Crypto Market Forecast: January 28th

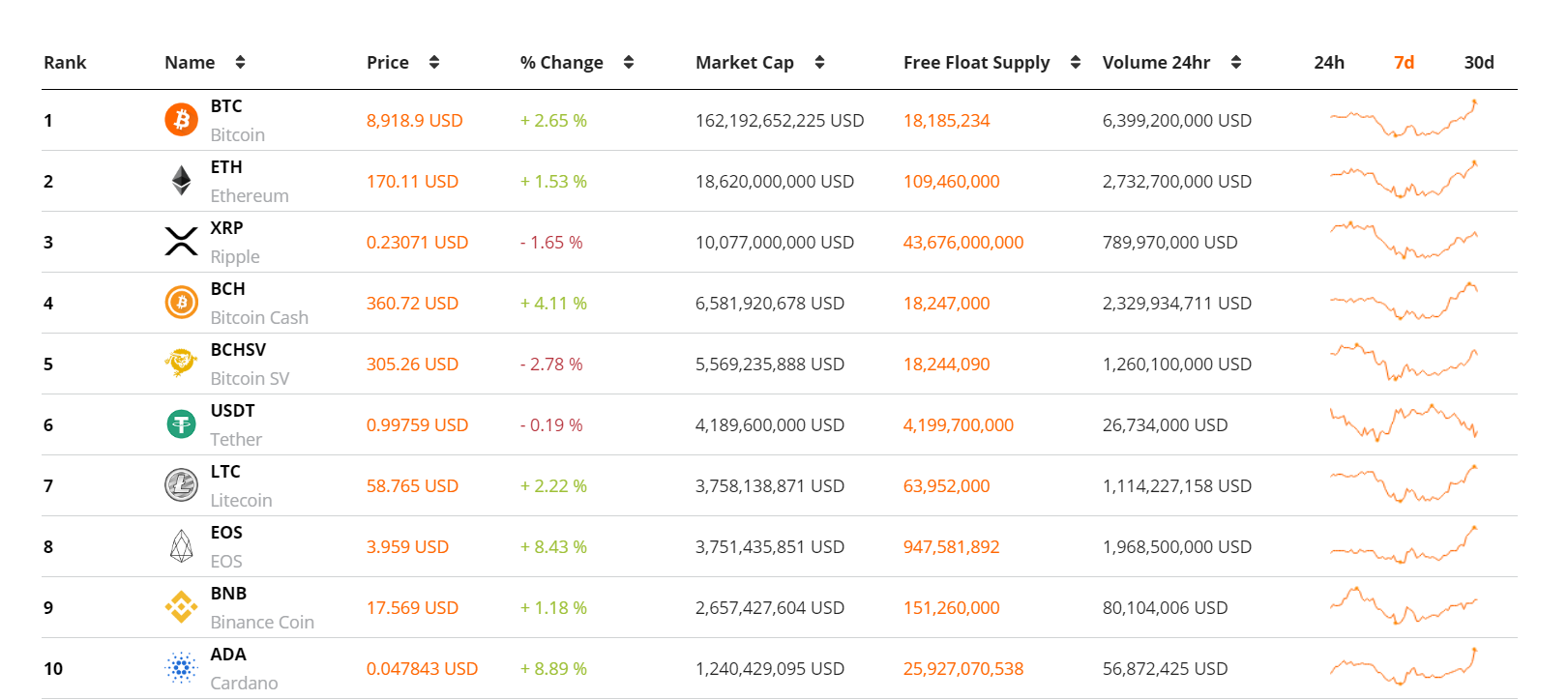

The crypto markets rallied strongly over the weekend turning a bearish start to the week into a bullish close. The leading crypto asset Bitcoin (BTC) rose ~3% over the course of the week and now sits just above the key psychological level of US$9,000. The number two and three crypto assets on Brave New Coin’s market cap table, ETH and XRP, rose ~3% and fell ~1% respectively, while the overall crypto market cap rose ~3%.

XRP’s underperformance compared to other large-cap crypto assets was surprising. Speaking at the Davos 2020 meeting last week, Brad Garlinghouse, CEO of Ripple Labs, said that, “in the next 12 months you’ll see initial public offerings in the crypto/blockchain space.” He further suggested, “We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side… it’s a natural evolution for our company.”

Generally, a public announcement like this would be a strong buy signal for crypto bulls. It implies that in the future (within the next year) there will be an injection of new funds into the Ripple ecosystem, adding value to the XRP token. The tepid price reaction suggests that XRP bulls are less reactive to speculative news events than they have been in the past.

Additionally, a number of key metrics on the XRP ledger have been lagging over the last few months suggesting weak fundamentals in the medium term. The Brave New Coin Monthly XRP Ledger Blockchain Statistics from December 2019 to January 2020, suggests that there have sharp drops in the growth of new accounts on the XRP ledger, the total average value of XRP ledger transactions, and the total number of payments on the ledger.

In other news last week, stablecoin giant Tether announced details about the launch of Tether Gold. The new stablecoin will be available on the Ethereum and Tron platform blockchains with an initial minimum buy-in of US$75,000. Each Tether Gold will be worth one troy fine ounce of physical gold. Registered investors will have the option to view the physical gold that backs up their Tether by visiting the vault in Switzerland that it is stored in.

Reaction to the Tether Gold launch has been mixed. Tether’s chequered history, and strategic missteps such as claiming to have 1-for-1 reserves for their flagship US dollar stablecoin before eventually being forced into admitting that they actually maintained a 74% reserve, have tarnished the Tether brand.

However, digital gold remains a sought after product for many in the digital currency space. Tether’s new offering distinguishes itself from existing gold stablecoins because of Tether’s widely known brand name and its history of providing a truly ‘stable’ stablecoin, USDT, that has proven utility within the volatile crypto markets.

This week in crypto

29th January - Cosmos(ATOM) Proposal #23 on-chain vote ends

The Cosmos platform blockchain, which allows token holders to stake their ATOM for the right to participate in network-wide governance decisions, completes voting on its #23 on-chain proposal this Wednesday. The new proposal moots the creation of a best practice ‘Cosmos Governance Working Group’ by Q1 2020 that would be funded by Cosmos stakeholders. The new group will generate collateral like educational wikis, a monthly newsletter, templates for proposals and charters. Voting currently stands at 92.1% ‘Yes’.

29th January- Stellar test network reset

This Wednesday the Test network for the Stellar network (XLM) will be reset and updated. On Stellar.com, utilizing the new testnet, users can demo the process of creating a new account, sending a payment or issuing an asset. A strong testnet can be a value driver for crypto assets if they create enough developer interest in their underlying projects. The price of XLM fell ~4% last week.

It was a strong week for assets in Brave New Coin’s market cap top 10 with most enjoying healthy gains aside from a few exceptions that traded marginally red. Just outside the top 10, Ethereum Classic (ETC) rose an impressive ~18% following news that Grayscale, the largest manager of digital assets in the world, will continue to donate up to one-third of the Grayscale Ethereum Classic Trust’s annual fees to the ETC Cooperative.

The strong end to the trading week with bullish price action and consistent trading volumes has many analysts excited about BTC’s short term prospects. This tweet analyzes the implications of Bitcoin’s recent weekly close(Sunday midnight UTC) above a key BTC/USD trendline using the Bitcoin Liquid Index. Historical patterns suggest that price has broken free of the downward trend and may keep rising from this weekly close.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow