Bitcoin options set to boom in 2020

Bakkt began offering regulated bitcoin options in December, and CME is to launch its own options products this week. These contracts give traders the right to buy or sell an agreed amount of bitcoin on a set date for a certain price, allowing traders to hedge their risk against spot and futures positions.

For example, a trader might buy a "call" options contract to purchase bitcoin at the price of $8,000, which lasts for one month. If the price of bitcoin rises within the month, the trader can exercise the option and buy Bitcoin at $8,000—making a quick profit. With a "put" option, traders can take the opposite side of the bet and buy the right to sell Bitcoin at a predefined price.

According to Luuk Strijers, Chief Commercial Officer at bitcoin derivatives exchange Deribit, these contracts are already being used by bitcoin traders to protect their holdings from volatility and generate an income.

Bitcoin miners are also uniquely positioned to benefit by using options to secure a price for selling p=mined bitcoin to lock in future revenue — just like owners of olive presses in ancient Greece used the first options contracts to ensure they didn't lose out on earnings in the event of a bad harvest.

An untapped market

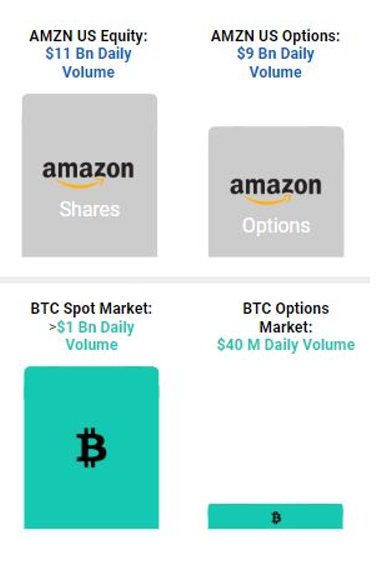

In legacy markets, derivatives typically account for more than four times the trade volumes of the underlying asset. But in the bitcoin markets, spot trading still accounts for a much larger proportion. This discrepancy is likely to be motivating Bakkt and CME to introduce more complex derivatives in a bet that the same ratio will eventually manifest across the cryptocurrency markets.

As Strijers told Brave New Coin, although cryptocurrency derivative infrastructure is still in its early stages, it could be expected to grow by five to ten times in the coming year, and eventually occupy an even greater proportion than legacy markets due to the higher leverage used in cryptocurrency trading.

"As can be seen from the Amazon example, the relation spot vs options activity is much higher in traditional markets due to various reasons," said Strijers. "We expect this ratio over time to be more in line with Amazon."

[Image from Deribit]

The decision of regulated players Bakkt and CME to move into bitcoin options is a big step for the bitcoin market and marks a key milestone for the maturity of cryptocurrency derivatives.

Futures trading volume has been growing steadily on both platforms since they were launched. Bakkt has gone from zero to over 6601 contracts traded each day since late September 2019, and CME continues to report growing interest from institutions. This suggests the trading venues might have been waiting to acquire enough market participants and liquidity to add another layer of complexity in the form of options.

Until now, the bitcoin options market has remained relatively small and retail-driven. Trading action has been dominated by two major exchanges—Deribit and LedgerX—that together account for the vast majority of the market, according to derivatives tracker Skew. Other crypto exchanges including Malta-based OKex have also recently introduced their own options contracts in an attempt to claim a slice of the growing market.

A new data source

One of the advantages that options give is the ability to tap into the collective wisdom of the market. This can be achieved by measuring _Implied Volatility (IV)_—an options term that reflects the market's expectations about a certain asset.

London-based crypto research company Skew has put this metric to use in an attempt to end the debate over whether or not the upcoming 2020 Bitcoin halving is already priced in.

Skew conclude that because there is no kink in the implied volatility during Q2, traders in the Bitcoin options market don't anticipate any major price moves following the halving in May.

But, the market is anticipating volatility just before the halving event in March, suggesting we could see a sudden surge and drop characteristic of the classic market adage "buy the rumor, sell the news."

OhNoCrypto

via https://www.ohnocrypto.com

Kieran Smith, Khareem Sudlow