Bitcoin and gold jump after Trump strikes Iran

However, the impact on the cryptocurrency market is less clear. Analysts are divided over whether a corresponding surge in bitcoin was a coincidence or yet more evidence that the leading cryptocurrency is acting as a new breed of digital safe haven.

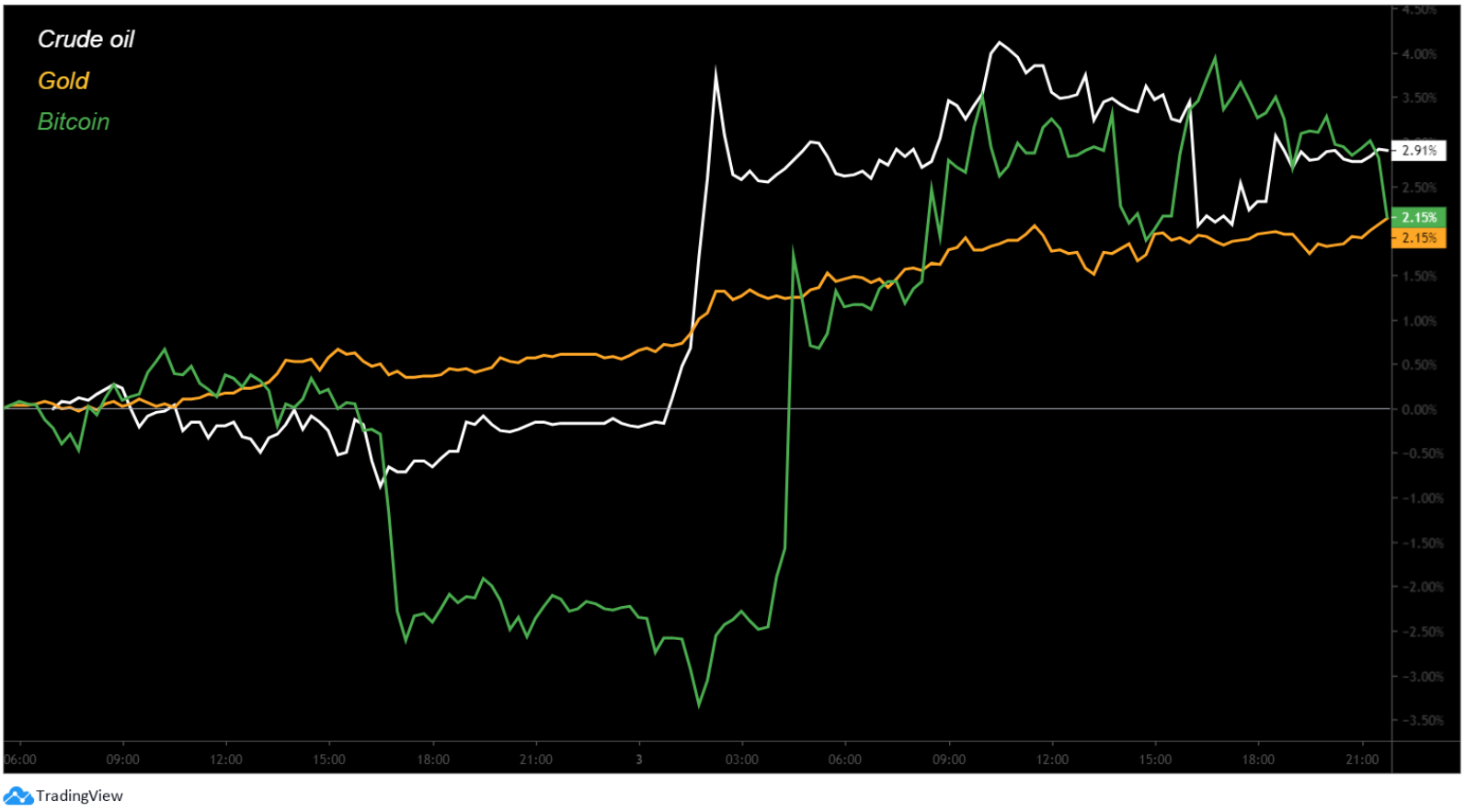

Bitcoin's 5 percent move up appeared to coincide with a general flight to safety as investors dropped stocks in favor of oil and gold, which pushed up around 4 percent and 2 percent respectively.

Several bitcoin bulls have chimed in to suggest the sudden rise in geopolitical tensions was a catalyst for the strong crypto rally which continued on Monday. Galaxy Digital founder Mike Novogratz was one of the first, using the opportunity to promote the digital gold narrative, and claim bitcoin is acting as a classic safe-haven asset.

"The more I analyze this Iranian situation," tweeted Novogratz, " the more bullish on gold and $btc I become. Iraq will be expelling US troops. Iran will have more pull in Iraq which is what they always wanted. Saudi isn’t in a position to want a conflict. Mideast less stable. Equals more volatility."

Others are more skeptical. Mati Greenspan, founder of the cryptocurrency-focused research firm Quantum Economics suggests “the Iranian market in and of itself is likely too small and slow to have caused this move single-handedly."

"It might be crypto traders speculating that Iranians are buying Bitcoin," noted Greenspan in an email, but it is more likely that "several players have been waiting on the side for a good buying opportunity below $7,000 per coin, and it seems one has presented itself.”

Outspoken goldbug and bitcoin critic Peter Schiff supports Greenspan's view. He chimed in on Twitter to suggest the "heightened geopolitical risk has resulted in both gold and bitcoin moving higher, but for different reasons." While "gold is being bought by investors as a safe haven,'' says Schiff, "Bitcoin is being bought by speculators betting that investors will buy it as a safe haven."

Economist Alex Kruger, who has made his name by quashing ideas of bitcoin acting as a macro asset, offers a different perspective. He dismisses the idea that bitcoin is a safe haven as absolute nonsense," and suggests even "seasoned traders" have become "delusional about bitcoin's correlation with war and international conflict."

But given the recent spread of misleading figures, one could be forgiven for drawing false conclusions about price action.

War-time premium

Rumors of a huge premium being paid for bitcoin in Iran began swirling after Messari's Ryan Selkis pointed to LocalBitcoins data suggesting Iranians could be paying 300 percent more for the privilege of buying bitcoin with the rial — the volatile local currency.

“Bitcoin is trading at nearly $24,000 in the USD equivalent of Iranian rials on LocalBitcoins today," wrote Selkis in a newsletter. "It's unlikely those purchases are paying for the Iranian military's response. Instead, it might be innocent (and desperate) Iranians looking for a way out of the coming chaos.”

Such high prices in Iran would indicate unprecedented demand, suggesting citizens are flocking en masse to buy bitcoin at a premium far beyond the meager 10 percent extra paid by South Koreans during the 2017 bull run.

What Selkis didn't explain though, is that Iran has two exchange rates: A government-subsidized rate that values the rial far above the open market and is only used for official business, and a free market rate—which represents the real number of dollars an ordinary citizen would get for their rials. This means the price of bitcoin wasn't really hitting an all-time-high in Iran, and was in fact trading at around $7,300—just like in the rest of the world.

Nevertheless, as Schiff and Greenspan point out, even if bitcoin is not currently acting as a safe haven asset in Iran and other troubled regions, it soon could be. Each time analysts attribute price action to macroeconomic forces, an association is forged and a self-fulfilling prophecy set in motion, which could mean bitcoin is one day widely recognized as a legitimate safe-haven asset. With geopolitical tensions mounting, and the Bitcoin halving just months away, 2020 is already off to a tumultuous start.

OhNoCrypto

via https://www.ohnocrypto.com

Kieran Smith, Khareem Sudlow