Crypto market forecast: 24th February

Despite a week of volatility in the crypto markets, many assets finished the week at around the same price level they started at. Both bulls and bears won significant battles over the course of the week, with crypto prices and fundamentals remaining volatile in the short term.

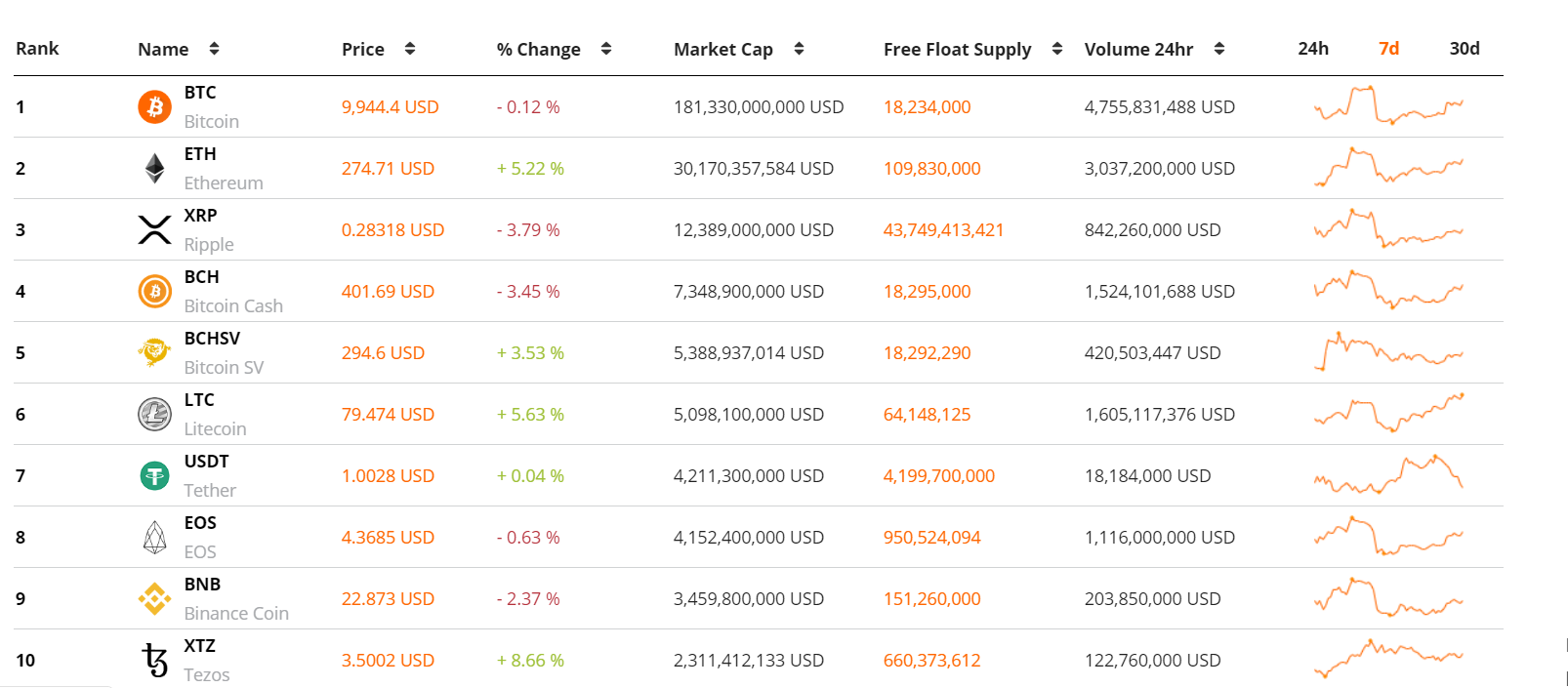

Bitcoin ended the week up 1% with its price ranging from as high as ~US$10,250 on Wednesday, to as low as ~US$9500 on Thursday, before settling around the ~US$9,900 level. The number two and three assets on Brave New Coin’s market cap table, ETH and XRP, rose ~7% and fell ~1% respectively, while the overall crypto market cap rose by 1%.

Ethereum’s excellent start to the year has been a key crypto narrative in Q1 2020 and the market’s top platform asset enjoyed another green price week taking its year to date gains to an impressive ~110% so far. ETH bulls enjoyed the gains despite a severe shock to Ethereum’s DeFi sector following two flash loan enabled exploits on the bZx platform. In the short term, the market appears set to continue its positive momentum, despite the emergence of potential flaws in one of ETH’s key use cases, DeFi.

Flash loans are a new double-edged innovation within DeFi that let ETH holders take out large crypto loans almost instantly. The flash loans used for last week’s bZx attacks offered as much as 10,000 ETH collateral-free and allowed the attacker to make large profits. The DeFi ecosystem is now discussing whether such large systemically risky loans should be enabled by DeFi protocols.

Why would lenders accept uncollateralized loans in such large amounts? Because the loans are designed to be paid back very quickly. Flash loans can be lent as part of a leveraged trade, and the loan, margin trade and loan repayment all take place within the same Ethereum smart contract transaction.

The open-source, sandbox nature of DeFi means that depending on your perspective, this week’s bZx exploit is either a clever arbitrage play, or malicious manipulation of the nascent DeFi ecosystem for profit. Since the 15th of February, the day after the first incident, as per Defi Pulse, the amount of ETH locked in DeFi dropped from US$1.22 Billion to 1.084 Billion, an ~11% fall.

This week in crypto

Launch of BitTorrent File System network beta v1.0.2

This Wednesday a core component of the TRON blockchain ecosystem will launch a beta version of its new distributed file storage system. Following the purchase of the BitTorrent protocol in August 2018 by the Tron Foundation, community members have awaited news on how the two technology stacks would be integrated together. The native tokens of the shared ecosystem, Tronix (TRX) & BitTorrent token (XBTT) fell ~5% and ~11% in the last week.

It was another up and down week for assets on Brave New Coin’s market cap table with a splash of red and green across the board. A recent entrant to the top 10, Tezos (XTZ), defied expectations of a pullback and continued its extended bull run rising another ~10% this week. XTZ now trades above ~US$3.50. In the coming weeks, it will be up to traders to determine whether the asset is ‘overbought’, given its soaring RSI, or if its bullish streak will continue as price discovery breaks resistance.

It was an unpredictable week in the Bitcoin markets defined by two periods of short sharp price action, wherein the space of a few minutes, the price of BTC moved quickly in either direction catching out many traders. Short and long liquidations in derivative markets on Wednesday and Thursday helped to amplify the magnitude of the price movements.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow