Fundstrat’s Tom Lee Eyes $40,000 Bitcoin as Positive Trend Forms

While Bitcoin’s price has started to show some uncharacteristic weakness over the past day, with the price slumping by nearly 5% from the $10,200 local top, analysts remain convinced that the cryptocurrency’s long-term trend is forming positive.

In fact, prominent industry commentator, Thomas Lee, is convinced that the cryptocurrency will soon rocket past all-time highs to potentially $40,000.

On Monday, Lee, the co-founder of New York-based research boutique Fundstrat Global Advisors, sat down with CNBC’s “Power Lunch” to speak on why he’s so optimistic about the long-term prospects of Bitcoin.

Why Fundstrat is Convinced of Bitcoin’s Long-Term Trend

Bitcoin has been on a tear over the past few weeks, rocketing from the $6,400 lows seen in December to $9,800, where it sits at the time of this article’s writing.

According to Lee, a former managing director at JP Morgan Chase, this rally is just the start of something even greater, citing a technical factor and a number of fundamental catalysts that could thrust the price of BTC even higher.

The #Bitcoin surge has wowed investors, but is it a better bet than U.S. equities for 2020 and beyond? @fundstrat's Tom Lee gives his verdict. $BTC pic.twitter.com/ad6kMg4yo9

— Power Lunch (@PowerLunch) February 10, 2020

On the matter of technical analysis, Lee remarked that the price of Bitcoin recently passed above its 200-day moving average (the rolling average of the past 200 days of price action).

While this is bullish in and of itself — this specific moving average is seen as an indicator of an asset’s long-term directionality — the analyst noted that per his firm’s analysis, the price of BTC had an average performance of 197% in the six months after it held above the 200-day moving average. This 197% average gain metric translates to a $27,000 Bitcoin by the middle of the year.

Lee then moved onto fundamental catalysts that could aid Bitcoin’s rise.

He first stated that with the impending U.S. presidential election, crypto won’t be under as much scrutiny by the government as it was in 2019, which was when President Trump and other key officials came out to denounce cryptocurrencies. Lee said that with less regulatory scrutiny should come more upside, for there will be less holding down Bitcoin.

Secondly, Lee said that the cryptocurrency could be buoyed by the ongoing coronavirus outbreak in China and around the world, for BTC is being increasingly seen as a hedge against geopolitical and macroeconomic risk; a mass coronavirus spreading would likely send traditional markets dropping, though would also send safe-haven assets hurtling higher.

And lastly, he claimed that Bitcoin’s upcoming block reward reduction, also known as a “halving” or “halvening,” could help to boost prices higher due to the shift to the supply-demand dynamic of this nascent market.

While he was hesitant to give an exact prediction, Lee ended his interview with CNBC by stating that he sees the Dow Jones Index hitting 30,000 and Bitcoin hitting $40,000 in the near future, adding that he expects for BTC to hit the aforementioned milestone before the Dow.

The Effects of the Halving Alone Could Send Prices Flying

Although there were a number of potentially bullish catalysts that Lee cited, the most potent of these is the halving, slated to take place in May 2020 of this year.

For those unaware, shortly, Bitcoin’s inflation rate will be decreased by 50% due to the halving, which is part of the code of the blockchain that ensures there will only ever be 21 million BTC in existence.

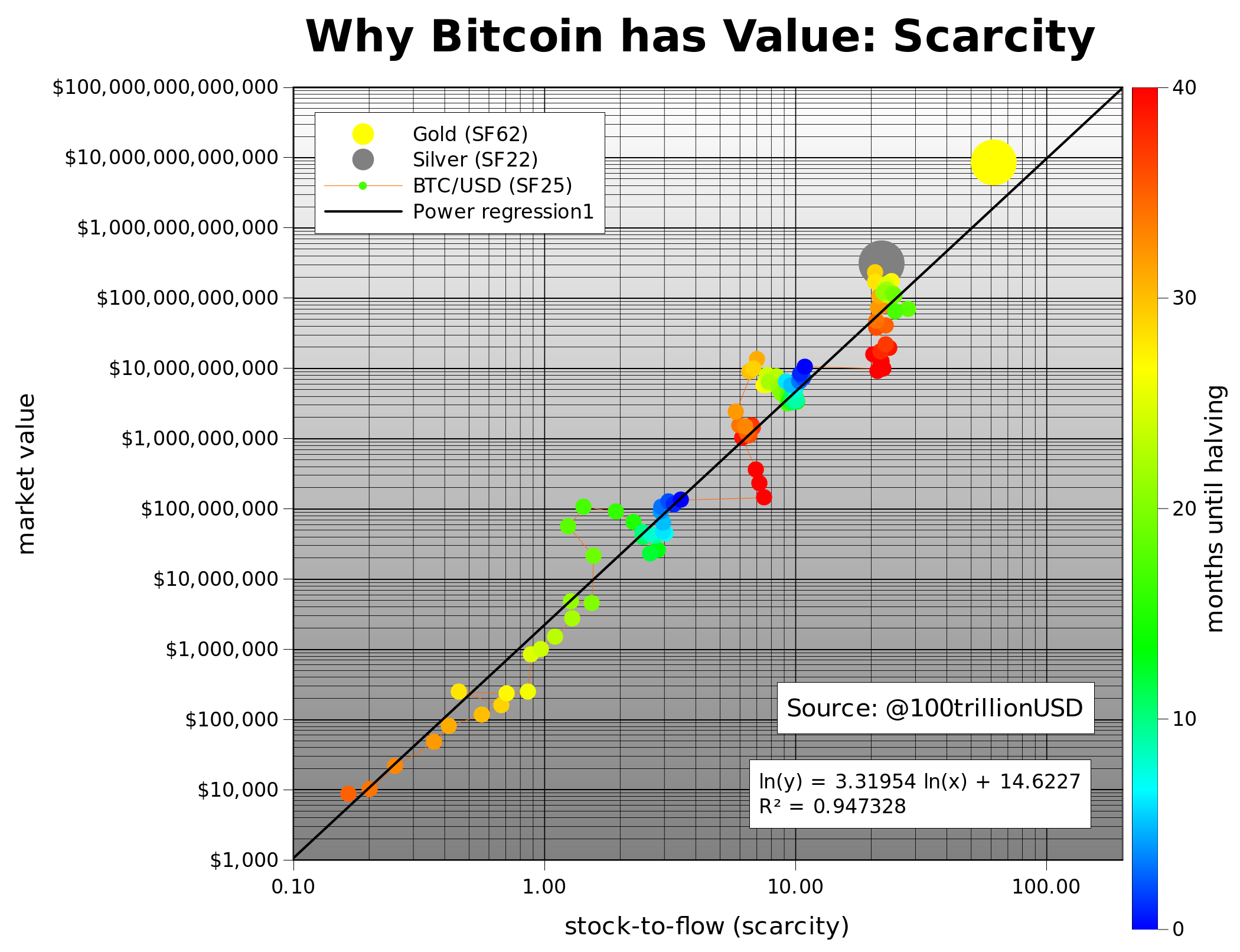

Per previous reports from Blockonomi, the so-called stock-to-flow model of Bitcoin’s price created by PlanB suggests Bitcoin will have a fair value of $55,000 per coin after the halving. The model, which relates BTC’s market capitalization to the scarcity of the asset, has been backtested to a 95% R squared.

The post Fundstrat’s Tom Lee Eyes $40,000 Bitcoin as Positive Trend Forms appeared first on Blockonomi.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @Nick Chong, @Khareem Sudlow