Grin Price Analysis - Distribution increasing inflation

Grin (GRIN) is a default privacy coin which employs MimbleWimble to obscure transaction data. The MimbleWimble (MW) whitepaper was first released in August 2016, on a Bitcoin IRC channel, by Tom Elvis Jedusor, an anonymous developer. In October 2016, Andrew Poelstra, a developer at Blockstream, released improvements to the original whitepaper.

A few days later, the first partial implementation written in Rust was released by another anonymous developer, Ignotus Peverell. That implementation was named Grin. A testnet was launched in November 2017, with a mainnet launch in January 2019. There was no ICO, no pre-mine, and no Founder’s Reward.

Similar to CoinJoin, MW hides transaction amounts by batching inputs per block, but does not inherently provide anonymity. GRIN also uses the Dandelion relay, which attempts to anonymize the IP address or client where the transaction originated.

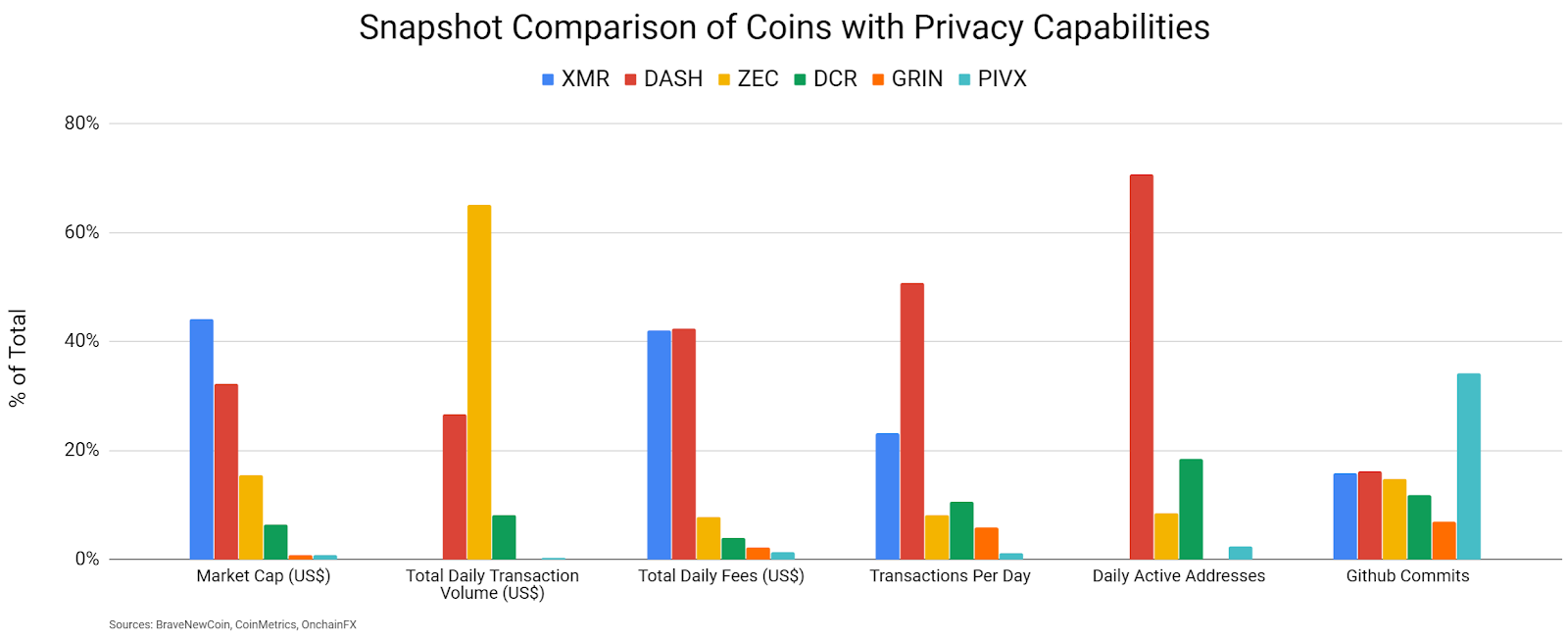

A quick comparison between coins with privacy capabilities shows that Monero (XMR) leads by market cap and holds second place in all other categories with available data. Both XMR and GRIN obscure the blockchain transaction values and addresses used.

DASH (DASH) holds the lead in total daily fees, transactions per day, and daily active addresses. On-chain metrics for another MW implementation, BEAM, could not be obtained. Litecoin (LTC) also has plans to add MW functionality via extension blocks.

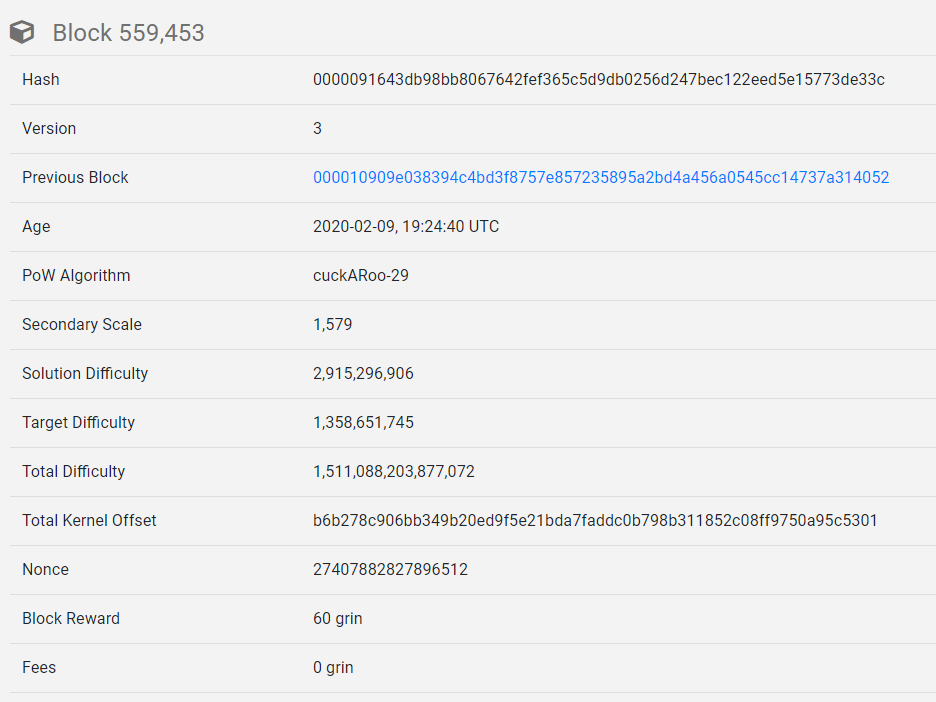

GRIN uses a progressive Proof-of-Work consensus algorithm dubbed the “cuckoo cycle”. The algorithm was created in 2015 by the Dutch computer scientist John Tromp. To help deter ASIC use, the network uses the ASIC friendly Cuckatoo31+ and GPU friendly Cuckaroo29, switching between the two every 24 hours. Obelisk Miner canceled ASIC development for three GRIN algorithms in February 2019 due to a lack of interest. Innosilicon, which had also been developing three ASICs for GRIN, announced a pre-order cancellation in January 2020.

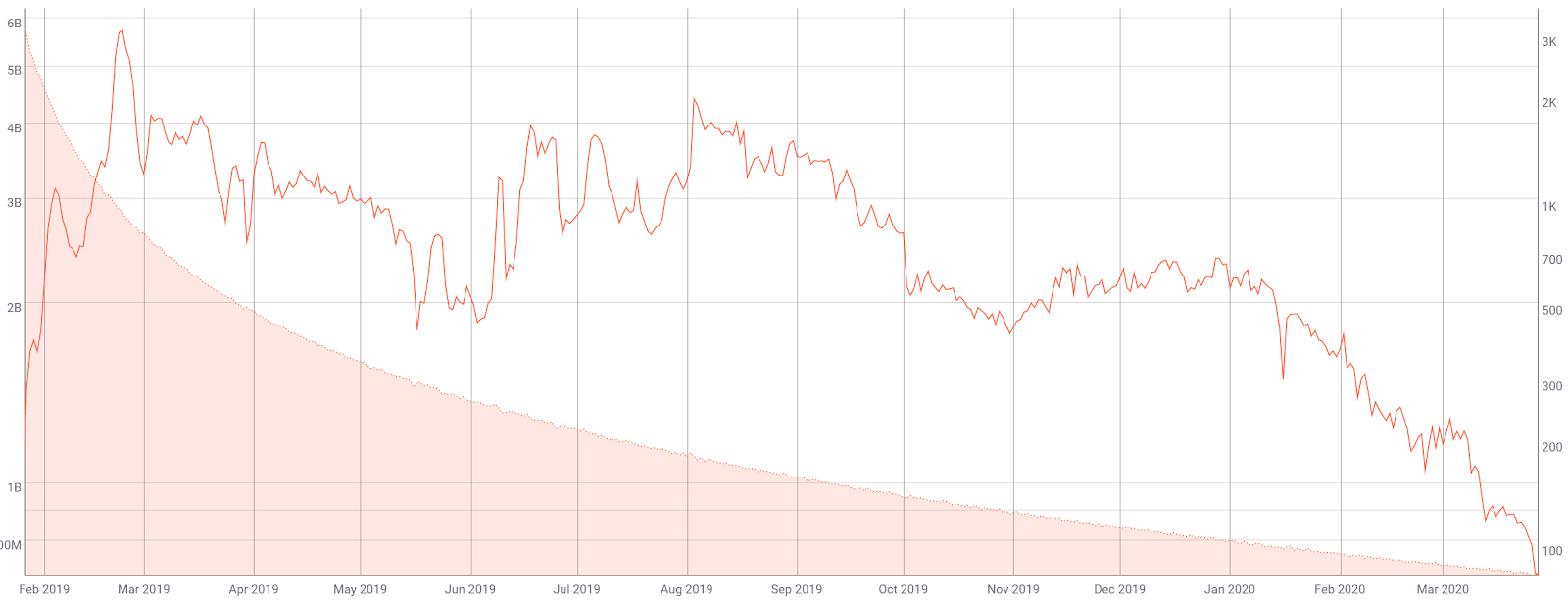

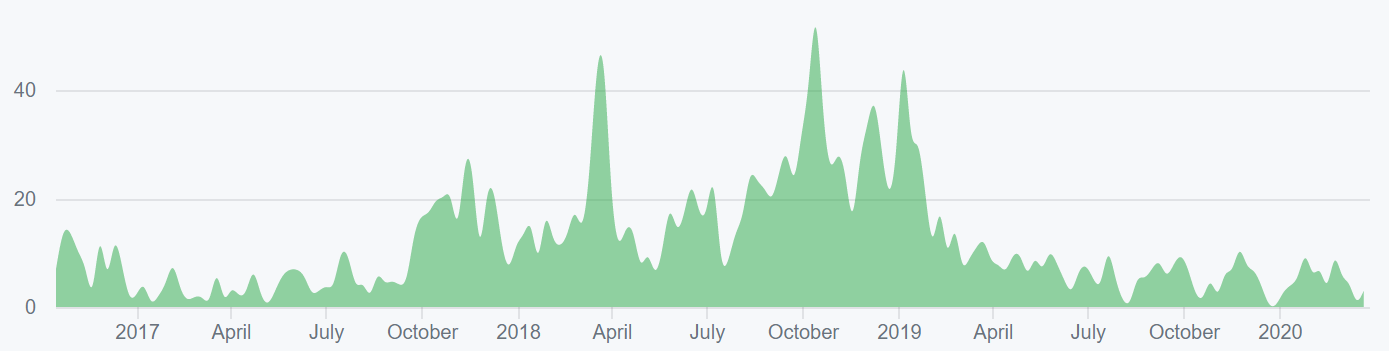

Since the networks launch, network difficulty (line, chart below) has continued to decline. Inflation (fill, chart below) is currently 83% per annum, and has fallen rapidly over the past year after starting with an aggressive distribution schedule. Issuance will drop to 10% after 10 years, 5% after 20 years, and 4% in 25 years, with no finite supply.

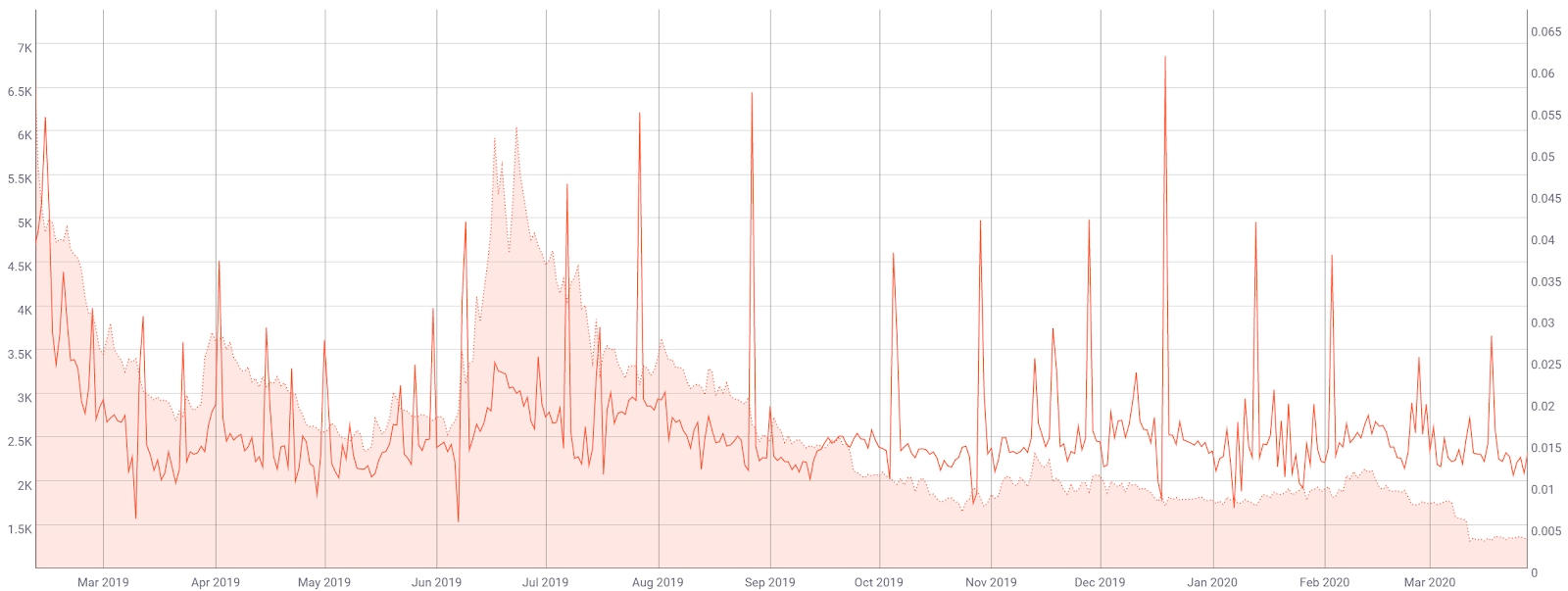

Transactions per day (line, chart below) have essentially held near a steady 2,500. The spikes in transactions, about once a month, may be related to mining pool payouts. Average transaction fees (fill, chart below) have continued to decline over the past year and currently sit at US$0.00356. This average fee is also lower than all other chains with privacy-enabling features.

Turning to developer activity, the GRIN repo has had 357 commits by 100 developers over the past year. GRIN development is funded through donations, which currently total US$1.05 million.

Most coins use the developer community of Github where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher developer activity and interest.

In total four hard forks are scheduled in the first two years, at regular six-month intervals, to introduce new features. GRIN’s first hard fork, to v2.0.0 occurred in July 2019, with a second, to v3.0.0 in January 2020 and v3.1.1 earlier this month. The most recent hard fork patched a vulnerability, CVE-2020-6638, which could have led to a malicious chain split. GRIN v4.0.0 has a planned release of July 15, 2020.

GRIN exchange traded volume is led by the Bitcoin (BTC) and Ethereum (ETH) pairs on HitBTC, Bittrex, and Poloniex. Although not currently listed on Binance, Ironbelly received US$15,000 in March 2019 for the development of a GRIN mobile wallet app. GRIN is also not currently listed on Bitfinex, BitFlyer, Bitstamp, Coinbase, Gemini, Kraken, or OKEx.

Technical Analysis

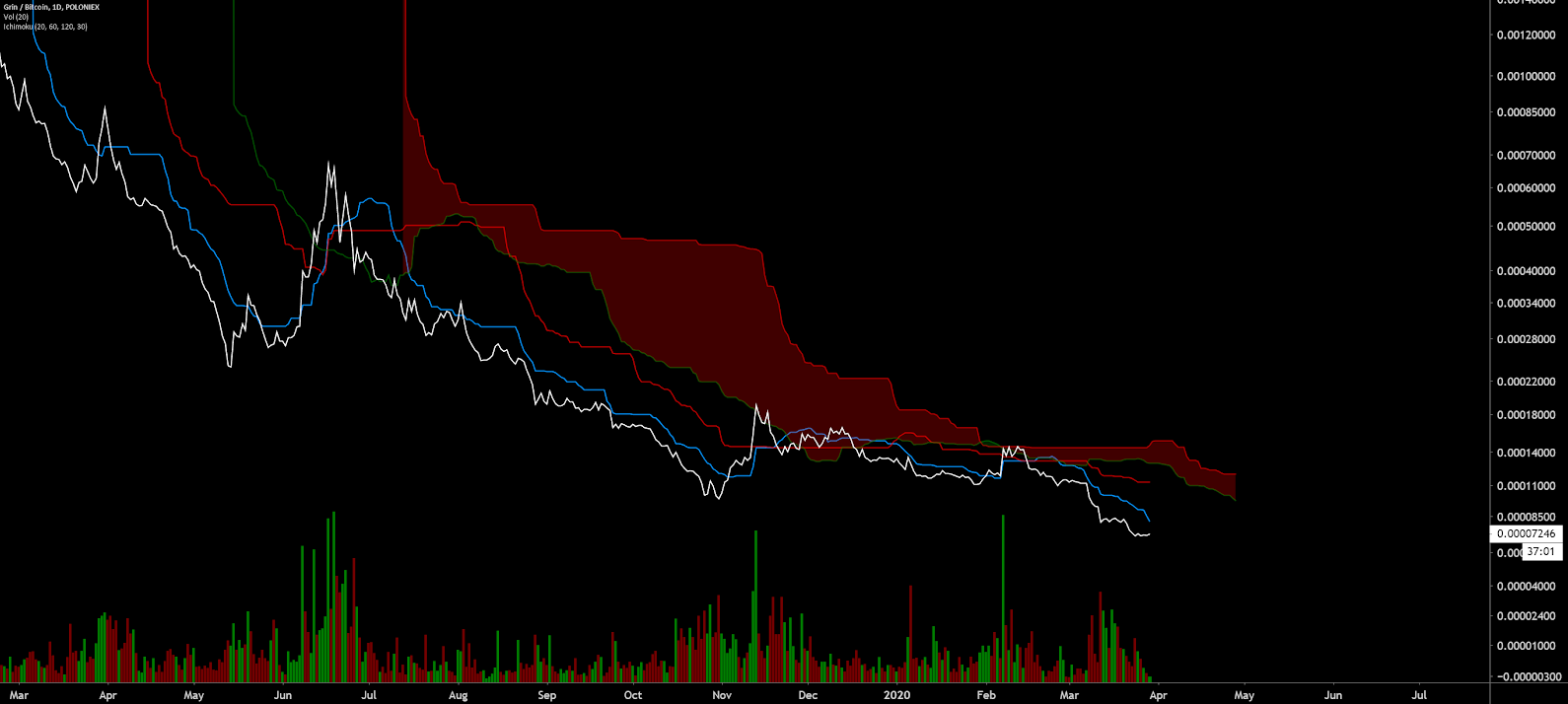

GRIN has a market cap of US$16.25 million with GRIN/BTC having a little more than one year of price history. As prices push all-time lows, roadmaps for future market movements can be found on high timeframes using Exponential Moving Averages, Volume Profile of the Visible Range, oscillators, divergences, chart patterns, and the Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

On the daily chart for the GRIN/USD pair, the spot price has mainly held below the 50-day Exponential Moving Average (EMA) since inception. A Golden Cross of the 50-day and 200-day EMA has never occurred. Most of the historical volume has occurred between the 10,000 sat and 20,000 sat zone based on Volume Profile of the Visible Range (VPVR, horizontal bars chart below). Currently, there is an active bullish divergence on volume and RSI suggesting waning bearish momentum.

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame, with doubled settings (20/60/120/30) for more accurate signals, are bearish; the spot price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and below the spot price.

A traditional long entry signal will not occur until the spot price is above the Cloud, which typically occurs in concurrence with a chart pattern. The spot price is also 60% below the Kijun, suggesting oversold conditions.

##Conclusion

GRIN enters the market alongside other default and non-default privacy chains, such as XMR, BEAM, DASH, ZEC, DCR, and PIVX. At just over a year old, inflation remains higher than most, if not all cryptocurrencies, in an effort to distribute the coin as widely as possible. Development is decentralized and well-funded through several donations since inception.

GRIN has limited exchange listings, which may hamper speculation in the near term. Any additional exchange listings should be extremely bullish for the pair, albeit unlikely due to the default privacy capabilities of the coin. For the GRIN/BTC pair, the spot price will likely regain bullish momentum after a breach of 11,000 sats. As the spot price sits at an all-time low, a bullish divergence is present, suggesting waning bearish momentum. Value traders will likely begin catching knives, hoping for a quick capitulation spike downward, followed by mean reversion to 10,000 sats.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow