Crypto Market Forecast: 16th March

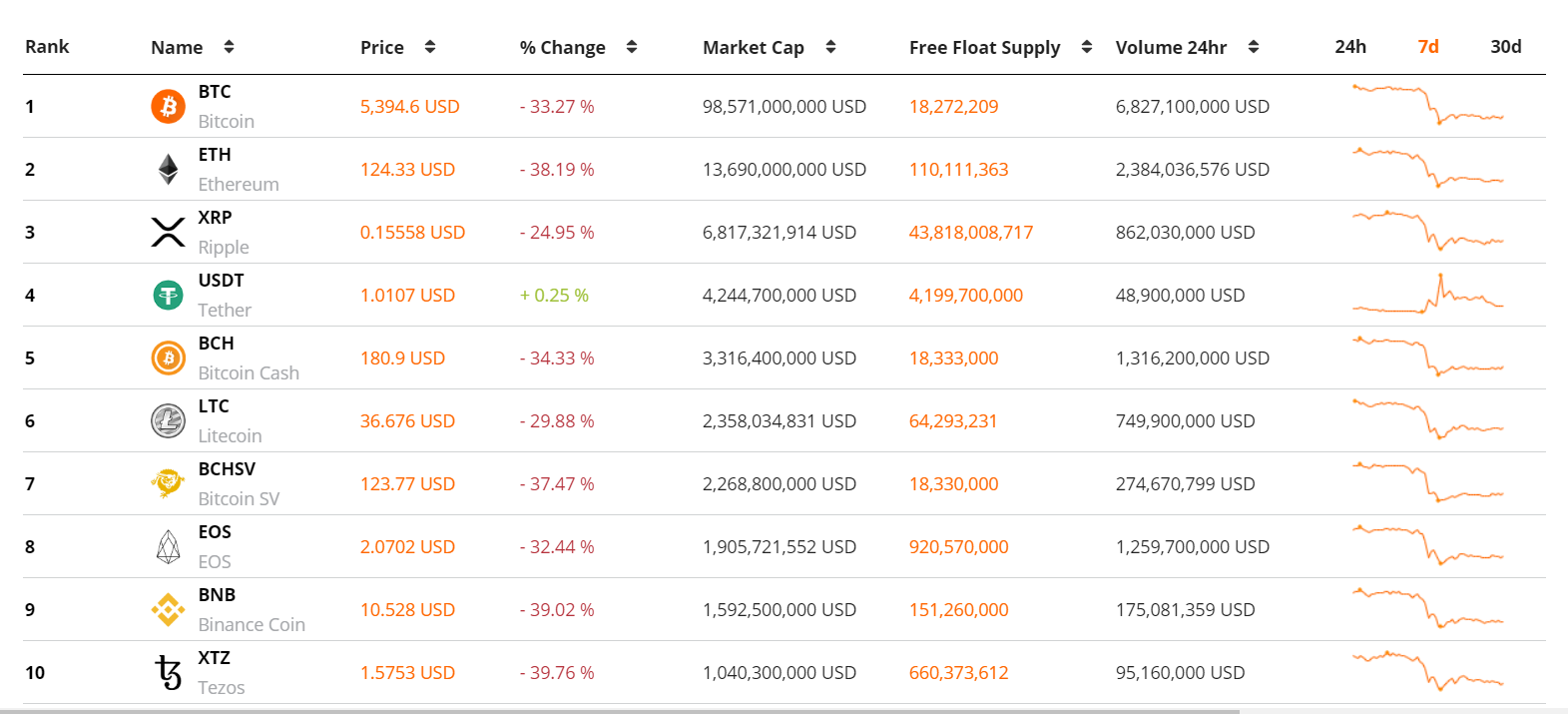

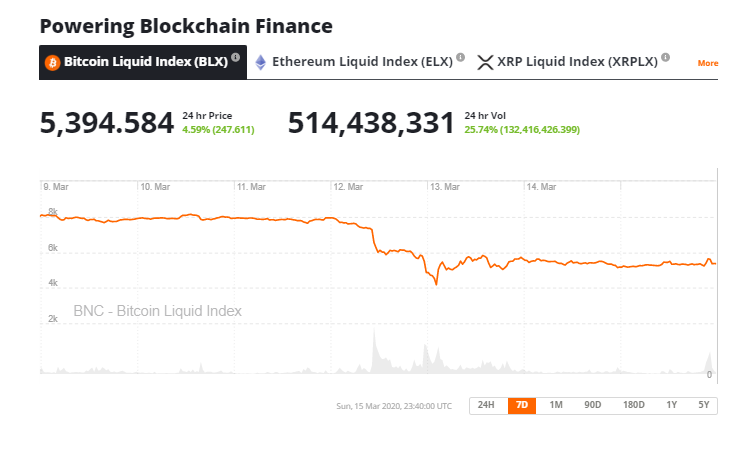

Last week the digital asset markets crashed as COVID-19 driven economic fears caused heavy losses across all financial markets. The price of Bitcoin - the leading asset on Brave New Coin’s market cap table - fell ~36%, while the price of the number two and three assets, ETH and XRP, fell 42% and 28% respectively. By the end of the 7-day period, the total market cap for crypto had fallen ~35%, a loss of US$85 billion in value ending a week that will go down in history.

BTC suffered one of its worst one-day price falls on Thursday when in a few chaotic hours the price of the asset dropped by US$4,000 as bearish selling pressure cascaded across crypto trading platforms. Flagship retail trading exchange, Coinbase Pro, hit a new all-time high for trading volume handling well over US$2Billion in volume across a two day period.

The infrastructure capabilities of crypto derivative platforms were tested by the extreme market conditions with Bitmex witnessing more liquidations over Thursday than any other day in the last year. A number of platforms buckled under the strain with Bitmex going completely offline for 25 minutes as prices continued to drop.

Elsewhere, Ethereum’s leading decentralized lending platform MakerDao had to manage a debt crisis as ETH’s price drop caused similar margin funding issues as faced by the CeFi crypto exchanges. These problems were likely compounded by congestion issues on the Ethereum blockchain that drove up gas prices to astronomical levels even for simple network operations.

CeFi derivatives platforms by Deribit and Binance had to dip into their insurance funds in order to meet liquidity requirements following the market collapse. Deribit’s Bitcoin insurance fund slid from ~390 BTC to ~180 BTC in the space of a few days. Insurance funds let exchanges run a simple ‘loser pays for losers’, where users who have been liquidated pay for traders who are being liquidated because unlike spot trading, margin trading is not one-for-one between traders.

The potential full depletion of a major Bitcoin derivative exchange’s insurance fund may lead to a market liquidity crisis and further price challenges for BTC, but the economic consequences of COVID-19 continue to extend.

A few hours ago the United States federal reserve announced that it would cut the benchmark interest rate to 0, leading to price drops in the futures markets for a number of key stock indices. Corona driven investment fears appear set to continue to control all financial markets in the short term. On the flip side of this narrative, the success that Asian economies like China and South Korea have had managing the COVID-19 outbreak, suggest that the prospects for Western economies could turn quicker than expected depending on policy-maker responses.

This week in crypto events

16th March- Tron core Devs meeting

This Monday the top builders from the Tron Proof-of-Stake platform blockchain will publicly convene to discuss the future development of the blockchain. The Tron project has courted controversy in recent weeks following the hostile takeover of the Steemit blockchain by Tron CEO Justin Sun. The price of TRX fell ~32%, suffering from a similar bout of Corona driven bearishness affecting the rest of the crypto market.

It was a brutal trading week across the crypto markets with most assets suffering losses of more than 25%, and for some assets like ETH, negative fundamental headwinds may have compounded Corona driven selling pressure. Just outside of the top 10, the Bitfinex native token LEO was one of the market’s best performers. LEO tokens are bought back hourly at market rates using iFinex profits and this buying pressure kept the price of the token propped up during the Thursday sell-offs.

Bitcoin’s trading week was defined by Thursday/Friday sell-offs that ravaged bulls across the crypto markets and led to record trading volumes across spot and derivative marketplaces. BTC’s price performance in coming weeks may be defined by the activity of participants in legacy markets. In recent times, the price of Bitcoin has moved based on signals sent by the central bank and institutional traders on the CME, putting a ding in the uncorrelated asset narrative.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow