Crypto market forecast: 23rd December

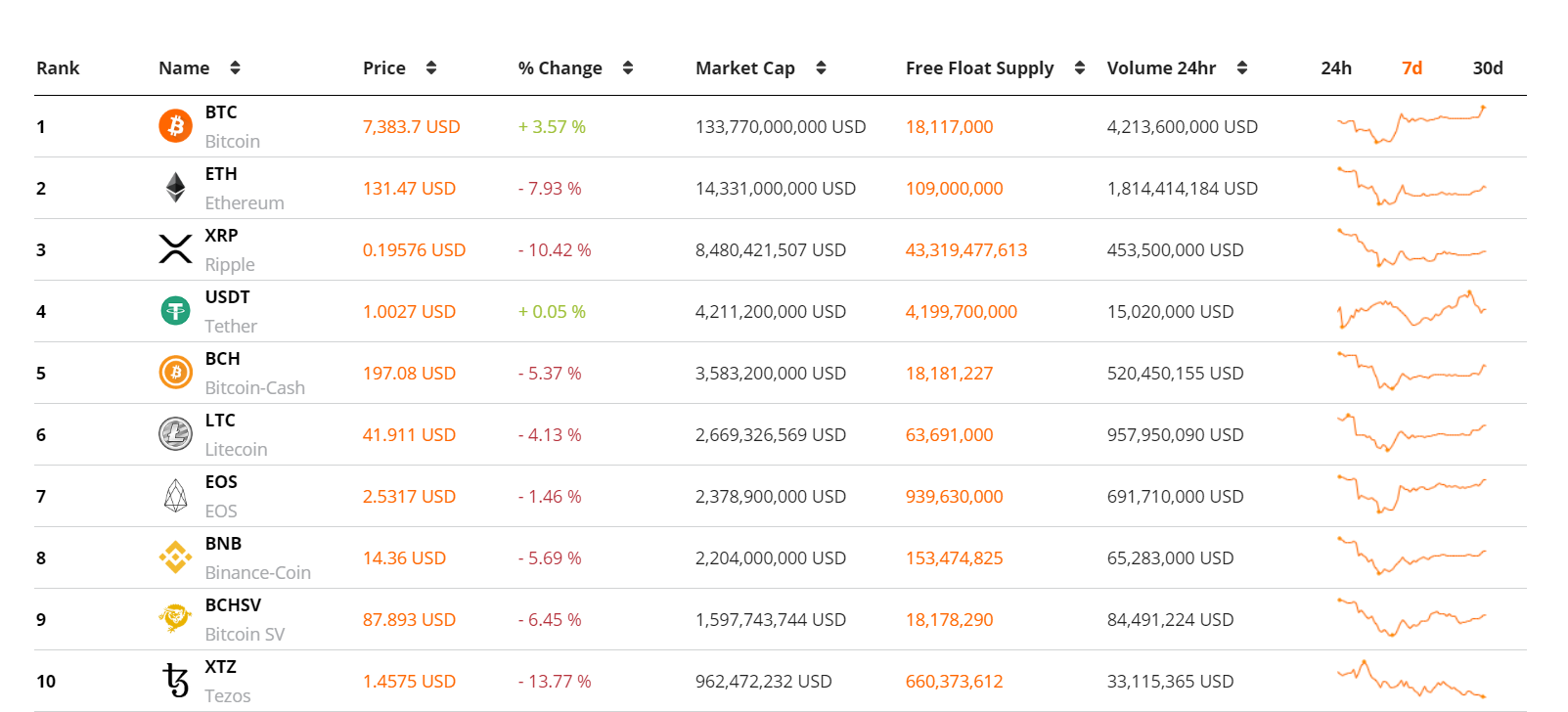

It was a mixed trading week in the crypto markets with benchmark asset Bitcoin rising steadily while the altcoin market remained flat. The price of BTC rose ~4%, while the number two and three crypto assets, ETH and XRP, fell 4% and 7% respectively.

Some technical traders have suggested that Bitcoin’s current positive price activity is reminiscent of the previous pattern in Q3 2019. The pattern is a series of upward head fakes, short sharp price positive moves that are erased quickly by an immediate move in the opposite direction that retraces the short term gains. If the pattern continues then this week’s BTC gains can be considered a false bullish flag for continued price gains.

In wider market news, Riccardo Spagni, a key figure within the Monero privacy-focused cryptocurrency project, stepped down from his position as head maintainer of the network. Spagni, also known by his handle ‘fluffypony’, will hand the reins to an anonymous developer ‘snipa’. Spagni will continue to be a backup maintainer and will have a less prominent role after having held the head maintainer position for the last five years.

Spagni has helped to develop key Monero mining pool software and been a key promoter of the project over the last five years. The price of native token XMR, fell by 7% last week, as the wider altcoin market continued to drop.

Also last week, the parent company of the number three crypto asset on Brave New Coin’s market cap table, XRP, announced the completion of a sizable US$200 million series C funding round. Post the round, Ripple’s valuation is now US$10 billion making the remittance and banking service provider one of the largest blockchain companies in the world. The fund was led by global investment firm Tetragon, and included investments from Japanese mega-conglomerate SBI and Route 66 ventures.

This week in crypto events

30th December- CME BCTZ19 settlement date

This Friday the latest round of CME 6 month Bitcoin futures contracts ends. The nature of futures contracts means they need to be settled on a set date, based on a contract. All CME contracts will have to be traded, or settled, before this date. There is generally a fall in the trading volume of futures around settlement. This may coincide with a rise in volatility and the potential for short/long squeezing.

23-30th December- 7 million BitTorrent token giveaway

Over the next 7 days, the Justin Sun backed BitTorrent blockchain file storage company will give away ~USD 200,000 worth of digital tokens to network users. Every day of the giveaway, 10 random BTT accounts will be gifted 50,000 tokens. The promotional event may trigger buying pressure for the tokens as users create new accounts seeking to be a winner of the giveaway. The price of BTT fell ~5% last week.

Apart from BTC, large-cap assets traded red and bearish last week. Across altcoin markets, low volumes continue to create liquidity concerns around trading many of these assets. Just outside of the top 10 Huobi-Token and Tronix (TRX) both traded green last week finding some bullish support and now both hover just outside the Market cap top 10.

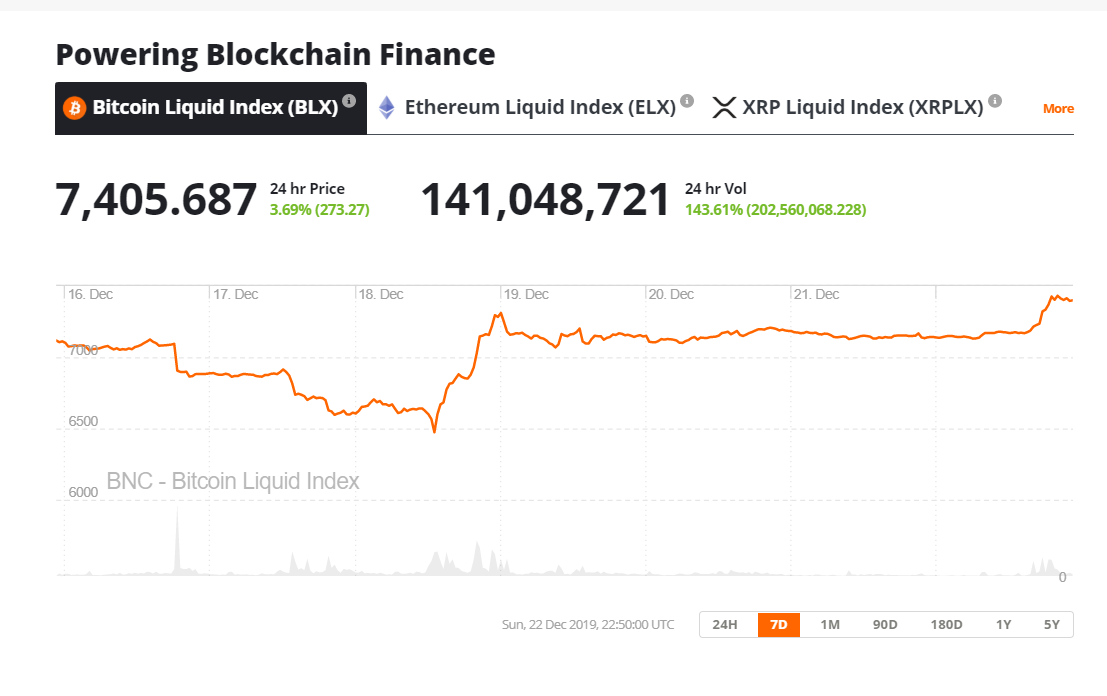

The price of Bitcoin rose sharply on the 18th of December as soon as BTC’s US dollar price touched the US$6,000 price level. This suggests that US$6,000 price is currently a strong support level. BTC also had a strong Sunday leading to a bullish close to the week. This may fuel momentum for further gains as the coming week progresses.

OhNoCrypto

via https://www.ohnocrypto.com

, Khareem Sudlow