Crypto Market Forecast: 30th December

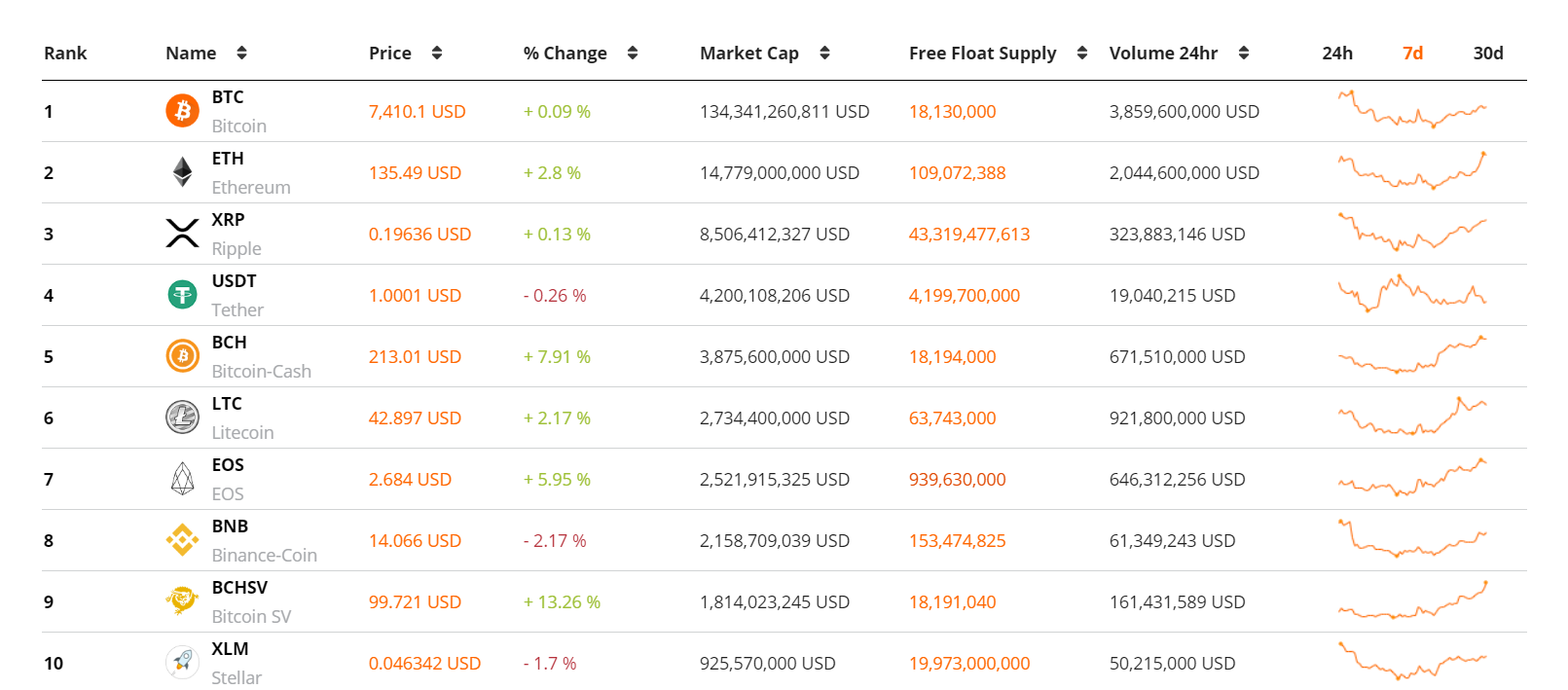

A quiet week in crypto markets closed out what has been an up and down year for digital assets, with most major assets only moving by few percentage points by week’s end. Number one crypto Bitcoin, fell ~0.5%, while ETH and XRP rose ~2% and fell ~0.5% respectively and the overall crypto market cap rose ~1%.

In the last week Ethereum confirmed that the network will go through with the scheduled Muir Glacier upgrade on January 1st 2020. The upgrade is designed to delay Ethereum’s difficulty bomband changes how the blockchain currently executes Proof-of-Work difficulty adjustments to ensure block times are not affected.

The mandatory upgrade is a smaller, temporary fix to the existing difficult bomb problem and is happening soon after the larger Istanbul hard fork that was implemented in early December. Work on Ethereum continues to progress rapidly with Serenity phase 0 set to launch midyear. There is also a possibility of an upcoming miner block reward reduction. A recent community poll on reddit suggested Ethereum stakeholders are eager to drop the block reward from two ETH to one. This may effect Ethereum in a similar way to Bitcoin’s upcoming block reward halving - increasing the scarcity of tokens by tightening their flow and theoretically increasing the value of already issued ETH.

Also last week, video platform giant YouTube removed much cryptocurrency related content for apparently containing connections to “harmful or dangerous content” and promoting the “sale of regulated goods”.

YouTube has since said the purge was a “error” and the videos would likely be reinstated, nonetheless a number of crypto content creators are already planning to make the shift to decentralized video streaming alternatives.

This week in crypto

30th December - First trading date CME BTCM20 and BTCZ21 contracts (Yearly and six month BTC futures contracts).

Two major long term CME contracts will begin trading on Monday. The daily volumes of CME futures has been as high as US$300 million in recent months and there has been market speculation about the effect institutional CME traders have Bitcoin prices. If CME traders expect a price bounce on Monday following a period of quiet price movements and markets being wound up, this may exaggerate price movements as leveraged longs are bought when markets open. Vice versa if traders detect bearish pressure.

Present-7th January - Zero trading fees on Poloniex

The recent trend of major crypto exchanges competitively dropping fees continues with Poloniex now offering no trading fees until the start of 2020. Post the 7th of January 2020, the exchange will operate a new tiered incentive fee program where users receive discounts for having higher 30 day volumes. Traders will also pay cheaper fees if the fees are paid using Tronix (TRX). Poloniex was recently purchased by a group of Asian investors that included Tron CEO Justin Sun.

While the price of BTC stagnated last week, a number of altcoins enjoyed healthy green gains. EOS rose 6% following a proposed upgrade that would change resource allocation on EOS from a buyer model to a rental model. Outside the top 10, Ethereum Classic (ETC) rose 12% in anticipation of the upcoming Athena upgrade which will make its parent blockchain backwards compatible with Ethereum.

Bitcoin markets have been tepid in the last few weeks but there appears to be support around the US$7100 level and signs that the market is in a phase of bullish re-accumulation.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow