2020: The year of DeFi

One of the key themes of 2019 was the rise of decentralized finance, (DeFi), a new type of finance that runs on trustless protocols and without the need for financial intermediaries.

Today, cryptocurrency users around the globe can make use of traditional financial services such as borrowing, lending, trading, and investing in a decentralized and transparent manner. All you need is an Internet connection and a cryptocurrency wallet. In 2020, we expect this new market segment to continue to grow.

The rise of DeFi

Bitcoin (BTC) was the first implementation of decentralized finance. It enabled individuals to make financial transactions with other individuals without the need for a financial intermediary in the digital age. Bitcoin and similar cryptocurrencies were the first wave of DeFi.

The second wave of DeFi was enabled by the Ethereum blockchain which added another layer of programmability to its blockchain. Now, at the start of 2020, individuals (and businesses) can borrow, lending, trade, invest, exchange, hedge, and store cryptographic assets in a trustless manner thanks to the growing number of decentralized finance applications on the Ethereum network.

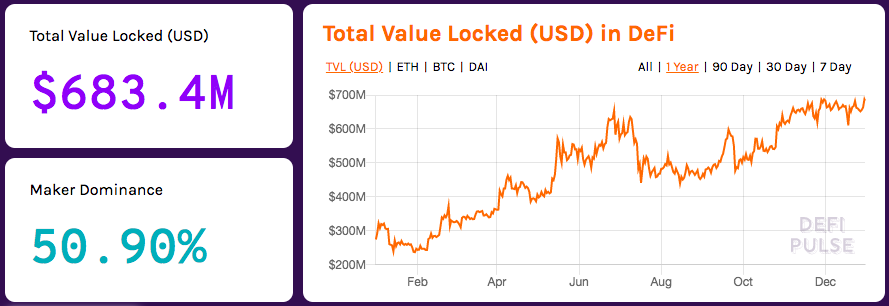

According to data compiled by DeFi Pulse, the US dollar value of ETH locked in DeFi protocols has grown from $293 million at the start of January to over $687 million at the end of December 2019. Using this metric as a proxy for the value of the DeFi market, we can see DeFi has exploded in 2019, growing by over 130 percent.

The largest contributor to the total US dollar value locked in Defi has been MakerDAO, which powers the stablecoin Dai (DAI). The decentralized synthetic assets investment platform Synthetix, the lending protocols Compound and InstaDapp, and the DEX Uniswap make up the majority of the remaining value in the open finance market.

What does the DeFi market offer today?

Today, there is a wide range of DeFi apps available that provide much of what the traditional, centralized financial system provides. From borrowing and lending to investing and insuring, the largely Ethereum-powered DeFi market caters to many of the most pressing financial needs of the individual.

The DeFi market’s current key offerings include:

- Earning interest on crypto asset holdings has become easier than ever, thanks to the Compound protocol and DApps like Dharma and Celsius.

- Converting your ETH to other Ethereum tokens can be done securely and privately decentralized exchanges such as Uniswap or IDEX.

- Hedging your cryptographic asset portfolio is now possible thanks to decentralized derivatives trading platforms, such as dYdX.

- Insuring yourself against the failure of smart contracts has become possible thanks to Nexus Mutual.

- Betting on the outcome of elections, sporting events or whether John McAfee’s bitcoin price prediction will come true can be done on prediction markets platforms, such as Augur.

- Storing funds in crypto-backed stablecoins during times of extreme market volatility is now as easy as buying DAI.

DeFi in 2020

In the coming twelve months, we expect to see the list of DeFi offerings expand.

Lending and trading have made up the bulk of the DeFi market in 2019. The ability to earn interest on crypto has been very alluring to HODLers, which can be seen by the increase in crypto-backed loans over the course of the last year. In 2020, we can expect the amount of money locked in lending protocols to increase as long-term investors diversify into interest-bearing offerings - especially if the market fails to rally towards 2017/18 highs.

Active crypto traders, on the other hand, are becoming increasingly interested in decentralized trading offerings. In light of the never-ending threat of (centralized) exchange hacks, the increased level of fund security that decentralized trading platforms offer should see not only an increase in trading DApp users but also in the number of available non-custodial trading platforms and exchanges.

Stablecoins were another major theme of 2019, which saw fiat-backed stablecoins, such as Tether (USDT) and USD Coin (USDC), reach all-time high trading volumes, while MakerDAO’s Dai managed to establish itself as the market-leading non-fiat-backed stable currency. We expect stablecoins to remain an integral part of open finance in the coming twelve months as they offer an easy gateway into cryptocurrencies, and are poised to enter the digital payments market.

We can also expect new types of products to launch in areas such as insurance, investing, and asset tokenization.

For example, staking-as-a-service provider Staked launched Robo-Advisor for Yield (RAY), which is a decentralized, Ethereum-based protocol that automatically allocates ETH, USDC or DAI to the highest-yielding interest-bearing DeFi protocols. We can expect similar types of offerings to increase as demand for new crypto-based investment products grows.

In the insurance market, which has so far been largely untapped by smart contract-powered solutions, will likely also witness new product offerings. Exchange hack insurance, for example, would make a strong DeFi insurance use case while peer-to-peer insurance pools would be another area where the DeFi market could provide services.

Asset tokenization, a much-talked-about blockchain use case, is also an area where we could expect more DeFi products to hit the market. You can already invest in a range of tokenized assets through synthetic tokens. In the coming twelve months, we expect these offerings to grow.

Arguably the biggest hurdle that the DeFi market could face in 2020 is regulations. While DeFi protocols can operate without regulatory approval - due to their decentralized nature - the DeFi market would benefit greatly from crypto-friendly regulations in key jurisdictions.

Should global leaders come together to create a crypto-friendly global blockchain framework, the DeFi market is poised to become an integral part of the financial industry of the future. Should lawmakers struggle to formulate a conducive regulatory framework, we could still see DeFi flourish in markets where traditional financial institutions have failed large pockets of the population.

OhNoCrypto

via https://www.ohnocrypto.com

Alex Lielacher, Khareem Sudlow