Stellar Price Analysis - Network inflation removed and 55 billion tokens burned

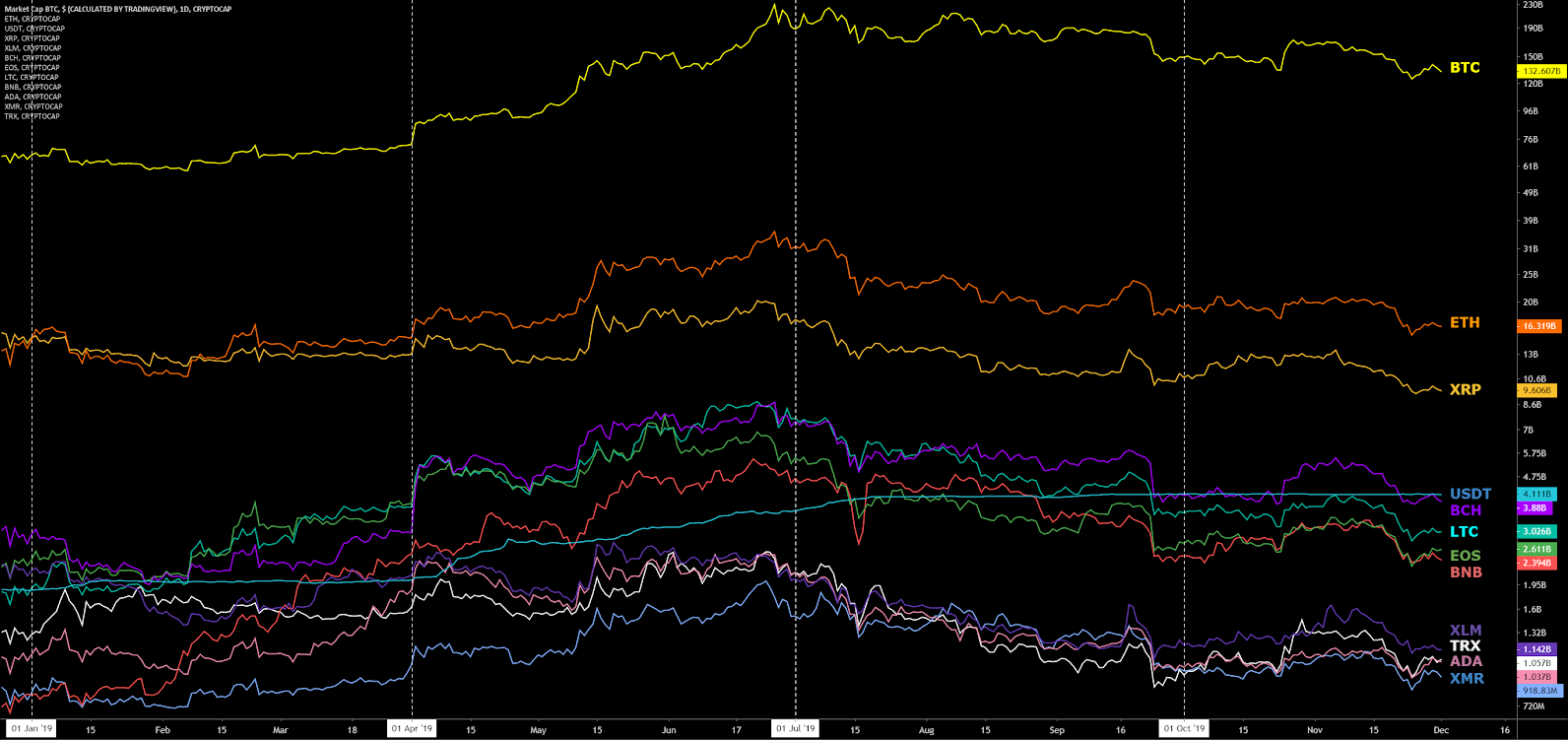

Stellar (XLM) is a payment protocol that aims to connect banks, payment systems, and people. The current spot price is down 94% from the all-time high of US$0.72, set in January 2018. The market cap currently stands at US$1.16 billion on a 20.2 billion XLM circulating supply, with US$142 million in exchange-traded volume over the past 24 hours.

Now ranked 10th on the BraveNewCoin market cap table, XLM pulled ahead of Tron (TRX), Cardano (ADA), and Monero (XMR) in mid-September, after being intertwined and highly correlated since April.

Stellar and the Stellar Development Foundation (SDF) were created by Jed McCaleb and Joyce Kim in 2014. The project is analogous to Ripple (XRP) in many ways, where McCaleb previously worked. The SDF was created to promote global financial access, literacy, and inclusion by expanding worldwide access to low-cost financial services, through the development and maintenance of technology and partnerships.

The SDF leadership includes CEO Denelle Dixon and founder Jed McCaleb. The board of directors includes Stellar’s chief scientist, David Mazières, Keith Rabois, Shivani Siroya, and Greg Brockman. The SDF was incorporated in 2014 as a non-stock nonprofit corporation in the U.S. State of Delaware but is not currently an independently operated 501(c)(3), or non-profit. The SDF last applied for this distinction in 2015 but has not obtained tax-exempt status.

XLM originally used the Federated Byzantine Agreement (FBA) for consensus, which was pioneered by XRP. Mazières later switched the network to the Stellar Consensus Protocol (SCP), in 2016, after the chain was unable to maintain reliable consensus.

Neither XRP nor XLM uses Proof of Work or Proof of Stake, but instead use validators to confirm transactions on the network. Validators do not receive a block reward. Anyone in the XLM network can be a validator, so the user must decide which validators to trust. Ideally, each trust group, or quorum slice, has overlapping transactions with other groups, and thus can collectively achieve consensus.

SCP quorum intersections ensure that each quorum slice is always linked by one node with consensus agreement, based on a large pool of individuals or validators. There have been 144 public nodes and 80 validators active on the network over the past two days, with most of these nodes residing in the United States and Germany.

In April, a team of South Korean researchers released an analysis of the SCP consensus algorithm and nodes on the network. Their findings revealed that all of the nodes are unable to run SCP if only two nodes fail, leading to a security risk. These critical nodes are controlled by the SDF. A response from Mazières confirmed that the centralization of validators is currently a weakness in the ecosystem. “Downtime does happen, so what if a set of important nodes goes down and the network halts?,” Mazières questions.

On May 15th, the network stalled for 67 minutes due to an inability to reach consensus. As opposed to most other chains, which can temporarily fork when consensus is not reached, the network halts completely. The SDF nodes were not the reason for the network failure. The reason for the halt was revealed in a Stellar developers blog post, “Stellar has added many new nodes recently. In retrospect, some new nodes took on too much consensus responsibility too soon.”

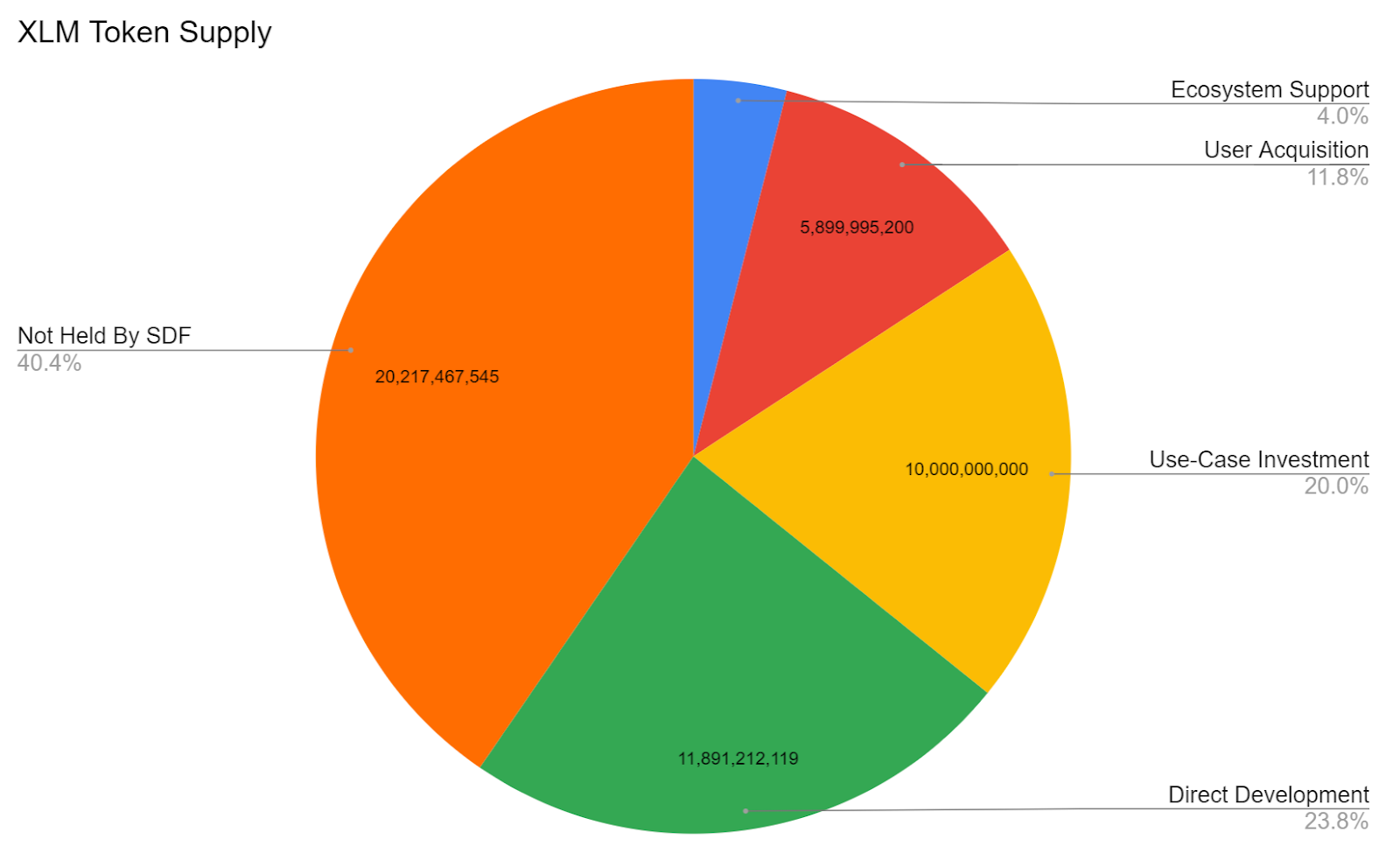

The XLM genesis block minted 100 billion tokens with a 1% per year initial supply growth rate. The coins created to satisfy this yearly inflation rate were distributed through an inflation pool, including network transaction fees. In late September, the SDF released a proposal to remove inflation rewards completely. The SDF believed that the inflation mechanism did not benefit projects building on the platform and will lead to scalability problems in the future. This change was approved by validators and took effect in early November.

Additionally, in early November, the SDF decided to burn 55 billion lumens, previously earmarked for future operations costs, partnerships, and giveaways. SDF CEO Denelle Dixon told attendees at the Stellar Meridian conference, “as much as we wanted to use the lumens that we held, it was very hard to get them into the market.” The SDF continues to hold a remaining 29.78 billion XLM.

In late 2018, the SDF announced an up-to-500 million XLM distribution, or airdrop, through Blockchain.com, which added wallet support for the asset. The airdrop is ongoing and is touted as encouraging first-time crypto users, and the crypto-curious. Each user can receive US$25 in XLM, after KYC verification in the form of an email address and identity documentation.

In March 2019, the SDF partnered with Coinbase to giveaway a further one billion tokens, through a learning exercise and referrals. In September, the Stellar SDF also announced a two billion coin airdrop to Keybase users.

The SDF also partnered with Wirex, a fiat (GBP, USD, and EUR) and crypto Visa card processor. Users can earn 0.5% back in BTC after each use of the Wirex Visa card. The partnership allows users to buy, store, exchange, and spend XLM on the Wirex platform. In November, XLM was also added to the Coinbase card, a similar debit Visa card.

Earlier this year, IBM announced the launch of World Wire, which is a payment system built on the Stellar network. Six international banks have signed letters of intent, indicating that they will either use the XLM token or issue stable coins on IBM’s service, pending regulatory review. IBM also has several validators on the Stellar chain.

The wider ecosystem includes Interstellar, which allows enterprises and institutions to use, and build on, the network. Interstellar combines the Chain and Lightyear brands. Chain’s products included Sequence and Chain Core. Sequence was a cloud-based ledger service for managing balances in financial and commerce applications like wallet apps, lending platforms, marketplaces, and exchanges. Chain Core was designed to operate and participate in permissioned blockchain networks.

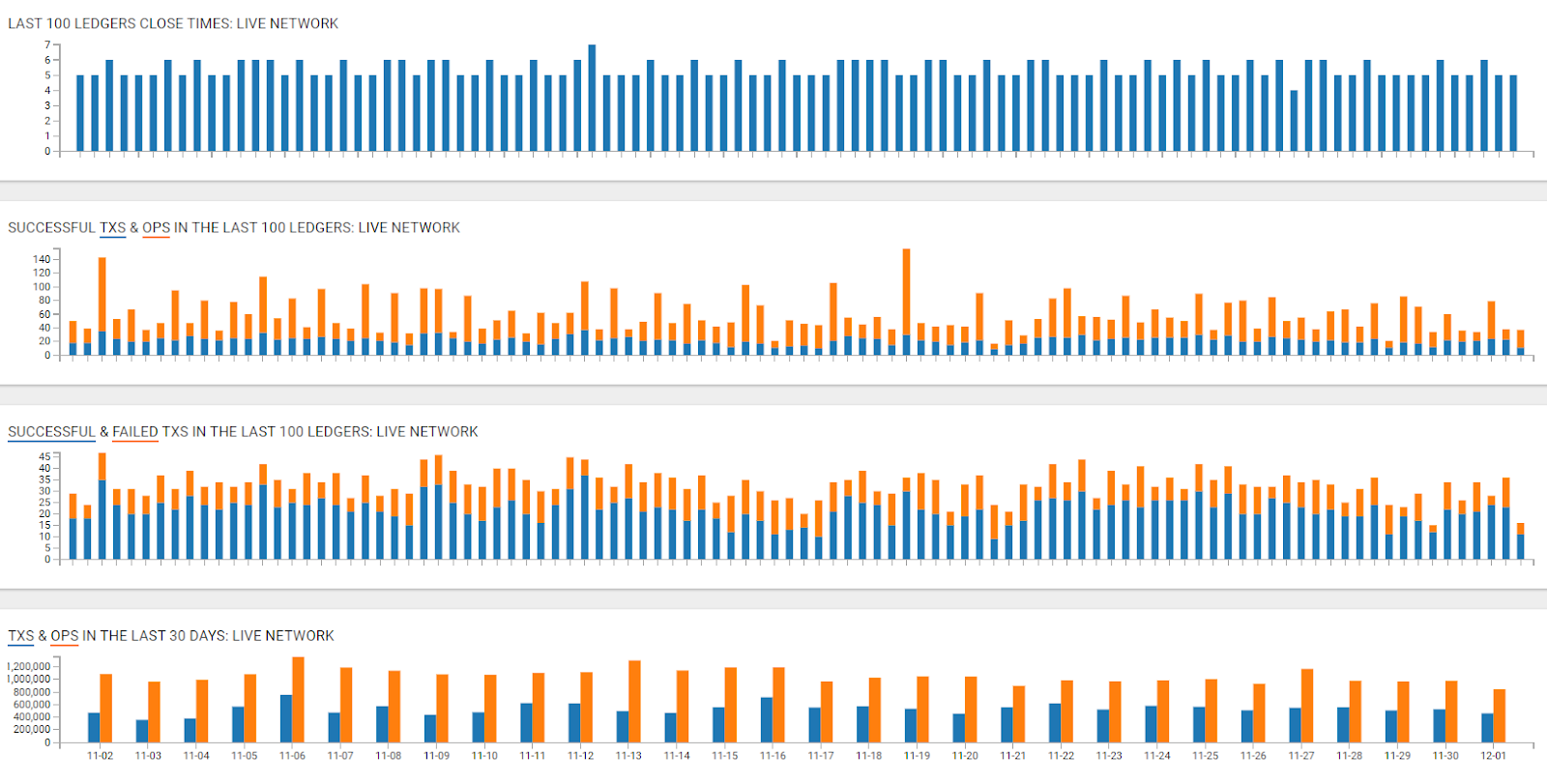

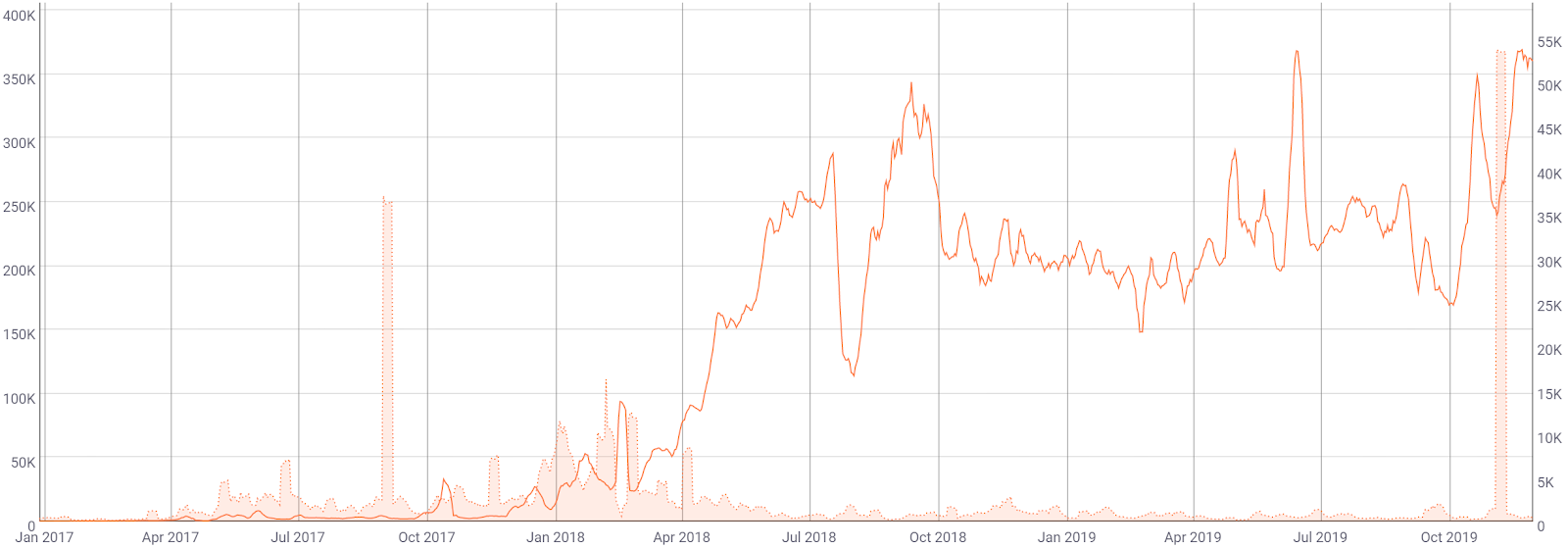

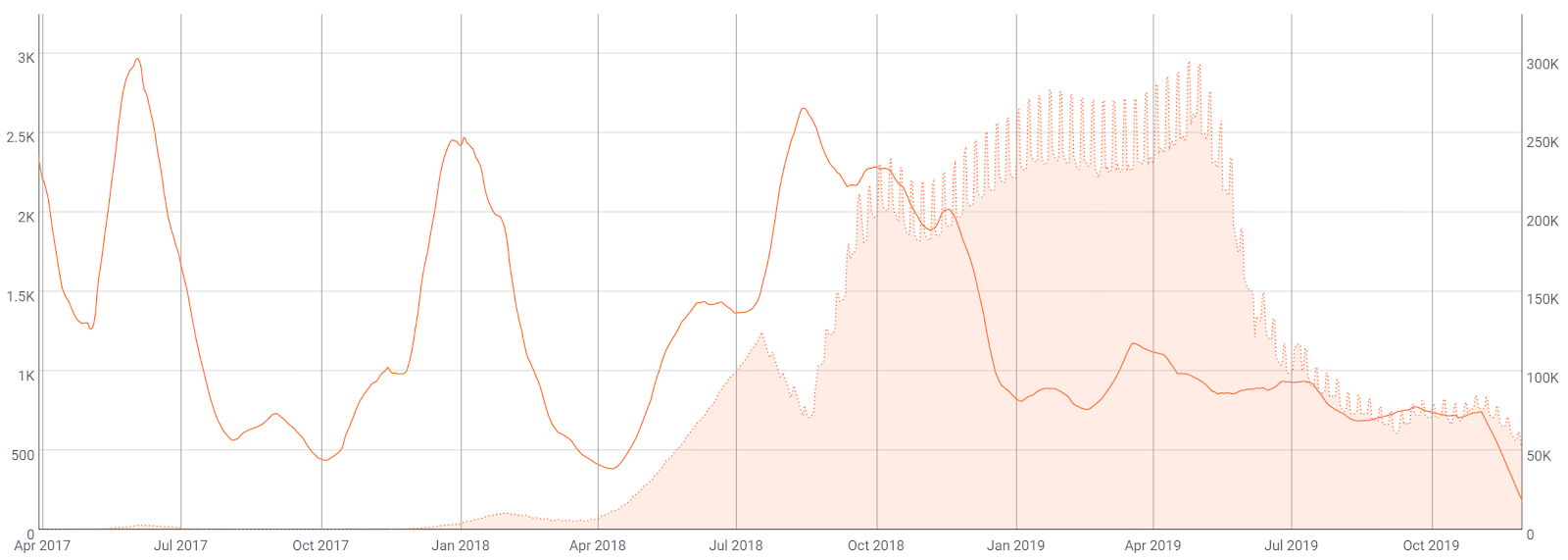

The network uses a default transaction fee of 0.00001 XLM to prevent spam or Denial of Service attacks. In USD terms, XLM average transaction fees rose substantially from February to May but have since returned to the previous range (orange line, chart below). Average transaction fees on the chain are much lower than most other chains, including XRP (black line, chart below).

The current number of transactions per day on the network (line, chart below) stands at 360,000, and has essentially ranged between 100,000 to 300,000 since April 2018. The record high in transactions per day stands at nearly 533,000, occurring in September 2018. Overall, transactions per day have increased substantially since October.

The average transaction value (fill, chart below) is currently US$79, which is down from a July 2017 high of US$3,000. Average transaction values have fluctuated around US$500 since June 2018. Nearly feeless on-chain transactions often encourage lower average transaction values due to a higher number of smaller sized transactions.

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has fallen significantly since August 2018 and is currently 179. Historically, an NVT below 500 for the Stellar network signified bull market conditions. The current all-time low in NVT may be related to the recent 55 billion XLM coin transaction and burn, not necessarily organic market activity.

A clear downtrend in NVT suggests a coin is undervalued based on its economic activity and utility, which should be seen as a bullish price indicator. Inflection points in NVT can also be leading indicators of a reversal in asset value.

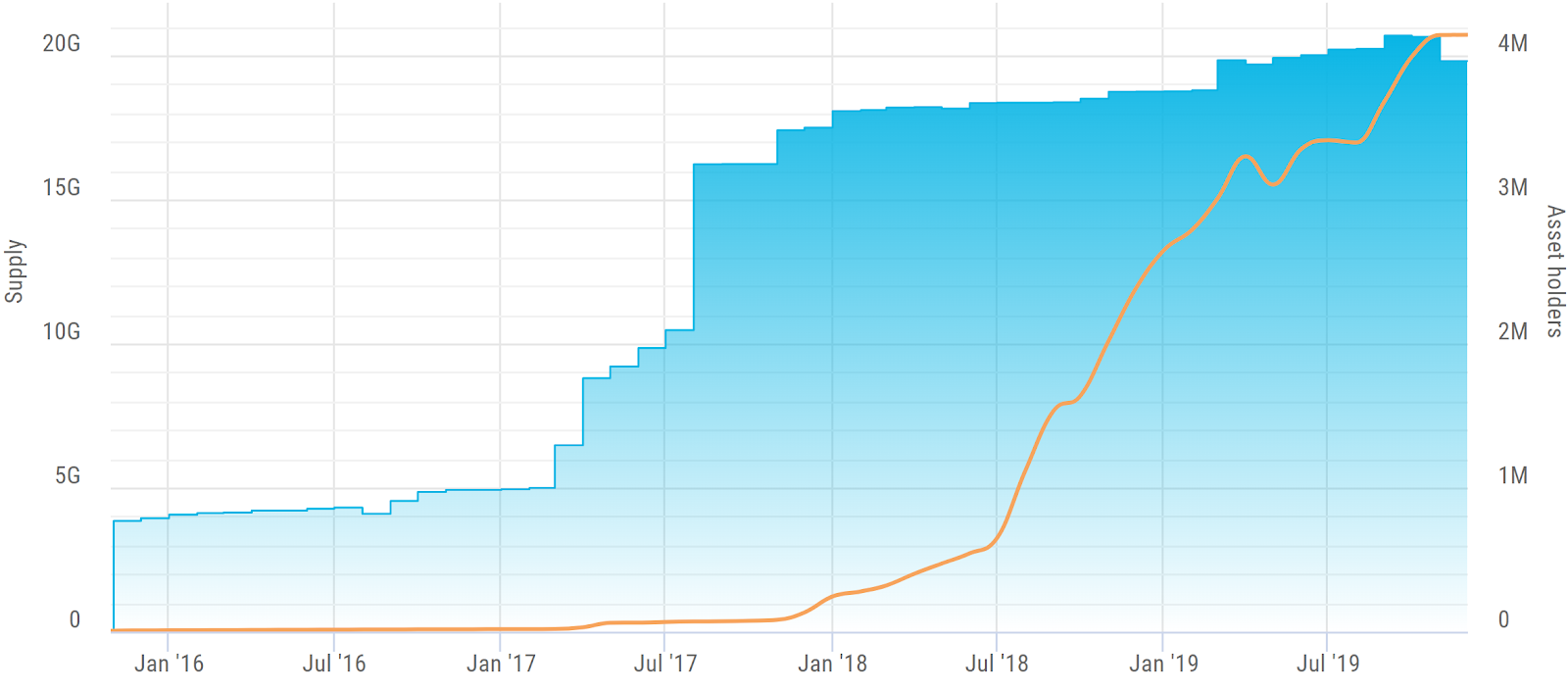

The number of monthly active addresses (fill, chart below) increased from October 2017 to April 2019, but have continued to fall over the past few months, and are currently around 55,000. Active addresses had spiked once a week due to the release of inflation rewards. Active and unique addresses are important to consider when determining the fundamental value of the network based on Metcalfe's law.

Turning to developer activity, the Stellar project has 60 repos on Github. In total, over 300 developers have contributed to the project, with 700 commits on the main repo in the past year (shown below). Stellar Horizon v0.23 and Stellar Core v12.2 were both released in late November.

Most coins use the developer community of GitHub where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

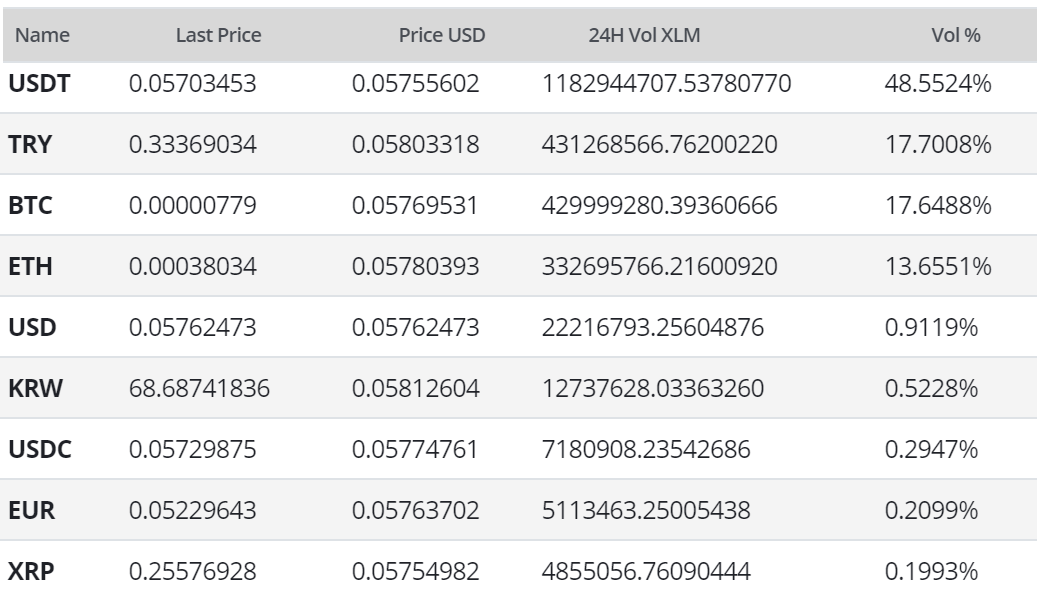

Exchange volume over the past 24 hours has predominantly been led by Tether (USDT), Turkish lira (TRY), and Bitcoin (BTC) markets. XLM had several exchange-related announcements last year, including OKCoin listing XLM based USD, BTC, and ETH trading pairs. The asset was also added to the Circle Invest, BitGo, and Coinbase platforms.

In June, Poloniex enabled weekly inflation rewards for fully-verified users. In August, eToroX added several XLM based trading pairs, including USDEX, GBPX, JPYX, EURX, BTC, ETH. Binance also added BTC and USDT margin trading pairs. Binance.US also added USD and USDT pairs at the end of September.

Stellar has also released StellarX, a peer-to-peer, third-party client built on top of Stellar’s open marketplace. StellarX is not the custodian of any assets, but the client is also not a DEX, and there are no fees. The platform includes a fiat on-ramp through ACH transactions from a U.S. bank account.

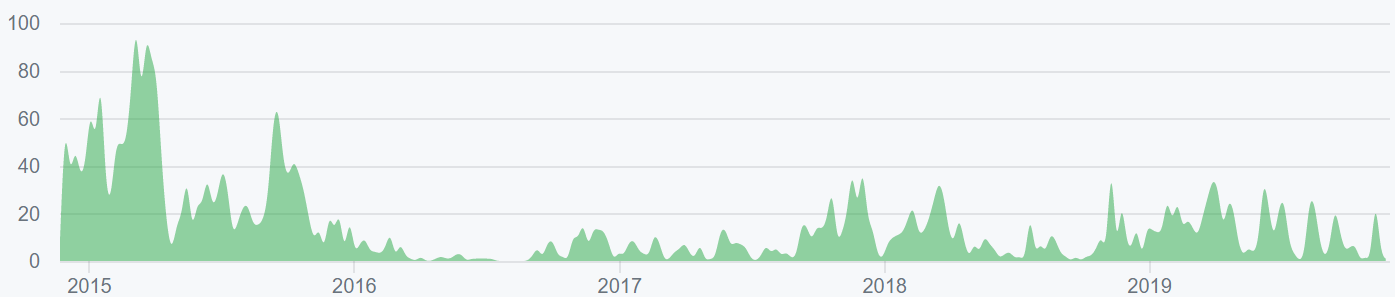

Grassroots interest in the XLM project includes nearly 8,600 members in 27 Stellar groups on meetup.com. Worldwide Google Trends data for the term "Stellar" has remained low throughout most of 2018 and early 2019, with the exception of a small uptick in mid-May. There has also been small rises recently, likely related to several airdrop announcements and the 55 billion XLM token burn.

A slow rise in searches for "Stellar" preceded the bull run in Q4 2017, likely signaling a large swath of new market participants at that time. A 2015 study found a strong correlation between the google trends data and BTC price whereas a 2017 study concluded that when the U.S. Google "Bitcoin" searches increased dramatically, BTC price dropped.

Technical Analysis

Despite several bullish consolidation attempts since 2018, XLM has been unable to find bullish strength or develop a bullish trend. The strength of any potential trend reversal can be mapped using Exponential Moving Averages, Volume Profile of the Visible Range, and Ichimoku Cloud. Further background information on the technical indicators discussed below can be found here.

On the daily chart for the XLM/USD pair, the 50-day Exponential Moving Averages (EMA) and the 200-day EMA have been bearishly crossed for 526 days. The spot price has mostly remained below the 200-day EMA since the Death Cross in June 2018.

Over the next few months, if a bullish 50-day EMA and 200-day EMA cross occurs, bullish momentum will likely increase significantly. Volume resistance sits at US$0.1337 with a potential upside target of US$0.20-US$0.23. If the current local lows break, volume support sits around US$0.037. There are no active volume or RSI divergences currently to suggest an end to the bearish trend.

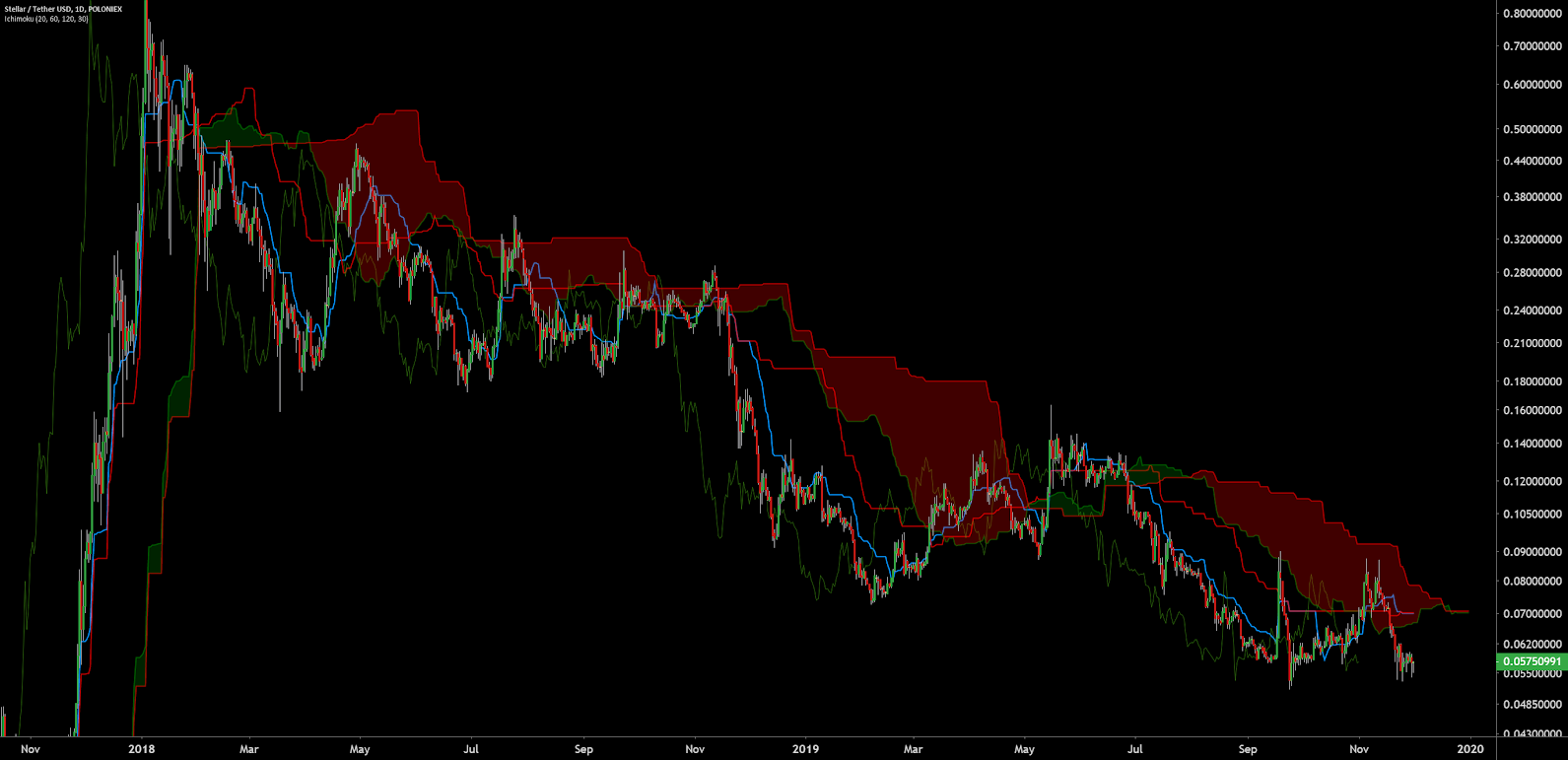

Turning to the Ichimoku Cloud, there are four key metrics; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. Trades are typically opened when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are bearish: the current spot price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and above the spot price. The most prudent long entry will take place once the spot price is above the Cloud with a bullish TK cross, otherwise, the trend will likely remain bearish.

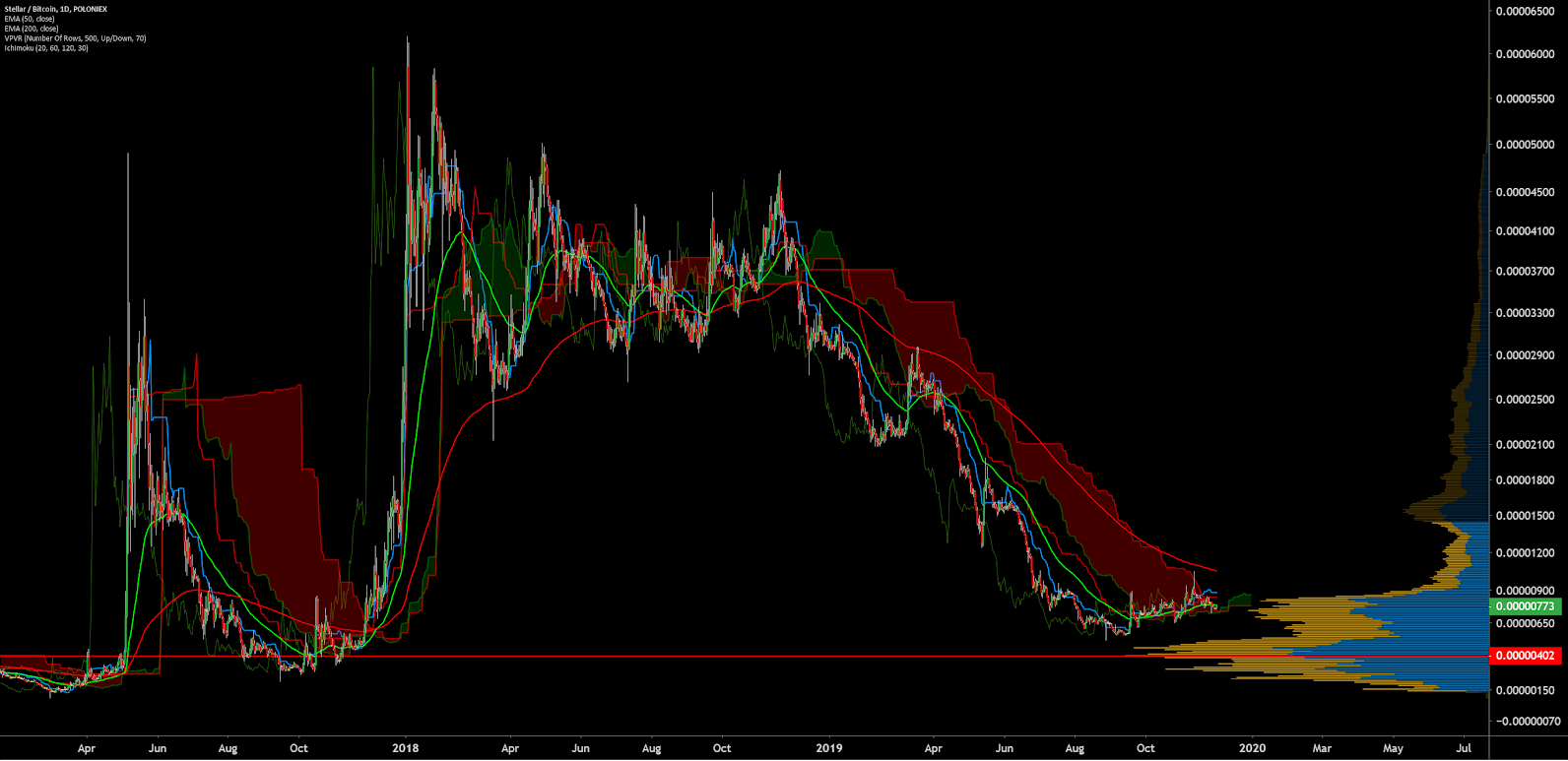

Lastly, the daily chart for the XLM/BTC pair is beginning to show signs of waning bearish momentum as the spot price has broken above the 50-day EMA and into the Cloud. A mean reversion attempt to the 200-day EMA would bring the market to the 1,050 sat zone. VPVR resistance also sits at the 1,600 sat zone. Similar to November 2017, the market may wait to fully break out into a bullish rally once the spot price has cleared Cloud resistance. Cloud metrics should begin to flip bullish by year’s end, as long as the pair does not make a lower low.

Conclusion

Despite Blockchain.com, Coinbase, and Keybase airdrops over the past year, active addresses have continued to decline. In a likely bid to increase XLM’s potential store of value, the SDF axed 55% of the total token supply as well as successfully campaigned for the removal of inflation on the network.

Transactions per day have increased dramatically over the past two months, and are now nearing an all-time high, as average transaction values remain less than US$100. Based on the growing number of partnerships, the network aims to directly compete with XRP in the payments and remittance realm, and ETH in the ICO and STO realm.

Technicals for the XLM/USD pair reveal bearish trend metrics, with the current spot price below both the 200-day EMA and daily Cloud. If a Golden Cross does occur within the next few months, coupled with price action above the daily Cloud, sustained bullish momentum may break the current resistance at US$0.1337. Otherwise, lower lows are very likely to bring price towards the US$0.037 zone

Technicals for the XLM/BTC pair have tilted from strictly bearish to neutral over the past few weeks. The spot price for this pair has broken above the 50-day EMA and into the daily Cloud, with bullish targets around 1,050 sats in the near term. Going forward, strong bullish momentum becomes more probable once the spot price is above the Cloud, as was the case in November 2017.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow