Stellar Price Analysis - Active addresses continue to decline

Stellar (XLM) is a payment protocol that aims to connect banks, payment systems, and people. The current spot price is down 96% from the all-time high of US$0.72, set in January 2018. The market cap currently stands at US$764 million on a 20.2 billion XLM circulating supply, with US$141 million in exchange-traded volume over the past 24 hours.

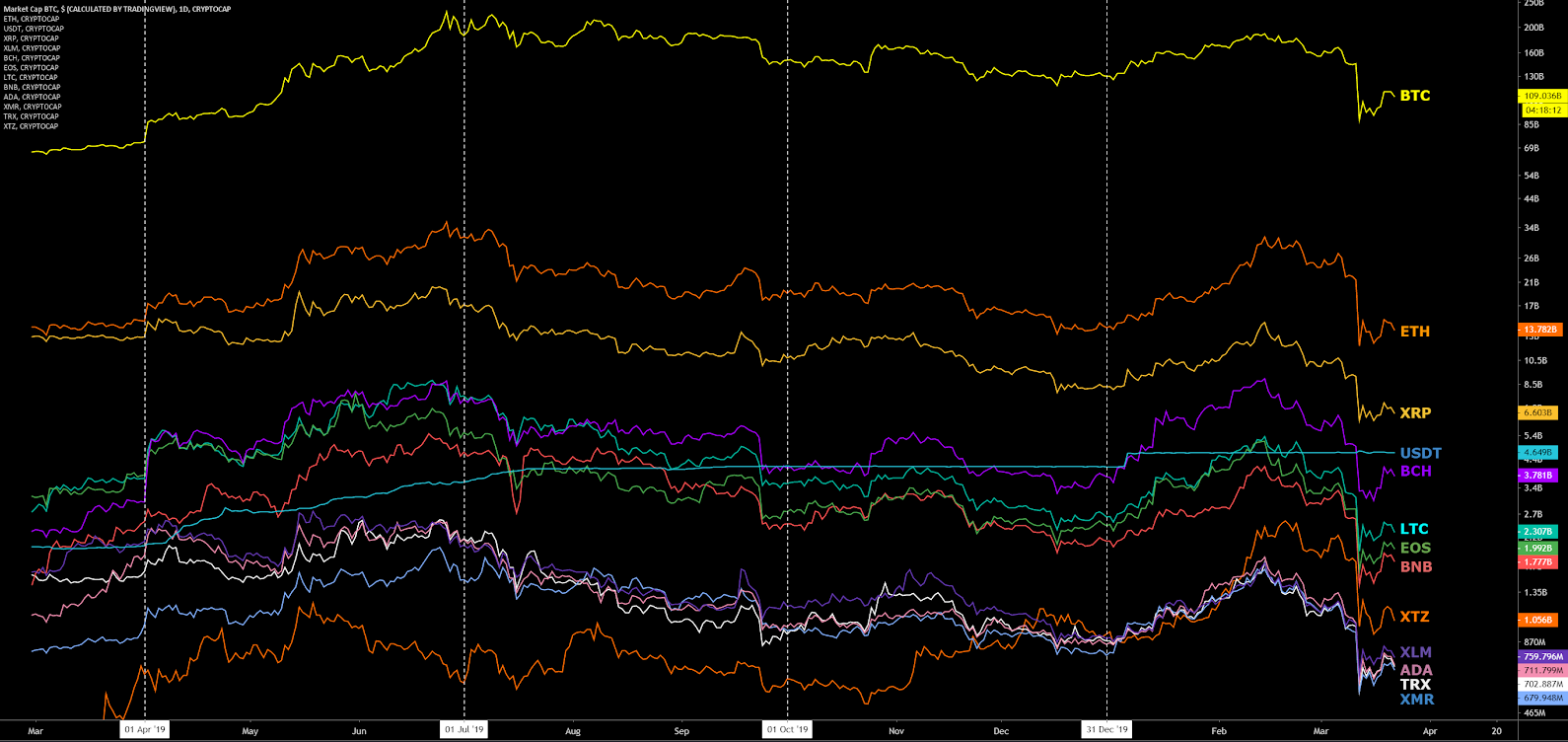

Now ranked 12th on the BraveNewCoin market cap table, XLM pulled ahead of Tron (TRX), Cardano (ADA), and Monero (XMR) in mid-September 2019, after being intertwined and highly correlated since April 2019.

Stellar and the Stellar Development Foundation (SDF) were created by Jed McCaleb and Joyce Kim in 2014. The project is analogous to Ripple (XRP) in many ways, where McCaleb previously worked. The SDF was created to promote global financial access, literacy, and inclusion by expanding worldwide access to low-cost financial services, through the development and maintenance of technology and partnerships.

The SDF leadership includes CEO Denelle Dixon and founder Jed McCaleb. The board of directors includes Stellar’s chief scientist, David Mazières, Keith Rabois, Shivani Siroya, and Greg Brockman. The SDF was incorporated in 2014 as a non-stock nonprofit corporation in the U.S. State of Delaware but is not currently an independently operated 501(c)(3), or non-profit. The SDF last applied for this distinction in 2015 but has not obtained tax-exempt status.

For consensus, XLM originally used Federated Byzantine Agreement (FBA), which was pioneered by XRP. In 2016, Mazières switched the network to the Stellar Consensus Protocol (SCP), after the chain was unable to maintain reliable consensus.

Neither XRP nor XLM use Proof of Work or Proof of Stake, but instead use validators to confirm transactions on the network. Validators do not receive a block reward. Anyone in the XLM network can be a validator, so the user must decide which validators to trust. Ideally, each trust group, or quorum slice, has overlapping transactions with other groups, and thus can collectively achieve consensus.

SCP quorum intersections ensure that each quorum slice is always linked by one node with consensus agreement, based on a large pool of individuals or validators. There have been 125 public nodes and 70 validators active on the network over the past two days, with most of these nodes residing in the United States and Germany.

In April 2019, a team of South Korean researchers released an analysis of the SCP consensus algorithm and nodes on the network. Their findings revealed that all of the nodes are unable to run SCP if only two nodes fail, leading to a security risk. These critical nodes are controlled by the SDF. A response from Mazières confirmed that the centralization of validators is currently a weakness in the ecosystem. “Downtime does happen, so what if a set of important nodes goes down and the network halts?,” Mazières questions.

On May 15th 2019, the network stalled for 67 minutes due to an inability to reach consensus. As opposed to most other chains, which can temporarily fork when consensus is not reached, the network halted completely. Stellar developers reported the high number of new nodes were the reason for the halt, “in retrospect, some new nodes took on too much consensus responsibility too soon.” The SDF nodes were not the reason for the network failure.

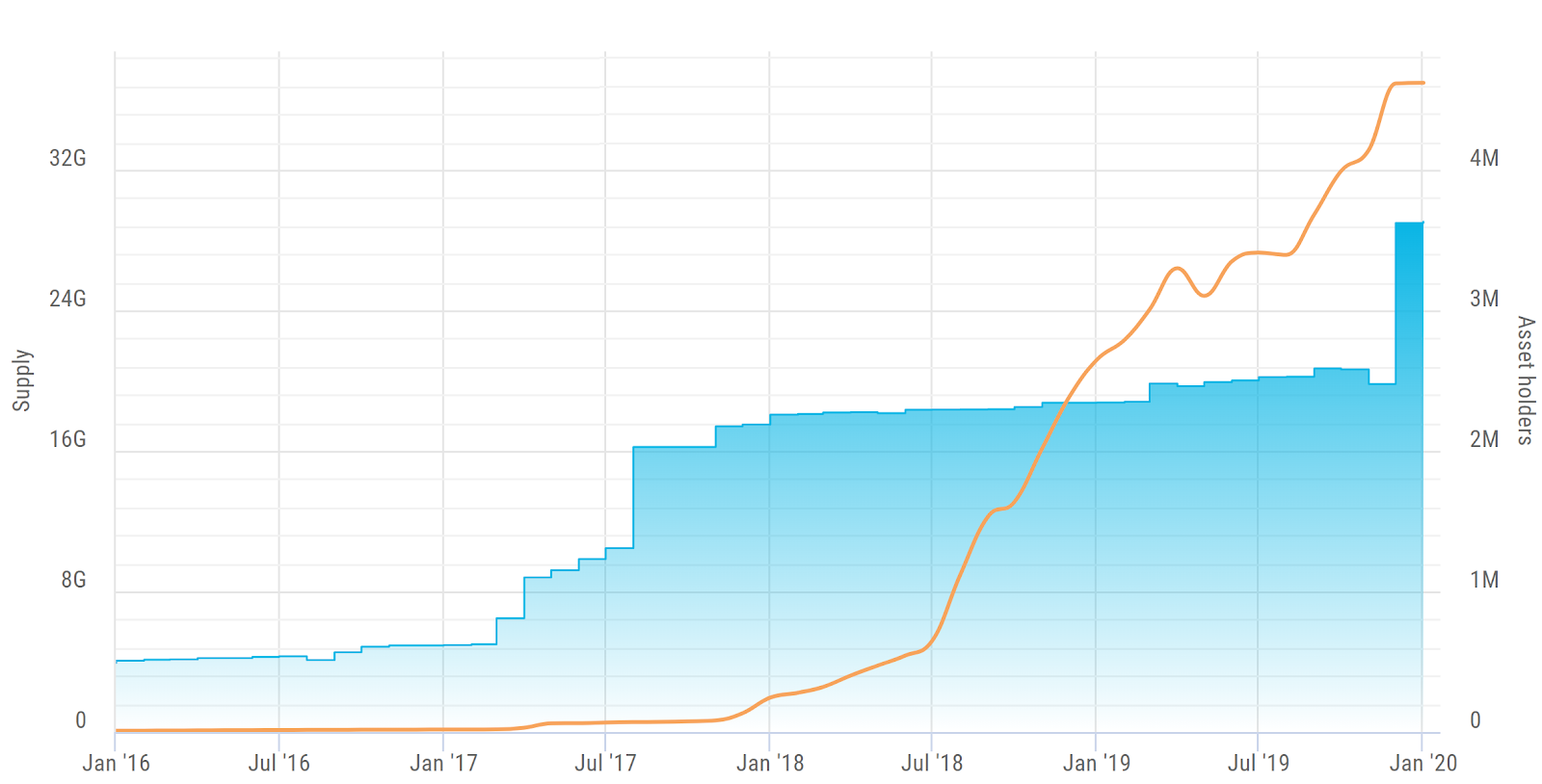

Initially, the XLM genesis block minted 100 billion tokens with a 1% per year initial supply growth rate. The coins created to satisfy this yearly inflation rate were distributed through an inflation pool, including network transaction fees. In late September 2019, the SDF released a proposal to remove inflation rewards completely. The SDF believed the inflation mechanism did not benefit projects building on the platform and eventually will lead to scalability problems in the future. This change was approved by validators and took effect in early November.

Additionally, in early November, the SDF decided to burn 55 billion lumens, previously earmarked for future operations costs, partnerships, and giveaways. SDF CEO Denelle Dixon told attendees at the Stellar Meridian conference, “as much as we wanted to use the lumens that we held, it was very hard to get them into the market.” The SDF continues to hold a remaining 29.30 billion XLM.

In late 2018, the SDF announced an up-to-500 million XLM distribution, or airdrop, through Blockchain.com, which added wallet support for the asset. The airdrop is ongoing and is touted as encouraging first-time crypto users, and the crypto-curious. Each user can receive US$25 in XLM, after KYC verification in the form of an email address and identity documentation.

In early 2019, IBM announced the launch of World Wire, which is a payment system built on the Stellar network. Six international banks have signed letters of intent, indicating that they will either use the XLM token or issue stable coins on IBM’s service, pending regulatory review. IBM also has several validators on the Stellar chain.

In March 2019, the SDF partnered with Coinbase to give away a further one billion tokens, through a learning exercise and referrals. In September, the Stellar SDF also announced a two billion coin airdrop to Keybase users. Since these airdrops, XLM holders have increased substantially.

The SDF also partnered with Wirex, a fiat (GBP, USD, and EUR) and crypto Visa card processor. Users can earn 0.5% back in BTC after each use of the Wirex Visa card. The partnership allows users to buy, store, exchange, and spend XLM on the Wirex platform. In November, XLM was also added to the Coinbase card, a similar debit Visa card.

The wider ecosystem includes Interstellar, which allows enterprises and institutions to use, and build on, the network. Interstellar combines the Chain and Lightyear brands. Chain’s products included Sequence and Chain Core. Sequence was a cloud-based ledger service for managing balances in financial and commerce applications like wallet apps, lending platforms, marketplaces, and exchanges. Chain Core was designed to operate and participate in permissioned blockchain networks.

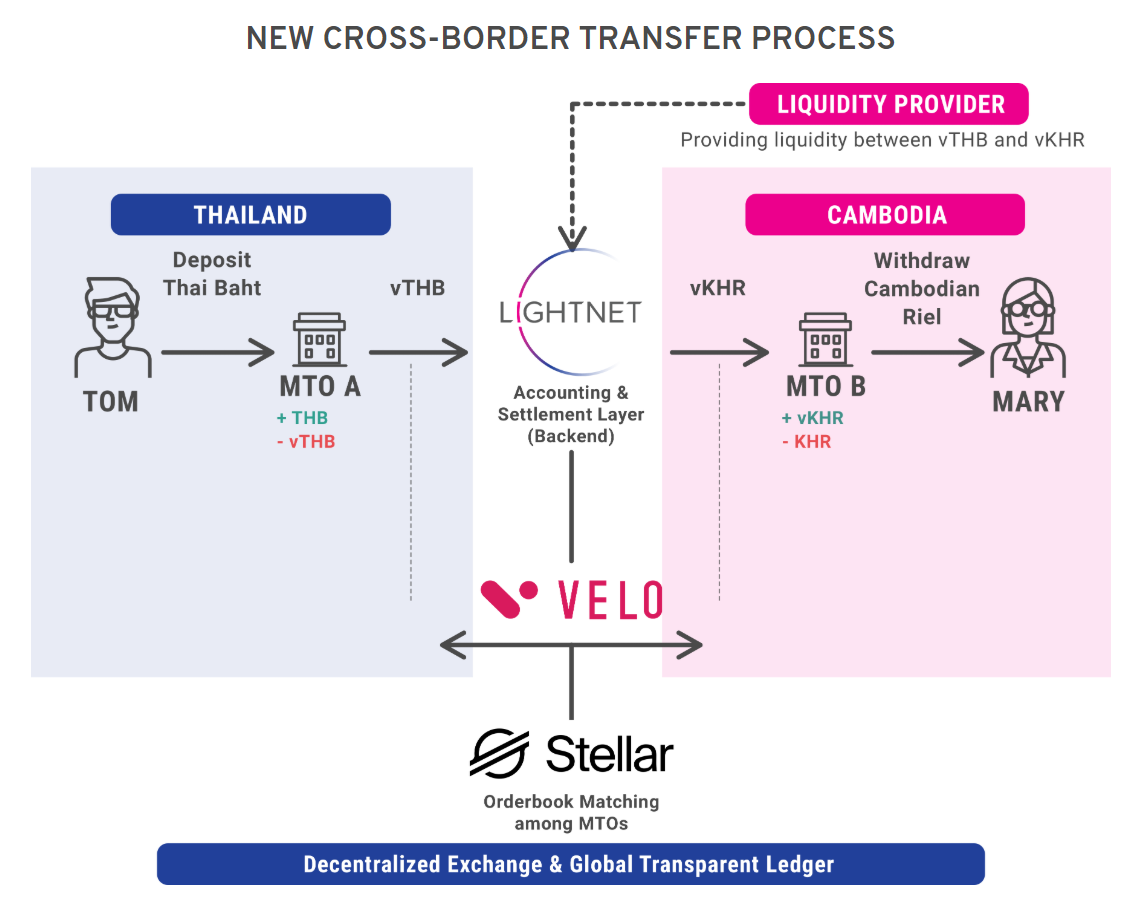

Another Stellar-based startup operating in Thailand, Lightnet, recently raised US$31.2 million to develop a SWIFT-like system using smart contracts and distributed ledgers. Advisors to the project include McCaleb and Mazières with investments from United Overseas Bank, HashKey Capital, Signu Capital, and Seven Bank.

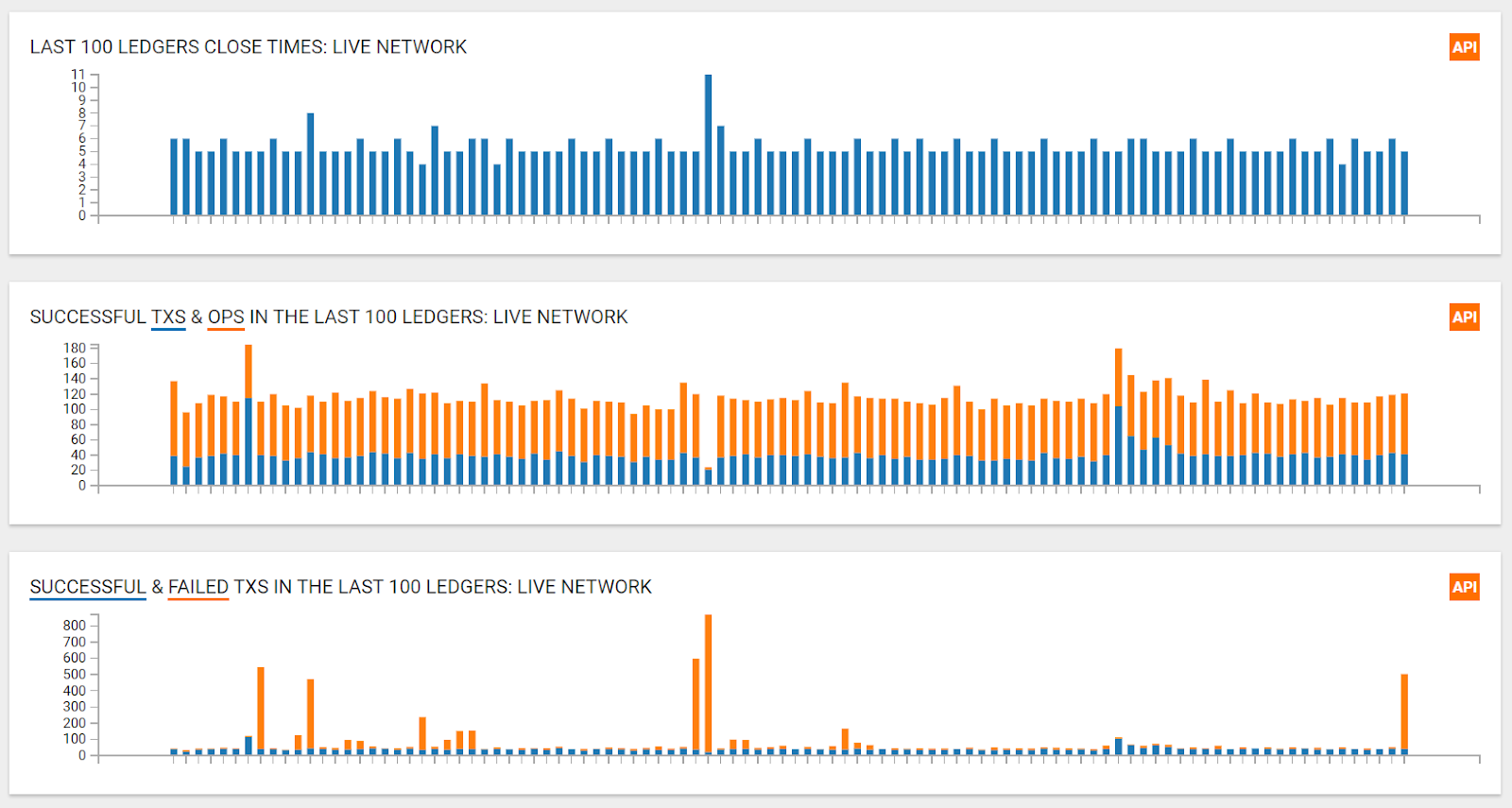

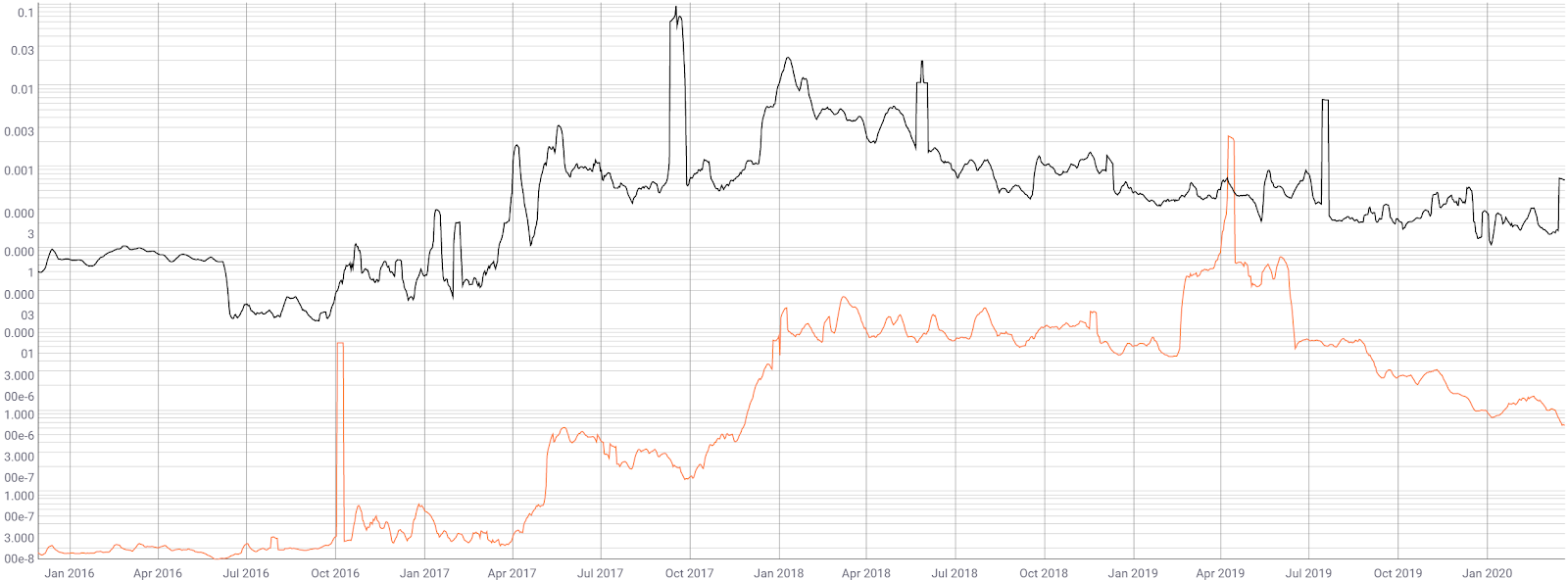

The network uses a default transaction fee of 0.00001 XLM to prevent spam or Denial of Service attacks. In USD terms, XLM average transaction fees rose substantially from February to May 2019 but have since returned to the previous range (orange line, chart below). Average transaction fees on the chain are much lower than most other chains, including XRP (black line, chart below).

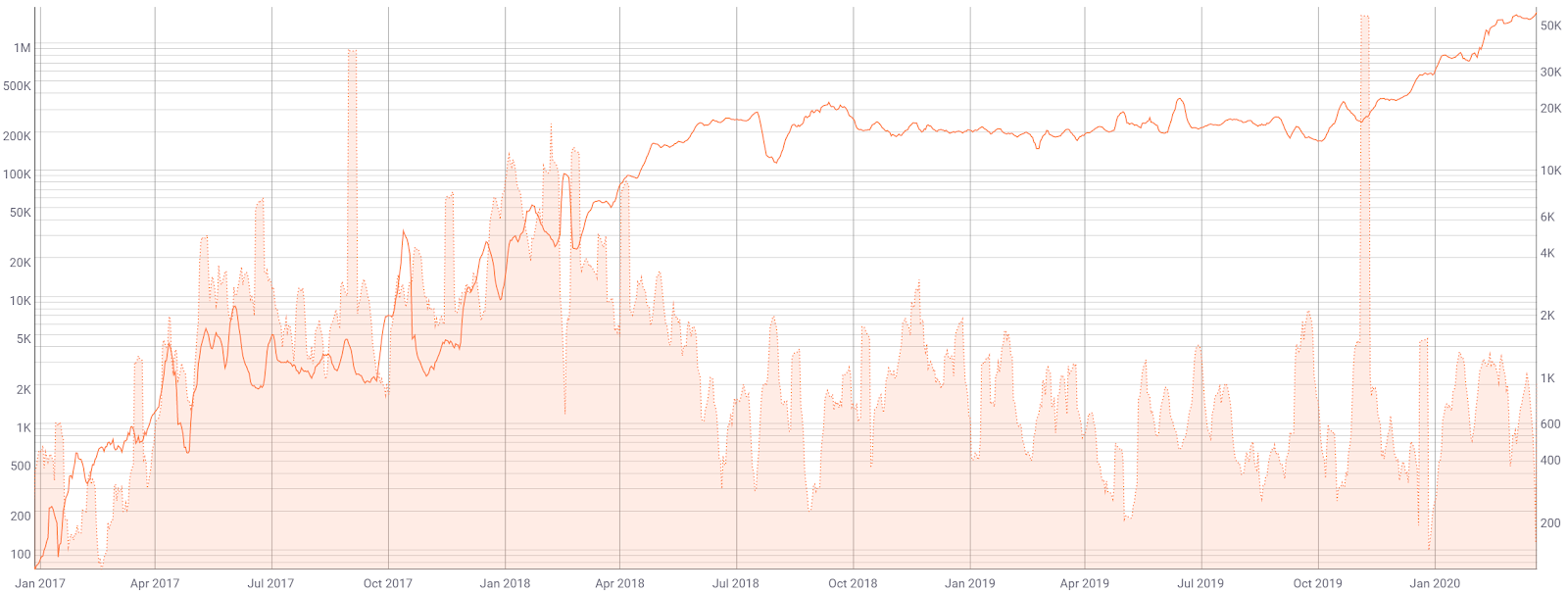

The current number of transactions per day on the network (line, chart below) stands at 1.77 million, which represents a new record high. Transactions per day had essentially ranged from 100,000 to 300,000 between April 2018 and November 2019. Overall, transactions per day have increased substantially since October 2019.

The average transaction value (fill, chart below) is currently just under US$900. Aside from the 55 billion XLM coin transaction and burn, average transaction values have ranged around US$750 since June 2018. Nearly feeless on-chain transactions often encourage lower average transaction values due to a higher number of smaller sized transactions.

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has fallen significantly since August 2018 and is currently 467. Historically, an NVT below 500 for the Stellar network signified bull market conditions. The current all-time low in NVT may be related to the 55 billion XLM coin transaction and burn, not necessarily organic market activity.

A clear downtrend in NVT suggests a coin is undervalued based on its economic activity and utility, which should be seen as a bullish price indicator. Inflection points in NVT can also be leading indicators of a reversal in asset value.

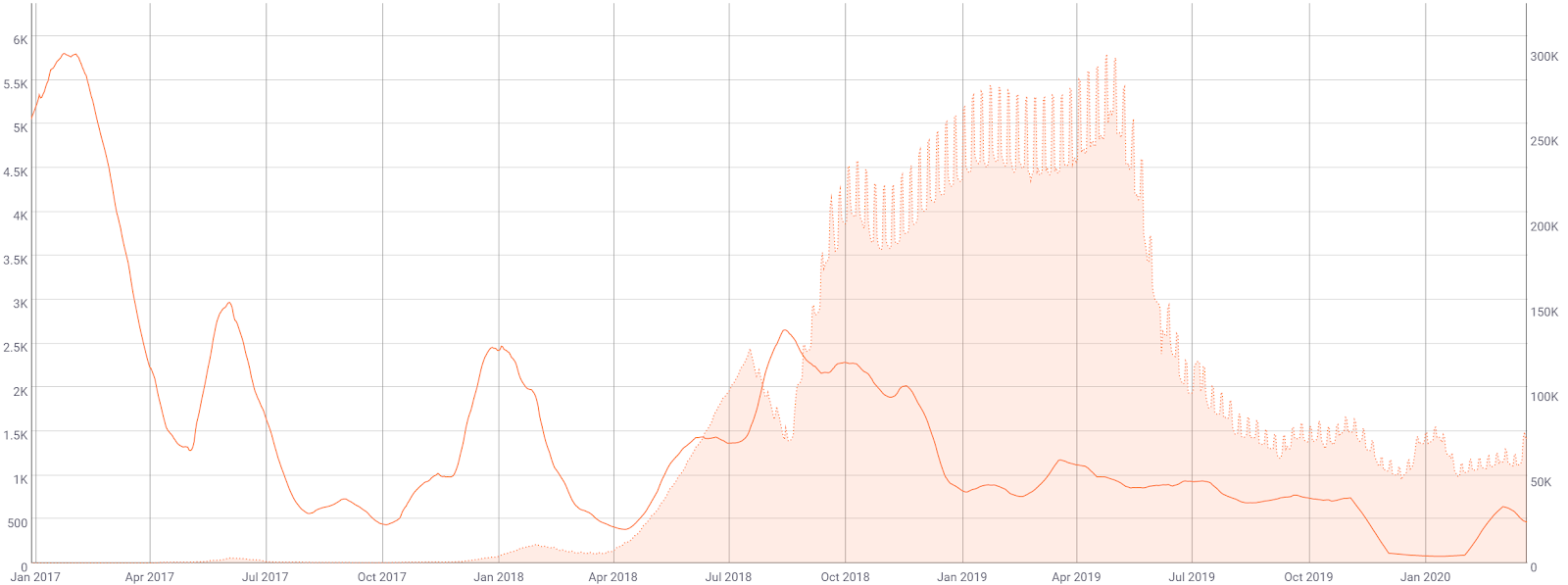

The number of monthly active addresses (fill, chart below) increased from October 2017 to April 2019, but have continued to fall over the past few months, and are currently around 73,000. Active addresses had spiked once a week due to the release of inflation rewards. Active and unique addresses are important to consider when determining the fundamental value of the network based on Metcalfe's law.

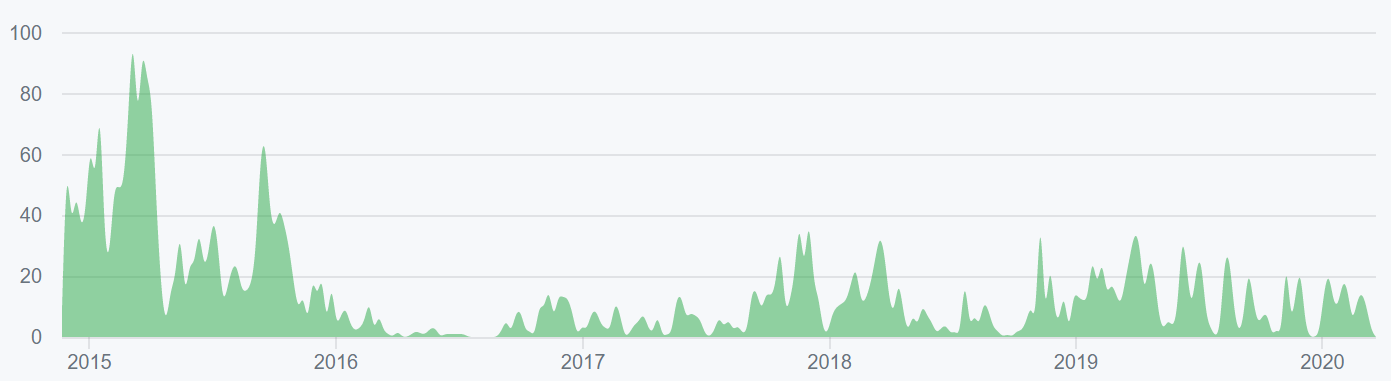

Turning to developer activity, the Stellar project has 65 repos on Github. In total, over 300 developers have contributed to the project, with nearly 700 commits on the main repo in the past year (shown below). Stellar Core v12.5 and Stellar Horizon v1.0 were released last week and last month, respectively.

The Stellar Github also has a repo started in September 2019 called “Slingshot” which is a “new blockchain architecture under active development, with a strong focus on scalability, privacy and safety.” Features being developed include; cloaked assets and zero-knowledge smart contracts (ZkVM), confidential assets protocol based on the Bulletproofs zero-knowledge circuit proof system, a Rust implementation of Schnorr multi-sig, an API for issuing assets using ZkVM, and a “slidechain” demo which allows a user to peg funds from the Stellar testnet, import them to a sidechain, and later export them back to Stellarm

Most coins use the developer community of GitHub where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

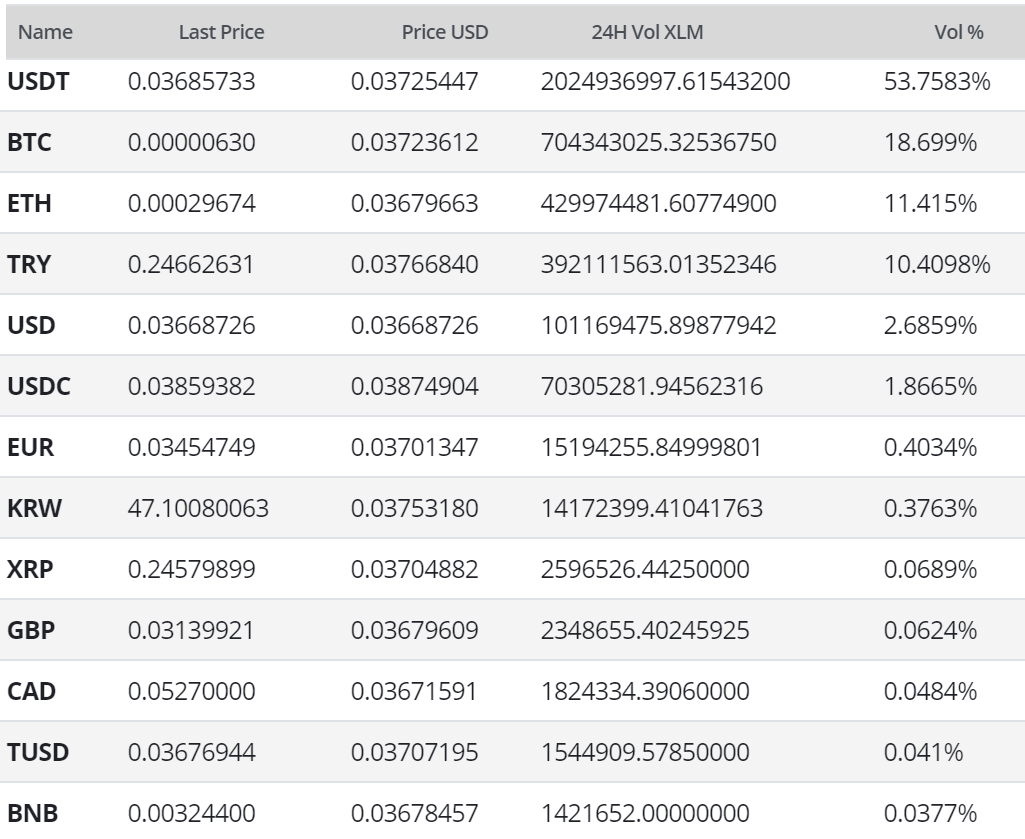

In the markets, exchange volume over the past 24 hours has predominantly been led by Tether (USDT) and Bitcoin (BTC) markets on Binance, Huobi, and Coinbase. The Turkish Lira (TRY) holds a high percentage of XLM volume when compared to

XLM has had several exchange and custody-related announcements over the past two years, including listings on Binance, and Binance.US, BitGo, Coinbase, and eToroX. Stellar has also released StellarX, a peer-to-peer, third-party client built on top of Stellar’s open marketplace. StellarX is not the custodian of any assets, but the client is also not a DEX, and there are no fees. The platform includes a fiat on-ramp through ACH transactions from a U.S. bank account.

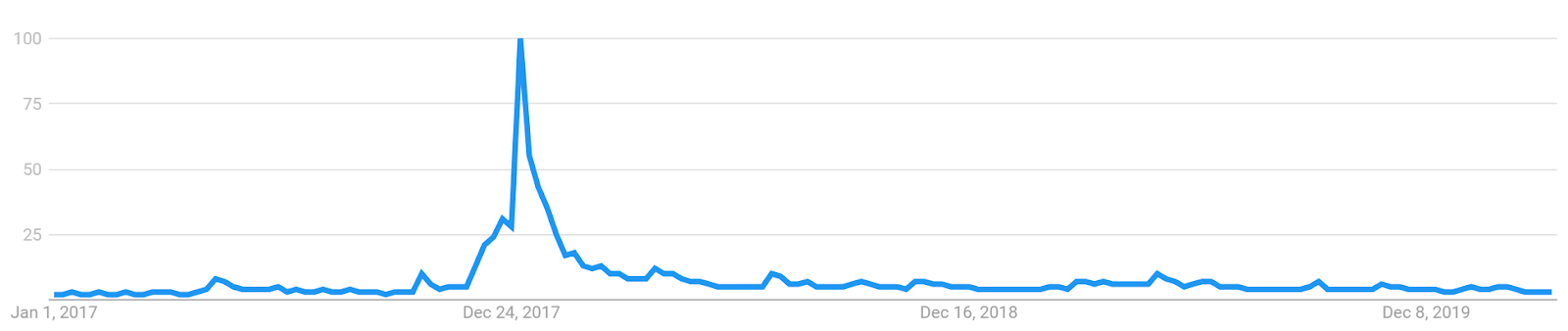

Grassroots interest in the XLM project includes nearly 7,600 members in 23 Stellar groups on meetup.com. Worldwide Google Trends data for the term "Stellar" has remained low throughout most of 2018, 2019, and early 2020, with the exception of a small uptick in mid-May 2019. Any small rise was likely related to several airdrop announcements and the 55 billion XLM token burn.

A slow rise in searches for "Stellar" preceded the bull run in Q4 2017, likely signaling a large swath of new market participants at that time. A 2015 study found a strong correlation between the google trends data and BTC price whereas a 2017 study concluded that when the U.S. Google "Bitcoin" searches increased dramatically, BTC price dropped.

Technical Analysis

Despite several bullish consolidation attempts since 2018, XLM has been unable to develop a bullish trend. The strength of any potential trend reversal can be mapped using Exponential Moving Averages, Volume Profile of the Visible Range, and Ichimoku Cloud. Further background information on the technical indicators discussed below can be found here.

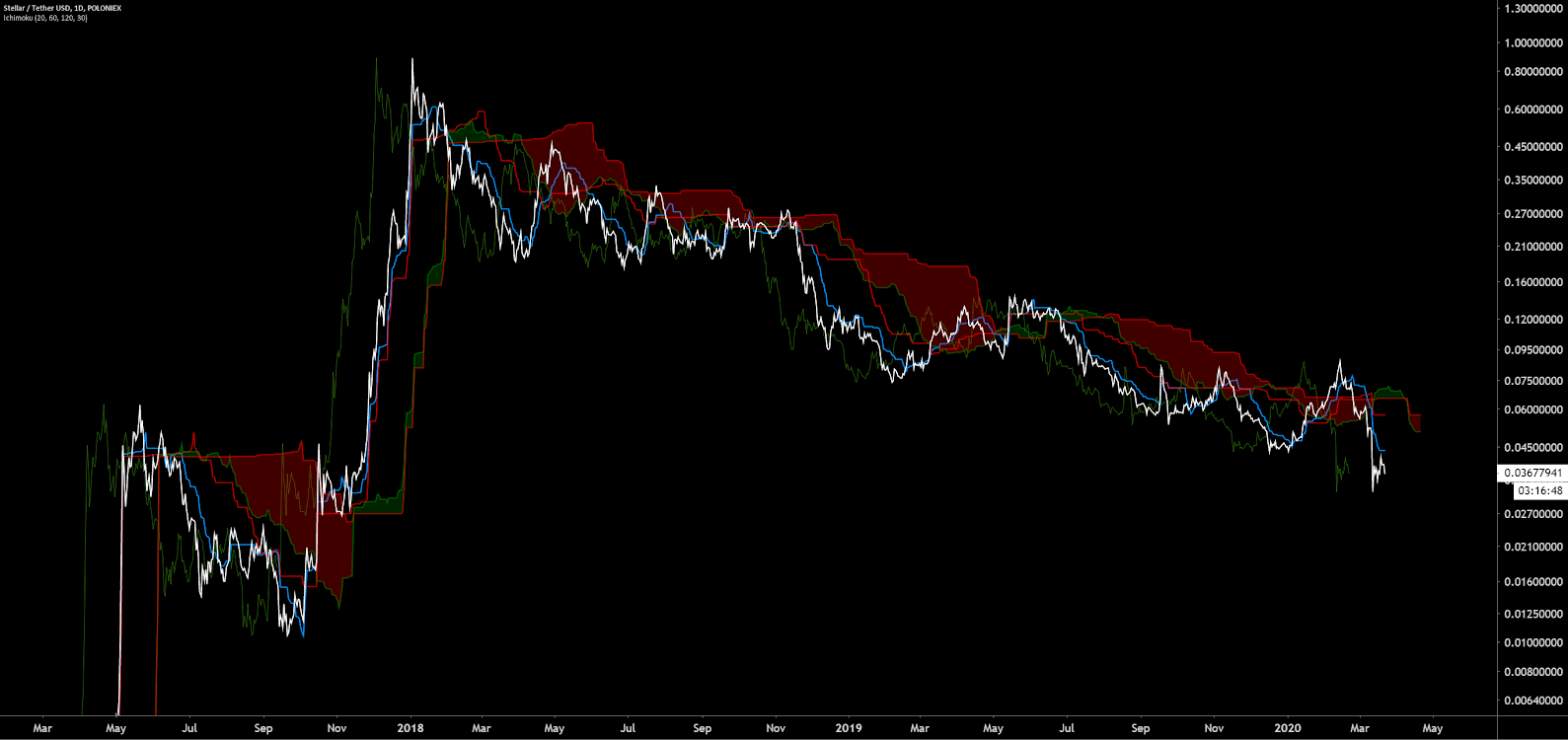

On the daily chart for the XLM/USD pair, the 50-day Exponential Moving Averages (EMA) and the 200-day EMA have been bearishly crossed for 540 days. The spot price has mostly remained below the 200-day EMA since the Death Cross in June 2018.

Over the next few months, if a bullish 50-day EMA and 200-day EMA cross forms, bullish momentum will likely increase significantly. Volume resistance sits at US$0.1337 with a potential upside target of US$0.20-US$0.23. If the current local lows break, volume support sits around US$0.035 and US$0.017. There are no active volume or RSI divergences currently to suggest an end to the bearish trend.

Turning to the Ichimoku Cloud, there are four key metrics; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. Trades are typically opened when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are bearish: the current spot price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and below the spot price. The most prudent long entry will take place once the spot price is above the Cloud with a bullish TK cross, otherwise, the trend will likely remain bearish. Price is currently 55% below the Kijun, suggesting oversold conditions.

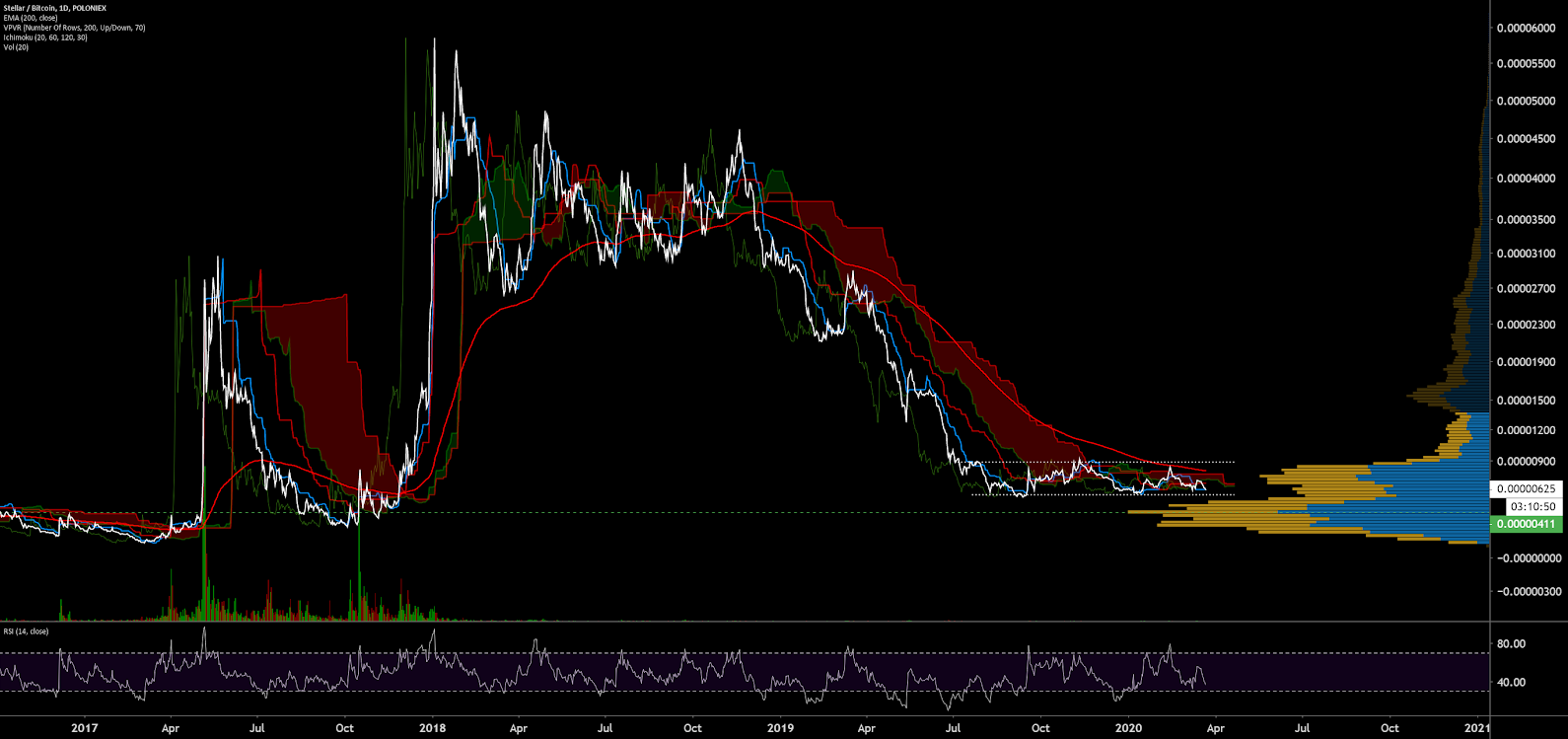

Lastly, the daily chart for the XLM/BTC pair has been held with a tight range for the past 260 days which resembles Wycoffian accumulation. A “spring”, or sudden drop in price resembling capitulation, is highly possible within the next few weeks. Prices above the 900 sat resistance zone would suggest a confirmation of bullish continuation. High volume VPVR support sits between 300-500 sats and VPVR resistance also sits at the 1,600 sat zone. Similar to November 2017, the market may wait to fully break out into a bullish rally once the spot price has cleared Cloud resistance. Cloud metrics should begin to flip bullish in the next few months, as long as the pair does not make a lower low.

Conclusion

Despite Blockchain.com, Coinbase, and Keybase airdrops over the past two years, active addresses have continued to decline. In a likely bid to increase XLM’s potential store of value, the SDF axed 55% of the total token supply as well as successfully campaigned for the removal of inflation on the network.

Transactions per day have increased dramatically over the past three months, reaching a new all-time high, as average transaction values have held near US$1,000 in the same period. Based on the growing number of partnerships, the network aims to directly compete with XRP in the payments and remittance realm, and ETH in the ICO and STO realm.

Technicals for the XLM/USD pair reveal bearish trend metrics, with the current spot price below both the 200-day EMA and below daily Cloud. If a Golden Cross does occur within the next few months, coupled with price action above the daily Cloud, sustained bullish momentum may break the current resistance at US$0.1337. Otherwise, lower lows are very likely to bring price towards the US$0.017 zone.

Technicals for the XLM/BTC pair have tilted from strictly bearish to neutral over the past few months as price has held a tight range resembling Wyckoffian accumulation. Going forward, strong bullish momentum becomes more probable once the spot price is above the 200-day EMA and Cloud, as was the case in November 2017. A breach of 900 sats should satisfy both conditions and eventually bring price towards the next resistance zone at 1,600 sats.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow