Can Bitcoin Maintain Stability Amid Coronavirus Uncertainty?

Mar 08, 2020 at 14:31 //

News

Despite recent fluctuations in traditional asset markets such as stock and bond yields, Bitcoin is closing its week in a stable flow. As global uncertainty arising from the coronavirus outbreak, the possibility of BTC falling again should not be ruled out.

However, the prevailing view is that Bitcoin's overall bullish trend is still maintained at this point. Currently, the price of BTC/USD is sitting at almost $8753 (-4.03%).

Bitcoin plunged with the stock market last week, but this week it has been solid since mid-week after hitting the bottom in the mid- $8000 range.

Therefore, whether Bitcoin will be able to continue its stable flow away from the influence of the traditional asset market next week will be a big concern for the cryptocurrency market.

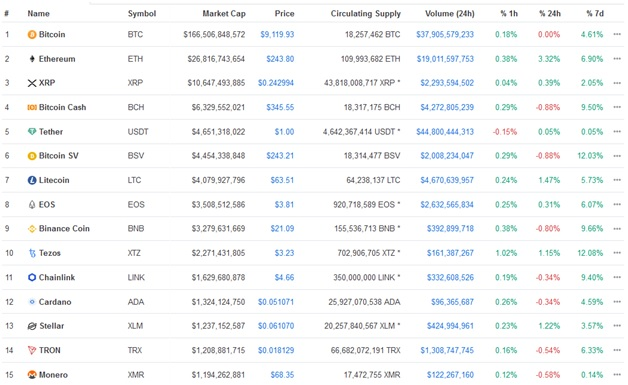

Yesterday (March 7), BTC pointed to $9,109.49, a 0.16% drop from 48 hours ago at 4:08 pm New York (NY) time. At press time (24 hours ago), BTC/USD is standing with a market cap of around $166,554,002,847, price of $9,122.52, and volume of $37,857,540,249 at 03:23 Saturday, 7 March 2020 (GMT-5) Time in NY, USA.

The world’s original cryptocurrency continued to rise until the beginning of the day, but over time it turned weak. But compared to the sharp fall in the NY stock market, it is still stable and eye-catching.

Bitcoin's Recent Month Price and Volume Trend

Bitcoin bottoms may remain low, but the adjustment within the 80-day cycle seems to be coming to an end. BTC's past trading history also showed little correlation with the stock market.

The daily average of the moving average convergence and divergence index (MACD) lows in the daily charts continued to rise, which would be advantageous for bullies. In addition, the five-day moving average (MA) through the 10-day MA suggests that the market sentiment has turned bullish. As a result, BTC is likely to test the $9,312 resistance line (lower on Feb. 4) this weekend, and beyond that line, it would expose $9,550 (a breakout target for the reverse head and shoulders pattern).

However, Bitcoin has not gained the momentum needed for further gains after breaking above $8700, but there is no need to worry yet. A bullish trendline is forming on the BTC time chart, with support near the $8800 level, suggesting that BTC may rebound from $8000 to $8600, although it is likely to undergo some downward revisions.

It is expected that if the $9000 support breaks, some buyers will break away and Bitcoin may retreat to the 200-day moving average, now at $8750.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @coinidol.com By Coin Idol, @Khareem Sudlow