The search terms that defined crypto in 2019

From growth areas to ideas that are falling out of favor, the following keywords represent some of the clearest cryptocurrency trends of 2019—as determined by Google search volume.

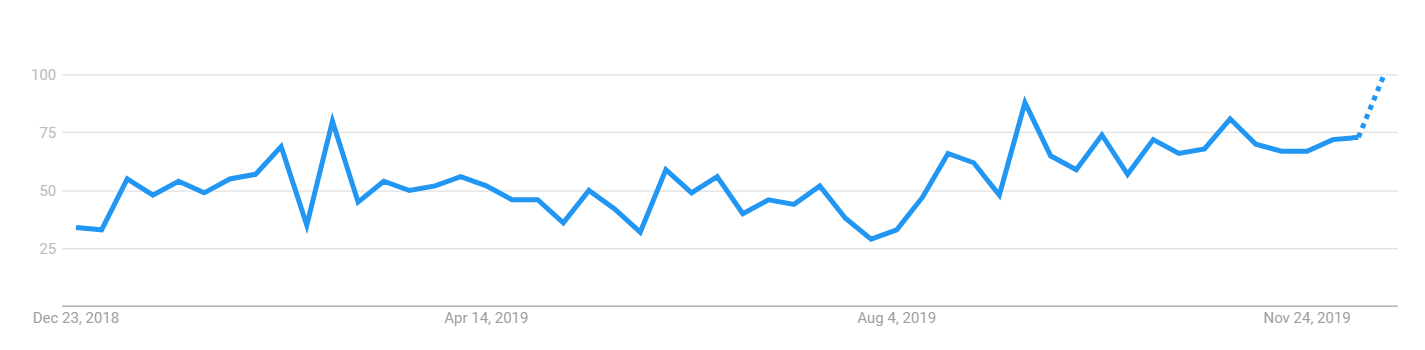

'CBDC'

Search volume for 'CBDC'—Central Bank Digital Currency—surged upwards during the second half of 2019.

The biggest development in this arena is China's digital yuan, which is set to be piloted in the cities of Shanghai and Shenzhen. This has catalyzed a flurry of development as central banks all around the world realize they are being left behind.

Speaking at her first news conference with the European Central Bank (ECB) in early December, Christine Lagarde summarised the situation with an urgent call for Europe to catch up, "We’d better be ahead of the curve," said Lagarde about digital currency, "because there is clearly demand out there that we have to respond to.”

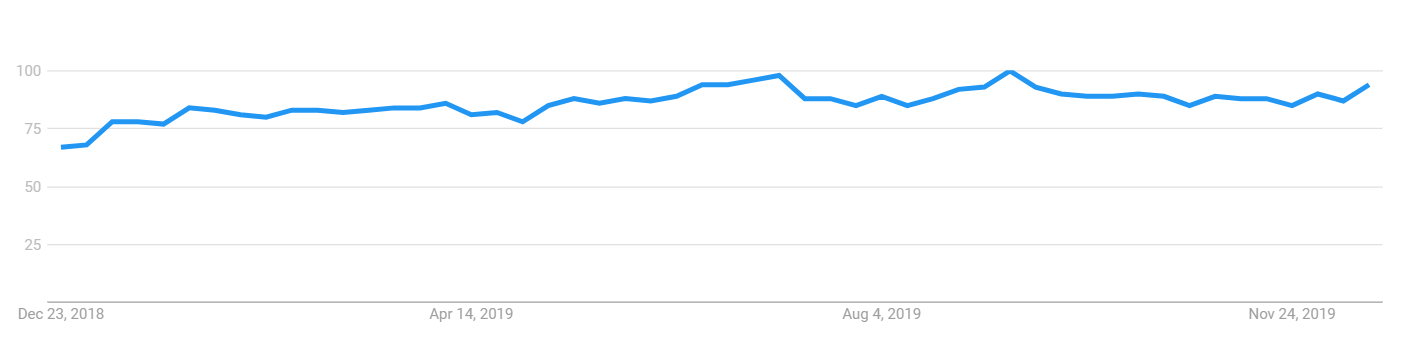

'Security token'

Google Trends shows the Security Token industry to be in the ascendancy. Search volume for the term has pushed up over the last five years, and this has continued in 2019 as several new platforms have launched.

Over the year, the SEC has also stepped up its “guidance by enforcement” actions against errant token projects, which Security Token Academy director Derek Schloss expects to continue in 2020. "Demand for digitized real-world assets continues to increase every month," said Schloss to Brave New Coin. "I expect to see efforts from legislators and regulators ramp up to create safe environments around security tokens in 2020."

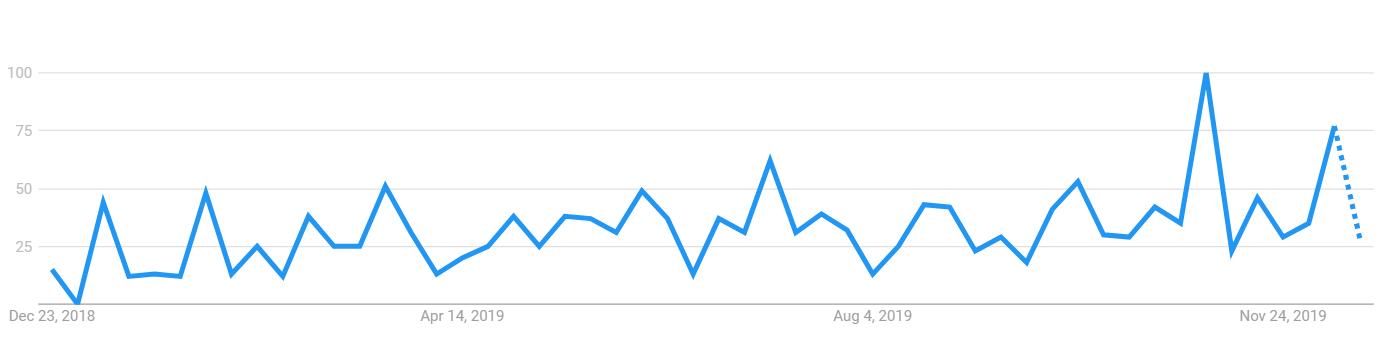

'Crypto staking'

Masternodes were the word on the crypto street in the 2017 bull market, with many altcoin fans hoping to collect enough coins to win passive income by staking with their own node.

Since then search volume for 'masternode' has dwindled, but the term 'crypto staking' has made a comeback in 2019.

This increased interest is likely spurred by proof-of-stake cryptocurrency Tezos, which has recently been supported by the likes of Binance, Coinbase Custody, and Ledger Live.

According to economist Alex Krüger, this could be just the beginning, and "2020 could be the year of staking" driven by Ethereum's transition to proof-of-stake.

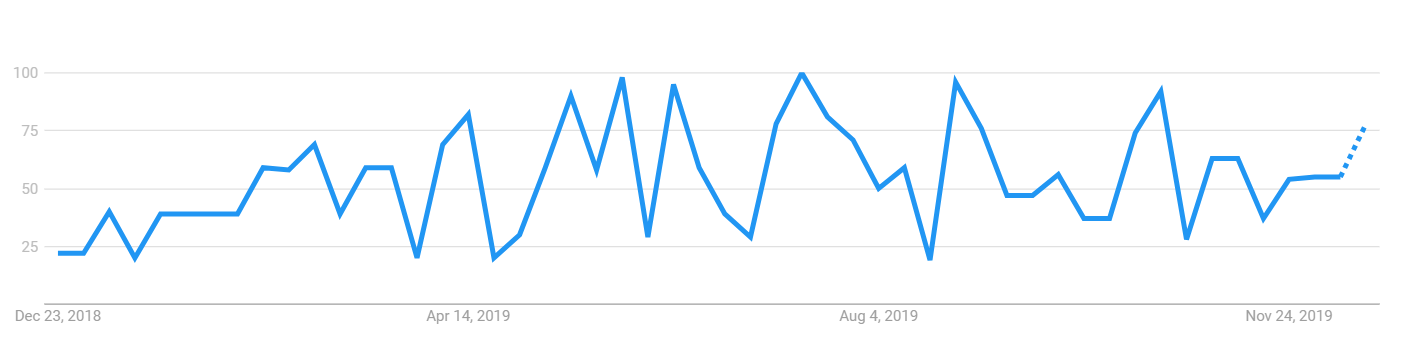

'Crypto lending'

The explosion of Decentralized Finance (DeFi) protocols has made crypto lending a massive growth industry in 2019. DeFi platforms, and their centralized equivalents, have begun to offer borrowers and lenders competitive rates.

This growing popularity is reflected in steadily rising search volume, and an increase in the

total collateral locked in DeFi applications from ~240m to ~680m, as measured by DeFi Pulse.

'Stablecoins'

The growth of lending dovetails with the development of another segment of the cryptocurrency industry: stablecoins.

Search volumes show interest in 'stablecoins' has continued to grow over the last 12 months, which is likely to be due to the growth of DeFi, and increased trading volume on exchanges particularly in USD-backed stablecoins like Tether, Coinbase’s USDCoin, and Gemini’s Gemini Dollar.

Stablecoins have also appeared on the radar of regulators, with authorities around the world voicing concerns about a possible threat to monetary stability.

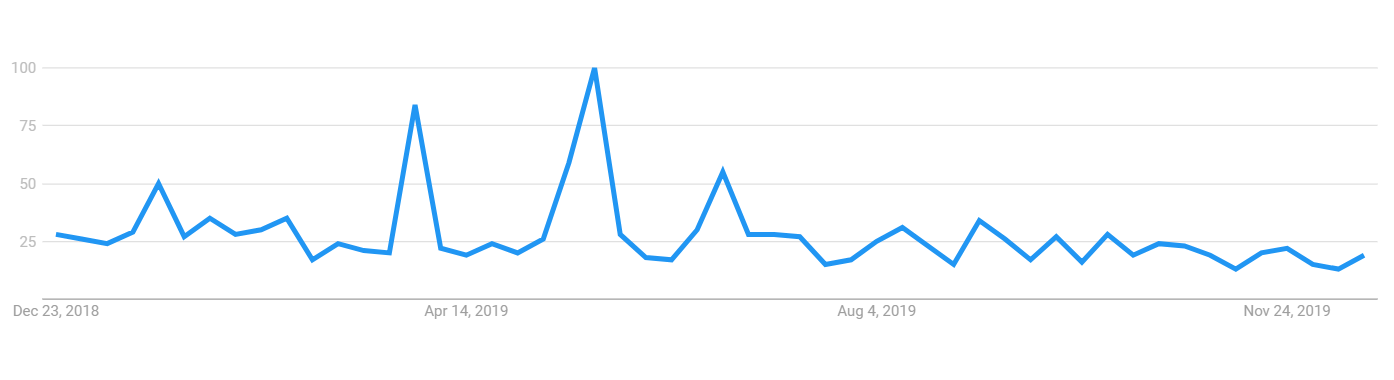

'Facebook Libra'

Search volumes for 'Facebook Libra', which once promised to be the biggest stablecoin of them all, have followed a different trajectory.

Interest in the project spiked when it was announced in June, and has since dropped as regulators stepped in and made clear that the basket-weighted stablecoin is unlikely to be rolled out as planned.

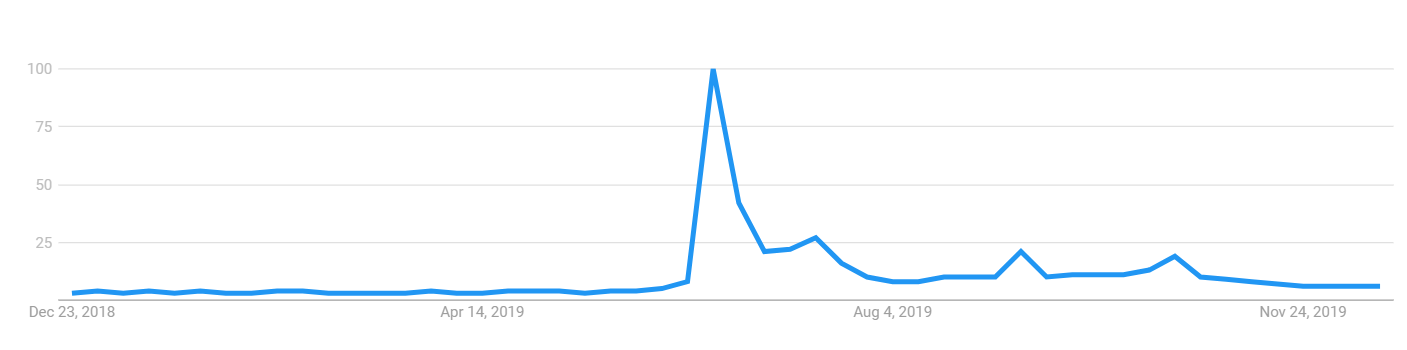

'Bakkt'

'Bakkt' search volume follows a similar trajectory to Libra, reflecting the underwhelming entry of another mainstream player into the cryptocurrency arena.

Interest reached a fever pitch at the launch of Bakkt's physically-delivered bitcoin futures product in September. Then, as it became evident that volumes on the platform were relatively low, interest has ebbed away.

The lacklustre launch was a big disappointment for many, especially those who expected that Bakkt might have a similar bullish effect on the market as the long-awaited Bitcoin ETF, which also failed to materialize in 2019.

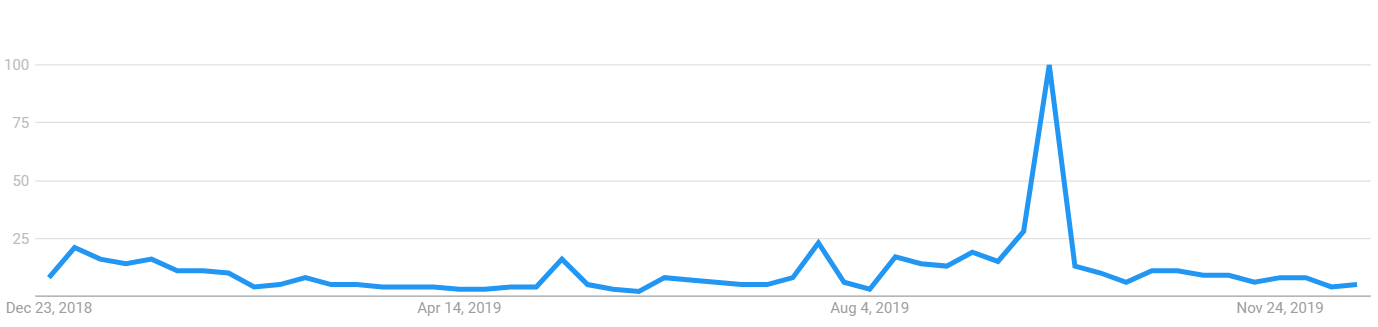

'Bitcoin ETF'

Despite the efforts of Bitwise and others, the Bitcoin ETF has hit repeated snags, with approval now looking more distant than ever.

Search interest for 'Bitcoin ETF' peaked in April, when rumors of an approval were said to have been picked up by trading algorithms, catalyzing a sudden rally to $5,000. Then in May, interest peaked again when the SEC delayed its decision on the VanEck/SolidX Filing.

Since then, search volumes have been declining as the Bitcoin ETF has fallen away from the public eye.

OhNoCrypto

via https://www.ohnocrypto.com

Kieran Smith, Khareem Sudlow