0x Price Analysis - v3.0 and staking now live

0x (ZRX) is an ERC-20 token designed to power various forms of decentralized exchange (DEX). The current USD spot price is down 92% from the all-time high set in January 2018. The token has a total market capitalization of US$115 million, with US$7.58 million in trade volume over the past 24 hours.

The ZRX protocol was founded by Will Warren and Amir Bandeali. Neither had significant technical work experience before starting the project. Warren is an engineer and self-proclaimed U.C.S.D. Ph.D. dropout. Bandeali is a former fixed-income trader and previously worked for a leading Over The Counter cryptocurrency trading platform, DRW.

Notable project advisors include the current co-CIO at Pantera Capital and founder of Augur, Joey Krug, as well as three Coinbase alums; Fred Ehrsam, the co-founder of Coinbase, Linda Xie, who is Will Warren’s wife and the co-founder of Scalar Capital, and Olaf Carlson-Wee, the founder of PolyChain Capital.

The rise of the DEX is, in part, a response to the more than US$1.5 billion lost by centralized exchanges in the form of hacks, malfeasance, or incompetence over the past 10 years. As opposed to centralized exchange, which requires assets to be deposited in exchange wallets, a DEX user maintains custody of their assets. This key difference removes any centralized honeypot for hackers to target.

ZRX includes a messaging format for trade settlement, and a system of smart contracts for a decentralized governance module, which has yet to be implemented. Decentralized governance was included in an attempt to reduce the friction associated with upgrades and platform downtime. However, the platform’s core feature is providing DEX architecture solutions through a system of relayers.

Relayers can use the ZRX token to approve proposed upgrades, which decreases the tokens circulating supply, and is reminiscent of proof-of-stake. This model does not prevent relayers from forking the ZRX protocol, should they wish to implement their own changes, or if they disagree with changes implemented by the ZRX core team.

In December 2018, DDEX forked the ZRX protocol and created the Hydro protocol (HYDRO). CEO of DDEX, Tian Li, stated that the DDEX and ZRX teams had divergent opinions on what constituted an urgent protocol improvement, and whether fee-based tokens create unnecessary friction.

The original ZRX token ICO occurred in August 2017 and raised US$24 million through the sale of 500 million of the one billion tokens created. The remaining 50% of the tokens were split between the 0x company, a developer fund, the founding team, early backers, and advisors. Tokens allocated to founders, advisors, and staff members were locked in a four-year vesting schedule.

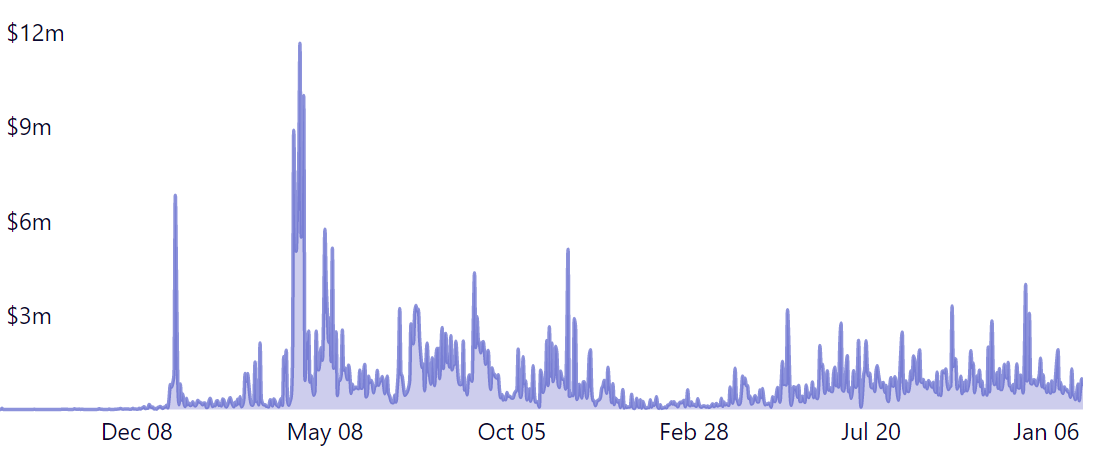

While there were no pre-sale or reservation agreements, PolyChain Capital lead an early seed round that covered legal fees. The ZRX team holds 11,480 Ethereum (ETH) in its treasury, currently valued at US$2 million. At least half of the treasury was spent during 2017, 11,000 ETH spent in late December 2018, and 7,120 ETH in 2019 (blue, chart below).

In September 2018, ZRX released v2.0 of the protocol which brought several new features including; the 0x Portal, Non-Fungible Token support (ERC-721), increased order matching efficiency, and the option for permissioned liquidity pools where token addresses must meet specific requirements that enable the enforcement and adherence to KYC/AML regulations. Wyre has also been working with a number of DEXs to help integrate a KYC token, as well as a fiat to Dai (DAI) on-ramp.

DEX legal compliance was thrust into the spotlight in November 2018 when the U.S. Securities and Exchange Commission fined the founder of EtherDelta, a non-ZRX DEX, US$388,000 for operating an unregistered national securities exchange.

0x Instant was released in December 2018, and enabled crypto purchases on any app or website with a few lines of code. Instant is open-source, configurable, and allows hosts to earn affiliate fees on every transaction. The process works by aggregating liquidity from 0x relayers and finding the best price for the purchaser. The transaction occurs using ETH through MetaMask, Ledger, Trezor, or any other Ethereum wallet. 0x has also attracted NFT marketplaces, like Emoon, to the family of relayers. Emoon has 0x instant enabled.

In January 2019, ZRX announced a market maker program to improve liquidity across relayers. Market makers increase liquidity by adding to order book depth when necessary. Accepted applicants can receive up to US$15,000 for completing the onboarding process.

Throughout 2019, the ZRX team has updated the roadmap for future protocol changes, or 0x Improvement Proposals (ZEIPs). In April 2019, Warren proposed a stake-based liquidity incentive (ZEIP-31), slated for release in v3.0 later this year. ZEIP-31 changes will mean that market takers pay a small protocol fee on each ZRX trade and market makers receive a liquidity reward proportional to the protocol fees generated from their orders and their stake of ZRX tokens. Market makers who do not own sufficient ZRX to collect liquidity rewards will also be able to form a ZRX staking pool for third-party delegators.

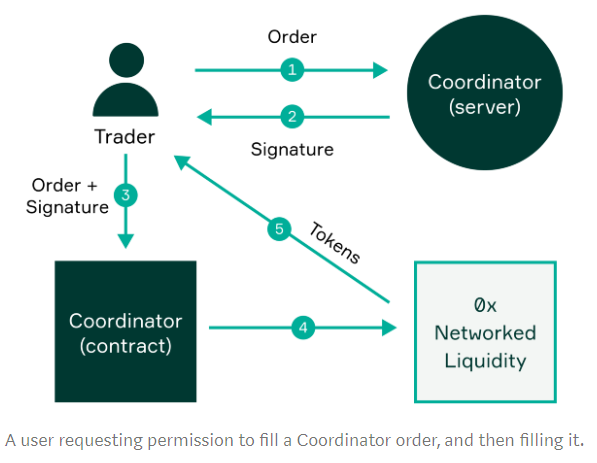

In July 2019, the ZRX team introduced coordinators, a service that combines order matching and open order book relayer models. These coordinators allow for pooled liquidity across all DEXs, quickly finding the best price for an asset. A demo implementation of a coordinator is currently live on Bamboo Relay.

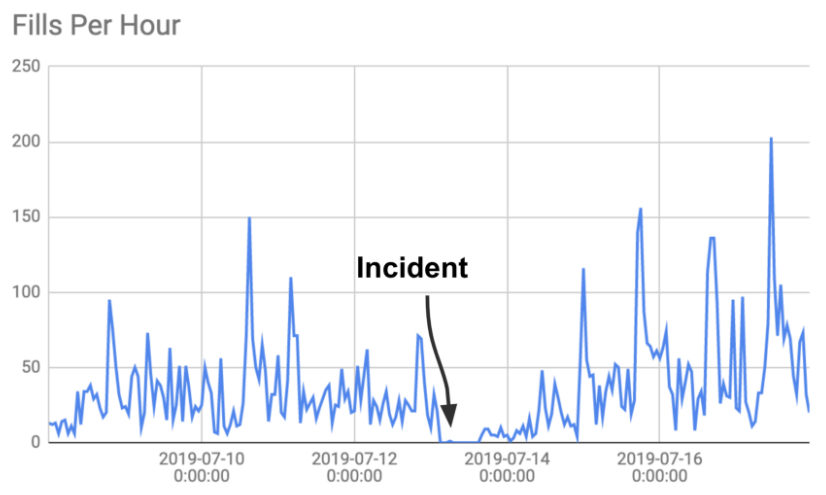

A contract vulnerability was found in July 2019, before it was exploited, and the network was briefly halted. The 0x v2.0 contract was shut down temporarily, patched, and brought back online. No user funds were lost and the bug reporter was awarded US$100,000.

The ZRX project has 88 repos on Github with developers contributing over 3,400 commits to ZRX repos in the past year. Most coins use the developer community of Github where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Most of the ZRX related commits have occurred in the 0x-monorepo (shown below). There are currently 36 issues in the ZEIP Github repo. ZRX v3.0 was released on December 2nd and included a ZRX staking mechanism, DEX liquidity aggregation, the ability for relayers to support flexible fees, and various technical improvements for ecosystem devs. The ZRX staking mechanism gives market makers monetary rewards denominated in ETH and additional ZRX voting power for providing liquidity. Every ZRX holder may earn staking rewards as well by delegating tokens to market maker pools.

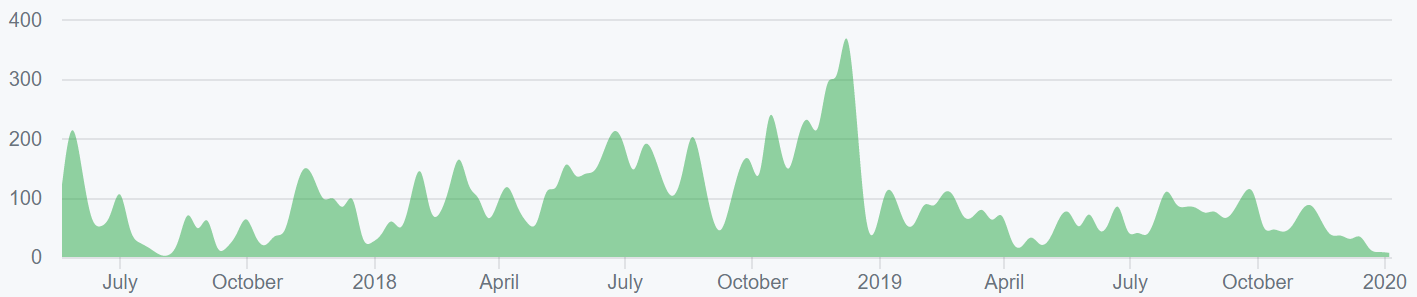

On the network, the total USD network volume (top chart, below) across all relayers has decreased substantially, while ZRX fees are non-existent (not shown). Exchange fills dropped off substantially in mid-December 2018 when DDEX left the ZRX protocol. However, relayer fills have increased substantially in recent months (bottom chart, below).

Of the eight relayers tracked, TokenTrove leads the pack by trades, and Tokenlon leads by trade volume. The most popular tokens traded between all relayers over the past month is Wrapped ETH, an ERC-20 compliant derivative of ETH, Tether (USDT), and Dai (DAI).

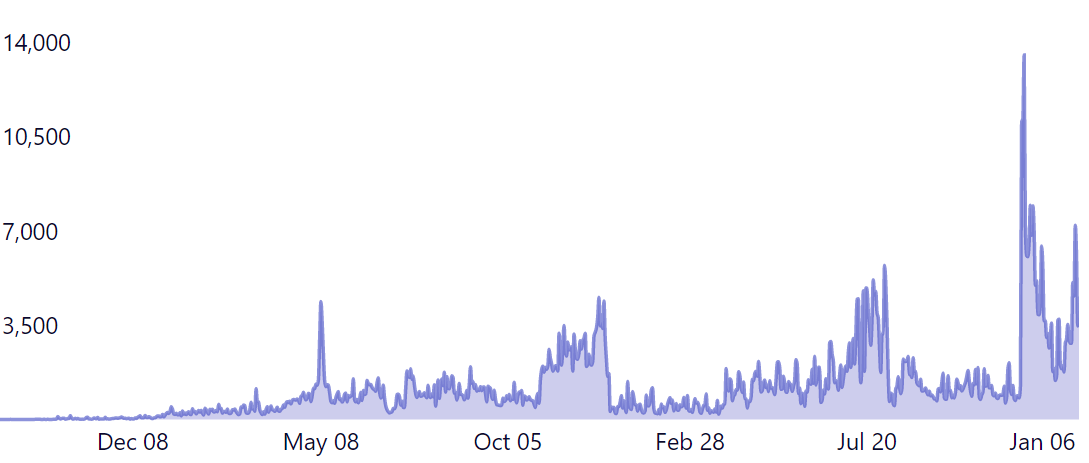

Transactions per day (line, chart below) spiked dramatically in late September 2019, which is likely due to speculative demand. The spike in transactions in October 2018 corresponded with a Coinbase listing at the time. The average transaction value (fill, chart below) has been in a downward trend since May 2018 and currently stands at US$1,150. Both metrics have not surpassed all-time highs set during token distribution in September 2017.

Declining ZRX token transactions, from October 2018 until recently, can be attributed to an inherent lack of importance regarding the ZRX token itself. The ZRX tokens are almost purely a speculative vehicle and are not required to trade on relayers. Staking and upcoming governance changes for v3.0 potentially contributed to the transactions in late 2018.

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) is currently 125 after falling from 200. A rising NVT suggests the coin is overvalued based on its economic activity and utility, which should be seen as a bearish price indicator, whereas a falling NVT suggests the opposite.

Monthly active addresses (fill, chart below) have decreased dramatically since November 2018, and are currently near an all-time low at 514. The previous rise in active addresses corresponds with the Coinbase listing in mid-October 2018. Active and unique addresses are important to consider when determining the fundamental value of the network using Metcalfe's law.

Exchange-traded volume has been led by the Bitcoin (BTC) and Tether (USDT) pairs on Binance and Coinbase Pro. Over the past year, ZRX has been listed on, or gained new pairs on, several exchanges including Binance, Binance.US, Bittrex, Coinbase, Coinbase UK, Ethfinex, OKCoin.com, and Poloniex. In June 2019, dYdX integrated 0x-based liquidity using Radar Relay.

Technical Analysis

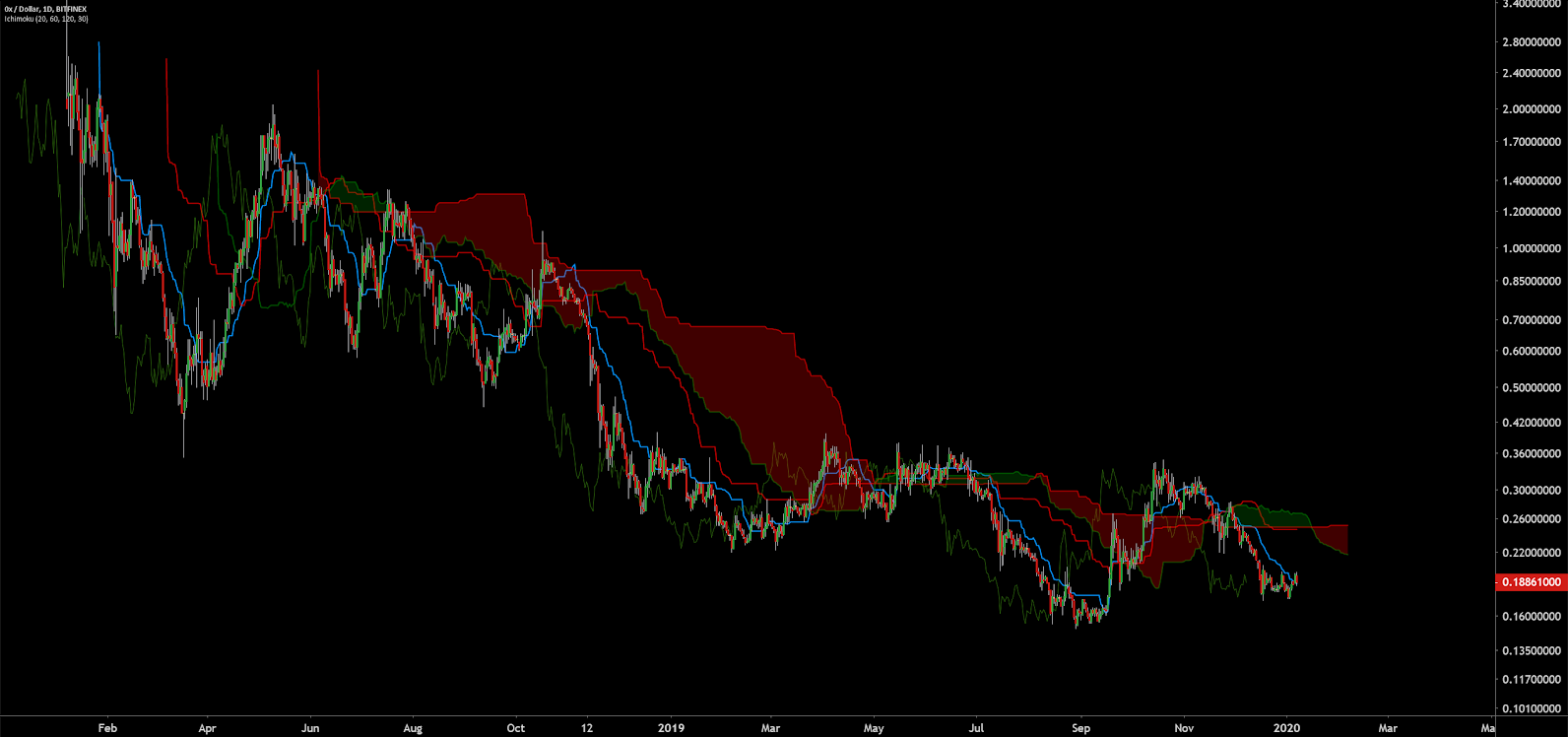

To determine entries and exits throughout a trend, as well as the potential for a trend reversal, exponential moving averages, volume profiles, divergences, and the Ichimoku Cloud can be used. Further background information on the technical analysis discussed below can be found here.

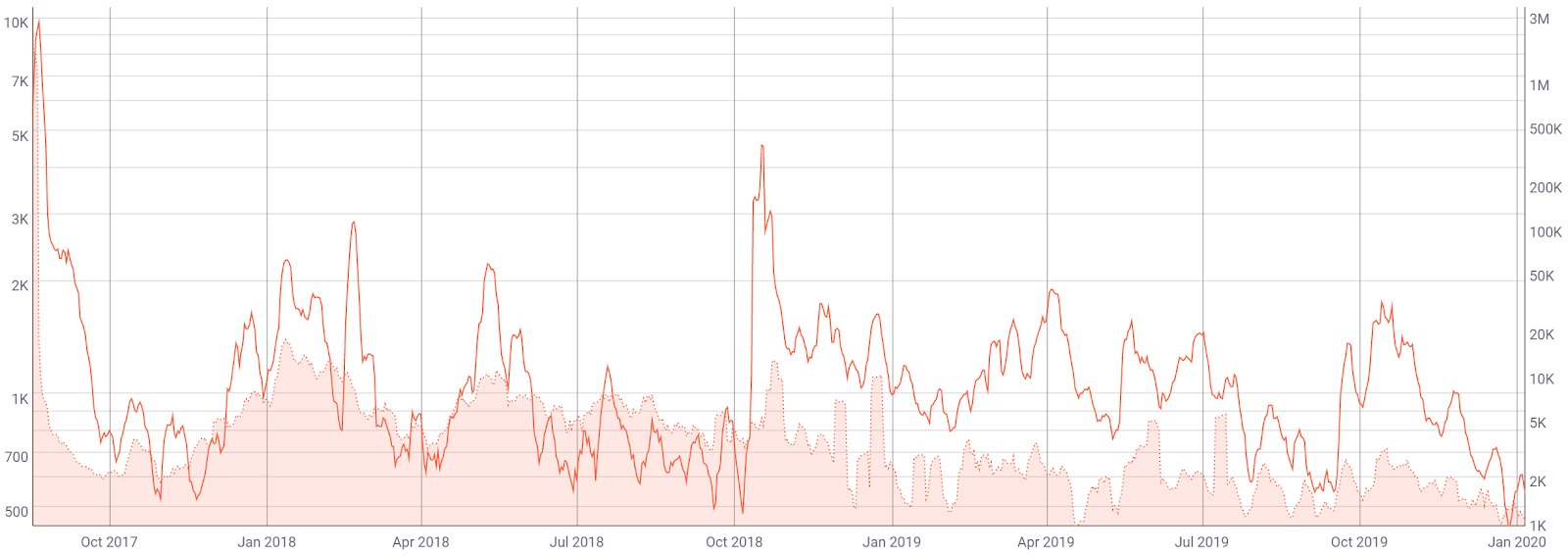

On the daily chart for the ZRX/USD market pair, virtually all the gains from September 2019 have reversed after the market failed to break above the key resistance around 0.33. The 50-day Exponential Moving Averages (EMA) and 200-day EMA bearishly re-crossed in late November, and the spot price has mostly held below the 200-day since the cross. Current significant resistance, according to the volume profile of the visible range (horizontal bars), stands at US$0.32 - US$0.35 with virtually no significant resistance above this level. There are no active volume or RSI divergence at this time.

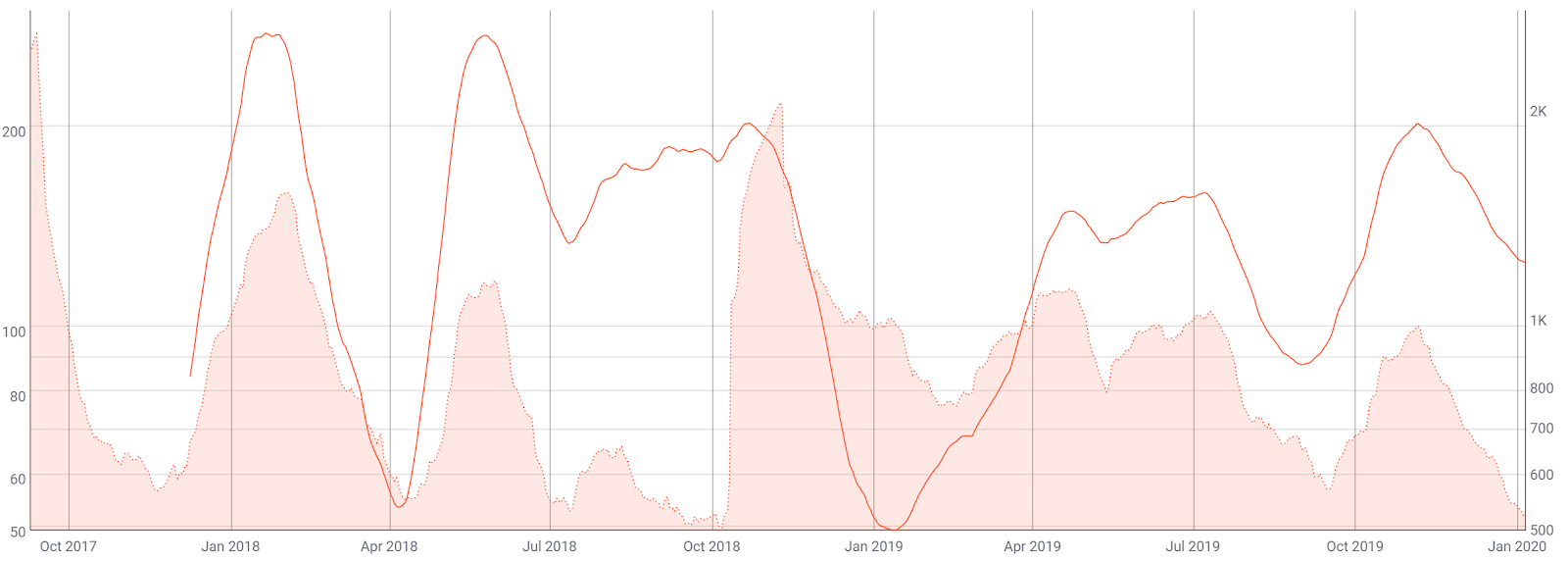

Turning to the Ichimoku Cloud, there are four key metrics; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. Trades are typically opened when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are bearish; price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and below the current spot price. The trend will remain bearish until the spot price is once again above the Cloud. A TK disequilibrium, or c-clamp, does suggest oversold conditions currently.

Lastly, on the daily ZRX/BTC pair, trend metrics mirror the ZRX/USD pair. Price is below both the 200-day EMA and the Cloud after being unable to remain above these key levels for multiple weeks. Downside support sits at 1,800 sats - 2,000 sats based on the historic volume profile (horizontal bars). There is a small and unconfirmed bullish RSI divergence suggestive of waning bearish momentum in the near term.

Conclusion

With the opportunity to stake ZRX now here, a potential use case has emerged. Active addresses on the network, currently near an all-time low, suggest that users have not embraced this mechanism yet. Despite declining USD relayer volume and ZRX active addresses dropping significantly, relayer fills have recently hit an all-time high, suggesting the strong use of existing DEXs. Additional governance decisions may also help to retain token value going forward.

The ZRX core team continues to be very active, with multiple significant updates and an extensive upcoming roadmap. As regulatory concerns globally for crypto exchanges ratchet up significantly, DEXs may gain prominence in the absence of other options.

Technicals for the ZRX/USD and ZRX/BTC pairs are both leaning bearish as trend metrics were unable to sustain bullish market conditions in late 2019. Both pairs have lost nearly all the gains made from September to October last year. Significant support for the ZRX/USD and ZRX/BTC pairs sits at US$0.15 - US$0.17 and at 1,800 sats - 2,000 sats, respectively.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow