Bitcoin and Ethereum Recover After Entering Oversold Territory

Mar 03, 2020 at 11:48 //

News

On March 2nd, the technical indicators of Ethereum showed oversold over the weekend and recovering. The Relative Strength Index (RSI), a technical indicator of Ethereum, entered the oversold (O/S) segment and then escaped the segment on the 2nd.

In Bitcoin's case, another technical indicator, the Money Flow Index (MFI), was left oversold the day before. This is in line with the trend that the international gold market, a leading safe asset, hit -4% last week before recovering.

ETH RSI Declines After BTC Oversold

On February 29, Ethereum's RSI reached 29.7, signalling over-selling. In traditional financial markets. If over 30, oversold; over 70, overbought.

Last week's Ethereum RSI index declined on the 27th. That was the same day when Bitcoin was on the O/S side. (If bitcoin RSI 27.7, MFI 19.2, MFI 20 or less on the 27th, oversold)

ETH's RSI was 53.6 on the February 26, then 37.6 a day later, and 36.9 on the next day, and fell to 29.7 on the 29th and unretouched 30. On the 1st and 2nd day, it showed an increase of 32.6, 33.7.

BTC Escapes Oversold Segments

In the case of Bitcoin, the RSI stands at 27.7 on February 27 and enters the O/S section and remains in the O/S section until this date. However, MFI, another disclosure of technical indicators, shot on the O/S section of 20 or less on the 27th, and has risen to more than 20 since the 1st.

The decline in the technical indicators of Bitcoin and Ethereum seems to have been impacted by the weakening of most financial market sentiment after the global recession since the Coronavirus outbreak. Last week, while the traditional money markets sank, even the world's safest asset gold fell. The price of gold was -4.61% on the 28th and is currently rising by 1%.

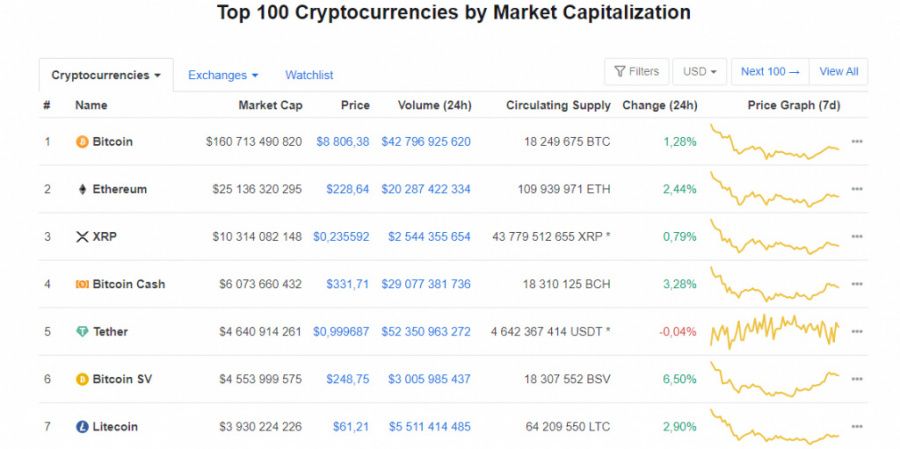

At press time, Bitcoin’s price ( BTC/USD) is standing at $8 806 (1,28%) with a market cap (MC) of $160 billion and volume of $39.635 billion and it is still dominating the market by 63.9%. The entire MC is sitting at more than $252.327 bln, and the entire volume is at over $148.951 bln. Ethereum ( ETH/USD) is also changing hands at around $228 (2.42%) with a MC of $25.01 bln and volume of $18.51 billion.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @coinidol.com By Coin Idol, @Khareem Sudlow