Monero Price Analysis - The push for ASIC resistance

#crypto #bitcoin

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow

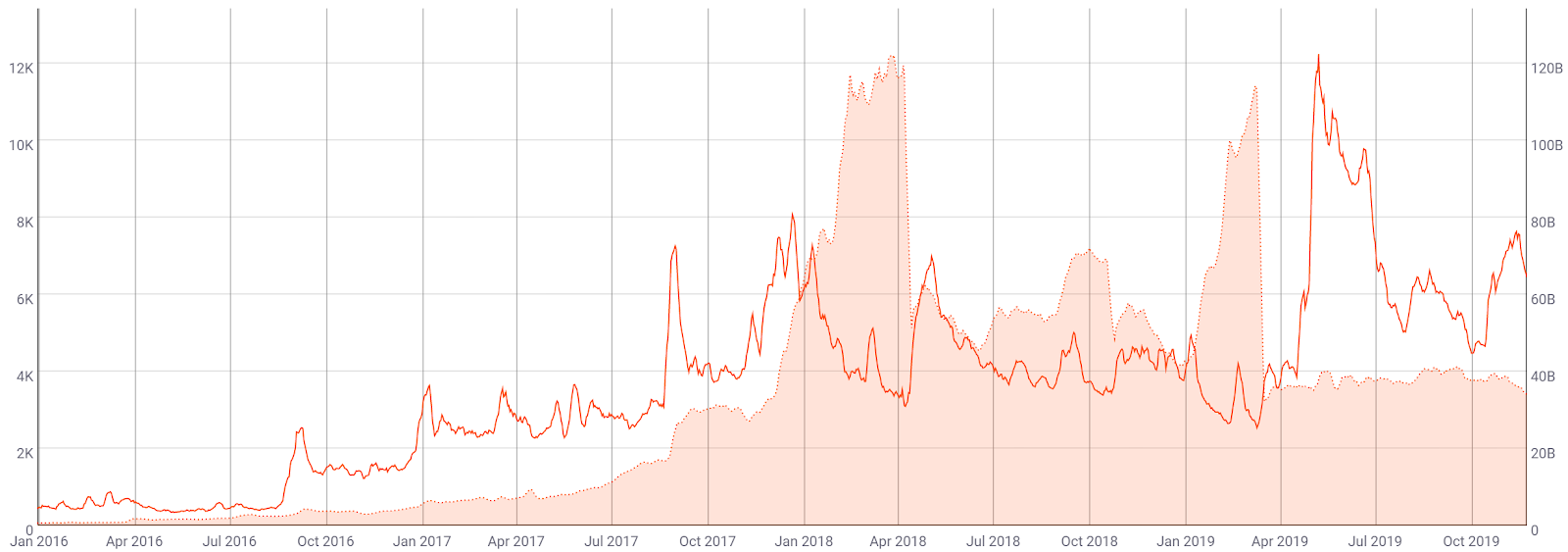

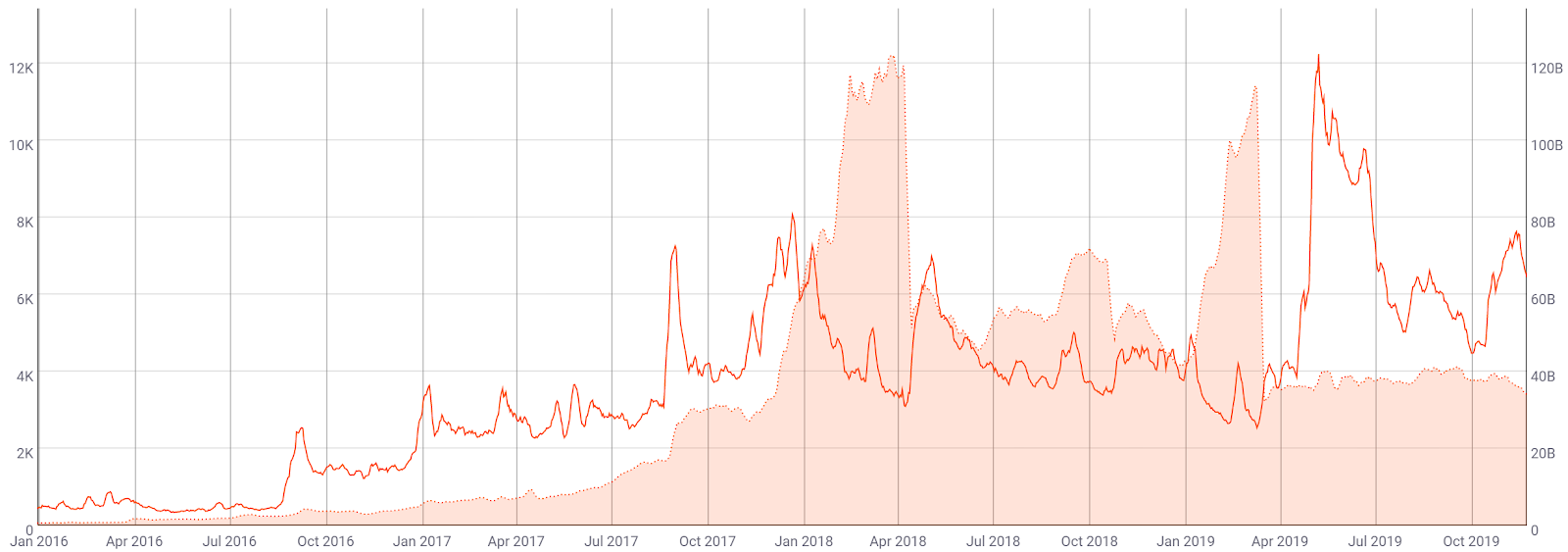

Created in April 2014, the privacy coin Monero (XMR) enables untraceable, unlinkable, private, and analysis resistant transactions. The cryptocurrency is down 90% from the all-time high of nearly $500, established in December 2017. The market cap currently stands at US$854 million, ranking XMR 15th on the Brave New Coin market cap table, with US$28.8 million in trading volume over the past 24 hours.

XMR’s default privacy features leverage Multilayered Linkable Spontaneous Anonymous Group signatures (MLSAG), ring confidential transactions (RCT), and stealth addresses. Other coins with the optional ability to send private transactions include Zcash (ZEC), DASH (DASH), GRIN (GRIN), and PIVX (PIVX), which use Zero-Knowledge proofs or CoinJoin.

A quick comparison between coins with privacy capabilities shows that XMR leads in market cap and holds second place in all other categories with available data. Both XMR and GRIN obscure the blockchain transaction values and addresses used.

MLSAG signatures, as used by Shen Noether's RCT, are based on Gregory Maxwell's Confidential Transactions, and Nicolas van Saberhagen's Ring Signatures. These digital signatures allow any member of a group to produce a signature on behalf of the group, without revealing the individual signer's identity.

RCT was initially implemented on XMR in January 2017 and improves upon ring signatures by allowing hidden transaction amounts, origins, and destinations with reasonable efficiency and verifiably trustless coin generation. A stealth address feature gives additional transaction privacy by allowing for single-use addresses, which only reveal where a payment was sent to the sender and receiver. A multi-signature wallet function in the native XMR wallet was also implemented in April 2018.

A drawback of a hidden ledger is the inability to audit the chain to determine if extra coins have been minted. In July, HackerOne revealed several vulnerabilities, including the ability to send counterfeit XMR to an exchange wallet. The report stated, “by mining a specially crafted block that still passes daemon verification, an attacker can create a miner transaction that appears to the wallet to include sum of XMR picked by the attacker...this can be exploited to steal money from exchanges.”

The bug did not affect on-chain XMR values and the vulnerability was patched months before the HackerOne report. ZEC had a similar but worse on-chain minting problem with an inflation bug that went without a fix for eight months.

XMR’s transactional privacy features have also attracted increased mining malware and ransomware operators over the past few years. A report released in January 2019 found that nearly 5% of all XMR in existence was created by crypto-mining malware.

There have been several malware variants affecting different operating systems. KingMiner, targeting Windows servers, likely accounted for an 86% increase in crypto-jacking throughout Q2 2018, as reported by McAfee labs. Linux.BtcMine.174, which targeted old Linux operating systems, was discovered in November 2018. Mining malware affecting cloud providers using Linux was found in January 2019 by Palo Alto Networks Unit 42. The Ukraine government was affected by the crypto jacker Minergate.

Trend Micro has also reported a significant uptick in XMR-related mining malware over the past year. This included two mining malware variants affecting Windows servers, RADMIN and MIMIKATZ, and Linux malware Coinminer.Linux.MALXMR.UWEIU which eliminated any competing malware on the infected machine. The security analysts also detected a URL that was spreading a botnet with an XMR miner bundled with a Perl-based backdoor component. The Perl-based backdoor component is capable of launching distributed denial-of-service (DDoS) attacks, allowing the cybercriminals to monetize their botnet through cryptocurrency mining and by offering DDoS-for-hire services. Most of the infection attempts thus far have occurred in China.

In response to the persistent and ongoing use of malicious software, the XMR community created a website to help users affected by these problems, including information for diagnosing and removing the malicious software. However, there are ongoing concerns around governmental attempts to declare a ban on XMR use. Japanese and U.S. governments have expressed interest in “legislative or regulatory actions” to prevent the use of privacy-focused cryptocurrencies, such as XMR and ZEC, for illicit purposes. UpBit delisted privacy coins in September, and OKEx Korea is also currently in the process of discussing delisting these coins.

In late 2018, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) blacklisted two specific Bitcoin addresses for the first time, both of which had been used for ransomware. Earlier this year, OFAC blacklisted 10 BTC addresses and one LTC address connected to narco-trafficking. These blacklisting procedures decrease coin fungibility and increases coin surveillance, both of which are not possible with XMR.

Riccardo Spagni, a member of Monero’s core developer team, has expressed his opinion that the U.S. is unlikely to declare privacy coins illegal. Spagni has stated that privacy coins will remain open to U.S. users as long as The Onion Router (TOR) remains open. He has also said that Zcash, which is managed by a U.S. company, is much more likely to be targeted by U.S. regulators.

There are two key XMR-related protocols, Tari and Kovri. Tari was announced in May 2018 and will introduce token creation, in a similar fashion to Colored Coins on Bitcoin, ERC20 tokens on Ethereum, and non-fungible tokens (NFTs) in general. Although there have been no recent announcements related to Tari, the GitHub repository remains active. Milestones include a Tari node and testnet by year-end.

Kovri, which is currently live, allows for wallet features that are similar to TOR by adding additional user privacy through anonymizing geographical locations and IP addresses with an overlay network. Eventually, all future XMR transactions will be routed through Kovri.

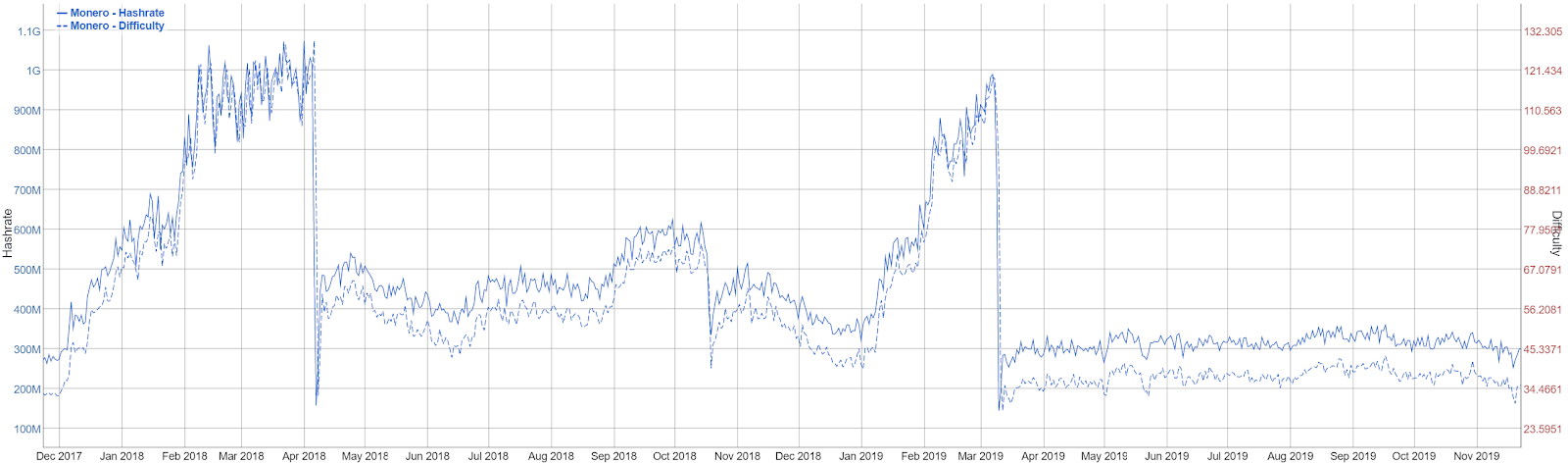

On the network side, the XMR community has taken an aggressive approach to regain Application Specific Integrated Circuit (ASIC) resistance. Beginning in late 2017, the XMR hash rate began to increase substantially, suggesting ASIC mining. This meant that CPUs and GPUs could no longer efficiently mine XMR due to ASIC competition. The increased use of ASICs on any chain can mean increased network centralization as less efficient hardware, like GPUs and CPUs, become unprofitable to use, allowing those with more resources to buy more ASICs.

The XMR Proof-of-Work (PoW) algorithm, CryptoNight, had been scheduled for slight changes through the use of periodic hard forks, every six months, which would have ideally decreased the use of ASICs on the chain. Future PoW algorithm changes, slated for release on November 30th, involve a new consensus algorithm altogether.

Developed over the past year, the Random X algorithm gives CPU mining a competitive advantage over both GPUs and ASICs. The algorithm has passed security audits and will be implemented through Monero Core v0.15.

Three further changes to the network include; the removal of long payment IDs, where transactions require at least two outputs, and a ten-block lock time for incoming transactions. The goal of these changes is to improve privacy for the users and the network.

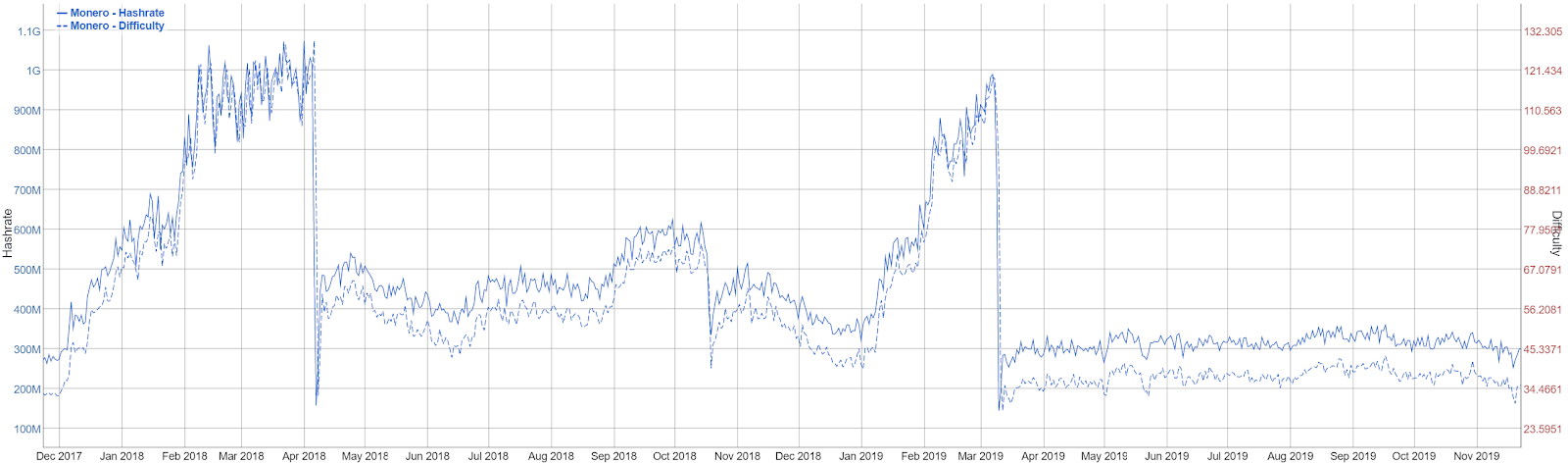

The most recent scheduled hard fork occurred on March 9th at block 1,788,000 and implemented Monero Core v0.14.1. The hard fork brought blockchain pruning and improves transaction efficiency, along with an immediate and significant drop in hash rate. A similar drop in hash rate occurred after the hard fork in April 2018, suggesting significant ASIC use on the chain.

Another possible reason for the significant rise and decline in hash rate may be due to increased mining malware using the now-defunct PoW algorithm. The October 2018 hard fork didn’t trigger as much of a change in the hash rate when compared to the April and March hard forks.

Source: BitInfoCharts

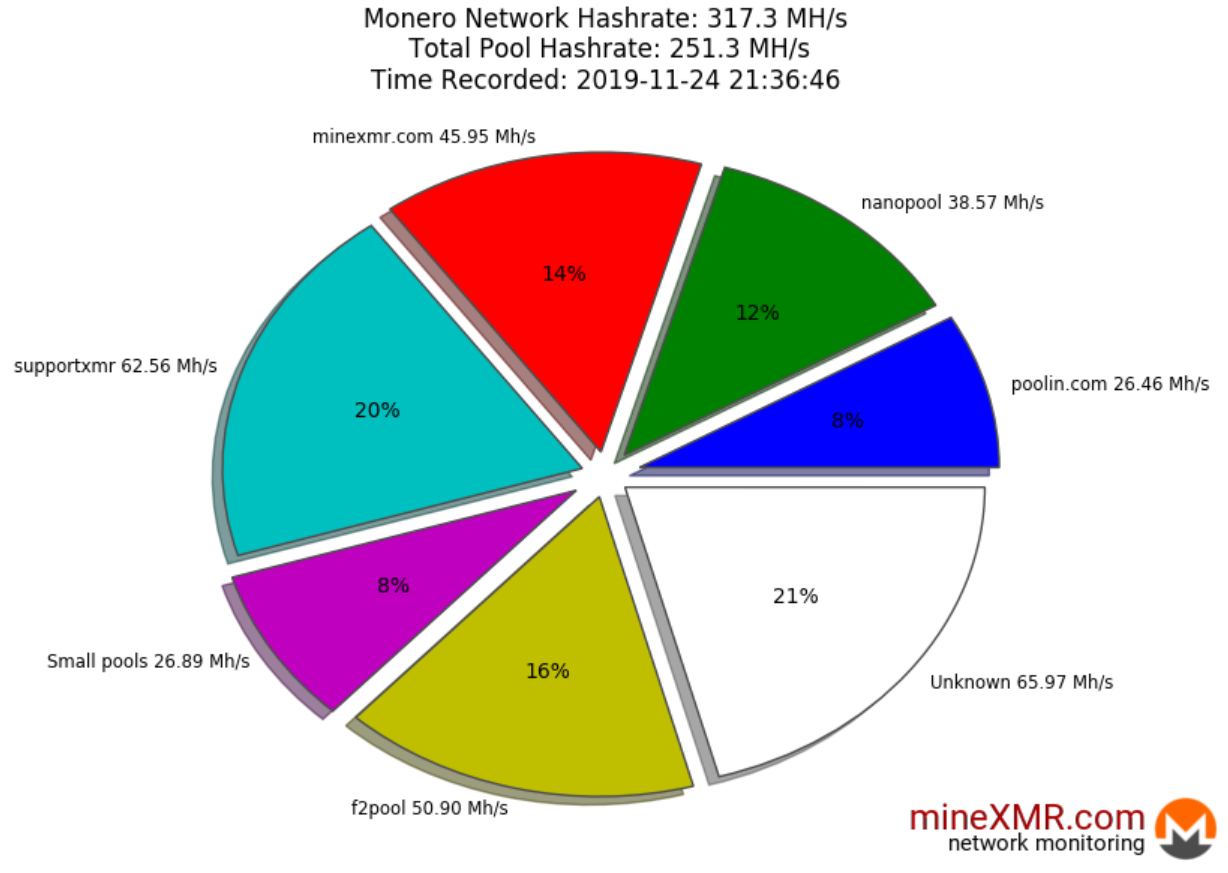

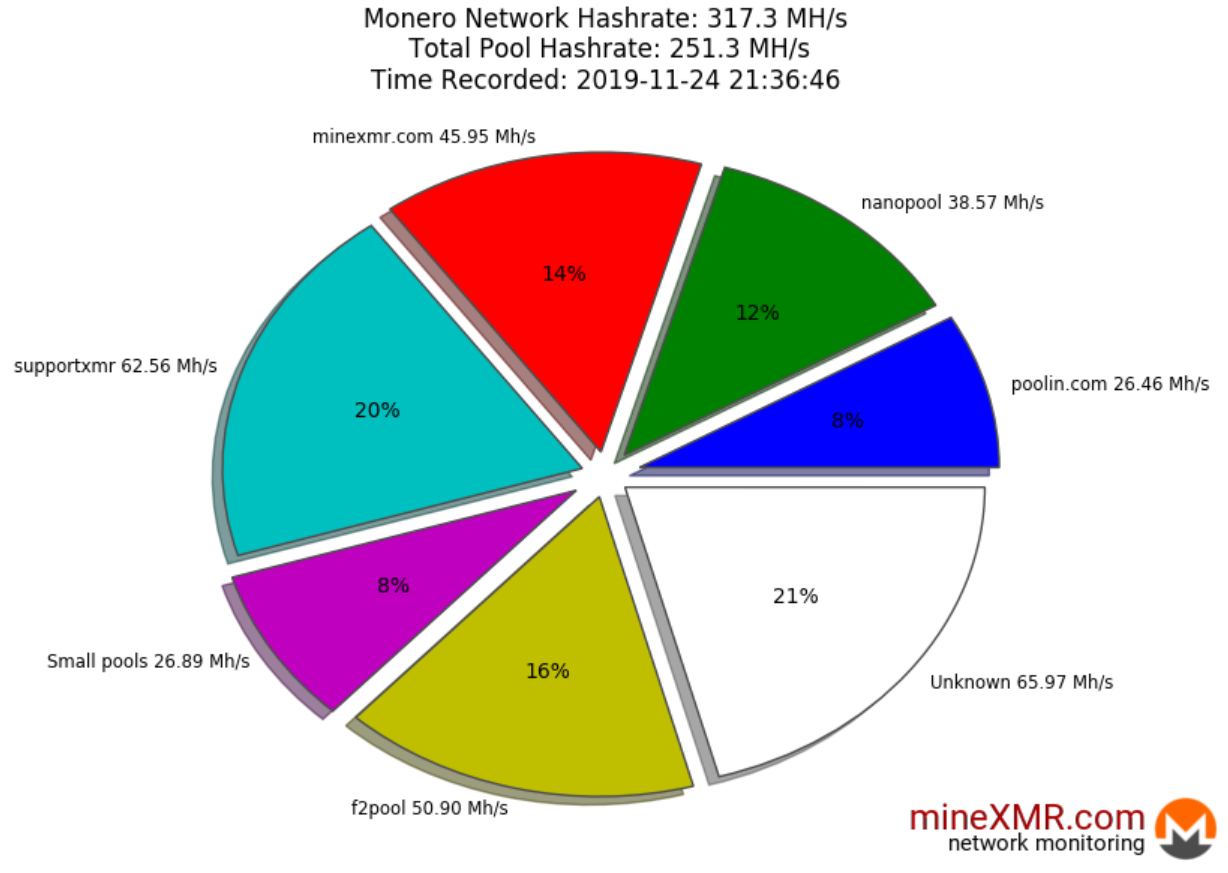

Since the March hard fork, the hash rate has stabilized and, based on mining difficulty, miner participation is holding near a two-year low. Despite the multiple hard forks, hash rate distribution remains widely varied between six major pools and several smaller and unknown pools. Although frequent PoW changes decrease ASIC mining, as the total hash rate drops the risks of a 51% attack increase.

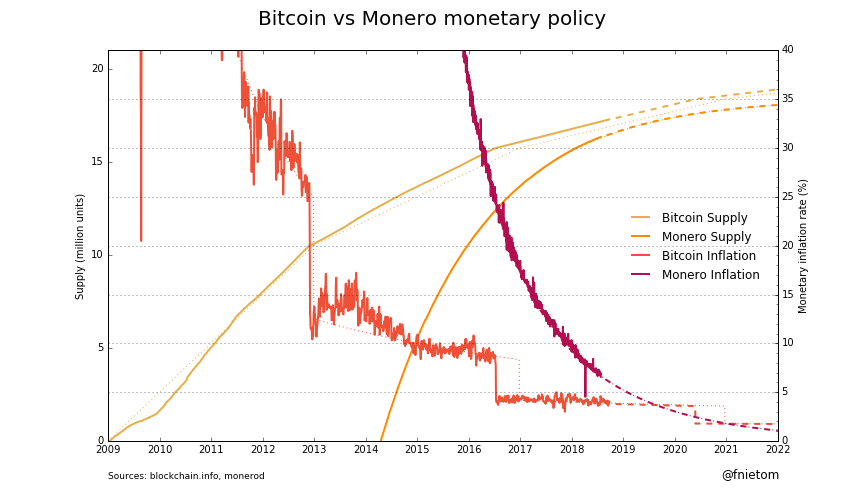

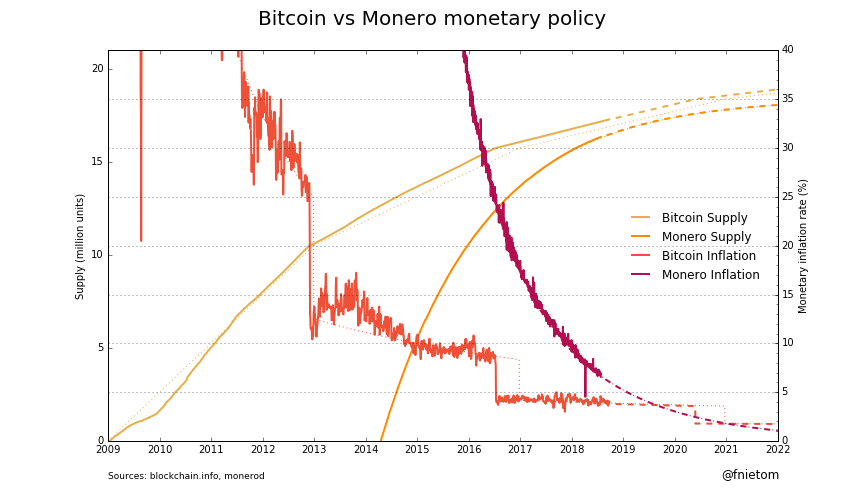

Just over 94% of the 18.4 million XMR to exist by May 2022 have now been mined. XMR has a two-minute targeted block time with ~3% annual inflation (line, chart below), which is among the lowest of all coins. When compared to the stepwise disinflationary curve which occurs after each Bitcoin block reward halving, XMR has a smoother emission curve until the block reward hits 0.3 XMR per minute, where it will remain indefinitely. This is known as tail emission and ensures a block reward in perpetuity, regardless of transaction fees.

Transactions per day (line, chart below) on the Monero network recently reached a high of 30,000 but have dropped nearly 60% since May. Peaks in mining difficulty (fill, chart below) since January 2018 have preceded spikes in transactions per day, suggesting that mining activity may be a cause for this transaction spike. As mining malware activity or new ASICs come on or offline, mining difficulty can vary wildly.

Source: CoinMetrics

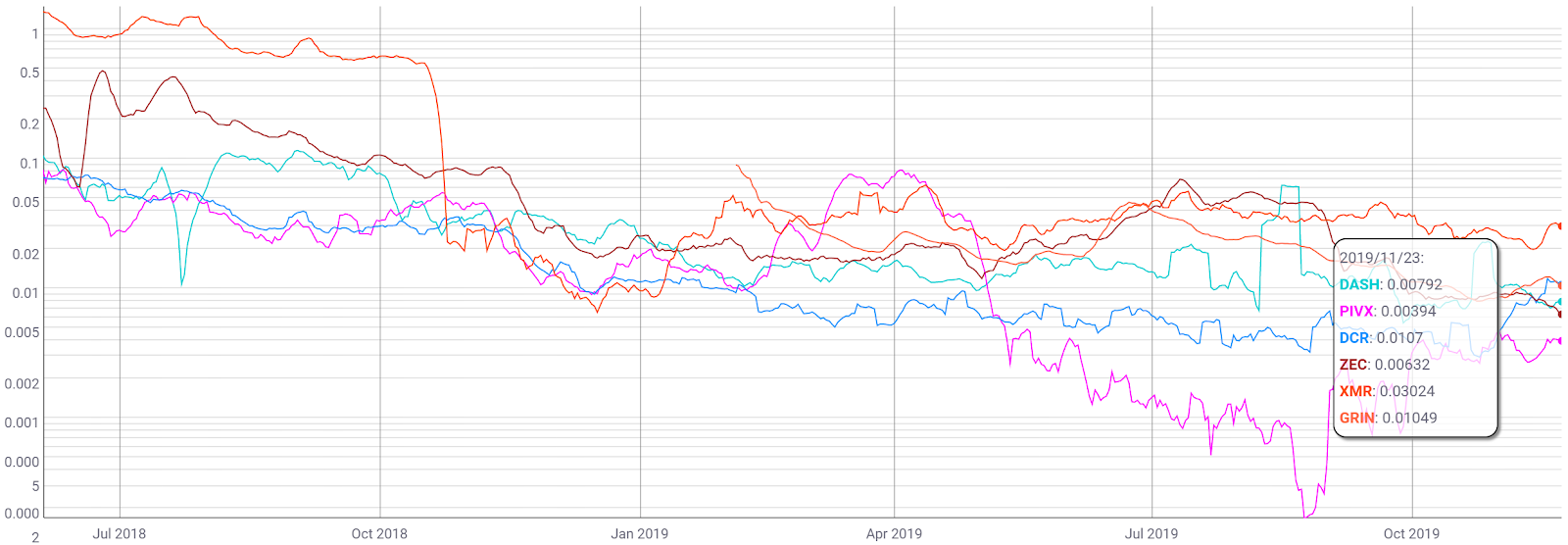

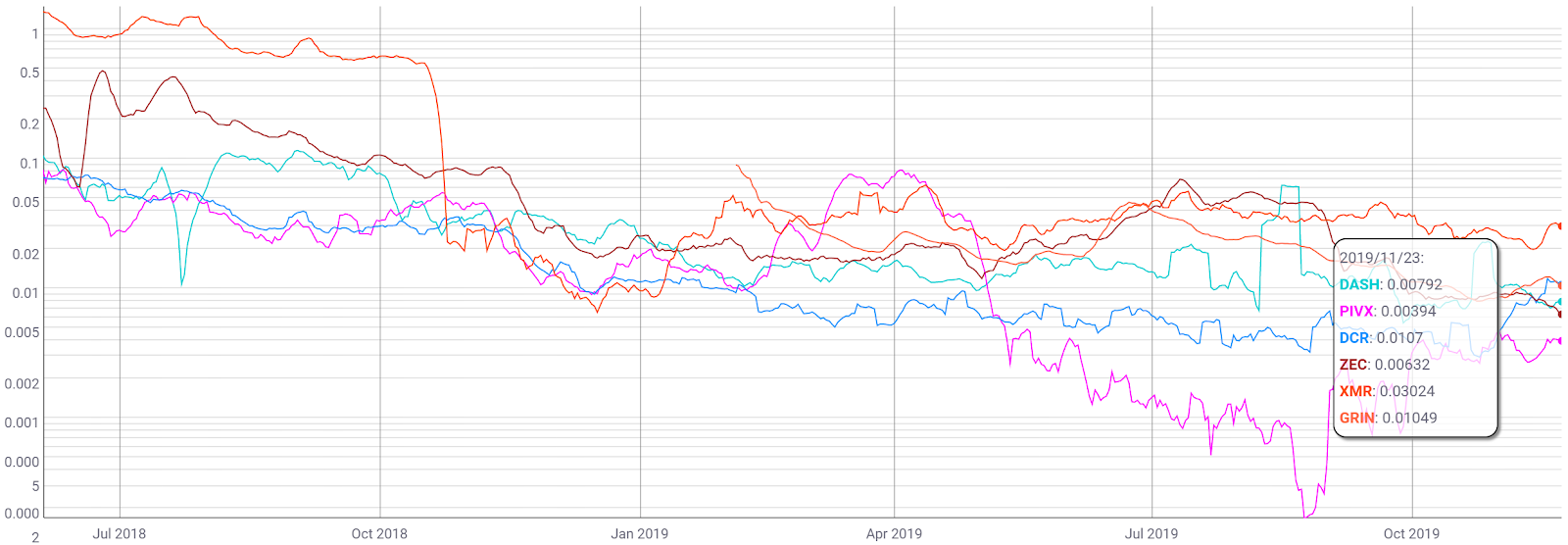

XMR historically led the pack in regards to transaction fees (red, chart below). However, XMR transaction fees are currently higher than DASH, ZEC, DCR, GRIN, and PIVX. XMR has also historically had more transactions per day than ZEC, GRIN, or PIVX, but fewer than DASH (not shown).

In October 2018, XMR completed a hard fork to implement Bulletproofs, which reduced transaction sizes by 80% and immediately brought average transaction fees down to US$0.027. XMR’s average daily block size is currently higher than DASH, ZEC, DCR, GRIN, and PIVX, and has also decreased significantly since the addition of Bulletproofs (not shown).

Source: CoinMetrics

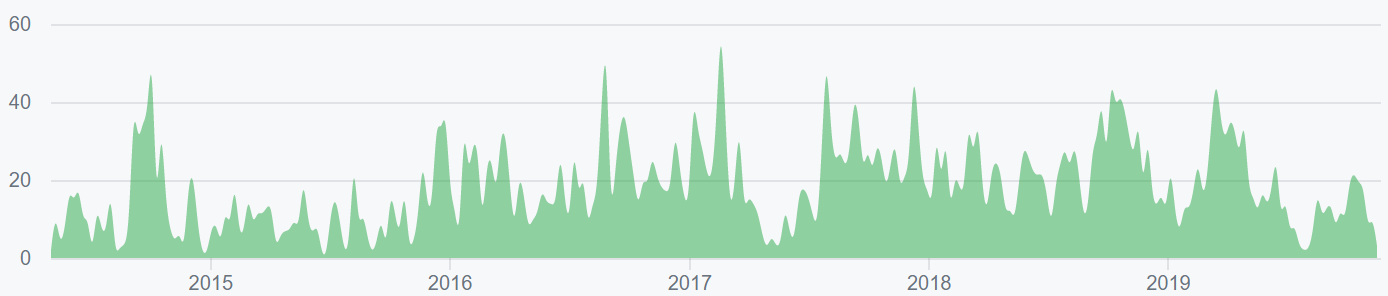

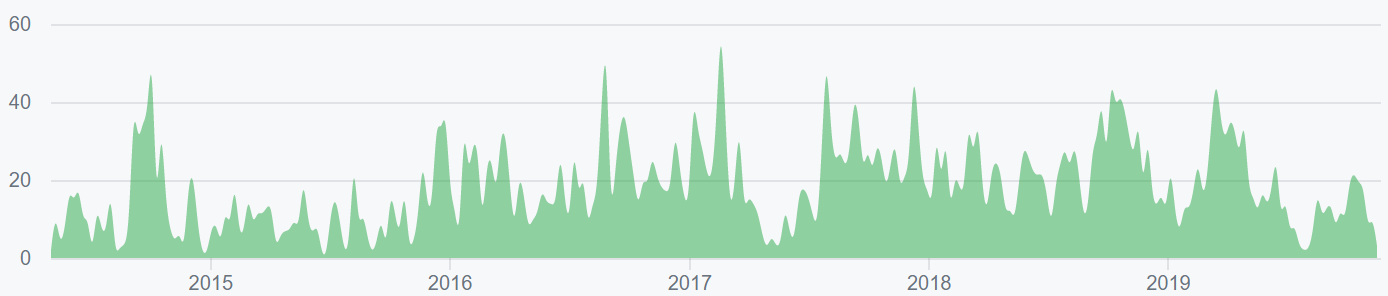

Turning to developer activity, XMR currently has 17 repos on GitHub. In total, over 200 developers have contributed over 3,000 commits in the past year across all repos. Most of these commits have occurred on the main XMR repo (shown below).

Most coins use the developer community of GitHub. Files are saved in folders called "repositories," or "repos." Changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Monero v0.15.0, dubbed “Carbon Chamaeleon” was released on November 12th in preparation for the RandomX consensus algorithm change as well as other changes to improve the robustness of the network and transaction privacy. On November 18th, a user spotted a compromised 64-bit Linux binary of the CLI wallet on the official Monero website. The Monero team confirmed the hack and remedied the issue, but not before one user on Reddit reported a loss of US$7,000 after running the compromised wallet software.

Source: GitHub

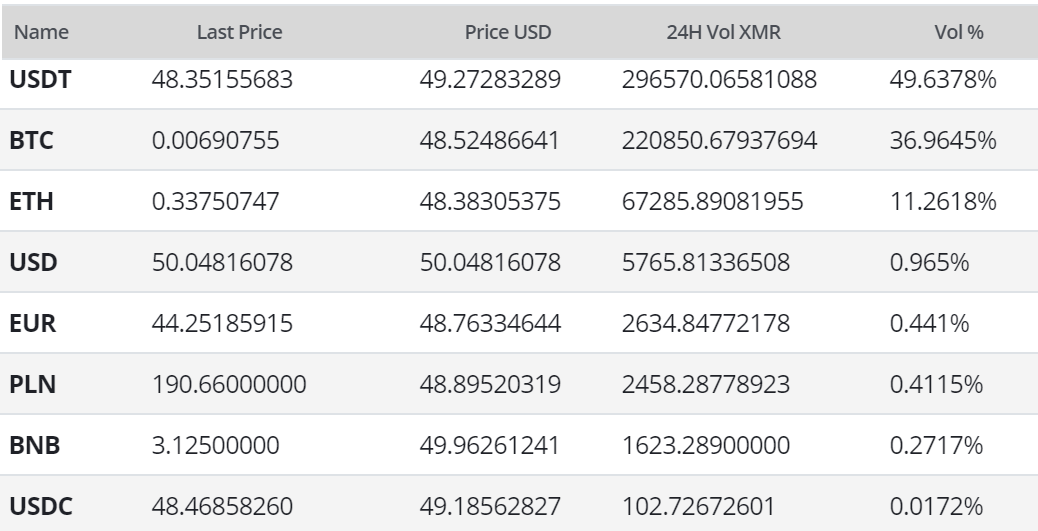

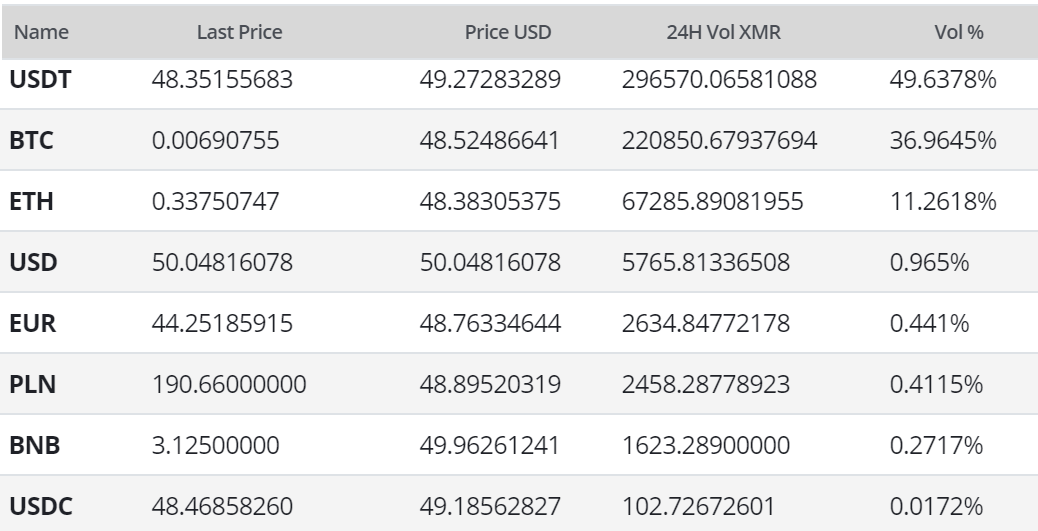

Exchange-traded volume has been led by the Tether (USDT) and Bitcoin (BTC) markets with most of the volume originating from Huobi and Binance. The sustained dominance of the BTC trading pair is largely due to the lack of direct fiat gateways for XMR. However, earlier this year, Binance added XMR/BNB and XMR/USDT trading pairs. XMR/BTC margin trading was added to Poloniex in late April. In September, Poloniex delisted LTC/XMR, DASH/XMR, ZEC/XMR, MAID/XMR, NXT/XMR, and BCN/XMR pairs due to low volume. In October, BTSE added XMR/BTC, LTC, ETH, USDT, USDC, TUSD, and a variety of other fiat pairs.

As exchange services like Shapeshift and Changelly now require customers to register for KYC/AML compliance, XMR volume on decentralized exchanges (DEXs) will likely continue to increase. The XMR/BTC pair on Bisq, a peer to peer private DEX, currently accounts for 50% of the total exchange volume. In 2018, the U.S. Securities and Exchange Commission announced that DEX owners need to register as exchanges, which may keep unregistered DEXs out of the U.S. entirely.

In the future, XMR may be delisted from centralized exchanges and relegated to DEXs entirely. Although, in August 2018, XMR was listed as a potential addition to Coinbase. ZEC was added to Coinbase with its optional privacy feature disabled. Hardware wallet solutions currently available for XMR include the Trezor Model T and the Ledger Nano S.

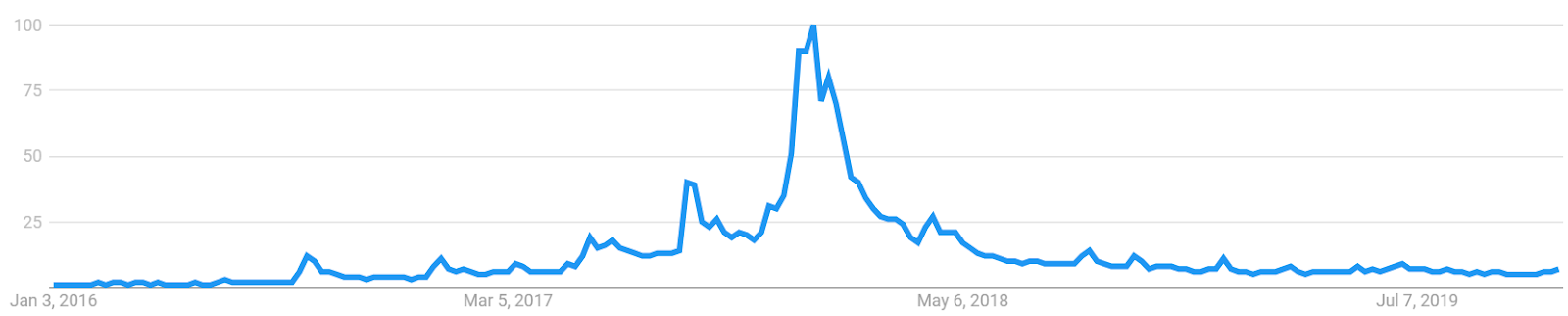

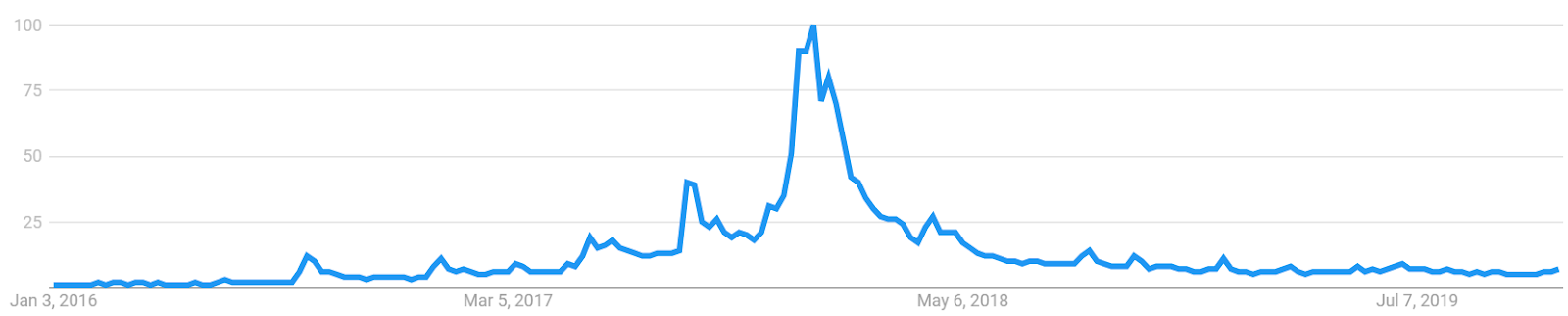

Worldwide Google Trends interest regarding the term "Monero" remained sharply down over the course of 2018 and early 2019, and is currently slightly up from a multi-year low. A slow rise in searches for "Monero" preceded the bull run in Q4 2017, likely signaling a large swath of new market participants at that time. A 2015 study found a strong correlation between the google trends data and bitcoin price, while a 2017 study concluded that when the U.S. Google "Bitcoin" searches increase dramatically, Bitcoin price drops.

On the daily chart, the 50-day exponential moving average (EMA) and 200-day EMA Death Cross occurred in early September. Both EMAs should now act as resistant until significant bullish volume re-emerges. Price is currently sitting inside a high volume Volume Profile Visible Range (VPVR) node from US$41 to US$53, which should act as near-term support. Further, long/short open interest on Bitfinex (top panel, chart below) is currently 69% long, with long and short positions slowly increasing over the past few weeks.

The current spot price has also been bound by a bearish Pitchfork (PF) for the past year, with anchor points in December 2017, February 2018, and April 2018. Price has been unable to definitively breach the PF despite several attempts. The median line (yellow), currently at US$27, will likely be continually tested as either support or resistance so long as the PF remains active. Additionally, there are no active divergences to suggest weakening bearish momentum.

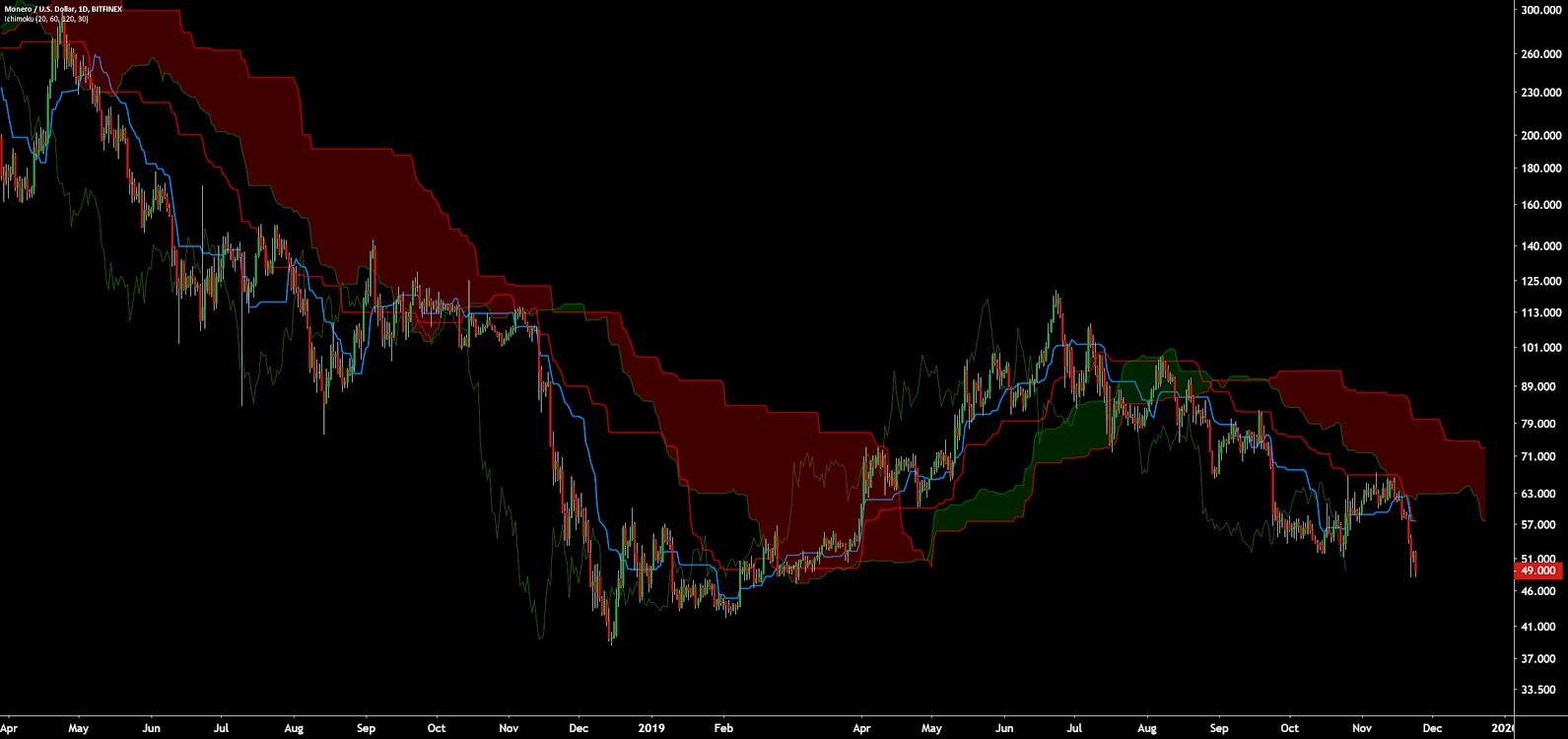

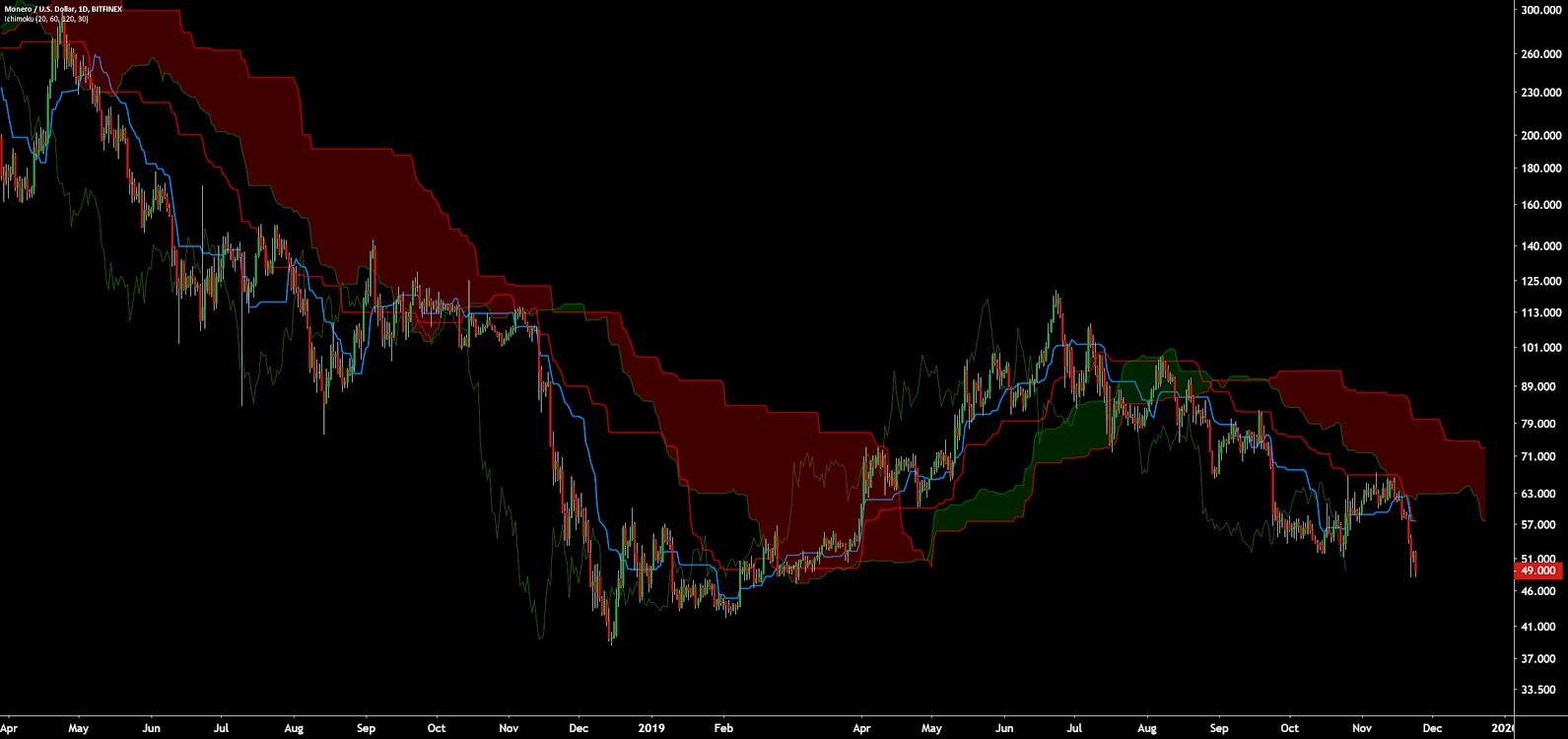

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best trade entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame with doubled settings (20/60/120/30) for more accurate signals are bearish; price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below price and below Cloud. A traditional long entry will not occur until price is above the Cloud. Price also recently retested the Kijun and failed a potential bullish reversal through the Cloud.

Lastly, on the XMR/BTC daily chart, the trend is significantly bearish. The 50-day EMA and 200-day EMAs have been bearishly crossed for over 500 days and Cloud metrics are also 100% bearish (not shown). Price last touched the 200-day EMA on April 1st. If buyers cannot hold the current low, there is no significant support until the previous local highs near 0.004 BTC. However, there is a multi-month bullish RSI divergence and falling wedge chart pattern, both suggestive of weakening bearish momentum.

The network is set to drastically change it’s consensus algorithm from CryptoNight to Random X over the course of the next week. The goal of the new algorithm is to help remove ASICs from the network permanently by giving CPUs a competitive mining advantage. Thanks to XMR’s ironclad privacy, darknet traffic continues at a fever pitch with new mining malware and various other attack vectors pointed at the Monero community, including on Monero’s official website.

Technicals for the XMR/USD pair show that trend metrics showing no signs of slowing bearish momentum. Strong support exists from US$41 to US$53 while strong resistance sits at US$120. The recent failed reversal attempt may push price towards the US$27 zone as suggested by the multi-month bearish Pitchfork.

Technicals for the XMR/BTC pair remain firmly bearish, with trend metrics showing no signs of bullish momentum, although a multi-month bullish divergence continues to grow. Critical support stands at the local low, which if breached, will likely result in significant downward momentum, potentially towards 0.004.

XMR’s default privacy features leverage Multilayered Linkable Spontaneous Anonymous Group signatures (MLSAG), ring confidential transactions (RCT), and stealth addresses. Other coins with the optional ability to send private transactions include Zcash (ZEC), DASH (DASH), GRIN (GRIN), and PIVX (PIVX), which use Zero-Knowledge proofs or CoinJoin.

A quick comparison between coins with privacy capabilities shows that XMR leads in market cap and holds second place in all other categories with available data. Both XMR and GRIN obscure the blockchain transaction values and addresses used.

MLSAG signatures, as used by Shen Noether's RCT, are based on Gregory Maxwell's Confidential Transactions, and Nicolas van Saberhagen's Ring Signatures. These digital signatures allow any member of a group to produce a signature on behalf of the group, without revealing the individual signer's identity.

RCT was initially implemented on XMR in January 2017 and improves upon ring signatures by allowing hidden transaction amounts, origins, and destinations with reasonable efficiency and verifiably trustless coin generation. A stealth address feature gives additional transaction privacy by allowing for single-use addresses, which only reveal where a payment was sent to the sender and receiver. A multi-signature wallet function in the native XMR wallet was also implemented in April 2018.

A drawback of a hidden ledger is the inability to audit the chain to determine if extra coins have been minted. In July, HackerOne revealed several vulnerabilities, including the ability to send counterfeit XMR to an exchange wallet. The report stated, “by mining a specially crafted block that still passes daemon verification, an attacker can create a miner transaction that appears to the wallet to include sum of XMR picked by the attacker...this can be exploited to steal money from exchanges.”

The bug did not affect on-chain XMR values and the vulnerability was patched months before the HackerOne report. ZEC had a similar but worse on-chain minting problem with an inflation bug that went without a fix for eight months.

XMR’s transactional privacy features have also attracted increased mining malware and ransomware operators over the past few years. A report released in January 2019 found that nearly 5% of all XMR in existence was created by crypto-mining malware.

There have been several malware variants affecting different operating systems. KingMiner, targeting Windows servers, likely accounted for an 86% increase in crypto-jacking throughout Q2 2018, as reported by McAfee labs. Linux.BtcMine.174, which targeted old Linux operating systems, was discovered in November 2018. Mining malware affecting cloud providers using Linux was found in January 2019 by Palo Alto Networks Unit 42. The Ukraine government was affected by the crypto jacker Minergate.

Trend Micro has also reported a significant uptick in XMR-related mining malware over the past year. This included two mining malware variants affecting Windows servers, RADMIN and MIMIKATZ, and Linux malware Coinminer.Linux.MALXMR.UWEIU which eliminated any competing malware on the infected machine. The security analysts also detected a URL that was spreading a botnet with an XMR miner bundled with a Perl-based backdoor component. The Perl-based backdoor component is capable of launching distributed denial-of-service (DDoS) attacks, allowing the cybercriminals to monetize their botnet through cryptocurrency mining and by offering DDoS-for-hire services. Most of the infection attempts thus far have occurred in China.

In response to the persistent and ongoing use of malicious software, the XMR community created a website to help users affected by these problems, including information for diagnosing and removing the malicious software. However, there are ongoing concerns around governmental attempts to declare a ban on XMR use. Japanese and U.S. governments have expressed interest in “legislative or regulatory actions” to prevent the use of privacy-focused cryptocurrencies, such as XMR and ZEC, for illicit purposes. UpBit delisted privacy coins in September, and OKEx Korea is also currently in the process of discussing delisting these coins.

In late 2018, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) blacklisted two specific Bitcoin addresses for the first time, both of which had been used for ransomware. Earlier this year, OFAC blacklisted 10 BTC addresses and one LTC address connected to narco-trafficking. These blacklisting procedures decrease coin fungibility and increases coin surveillance, both of which are not possible with XMR.

Riccardo Spagni, a member of Monero’s core developer team, has expressed his opinion that the U.S. is unlikely to declare privacy coins illegal. Spagni has stated that privacy coins will remain open to U.S. users as long as The Onion Router (TOR) remains open. He has also said that Zcash, which is managed by a U.S. company, is much more likely to be targeted by U.S. regulators.

There are two key XMR-related protocols, Tari and Kovri. Tari was announced in May 2018 and will introduce token creation, in a similar fashion to Colored Coins on Bitcoin, ERC20 tokens on Ethereum, and non-fungible tokens (NFTs) in general. Although there have been no recent announcements related to Tari, the GitHub repository remains active. Milestones include a Tari node and testnet by year-end.

Kovri, which is currently live, allows for wallet features that are similar to TOR by adding additional user privacy through anonymizing geographical locations and IP addresses with an overlay network. Eventually, all future XMR transactions will be routed through Kovri.

On the network side, the XMR community has taken an aggressive approach to regain Application Specific Integrated Circuit (ASIC) resistance. Beginning in late 2017, the XMR hash rate began to increase substantially, suggesting ASIC mining. This meant that CPUs and GPUs could no longer efficiently mine XMR due to ASIC competition. The increased use of ASICs on any chain can mean increased network centralization as less efficient hardware, like GPUs and CPUs, become unprofitable to use, allowing those with more resources to buy more ASICs.

The XMR Proof-of-Work (PoW) algorithm, CryptoNight, had been scheduled for slight changes through the use of periodic hard forks, every six months, which would have ideally decreased the use of ASICs on the chain. Future PoW algorithm changes, slated for release on November 30th, involve a new consensus algorithm altogether.

Developed over the past year, the Random X algorithm gives CPU mining a competitive advantage over both GPUs and ASICs. The algorithm has passed security audits and will be implemented through Monero Core v0.15.

Three further changes to the network include; the removal of long payment IDs, where transactions require at least two outputs, and a ten-block lock time for incoming transactions. The goal of these changes is to improve privacy for the users and the network.

The most recent scheduled hard fork occurred on March 9th at block 1,788,000 and implemented Monero Core v0.14.1. The hard fork brought blockchain pruning and improves transaction efficiency, along with an immediate and significant drop in hash rate. A similar drop in hash rate occurred after the hard fork in April 2018, suggesting significant ASIC use on the chain.

Another possible reason for the significant rise and decline in hash rate may be due to increased mining malware using the now-defunct PoW algorithm. The October 2018 hard fork didn’t trigger as much of a change in the hash rate when compared to the April and March hard forks.

Source: BitInfoCharts

Since the March hard fork, the hash rate has stabilized and, based on mining difficulty, miner participation is holding near a two-year low. Despite the multiple hard forks, hash rate distribution remains widely varied between six major pools and several smaller and unknown pools. Although frequent PoW changes decrease ASIC mining, as the total hash rate drops the risks of a 51% attack increase.

Just over 94% of the 18.4 million XMR to exist by May 2022 have now been mined. XMR has a two-minute targeted block time with ~3% annual inflation (line, chart below), which is among the lowest of all coins. When compared to the stepwise disinflationary curve which occurs after each Bitcoin block reward halving, XMR has a smoother emission curve until the block reward hits 0.3 XMR per minute, where it will remain indefinitely. This is known as tail emission and ensures a block reward in perpetuity, regardless of transaction fees.

Transactions per day (line, chart below) on the Monero network recently reached a high of 30,000 but have dropped nearly 60% since May. Peaks in mining difficulty (fill, chart below) since January 2018 have preceded spikes in transactions per day, suggesting that mining activity may be a cause for this transaction spike. As mining malware activity or new ASICs come on or offline, mining difficulty can vary wildly.

Source: CoinMetrics

XMR historically led the pack in regards to transaction fees (red, chart below). However, XMR transaction fees are currently higher than DASH, ZEC, DCR, GRIN, and PIVX. XMR has also historically had more transactions per day than ZEC, GRIN, or PIVX, but fewer than DASH (not shown).

In October 2018, XMR completed a hard fork to implement Bulletproofs, which reduced transaction sizes by 80% and immediately brought average transaction fees down to US$0.027. XMR’s average daily block size is currently higher than DASH, ZEC, DCR, GRIN, and PIVX, and has also decreased significantly since the addition of Bulletproofs (not shown).

Source: CoinMetrics

Turning to developer activity, XMR currently has 17 repos on GitHub. In total, over 200 developers have contributed over 3,000 commits in the past year across all repos. Most of these commits have occurred on the main XMR repo (shown below).

Most coins use the developer community of GitHub. Files are saved in folders called "repositories," or "repos." Changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Monero v0.15.0, dubbed “Carbon Chamaeleon” was released on November 12th in preparation for the RandomX consensus algorithm change as well as other changes to improve the robustness of the network and transaction privacy. On November 18th, a user spotted a compromised 64-bit Linux binary of the CLI wallet on the official Monero website. The Monero team confirmed the hack and remedied the issue, but not before one user on Reddit reported a loss of US$7,000 after running the compromised wallet software.

Source: GitHub

Exchange-traded volume has been led by the Tether (USDT) and Bitcoin (BTC) markets with most of the volume originating from Huobi and Binance. The sustained dominance of the BTC trading pair is largely due to the lack of direct fiat gateways for XMR. However, earlier this year, Binance added XMR/BNB and XMR/USDT trading pairs. XMR/BTC margin trading was added to Poloniex in late April. In September, Poloniex delisted LTC/XMR, DASH/XMR, ZEC/XMR, MAID/XMR, NXT/XMR, and BCN/XMR pairs due to low volume. In October, BTSE added XMR/BTC, LTC, ETH, USDT, USDC, TUSD, and a variety of other fiat pairs.

As exchange services like Shapeshift and Changelly now require customers to register for KYC/AML compliance, XMR volume on decentralized exchanges (DEXs) will likely continue to increase. The XMR/BTC pair on Bisq, a peer to peer private DEX, currently accounts for 50% of the total exchange volume. In 2018, the U.S. Securities and Exchange Commission announced that DEX owners need to register as exchanges, which may keep unregistered DEXs out of the U.S. entirely.

In the future, XMR may be delisted from centralized exchanges and relegated to DEXs entirely. Although, in August 2018, XMR was listed as a potential addition to Coinbase. ZEC was added to Coinbase with its optional privacy feature disabled. Hardware wallet solutions currently available for XMR include the Trezor Model T and the Ledger Nano S.

Worldwide Google Trends interest regarding the term "Monero" remained sharply down over the course of 2018 and early 2019, and is currently slightly up from a multi-year low. A slow rise in searches for "Monero" preceded the bull run in Q4 2017, likely signaling a large swath of new market participants at that time. A 2015 study found a strong correlation between the google trends data and bitcoin price, while a 2017 study concluded that when the U.S. Google "Bitcoin" searches increase dramatically, Bitcoin price drops.

Technical Analysis

XMR continues to bleed value following a market-wide selloff in September. A potential roadmap for price action can be found using Exponential Moving Averages, Pitchforks, Volume Profile Visible Range, chart patterns, and the Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.On the daily chart, the 50-day exponential moving average (EMA) and 200-day EMA Death Cross occurred in early September. Both EMAs should now act as resistant until significant bullish volume re-emerges. Price is currently sitting inside a high volume Volume Profile Visible Range (VPVR) node from US$41 to US$53, which should act as near-term support. Further, long/short open interest on Bitfinex (top panel, chart below) is currently 69% long, with long and short positions slowly increasing over the past few weeks.

The current spot price has also been bound by a bearish Pitchfork (PF) for the past year, with anchor points in December 2017, February 2018, and April 2018. Price has been unable to definitively breach the PF despite several attempts. The median line (yellow), currently at US$27, will likely be continually tested as either support or resistance so long as the PF remains active. Additionally, there are no active divergences to suggest weakening bearish momentum.

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best trade entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame with doubled settings (20/60/120/30) for more accurate signals are bearish; price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below price and below Cloud. A traditional long entry will not occur until price is above the Cloud. Price also recently retested the Kijun and failed a potential bullish reversal through the Cloud.

Lastly, on the XMR/BTC daily chart, the trend is significantly bearish. The 50-day EMA and 200-day EMAs have been bearishly crossed for over 500 days and Cloud metrics are also 100% bearish (not shown). Price last touched the 200-day EMA on April 1st. If buyers cannot hold the current low, there is no significant support until the previous local highs near 0.004 BTC. However, there is a multi-month bullish RSI divergence and falling wedge chart pattern, both suggestive of weakening bearish momentum.

Conclusion

Fundamentals show active and continued incremental upgrades over the past two years, including decreased transaction costs, improved transaction efficiency, blockchain pruning, and improved custody solutions. On-chain use has decreased over the past few months, which largely falls in line with the wider market. This all occurs in the setting of a global campaign to delist most privacy coins from exchanges due to mounting regulatory pressure.The network is set to drastically change it’s consensus algorithm from CryptoNight to Random X over the course of the next week. The goal of the new algorithm is to help remove ASICs from the network permanently by giving CPUs a competitive mining advantage. Thanks to XMR’s ironclad privacy, darknet traffic continues at a fever pitch with new mining malware and various other attack vectors pointed at the Monero community, including on Monero’s official website.

Technicals for the XMR/USD pair show that trend metrics showing no signs of slowing bearish momentum. Strong support exists from US$41 to US$53 while strong resistance sits at US$120. The recent failed reversal attempt may push price towards the US$27 zone as suggested by the multi-month bearish Pitchfork.

Technicals for the XMR/BTC pair remain firmly bearish, with trend metrics showing no signs of bullish momentum, although a multi-month bullish divergence continues to grow. Critical support stands at the local low, which if breached, will likely result in significant downward momentum, potentially towards 0.004.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow