Bitcoin’s real supply lower than believed says Coinmetrics

A new report by Coinmetrics suggests that the actual circulating supply of Bitcoin is much lower than the 18 million mined coins milestone that was hit on October 19. In light of the high number of lost, unclaimed, and tainted coins, the actual supply is likely much lower.

In this article, we will discuss the report’s findings and explain why they are relevant to investors.

On November 19, Massachusetts-based Coinmetrics published a report in which it explains than Bitcoin’s actual circulating supply is much lower than believed. In the report, the researchers categorize lost coins into “provably lost” and “assumed lost” to make their case.

*Provably lost coins *

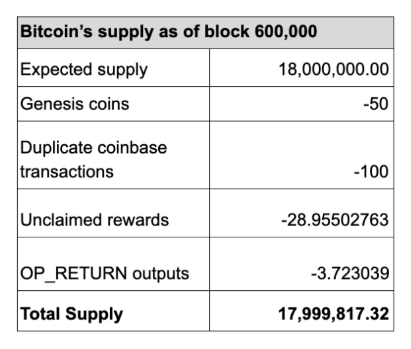

The number of coins that counted in today’s circulating supply figure that can be proven to be no longer accessible includes genesis coins, duplicate coinbase transactions, unclaimed mining rewards, and OP_RETURN outputs.

During the creation of the Bitcoin blockchain’s first block, called the genesis block, 50 BTC were minted and not included in the UTXO set and are not present on the ledger. Additionally, there were two duplicate Coinbase transactions - worth 100 BTC - that are also not present on the Bitcoin ledger. Unclaimed mining rewards amount to a total of 28.957 BTC and OP_RETURN outputs, which are transactions that are provably unspent, amount to 3.723 BTC.

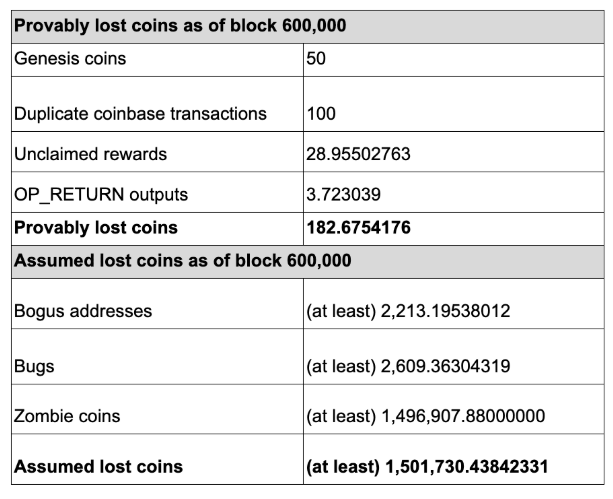

According to Coinmetrics, the total number of provably lost coins amounts to 182.6754176 BTC. While this figure does not change the total circulating supply number by a meaningful amount, the number of coins that are assumed to be lost is much higher.

Assumed lost coins

Before the use of OP_RETURNS outputs, bitcoin users resorted to using “bogus addresses” to burn coins. Three well-known bogus addresses used to burn Bitcoin are 1bitcoineateraddressdontsendf59kue, 1CounterpartyXXXXXXXXXXXXXXXUWLpVr, and 1111111111111111111114oLvT2. The combined total that has been sent to these three addresses amounts to around 2213 BTC.

Bugs in the Bitcoin code have also resulted in the loss of coins. Coinmetrics believes that code errors in the Bitcoin software have amounted to the loss of at least 2,609 BTC.

Coins that have not been moved in a very long time - often called zombie coins - also reduces the circulating supply of Bitcoin. For its study, Coinmetrics used coins that have not been moved since before Bitcoin became exchange-tradable in July 2010. 1,496,907.88 coins have not been moved since mid-2010. A large chunk of these are assumed to have been mined by Bitcoin’s pseudonymous creator Satoshi Nakamoto. Since it has been almost ten years since Bitcoin became tradable on exchanges, researchers believe that these coins will not move and can be subtracted from Bitcoin’s coin supply.

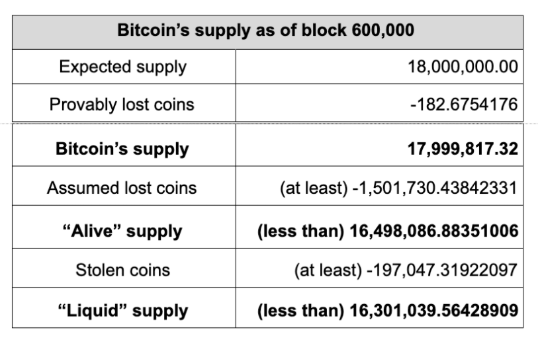

Finally, there are also stolen coins that have not been moved since they were illegally apprehended. Coinmetrics believes the amount of stolen coins but not accessible coins is at least 117,091 BTC.

The report’s findings conclude that the liquid supply of Bitcoin is around 16,301,039.56 BTC. That figure has been calculated by subtracting the number of provably lost coins, assumed lost coins, and known stolen coins that have not been moved from the current mined number of coins.

What does a lower circulating supply mean for investors?

Coinmetrics believes that Bitcoin’s current coin supply amounts to around 16.3 million BTC instead of little over 18 million as advertised on pricing platforms, such as CoinMarketCap. The researchers also suggest that the maximum coin supply of 21 million will, therefore, never be reached.

The laws of supply and demand dictate that limited supply met with growing demand will result in an increase in price. In fact, that has been one of the key driving factors for the increase in the price of Bitcoin (BTC) as the total number of coins that can ever be mined is limited to 21 million.

If Coinmetrics’ estimations are correct, the case for a Bitcoin as an investment asset may be stronger than previously thought.

OhNoCrypto

via https://www.ohnocrypto.com

Alex Lielacher, Khareem Sudlow