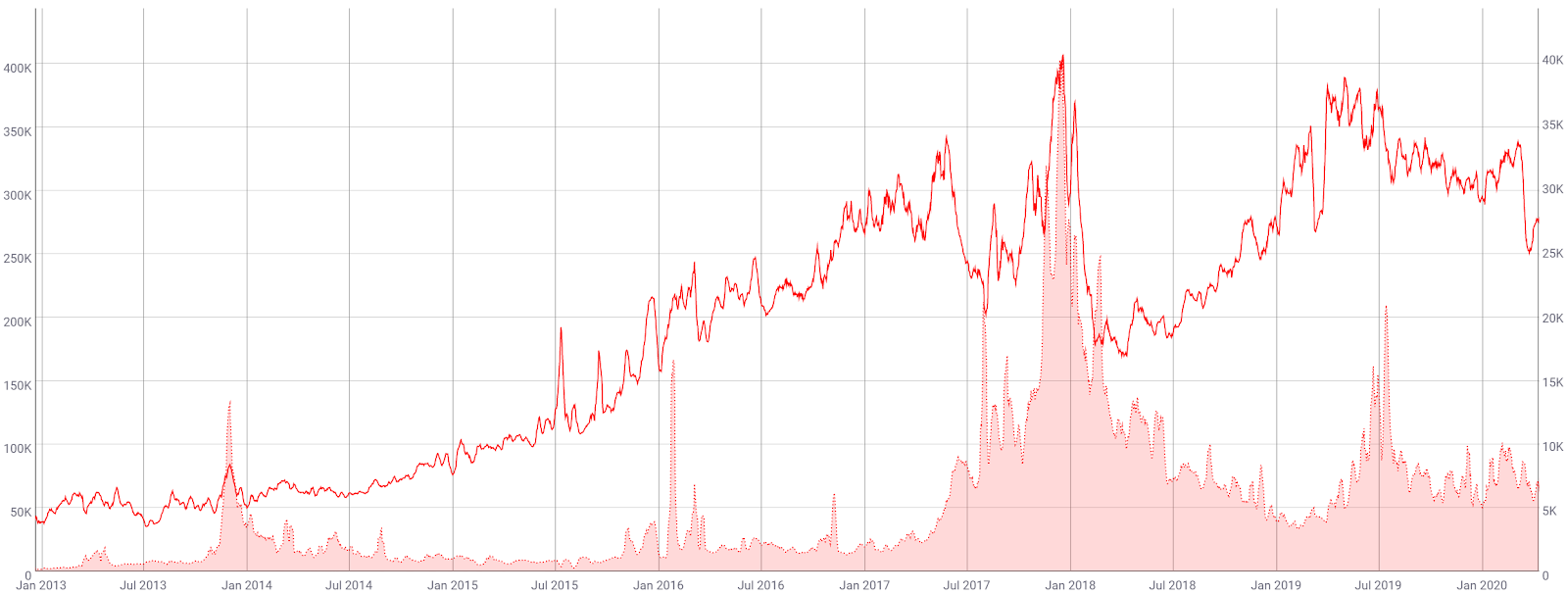

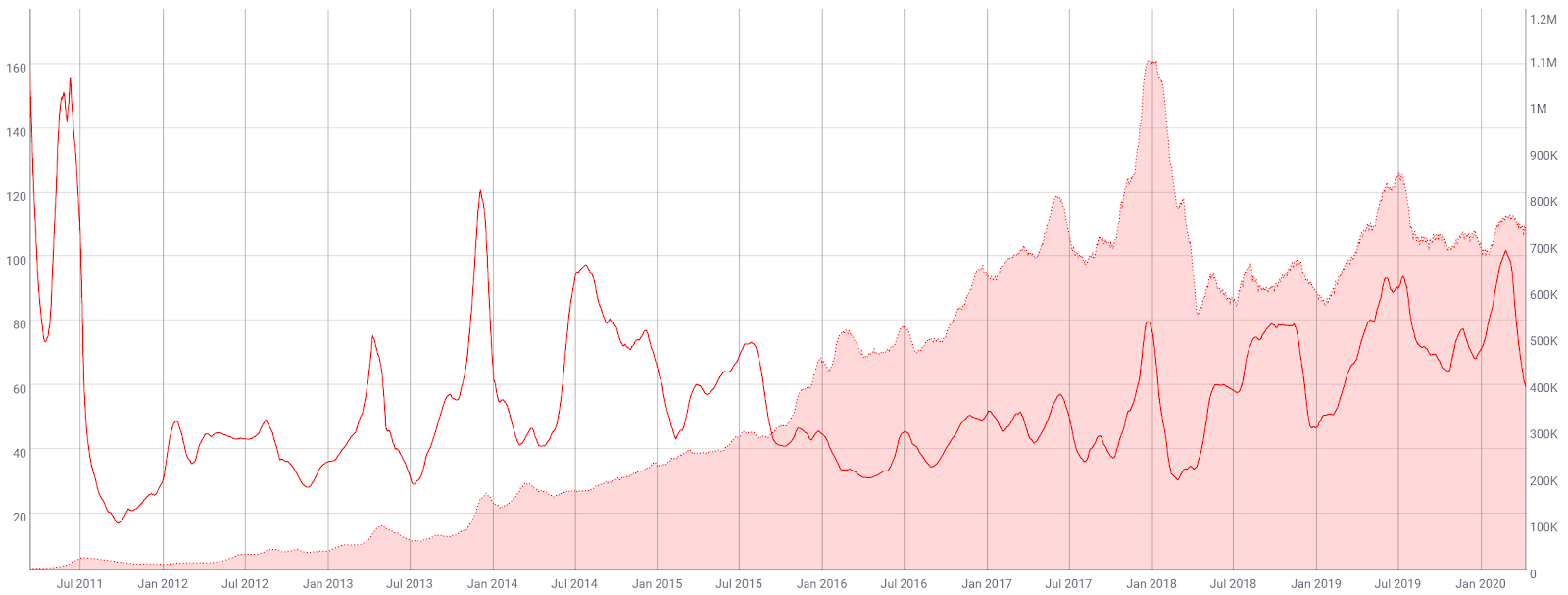

On the network side, on-chain transactions per day (line, chart below) took a steep dive over the past month, setting new yearly lows. Average transaction values in USD (fill, chart below) have ranged from US$5,000 to US$10,000 over the past eight months. The current record for transactions in a single day was set in December 2017, at 500,000. The current record for average transaction values in USD was set in January 2016, at US$51,000.

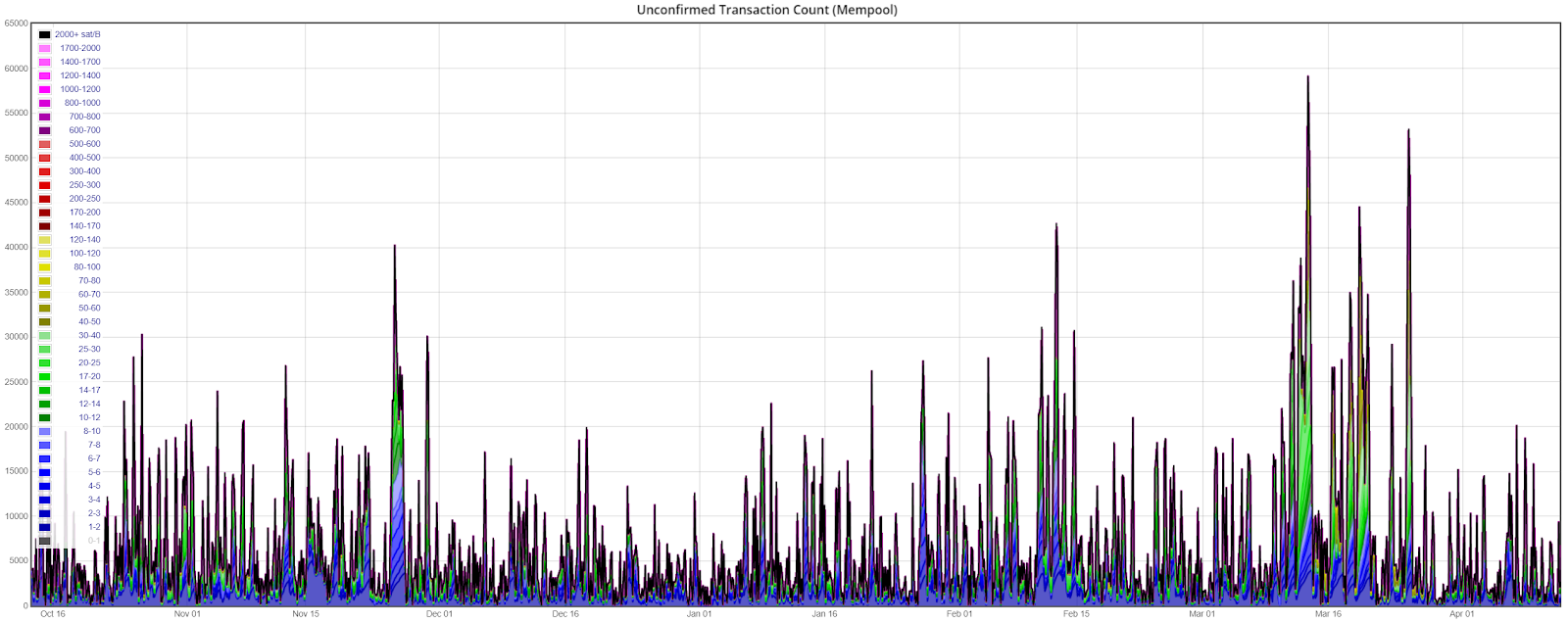

Unconfirmed transactions have mostly held below 20,000 since August 2019, during peak congestion, and have dropped below 5,000 during off-peak times (chart below). Over the past month, with increased price volatility, unconfirmed transactions have increased to nearly 40,000 during peak times. A decline in hash rate last month led to an increase in block times, which also contributed to network congestion.

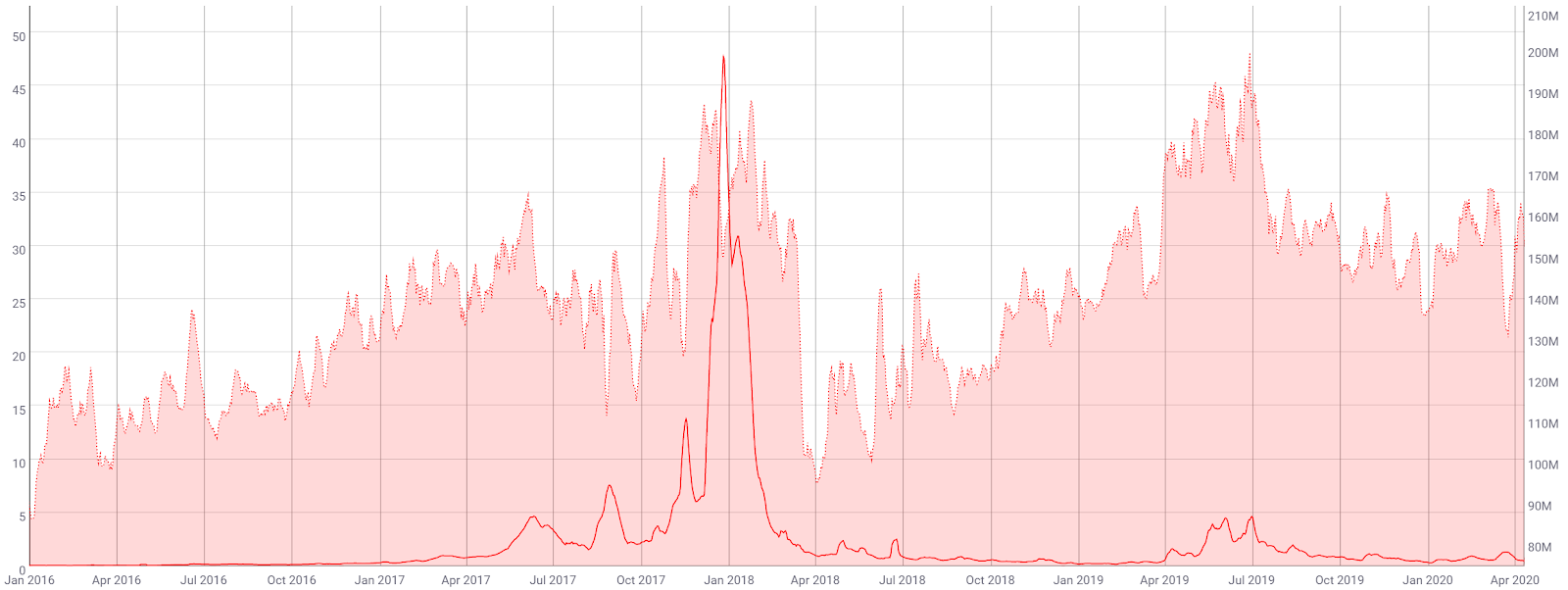

The average block size (fill, chart below) increased substantially from April 2018 to June 29th 2019, due to both an increase in on-chain activity as well as Veriblock (VBK), which secures other blockchains through the Proof of Proof consensus mechanism. From June 29th to late December, the average block size has dropped from nearly 4 MB to 1.35 MB. Since then, block size has increased to over 1.6 MB.

The average transaction fee (line, chart below) is currently US$0.51, despite a growing block size and increased on-chain use since the record high fee of US$62 in late December 2017. Both the lack of zero-fee unconfirmed transactions and increased scalability have kept fees substantially lower than late in 2017.

Additionally, transaction batching and the increasing off-chain capabilities of the Lightning Network have decreased on-chain transaction bloat. Transaction batching is most effective for entities with a high amount of on-chain transaction outputs, such as miners and exchanges.

The 30-day Kalichkin network value to on-chain transactions ratio (NVT) increased from 70 to 100 in the beginning of the year, but has since declined to 61 (line, chart below). While Kalichkin's NVT does not account for inflation or the use of off-chain transactions, which would decrease the overall NVT ratio, the metric remains in the upper-half of the historic range.

The three previous highs in NVT, in February 2011, October 2014, and October 2018, were all followed by bearish price moves. Based on this metric, the probability for a local top in price will increase if another local NVT high is reached. In December 2018, NVT declined to 46 before a price reversal.

Monthly active addresses (MAAs) have increased to 720,000 over the past three months, marking an eight-month high (fill, chart below). MAAs grew to 850,000 in July 2019, from a 2019 yearly low of 550,000. MAAs have held above 500,000 since October 2016.

Daily active addresses (DAAs) surpassed one million three times in 2019, on June 14th, 26th, and 28th. June 2019 was the first-month that DAAs exceeded one million since February 2018. DAAs nearly exceeded 940,000 on April 7th. On December 14th, 2017, DAAs exceeded 1.28 million.

The Bitcoin network has far more active addresses than any other blockchain. A large uptick or sustained increase in DAAs should be seen as a bullish indicator for market prices as it suggests an increase in on-chain BTC demand. As off-chain transaction facilities increase, daily active addresses may stagnate or decline over time.

The market cap divided by the realized cap (MVRV) is another crypto-native fundamental metric used to assess overbought or oversold conditions. Realized cap approximates the value paid for all coins in existence by summing the market value of coins at the time they last moved on the blockchain.

Historically, periods of an MVRV Z-score less than zero have represented oversold conditions, whereas periods of an MVRV Z-score greater than seven have represented overbought conditions. Since 2013, all three MVRV Z-score spikes above seven have coincided with record highs in price. MVRV is currently 0.51, after spiking to -0.20 on March 12th. All previous periods with an MVRV Z-score below zero consolidated for several months before moving into positive territory.

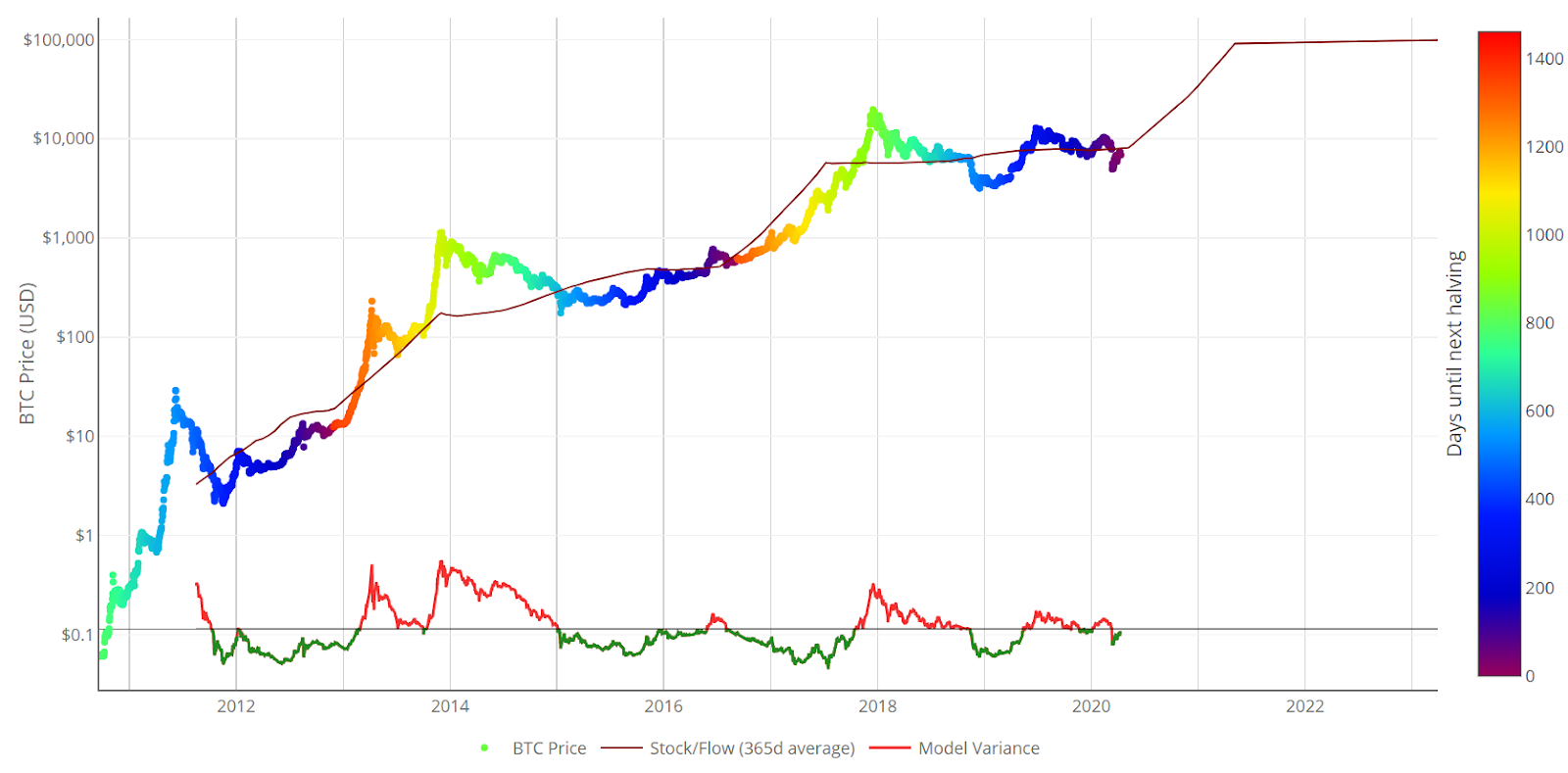

Bitcoin is often compared to other commodities with store-of-value properties, like gold, silver, or platinum. The Stock-to-Flow model, comparing the amount currently available against the amount mined over time, can be used to determine the potential future price of a commodity.

The Bitcoin Stock-to-Flow model, created by @100trillionUSD, suggests a US$100,000 price target over the next two years. Since 2011, Bitcoin price has maintained the predicted trajectory. The model variance can also be used as a measure of oversold or overbought conditions, relative to the Stock-to-Flow predicted price.

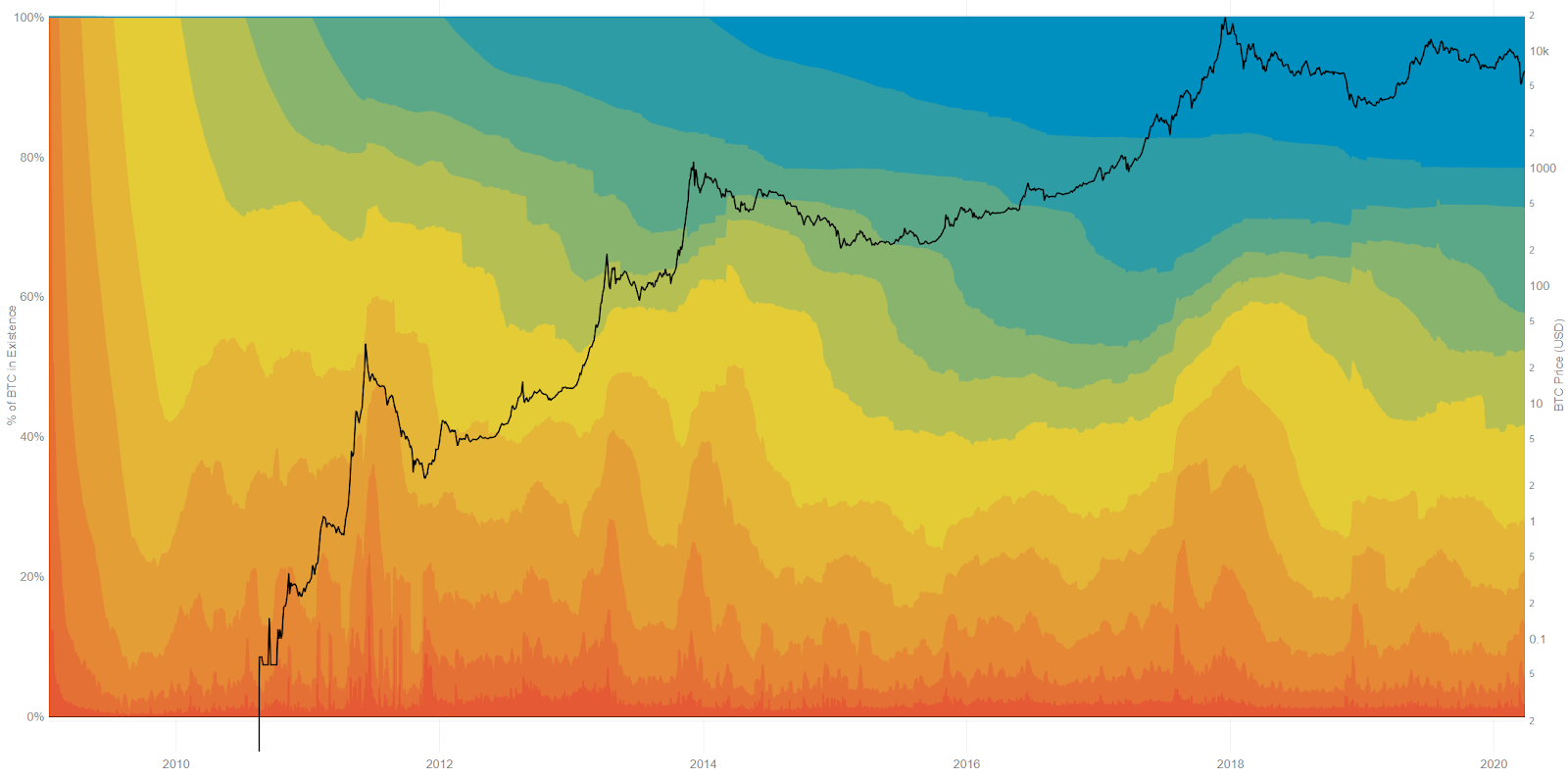

Analyzing the age of unspent transaction outputs (UTXOs), or unspent coins, can also provide some insights into price movements. Spikes in newly moved coins tend to correlate with local tops or bottoms in market values, and can represent euphoria or capitulation. Coins which have not moved recently are represented in cooler colors, whereas coins on the move are represented by warmer colors.

Coins that have not moved in more than five years (dark blue) account for 21.65% of the circulating supply, or around 3.96 million BTC. The two to three year age band (turquoise), or coins not moved since April 2017 - October 2018, holds the next highest distribution at 15.10%. The one to the three-month band (orange) gained 5% from April 2019 to June 2019, but has fallen in recent months. Historically, local tops in price have occurred when the one to three-month band, currently 7.36%, has represented more than 15% of all circulating UTXOs.

Turning to developer activity, Bitcoin Core version 0.19.1 was released earlier this year and provided various bug fixes and performance improvements. Future potential protocol improvements in the pipeline include Schnorr signatures, Taproot, and Graftroot.

Schnorr signatures and signature aggregation also bring the potential for storage and bandwidth reduction by at least 25%. Taproot and Graftroot improve upon Merkelized Abstract Syntax Trees (MAST) which offers three benefits; smaller transactions, more privacy, and larger smart contracts.

In September 2019, Pieter Wuille of Blockstream also unveiled plans for miniscript, a simplified way to write Bitcoin code. The current version, Script, is complex and difficult to use for those not intensely familiar with the language.

According to Wuille, miniscript allows a user to write some Bitcoin scripts, “in a structured, composable way that allows various kinds of static analysis, generic signing, and compilation of policies.” Miniscript is in the early stages of development and is currently being tested internally at Blockstream.

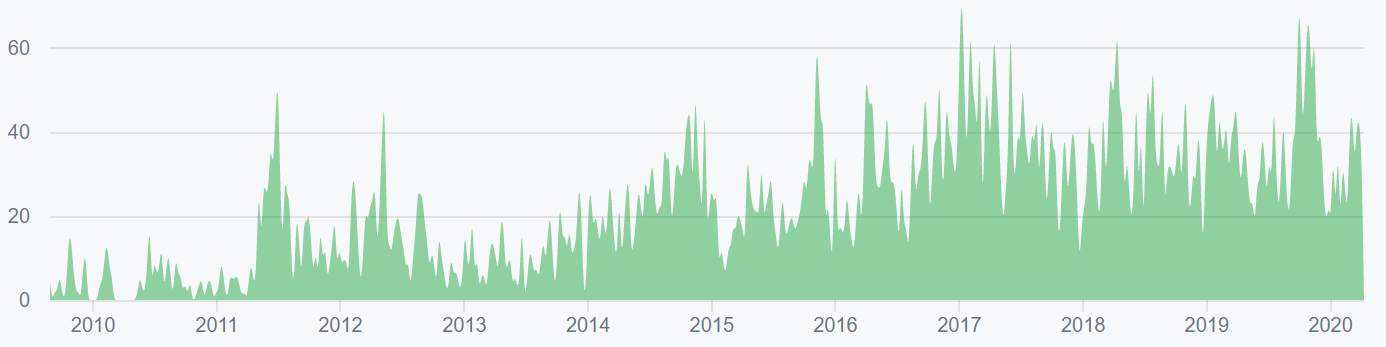

More than 50 developers have contributed nearly 1,800 commits in the past year, mostly on the main Github repo. Most coins use the developer community of GitHub where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher developer activity and interest.

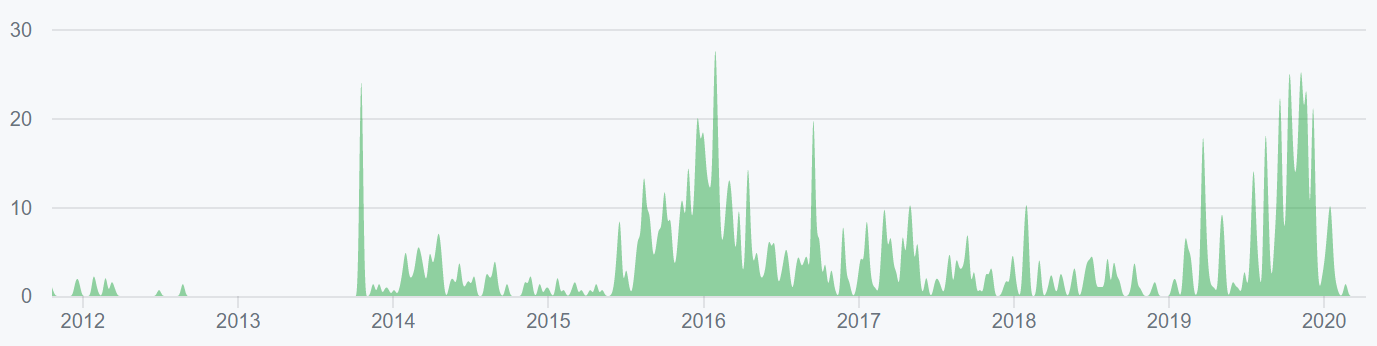

The BTC project on Github has two active repos, “bitcoin” (top chart, shown below) and Bitcoin Improvement Protocols, “BIPs” (bottom chart, shown below).

BTC exchange-traded volume over the past 24 hours has been dominated by Tether (USDT) trading, with the United States Dollar (USD) markets representing 8% of the total volume. Tether is a stable coin with a soft peg to the USD. Stablecoins in general currently represent over 85% of all reported volume over the past 24 hours.

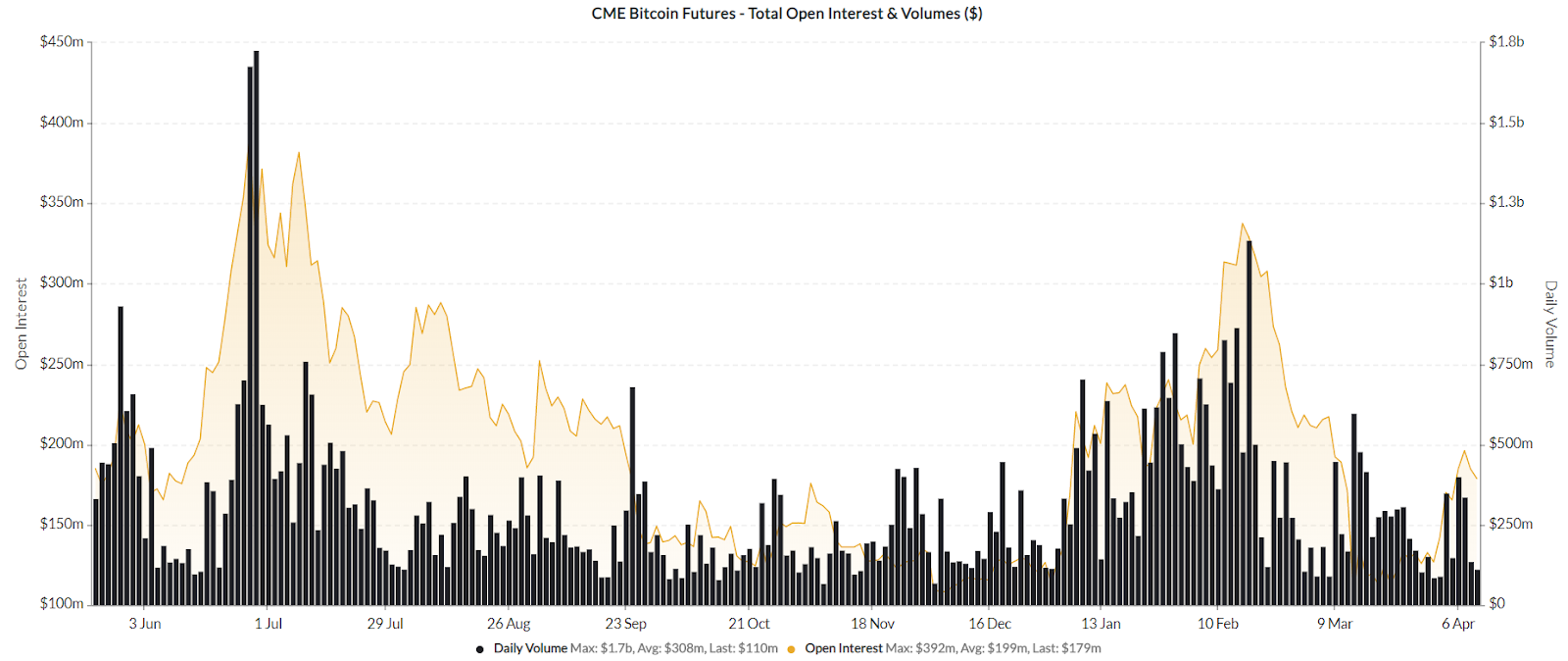

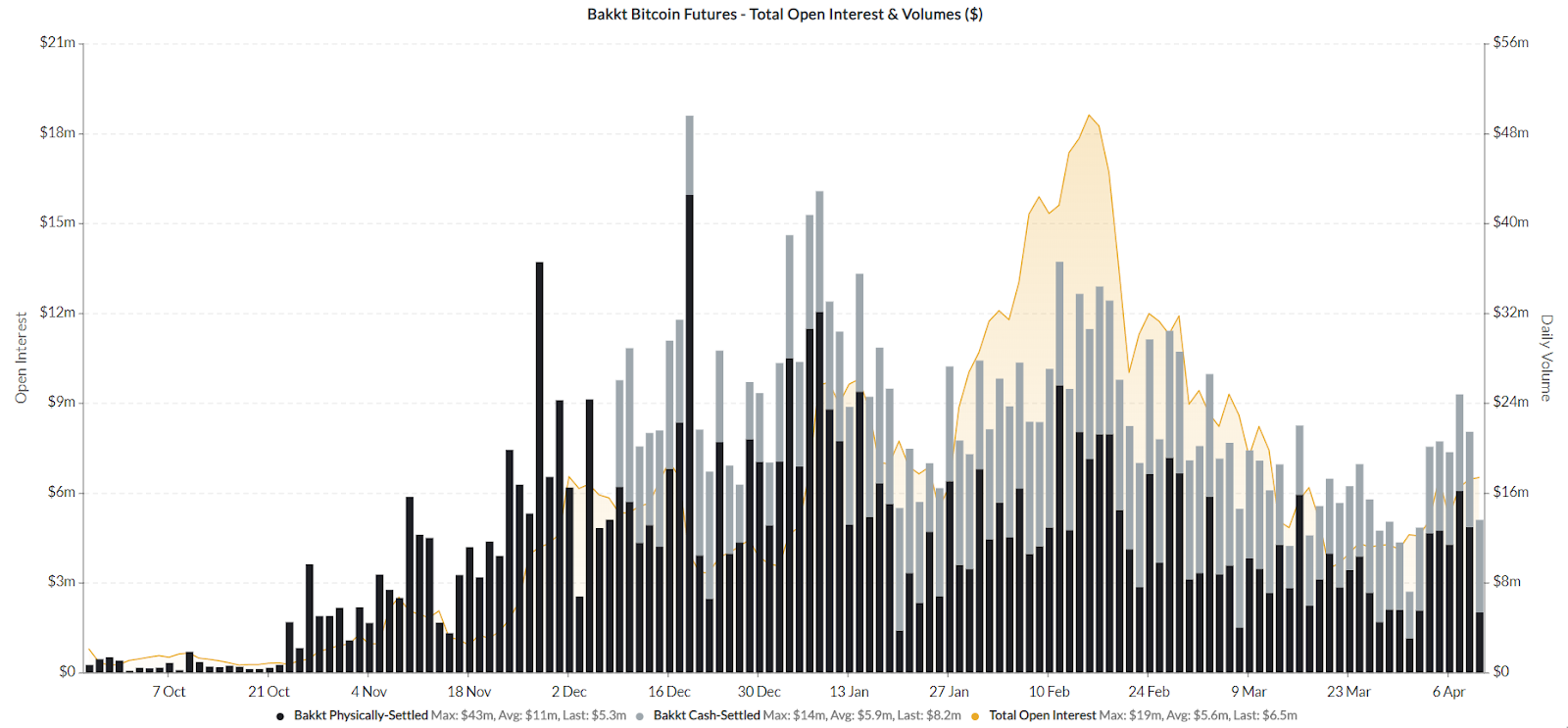

In lieu of an ETF in the U.S., the Chicago Mercantile Exchange (CME) launched cash-settle BTC futures in Q4 2017. The institutional product has seen large volumes and interest over the past year. Bakkt physically-settled BTC futures exchange launched in September 2019 which has seen increasing volumes throughout 2019, but decreasing volumes over the past month. Bakkt and the CME have also launched a BTC options product.

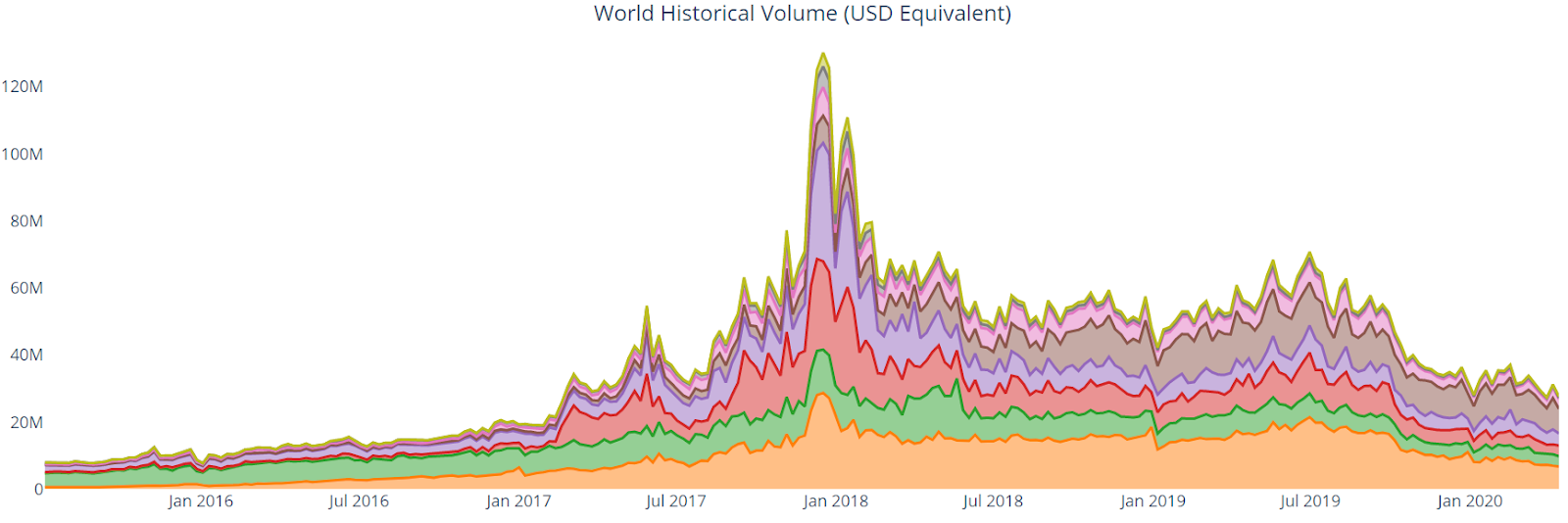

Global over the counter (OTC) volume, from LocalBitcoins.com, declined from late 2017 to mid 2019, and then declined again from mid 2019 to early 2020. Global notional volume has held near or above US$50 million since the beginning of the year. In May 2019, LocalBitcoins discontinued servicing Iran, likely as a result of U.S sanctions and in June 2019, the option to pay for BTC in person with cash was disabled.

Latin America (brown) holds the highest percentage of total notional volume, followed by Eastern Europe (orange). The Middle East (yellow) and the Australia/New Zealand regions (grey) hold the lowest notional volume, both posted less than US$400,000 in trade volume over the past week. Notional volumes for Venezuela and Columbia stand at US$3.4 million and US$2.1 million, respectively. Venezuela’s central bank has also floated plans to hold BTC within its reserve system.

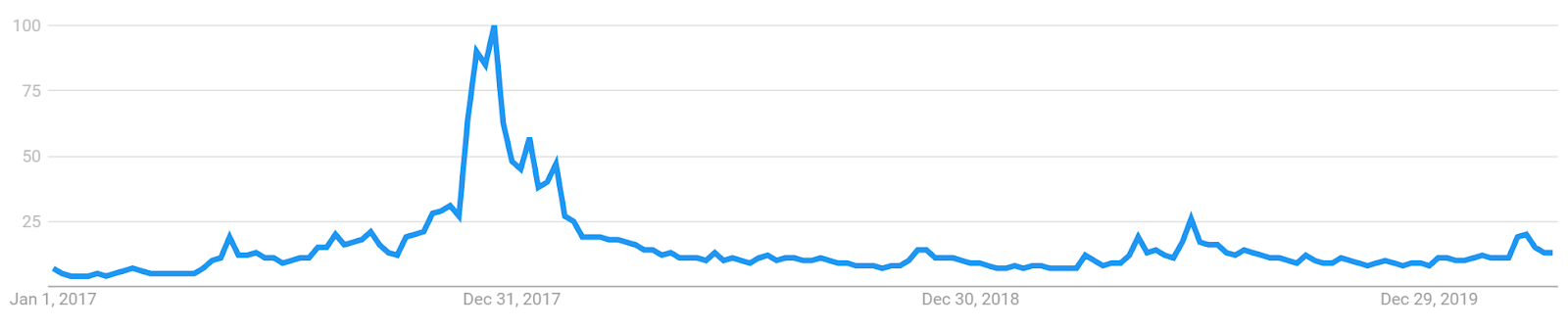

Worldwide Google Trends data for the term "bitcoin" increased dramatically from March to June 2019, marking a new yearly high. Since June, search interest has dropped but has begun to increase slightly again in recent weeks.

The previous increase in search traffic has likely been related to both the sharp increase in price in Q2 as well as mentions from several prominent U.S government officials, including the President of the United States. Throughout the course of 2018, “bitcoin” related searches declined dramatically. Despite the declining interest, the search “what is bitcoin” was the most popular “what is” Google search of 2018.

A slow rise in searches for "bitcoin" preceded the bull run in Q4 2017, likely signaling a large swath of new market participants at that time. However, a 2015 study found a strong correlation between google trends data and BTC price whereas a 2017 study concluded that when U.S. Google "bitcoin" searches increased dramatically, BTC price dropped.

Technical Analysis

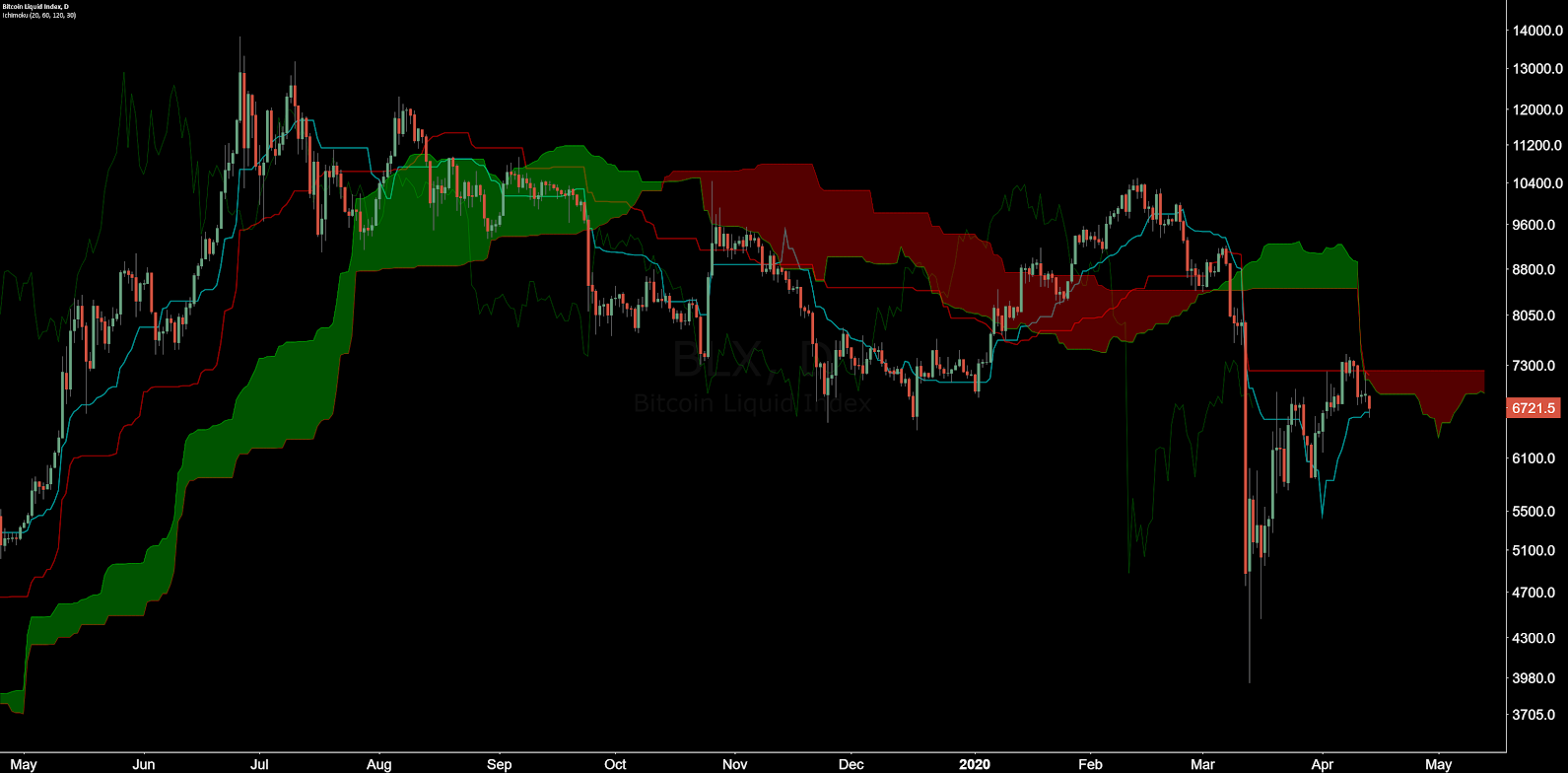

As a bullish recovery blossoms after the significant March 12th drop, roadmaps for future market movements can be found on high timeframes using Exponential Moving Averages, Volume Profile Visible Range, Yearly Pivots, divergences, and Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

On the daily chart for the BTC/USD market, the spot price relative to the 50-day Exponential Moving Average (EMA) and 200-day EMA can be used as a litmus test for the trend. In late January, the 50-day EMA crossed above the 200-day EMA, known as a Golden Cross, and was quickly followed by a bearish Death Cross on March 14th. The 50-day EMA is currently at US$7,156 and the 200-day EMA is currently at US$8,000, both should now act as resistance.

The volume Profile of the Visible Range (VPVR) shows a large volume resistance node at US$8,200 (horizontal bars, chart below) with relatively little volume resistance above that zone. Additionally, yearly Pivot Points, at US$8,100, US$13,000 and US$18,600, should all act as resistance.

The Bitfinex long/short ratio (top panel, chart below) is currently 63% long, with longs decreasing and shorts increasing over the past few weeks. There is a high likelihood for a price bottom if shorts overtake longs in the coming weeks. Historically, most periods with significant short interest have only fueled higher prices. There are no volume or RSI divergences currently, but RSI did hit a new yearly low on March 12th, suggestive of significantly oversold conditions.

Turning to the Ichimoku Cloud, there are four key metrics; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

On the daily chart, Cloud metrics are bearish; the spot price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and below the spot price. The trend will remain bearish so long as the spot price remains below the Cloud. Over the next few weeks, a long entry will trigger following any price rise above US$7,200.

Correlations with volatility in legacy financial markets have also had a significant impact on Bitcoin price. Since October 2014, spikes in the Chicago Board Options Exchange's CBOE Volatility Index (VIX) have represented local lows in BTC price. Over the past month, the VIX, or the ‘fear index’, spiked to over 70, the highest level since the 2008 financial crisis when the metric peaked at 90 (middle panel, chart below). The U.S S&P 500 Index has had an 87% correlation with BTC over the past week (bottom panel, chart below).

Lastly, the opening and expiration dates of the Chicago Mercantile Exchange (CME) BTC cash-settled futures contracts, launched in December 2017, have had a significant impact on price. The CME facilitates trades for the largest portion of derivatives contracts in the world.

In July 2019, the CME saw the highest notional volume ever in a single day for the BTC futures product, exceeding US$1.5 billion. Historically, price volatility tends to increase dramatically near any active contract expiration, as was again the case leading into January 31st. The July 1st to December 27th contract yielded an excellent short trade for the entirety of the contract, which is similar to the bi-annual contract of the same time period in 2018.

Conclusion

Network hashrate and difficulty have been just as volatile as price over the past few months. The third block reward halving is less than 30 days away, which has the possibility of decreasing mining profitability substantially if price does not rise to make up the difference. There are also four new ASICs set for release this year which may help keep hashrate elevated post-halving.

Transactions per day have increased dramatically over the past month, while monthly active addresses remain near eight-month highs. Both NVT and MVRV, which are inversely related to on-chain activity, have decreased substantially over the past time period, suggesting oversold conditions relative to the Bitcoin market cap and on-chain utility.

Technicals for BTC/USD suggest a successful mean reversion attempt after the 62% drop from February to March 12th. The trend remains bearish with the current spot price below both the 200-day EMA and the Cloud. Based on yearly pivots and volume, US$8,100 is key overhead resistance, while US$6,400 should act as significant support.

Historically, legacy markets will also need to stabilize in order for buyers to return to the crypto market. In the months to come, Bitcoin may recover swiftly as quantitative easing and central bank money printing surge to unparalleled levels.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow