Uniswap Exchange: Master The Crypto User Review Guide

How to Use, Trade and Sign Up to Uniswap Exchange

Uniswap is a protocol that lets you make automated token exchanges via Ethereum. Find out everything you need to know about Uniswap and how it works today in our guide and review.

What is Uniswap?

Uniswap is a protocol that lets you swap tokens via a smart contract on the Ethereum blockchain.

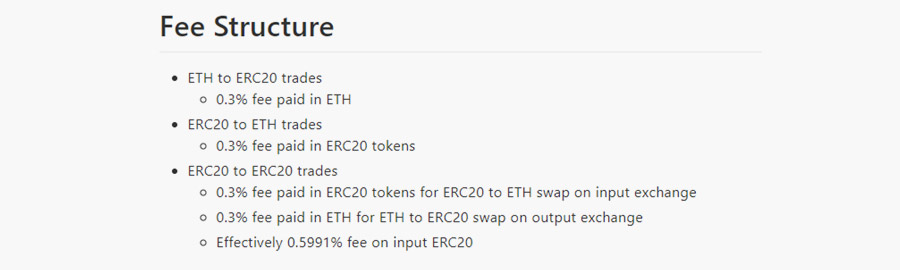

Thanks to Uniswap, you can swap ERC-20 tokens while paying fees of 0.3%, with all trades automated using smart contracts.

Uniswap was built with four founding principles, including:

- A simple smart contract interface for swapping ERC-20 tokens

- A formalized model for pooling liquidity reserves

- An open-source frontend interface for traders and liquidity providers

- A commitment to free and decentralized asset exchange

Today, Uniswap has successfully achieved those four principles. It’s an open exchange protocol (anyone can list any ERC-20 token via the protocol). It’s decentralized: all trades are completed automatically via smart contracts. And the formalized liquidity pooling model successfully groups liquidity in a way that incentivizes liquidity providers while also charging traders competitive fees (0.30%).

Uniswap is an Ethereum Foundation grant recipient. Ethereum developer and Uniswap inventor Hayden Adams announced the launch of the protocol on Twitter on November 2, 2018. Adams was inspired to launch the project after reading one of Ethereum creator Vitalik Buterin’s Reddit posts a few years ago.

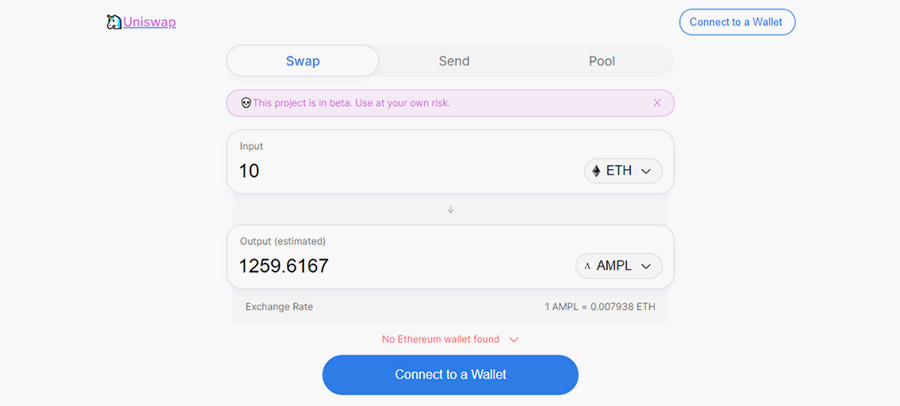

As of December 2019, Uniswap is officially still in beta, and traders are advised to use it at their own risk.

There are several things that make Uniswap unique. First, the token listing is open and free, and all smart contract functions are public.

Second, Uniswap is much more gas efficient due to its minimalistic design than, say, Bancor and other protocols. For an ETH to ERC-20 token trade, Uniswap will use about 10x less gas than Bancor. Uniswap can also perform ERC-20 to ERC-20 trades more efficiently than the 0x protocol, and it has significant gas reductions compared to on-chain order book exchanges like EtherDelta and IDEX.

You can make a swap online today via Uniswap.exchange or learn more about Uniswap and how it works by visiting Uniswap.io.

Uniswap Features

Key features of Uniswap include:

Automated 24/7 Trading: Uniswap lets you trade tokens any time of day or night. All trades are executed via an automatic smart contract.

Trade ERC-20 Tokens: Uniswap lets you trade ERC-20 protocol tokens on the Ethereum blockchain.

Like A Decentralized Exchange: Uniswap is like a decentralized exchange in that you can trade tokens without the intervention of a centralized third party. However, it’s different from a decentralized exchange in that there’s no real P2P ‘exchange’ taking place. You’re swapping tokens with a liquidity pool.

Runs in Perpetuity: Uniswap cannot be stopped. The protocol will run in perpetuity for as long as the Ethereum network is running.

Can Handle Orders of Any Size: Uniswap can technically handle any size of order – from 0 to infinity. The protocol uses an asymptotic curve to increase the price of the coin as the desired quantity increases. This means Uniswap can technically handle orders of any size, but really large orders are prohibitively expensive after a certain limit.

Not Ideal for Whales and Large Orders: Uniswap works because whales cannot overwhelm liquidity pools. Whales have no incentive to make large trades using the Uniswap protocol. In fact, the high Uniswap trading fees make large trades prohibitively expensive.

Received Ethereum Foundation Grant: The developer of Uniswap, Hayden Adams, received a grant from the Ethereum Foundation to develop Uniswap.

0.3% Trading Fees: Uniswap charges trading fees of 0.3%, with this money going towards the liquidity providers. These trading fees do not go towards the founders or any centralized trading platform. It just goes towards keeping the protocol in operation and giving liquidity providers and incentive to make markets.

Currently in Beta: Uniswap launched in November 2018. As of December 2019, Uniswap is fully available to be used and make swaps, although it’s still technically in beta.

80+ Tokens: As of December 2019, Uniswap supports 80+ tokens, all of which are ERC-20 protocol tokens. You can view all available tokens at Uniswap.exchange/swap. Just search a token name, symbol, or address, then select it and make the swap.

Make Money By Providing Liquidity: Those who provide liquidity on Uniswap can earn a cut of trading fees. You can add liquidity at Uniswap.exchange by depositing any of the supported ERC-20 tokens.

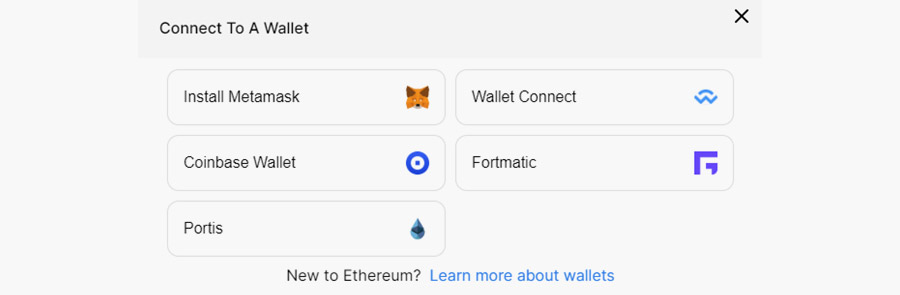

Multiple Supported Ethereum Wallets: You can connect an Ethereum wallet to Uniswap directly for easier swaps. Uniswap supports Metamask, Wallet Connect, Coinbase Wallet, Fortmatic, and Portis (obviously, however, you can send funds to any Ethereum wallet you like).

Efficient on Gas: Due to Uniswap’s minimalistic design, the protocol is very efficient on gas. Uniswap uses 10x less gas than Bancor for ETH to ERC-20 trades, for example, and transfers ERC-20 tokens more efficiently than 0x. Uniswap also has significant gas reductions compared to on-chain order book exchanges like EtherDelta and IDEX.

How Does Uniswap Work?

Uniswap is a set of smart contracts deployed to the Ethereum network, which means the entire trade process takes place on-chain. There is no token, no centralization, and no fees going to any of the founders.

Each smart contract is linked to a specific ETH-ERC-20 pair. There is one exchange contract per each ERC-20 token. If a token does not yet have an exchange, then anyone can create an exchange contract using the Uniswap factory contact. The factory works as a public registry and can be used to look up all token and exchange addresses added to the system.

The mechanics of Uniswap make it one of the most unique swap platforms available today.

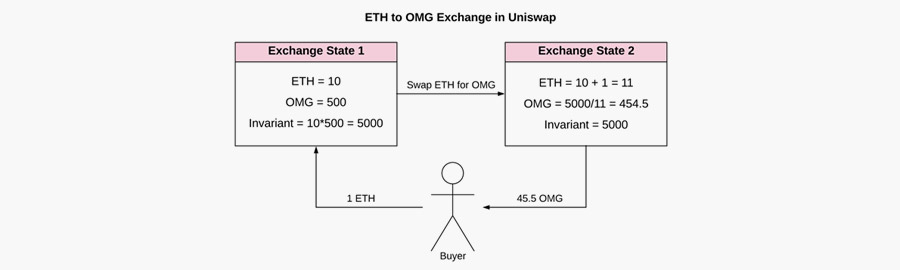

First, Uniswap removes the idea of a limit order book entirely. There’s no traditional “exchange” on Uniswap, and market makers don’t even specify a price when providing liquidity; instead, they simply supply the funds, then Uniswap takes care of the rest.

On a typical crypto exchange, market makers supply liquidity at certain price points. A market maker might have a buy order for ETH at a price of $100, for example, and a sell order for ETH at $200. The price of a cryptocurrency, like ETH, is quoted as the middle of the market between the highest bid and the lowest ask.

Uniswap throws that traditional limit order book concept out the window. It jumbles everyone’s orders together with no specific prices or limits. Everyone’s liquidity is pooled together, then the market is made based on a deterministic algorithm.

This deterministic algorithm is known as an automated market maker or AMM. It quotes prices to the end-user based on a pre-defined ruleset. You can find bots that act as AMMs – like bots that put bids and offers every $10 away from BTC’s mid-market price, with orders constantly revised as the market moves around.

Uniswap’s AMM is unique. It uses a variant called the development team calls the Constant Product Market Maker Model. This AMM is unique in that it always provides liquidity regardless of the order size or liquidity pool. How is that possible? Cyrus Younessi explains it best:

“The trick is to asymptotically increase the price of the coin as the desired quantity increases. While larger orders tend to suffer (as we’ll see in a moment), the system never has to worry about running out of liquidity. It will quite literally always work.”

How can Uniswap handle larger trades? Well, the premiums rise to make it prohibitively expensive for whales to transact large-sized orders.

Younessi goes into much further detail about how this protocol works for large and small orders (all the way to infinity). It gets complicated, but here’s how Younessi sums everything up:

“In a nutshell, the pooled liquidity smooths out the depth of the order book. There are no more large holes or large bid/ask spreads. This is preferable for small traders who don’t want to have to deal with limit order books (the Uniswap UX is one of the slickest we’ve seen in all of crypto). No more having to make bids or offers or doing heavy calculations. Liquidity providers can also “set it and forget it.” There’s significantly less overhead in terms of management of orders and positions. It’s an incredibly passive way to provide liquidity and earn some fees.”

It's all handled automatically via the Uniswap protocol.

Uniswap Pricing

Uniswap charges a flat fee of 0.30% per trade. This trade doesn’t go to the Uniswap developer or any centralized entity. Instead, it’s given to liquidity providers.

Specifically, the 0.3% fee is split by liquidity providers proportional to their contribution to liquidity reserves. If one liquidity provider is providing 50% of the liquidity pool for the ETH – AMPL smart contract, for example, then that liquidity provider will receive 50% of the transaction fees from swaps made using that smart contract.

How to Use Uniswap

You can use Uniswap to swap tokens. Or, you can add liquidity to earn a portion of all trading fees. Here’s how to do both.

Swapping Tokens Via Uniswap

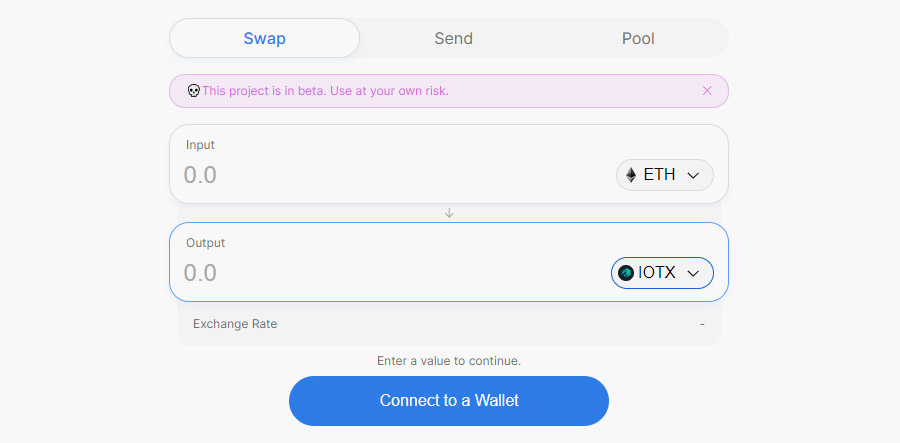

Step 1) Visit https://uniswap.exchange

Step 2) Select the type of cryptocurrency you wish to send (ETH or an ERC-20 token)

Step 3) Select the type of cryptocurrency you wish to receive

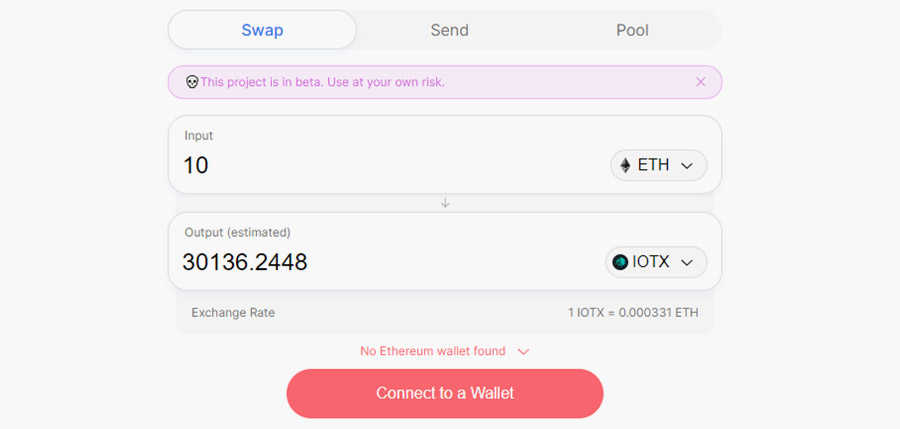

Step 4) Enter the amount you wish to send; you’ll see the corresponding amount appear in the output window, along with an exchange rate

Step 5) Check the exchange rate; it varies widely based on the size of the trade, and larger trades purposely have astronomical exchange rates to keep the protocol functional

Step 6) Click ‘Connect to a Wallet’, then add your Ethereum wallet (Uniswap supports MetaMask, Wallet Connect, Coinbase Wallet, Fortmatic, and Portis)

Step 7) Confirm the transaction within the browser and complete the swap

Adding Liquidity to Uniswap

Uniswap can be used for more than just ETH and ERC-20 trades. You can also add liquidity to Uniswap, then earn a portion of transaction fees.

You add liquidity to Uniswap by contributing equal values of ETH and an ERC-20 token. You cannot just add one or the other.

Here’s how to add liquidity to Uniswap:

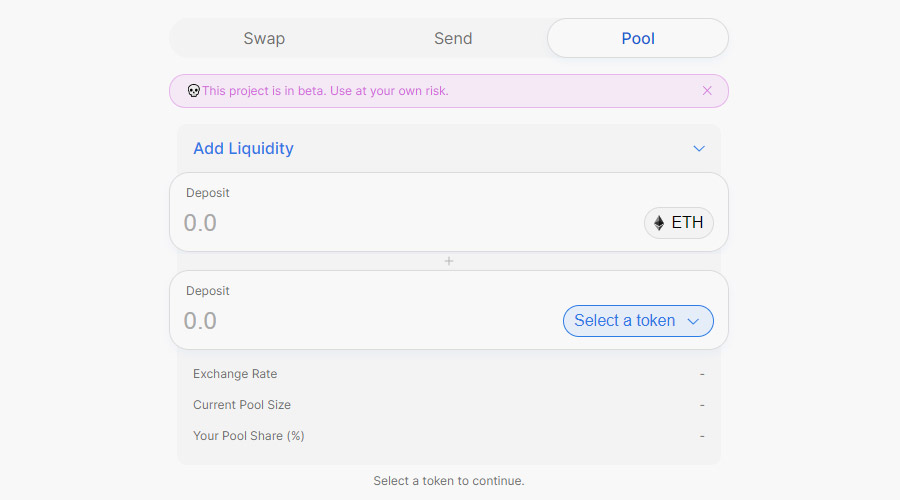

Step 1) Go to https://uniswap.exchange (make sure you’re logged in to MetaMask or another Web3 wallet)

Step 2) Click ‘Pool’ to go to the interface for adding liquidity

Step 3) Click ‘Add Liquidity’ on the left side, above the Deposit field

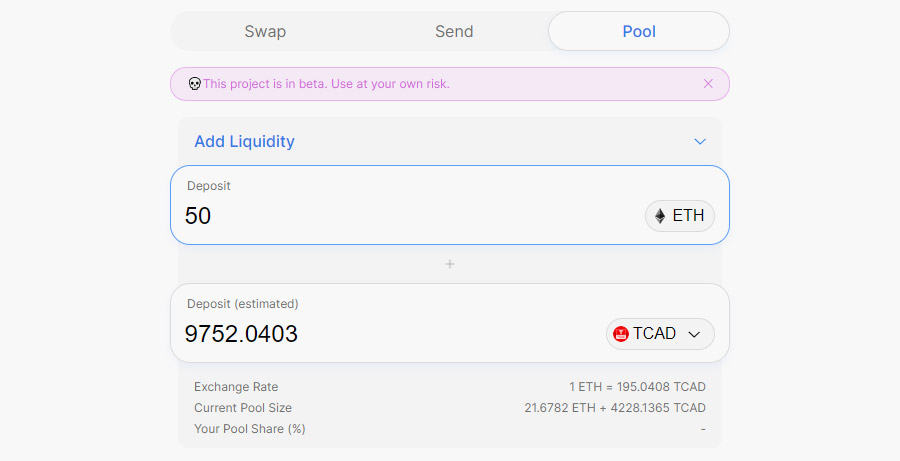

Step 4) Uniswap shows your connected wallet balances of ETH and the ERC-20 token you select in the bottom dropdown. You can also see the exchange rate and your share of the liquidity pool.

Step 5) When you enter a value for ETH or Dai, Uniswap automatically fills the correct amount of the other asset based on the current exchange rate (remember: you need to deposit equal amounts of both ETH and an ERC-20 token to add liquidity to Uniswap).

Step 6) Click ‘Transaction Details’ to see more info, including the number of liquidity tokens you’ll be minting and their value.

Step 7) Click the blue ‘Add Liquidity’ button. If using MetaMask, adjust the gas as you wish, then click ‘Confirm’ in the pop-up window.

Step 8) Once the transaction has been confirmed on the Ethereum blockchain, the process is complete. You have officially added liquidity to the Uniswap protocol. The interface shows your updated ETH and Dai balances and your share of the trading pair’s overall liquidity pool. You will continue earning a portion of the 0.3% fee on any trades between ETH and Dai until you remove your liquidity from the pool.

To remove liquidity from the pool, follow the same process up to step three, and then click the same dropdown but select ‘Remove Liquidity’.

About Uniswap

Uniswap was created by Ethereum developer Hayden Adams, who developed the project based on a Reddit post by Ethereum co-founder Vitalik Buterin.

Buterin and the Ethereum team were sufficiently impressed with Adam's proposal that they awarded Uniswap an Ethereum Foundation Grant.

The first version of Uniswap launched in November 2018. As of December 2019, Uniswap is still in beta.

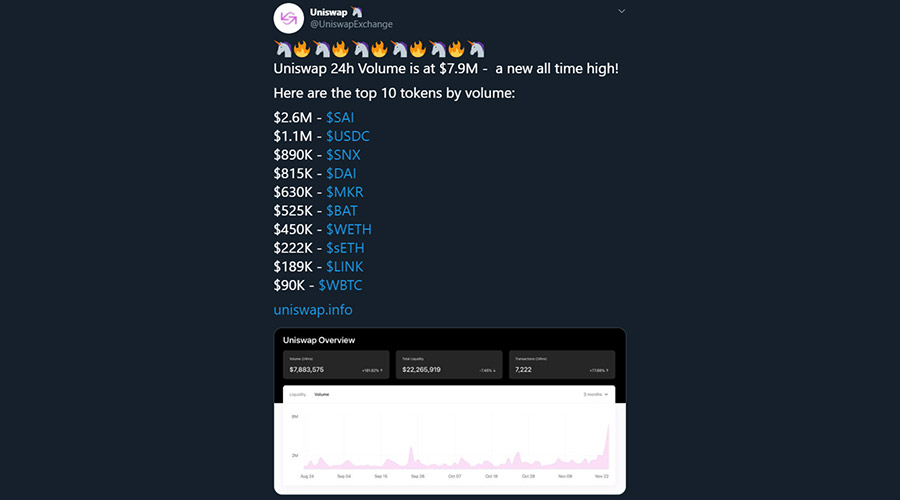

On November 22, Uniswap announced via Twitter that it hit 24-hour trading volume of $7.9 million, which is a new all-time high:

Final Word

Uniswap is one of the most unique exchange protocols available today. Built on the Ethereum blockchain, the exchange protocol allows you to swap ETH and ERC-20 tokens through automated smart contracts on the Ethereum blockchain. The protocol is open to anyone, and anyone can earn a portion of trading fees by providing liquidity to the Uniswap protocol.

To learn more or to make your first Uniswap trade today, visit https://uniswap.exchange

The post Uniswap Exchange: Master The Crypto User Review Guide appeared first on Master The Crypto.

OhNoCrypto

via https://www.ohnocrypto.com

Aziz, Master the Crypto Founder, Khareem Sudlow