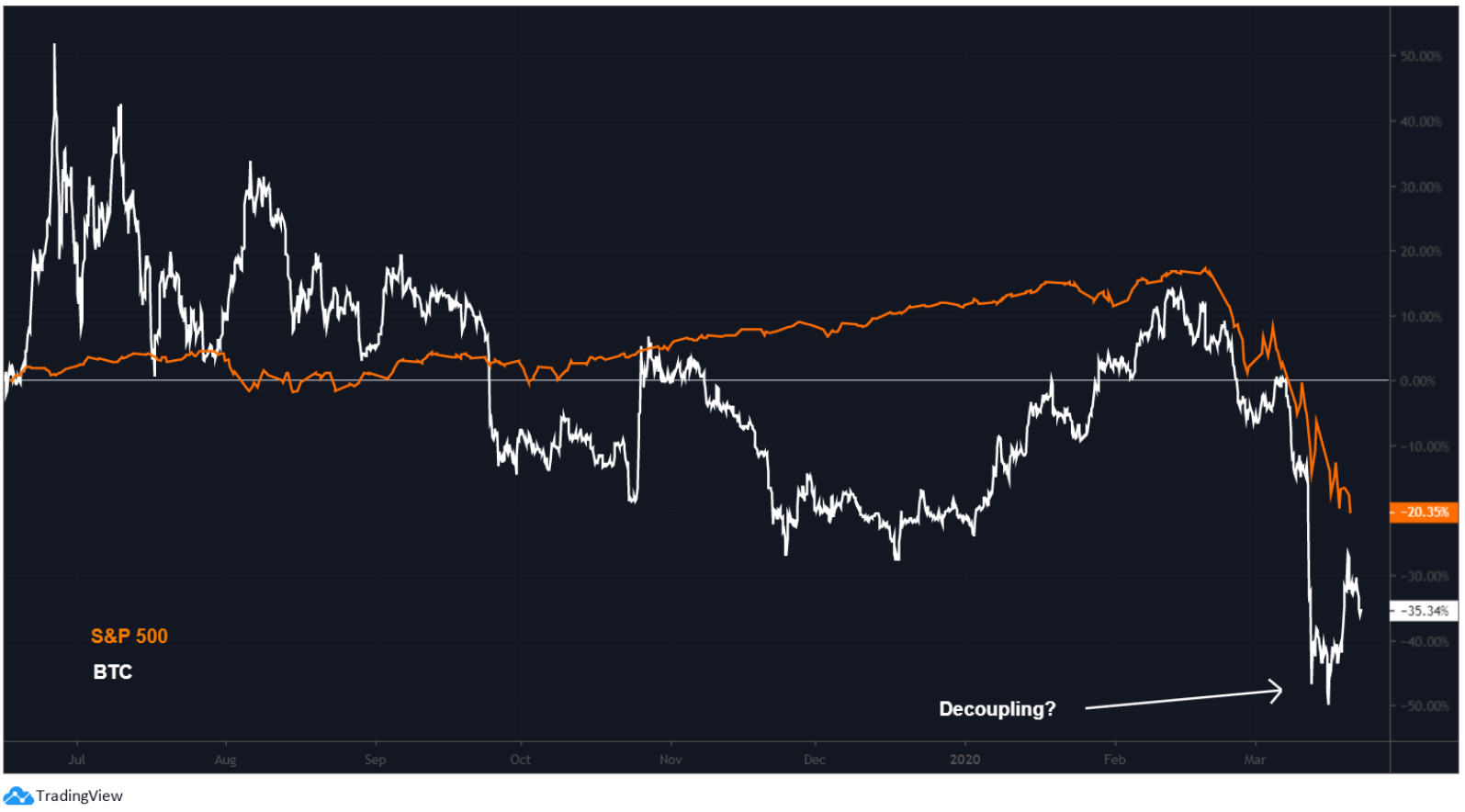

$BTC & $SPX: The decoupling

The COVID-19 coronavirus pandemic is rewriting the narratives around bitcoin. Now, instead of the 'halving' as a key driver of bitcoin price action, analysts are pointing to a potential 'decoupling'.

This event is expected to put an end to the recent correlation between bitcoin and the S&P 500, and set the leading cryptocurrency free to realize its ambition to act as a digital safe haven.

Coupling and decoupling

The initial 'coupling' of bitcoin and the stock market is thought to have taken place over the past few years as institutional investors gradually entered the cryptocurrency market through new regulated platforms like CME and Bakkt.

Though their presence is thought to be vital for widespread adoption, some blame this new breed of investors for causing bitcoin to mirror the price action of the U.S. stock market — and ultimately create the catastrophic crash of 'Black Thursday'.

Unlike real bitcoin fans, these institutional investors are not necessarily believers in the Bitcoin ethos. Instead, they are likely to see the cryptocurrency as just another 'risk on' asset like stocks.

Thus when coronavirus fears reared their ugly head, asset managers followed the standard order of operations and took capital away from these 'risk on' assets in favour of cash — turning bitcoin into a 'swimming float' attached to the Titanic, as Binance CEO Changpeng Zhao wrote in a blog post.

But as bitcoin has risen over the last week while stocks have continued to fall, analysts like Willy Woo suggest we are now seeing a 'decoupling' of the two asset classes.

Data from exchanges suggests the bounce may be related to the departure of institutions, with demand for bitcoin options on CME and Bakkt drying up in recent weeks, according to Skew.

Without institutions treating bitcoin as a 'risk on' asset, bitcoin could now be free to realize its potential as a digital safe haven in what security token pioneer Alan Silbert says is the 'best possible macro environment' of unprecedented money printing from central banks around the world.

Whether this is likely or not, the next few days are likely to determine if bitcoin will chart its own course or remain tethered to global markets.

OhNoCrypto

via https://www.ohnocrypto.com

Kieran Smith, Khareem Sudlow