EOS Price Analysis - An active but waning bearish trend

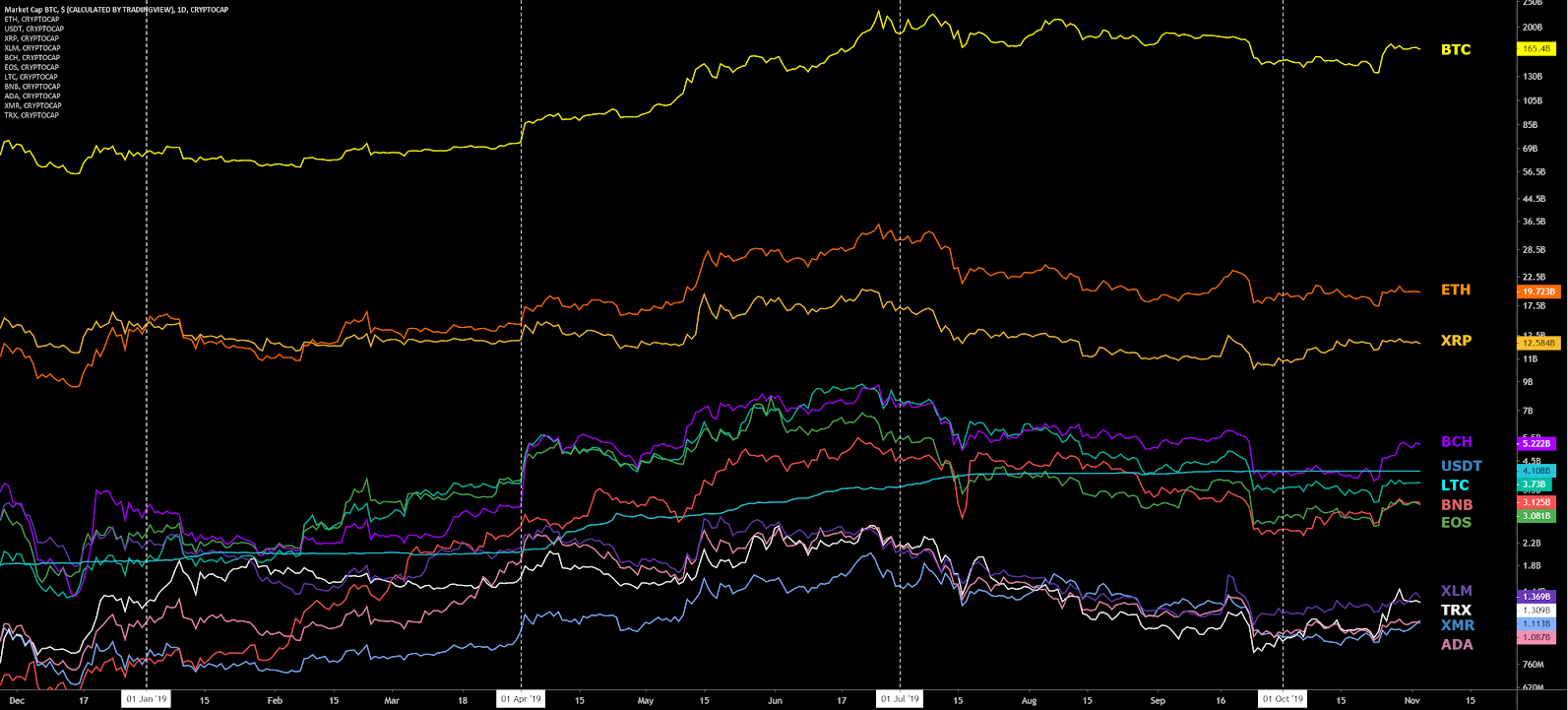

The EOS (EOS) platform, created by Block.One, is a global computing network designed to host a myriad of decentralized applications (Dapps) and decentralized autonomous corporations (DACs). The market value remains down 86% from the all-time high established in April 2018. The market cap currently stands at US$3.06 billion with US$802 million in trade volume over the past 24 hours. EOS is ranked 8th on the Brave New Coin market cap table.

The EOS network hosts smart contracts on Virtual Machines and looks to rival other Dapp or smart contract enabling blockchains, including Ethereum (ETH), Tronix (TRX), and NEO (NEO). The ETH and NEO platforms use gas to pay for units of computing power while EOS uses RAM.

The EOS blockchain went live on June 14th, 2018, after raising ~US$4.2 billion in a year-long ICO, with an average token price of US$5.74. Unlike many ICOs, which continue to hold a large quantity of Ethereum, EOS had spent most of their ETH holdings by June 2018 (chart below).

Initial concerns over a competitor chain holding large quantities of ETH, which could possibly be used in a nefarious matter, quickly dissipated. However, the large ETH outflows from the EOS treasury likely contributed to a drop in ETH price throughout May 2018.

In September, Block.One announced a US$10 million investment in Arlington County, Virginia, for new headquarters. Block.One’s CTO, Dan Larimer, has been based in Blacksburg, Virginia, along with an 80-employee team. The new headquarters are set to double the team size and will serve as a base for increased government relations.

On September 30th, Block.One announced it had reached a one-time civil settlement of US$24 million with the U.S. Securities and Exchange Commission (SEC) in regards to the unregistered EOS ICO on Ethereum. Block.One neither admitted nor denied wrongdoing. The settlement also resolved all ongoing matters between Block.One and the SEC according to the post. Globally, other regulatory agencies may also seek enforcement actions or settlements against EOS if the project is again deemed an unregistered securities offering.

The EOS blockchain uses a Delegated Proof of Stake (DPoS) consensus model, which was pioneered by Larimer. Other iterations of DPoS are currently being used by BitShares (BTS) and Steemit (STEEM), two of Larimer’s previous projects, as well as Lisk (LSK), Ark (ARK), and Tezos (XTZ).

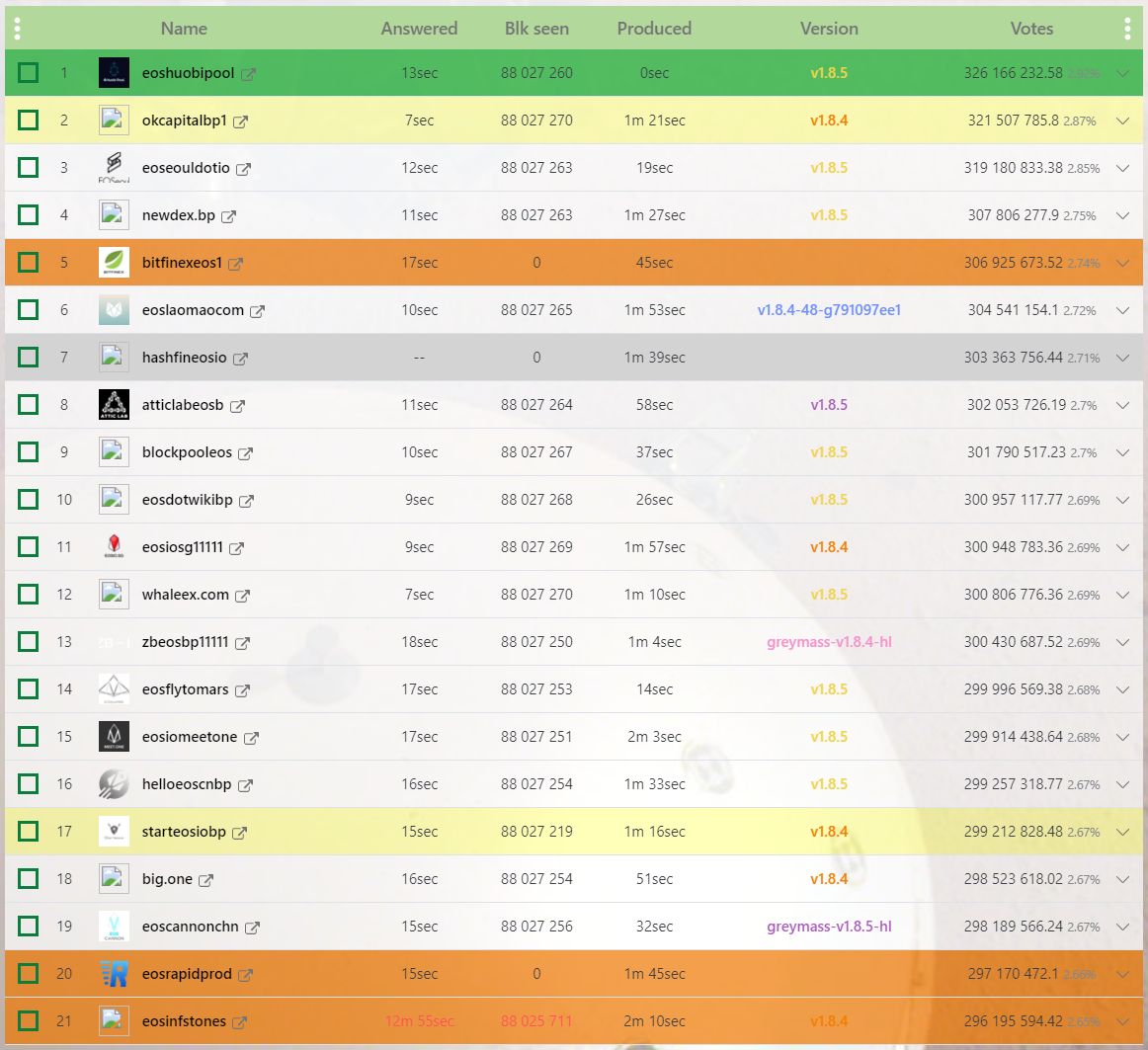

DPoS blockchains have users that vote for delegates, or Block Producers (BPs), who are considered trusted and good actors. The top 21 EOS BPs validate the blockchain, collect a passive income, and are expected to help further protocol development by proposing changes or improvements.

While the top 100 BPs are paid for their services, the top 21 BPs earn the highest reward. Should any of these BPs go against the community’s wishes, they can immediately be replaced. To encourage voting participation, EOS has implemented a vote decay system with newer votes initially carrying the most weight and eventually having zero impact after two years.

The governance structure is similar to that of a two-layer representative democracy with landowner suffrage. Each stakeholder has an influence proportional to their stake in the system. BPs can also offer reward sharing to encourage votes from stakeholders. However, this can encourage the election of BPs offering the highest reward to stakeholders and does not necessarily encourage what is in the network’s best interest. The current reward for staking on EOS, beyond voting on network proposals, is the use of Virtual Machine (VM) components, including; bandwidth, RAM, and storage.

Another, now discontinued arm of the EOS governance system is the EOS Core Arbitration Forum (ECAF), a volunteer-led tribunal. While active, the ECAF gave nine public notifications of arbitration and facilitated over 20 orders, or rulings. As of April 12th, 2019, the ECAF is no longer accepting claims. Instead, 15 of the 21 BPs can now decide on any arbitration matters. The process often involves blacklisting accounts, which only works if the top 21 BPs use the blacklist.

Earlier this year, a newly rotated top 21 BP, games.eos, failed to apply a blacklist correctly, allowing 2.09 million EOS, or about US$7.25 million, to move out of a blacklisted account. Due to the incident, games.eos is no longer a top 21 BP. Going forward, there are plans to cancel the keys for blacklist account holders entirely, so they can never be used on the EOS blockchain.

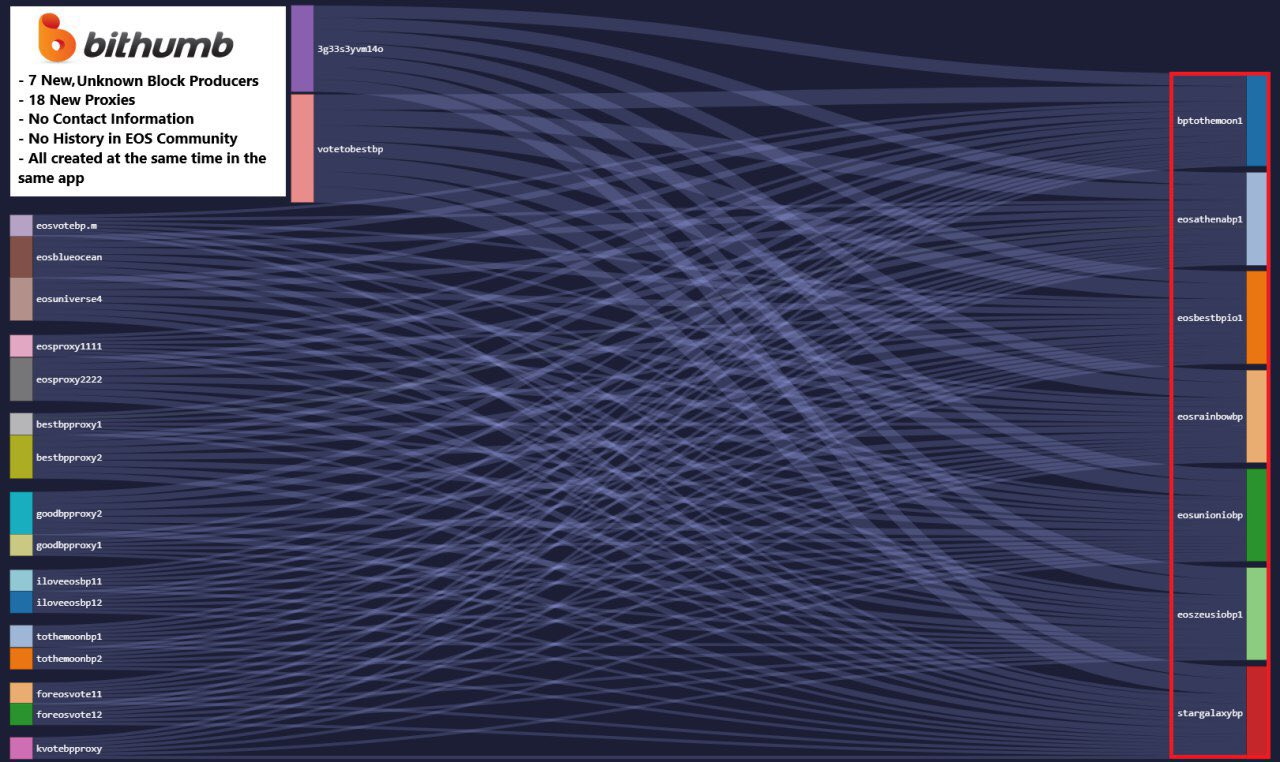

Recently, there has also been growing concern in regards to BP ballot stuffing and manipulation. The exchange Bithumb recently added seven new BP accounts with 18 new proxies, which may be an attempt to obscure the trail of its votes. These new BPs have virtually no social media presence and/or working websites. These “sock puppet nodes” could be mirroring larger nodes and siphoning the BP rewards from the top 100 BPs, without providing additional network security.

On the network side, the EOS blockchain has grown to over 4TB in the past year, with an estimated five BPs running a full archival node. The BPs with full nodes include Greymass, EOS Sweden, CryptoLions, EOS Tribe, and EOS Canada. The nodes are essential for fully-functional Dapp activity as 20% of blockchain lookup requests involve observing the entire blockchain history.

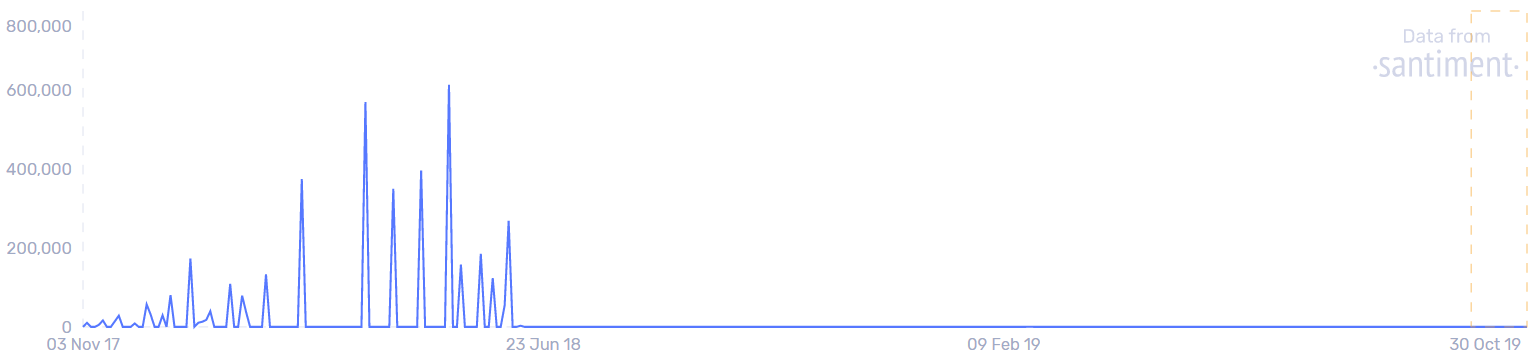

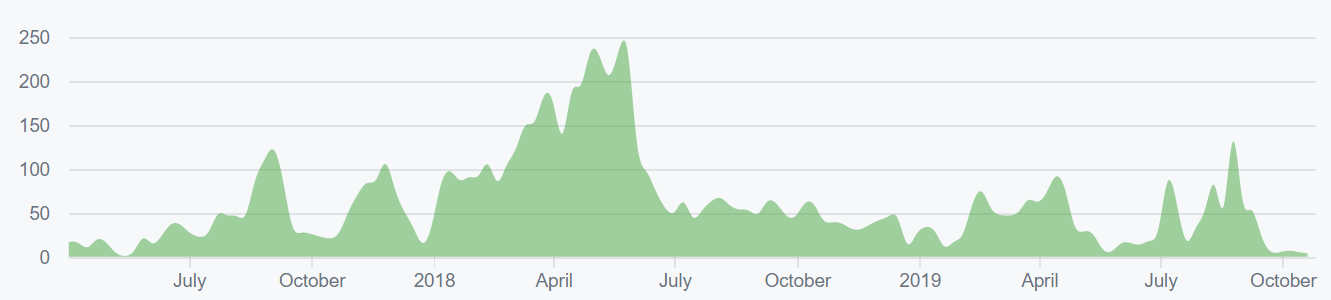

Developer activity for the EOS project on Github has produced over 2,000 commits in the past year on the main repository (shown below). Most coins use the developer community of Github. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Larimer pushed 15 commits in May 2018, with his commit contribution dropping off precipitously after June 2018. Larimer has also been working on a decentralized identity solution that was granted a patent. Despite Larimer’s absence from core dev work, incremental protocol updates continue.

EOS REX (Resource Exchange), first proposed by Larimer in 2018, went live on May 1st and now has a vibrant lending community. The exchange allows users to lease EOS tokens to Dapps, or other users, for a variable fee. EOS.IO v1.8 was released via a hard fork in September, enabling Voice, a social media platform. The hard fork is supported by all BPs and major exchanges. According to voice.com, the platform remains in the beta phase of development.

Currently, approximately 64% of all circulating EOS tokens are being staked, and the network is confirming around 35 transactions per second. The record number of transactions on the network at one time stands at 3,996 per second.

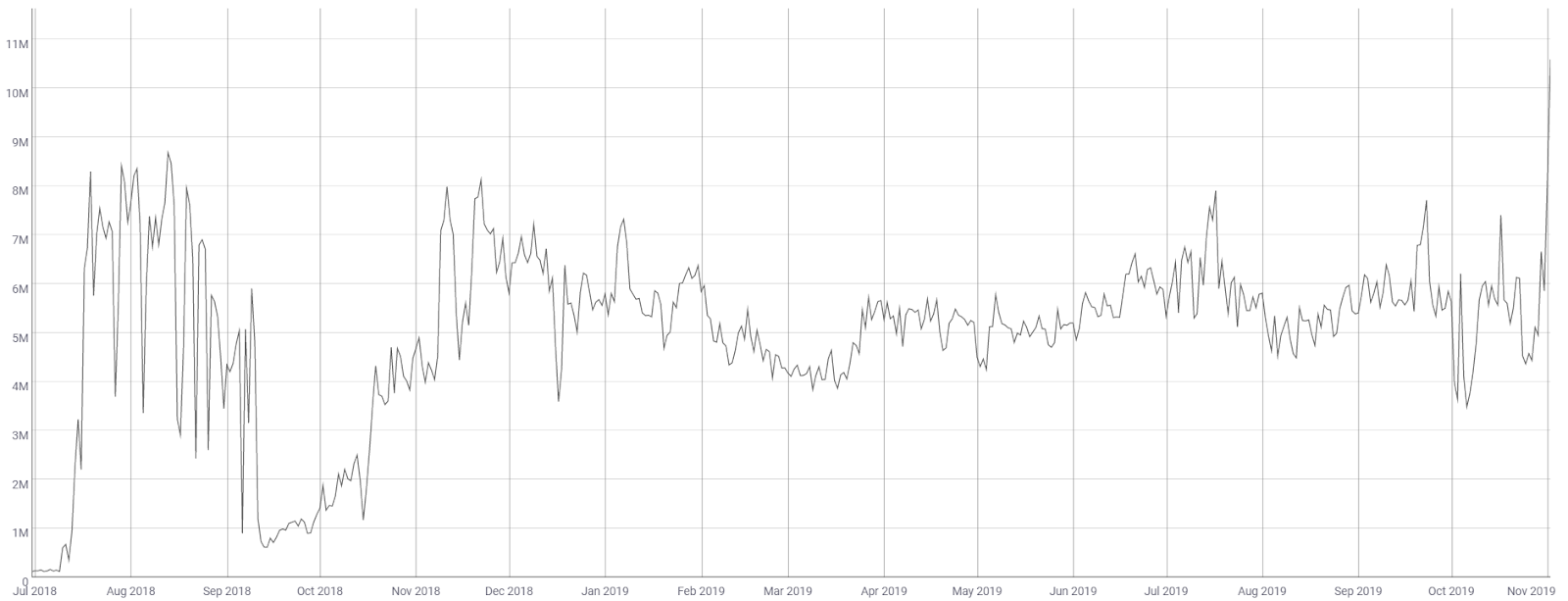

The current number of total transactions per day on the network (line, chart below) hit a new all-time high of over 10 million last week. Transaction costs on EOS are essentially free, enabling Dapp transactions to flourish. Grassroots interest on meetup.com shows nearly 61,000 people in 150 EOS-related groups worldwide and over 69,000 subscribers on the EOS Reddit sub.

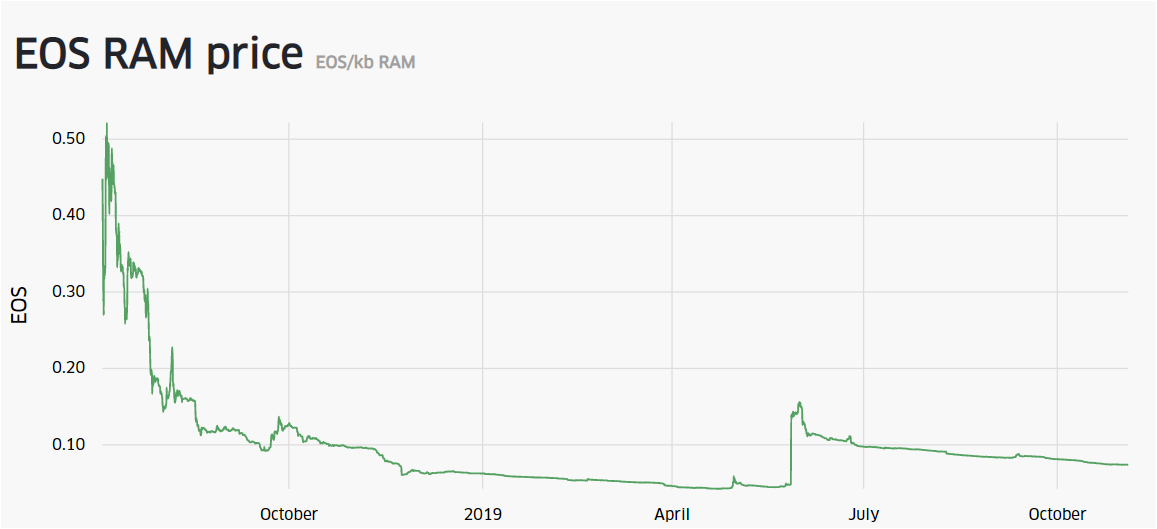

RAM on the EOS virtual machine is subject to supply and demand, as well as speculation. New EOS account creation uses 4kb of RAM and, after an account is created, there are minimal transaction fees. In July 2018, a few users attempted to corner the RAM market, causing RAM costs to skyrocket to more than 900EOS/MB. In response, 15 of the 21 EOS BPs approved a measure to double the supply of RAM, flooding the market and decreasing RAM costs.

Since July 2019, RAM costs have dropped below 0.1 EOS/KB. In June, RAM spiked to nearly 0.20 EOS/KB Block.One bought US$25 million worth of RAM for the launch of the Voice social network.

Gambling and exchange Dapps continue to be the most used application on EOS, which is likely due to gambling activity being highly regulated in most countries. These Dapps are currently outside of legal purview, at least for the moment. EOS Knights and EOS Dynasty, both role-playing games, have also seen sustained user growth since launching in August 2018 and April 2019, respectively.

Despite impressive user numbers, a report earlier this year from AnChain.AI found that blockchain bots account for 51% of all EOS Dapp users and 75% of all EOS Dapp transactions. These bogus transactions accounted for US$6 million of the daily transaction volume at the time. The report concluded that without sophisticated prediction models, Dapp leaderboard websites, or rating agencies; Investors, developers, and enthusiasts will be fooled by inauthentic numbers.

Transaction costs are also very minimal, or non-existent when interacting with EOS Dapps. Several Dapps have launched on EOS, or migrated from competitors in recent months, citing concerns over scalability or transaction costs on other platforms. These Dapps include; Effect.AI, Tixico, Unico, Medipedia, Sense Chat, Billionaire Token, EOSBet, HOQU, Everipedia, and Insights Network. Additionally, Tapatalk, a forum app with 300 million registered users, is building a reward system using the EOS blockchain.

Exchange traded volume in the past 24 hours has predominantly been led by the Tether (USDT)

and Bitcoin (BTC) pairs, with Ethereum (ETH) accounting for a smaller but substantial percentage of the volume. Tether was launched on the EOS chain on June 1st, where there are currently US$5.25 million USDT issued. Bitfinex and Huobi, which are both EOS BPs, have also launched exchanges on the EOS chain in recent months.

On April 9th, the EOS/USD, EOS/EUR, and EOS/BTC pairs were added to Coinbase Pro. EOS was made available for purchase on Coinbase.com on June 1st, along with the addition of an educational program about the EOS chain. THE EOS/USDT pair was added to Bitfinex on April 12th and Bittrex International added EOS/USDT, EOS/BTC, and EOS/ETH pairs on July 3rd. Margin pairs for EOS/USDT and EOS/BTC were also added to Binance in August. In the custody realm, Trezor added EOS support in late July. EOS holders can also now earn 4.25% interest on funds held within Celsius.

The Korean exchange Bithumb has been hit hard by hackers over the past year, including a loss of US$18 million in various coins during a theft in August 2018, and a loss of US$15 million of EOS on March 2019. The second hack came on the heels of the exchange cutting 50% of its staff, or 150 people, due to declining trade volumes. ChangeNOW, a non-custodial exchange service, reportedly intercepted and returned US$500,000 worth of the stolen EOS tokens to the exchange. Some reports have concluded that the exchange has been repeatedly targeted by North Korea, while others suggest the possibility of disgruntled staff playing a role in the theft.

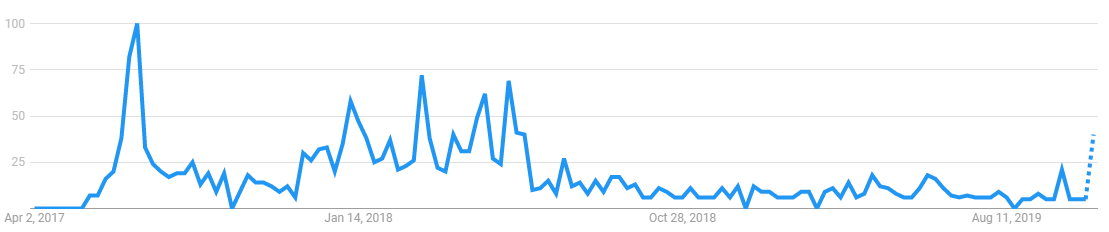

Aside from a brief period between July 2017 and March 2018, Google Trends data for the term "EOS.IO" has mostly been pinned to the floor. The increase in 2018 likely signaled a large swath of new market participants at that time. Over the past week, Google started projecting a steep increase in searches, leading to a new yearly high. A 2015 study found a strong correlation between the google trends data and bitcoin price, while a 2017 study concluded that when the U.S. Google "bitcoin" searches increase dramatically, bitcoin price drops.

Technical Analysis

EOS has followed the majority of the wider crypto market, with a bullish bounce off of the recent local low. This double bottom may signify the end of the previous bearish trend. The strength and duration of any trend can be measured using Exponential Moving Averages, Volume Profile of the Visible Range, Pitchforks, and the Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

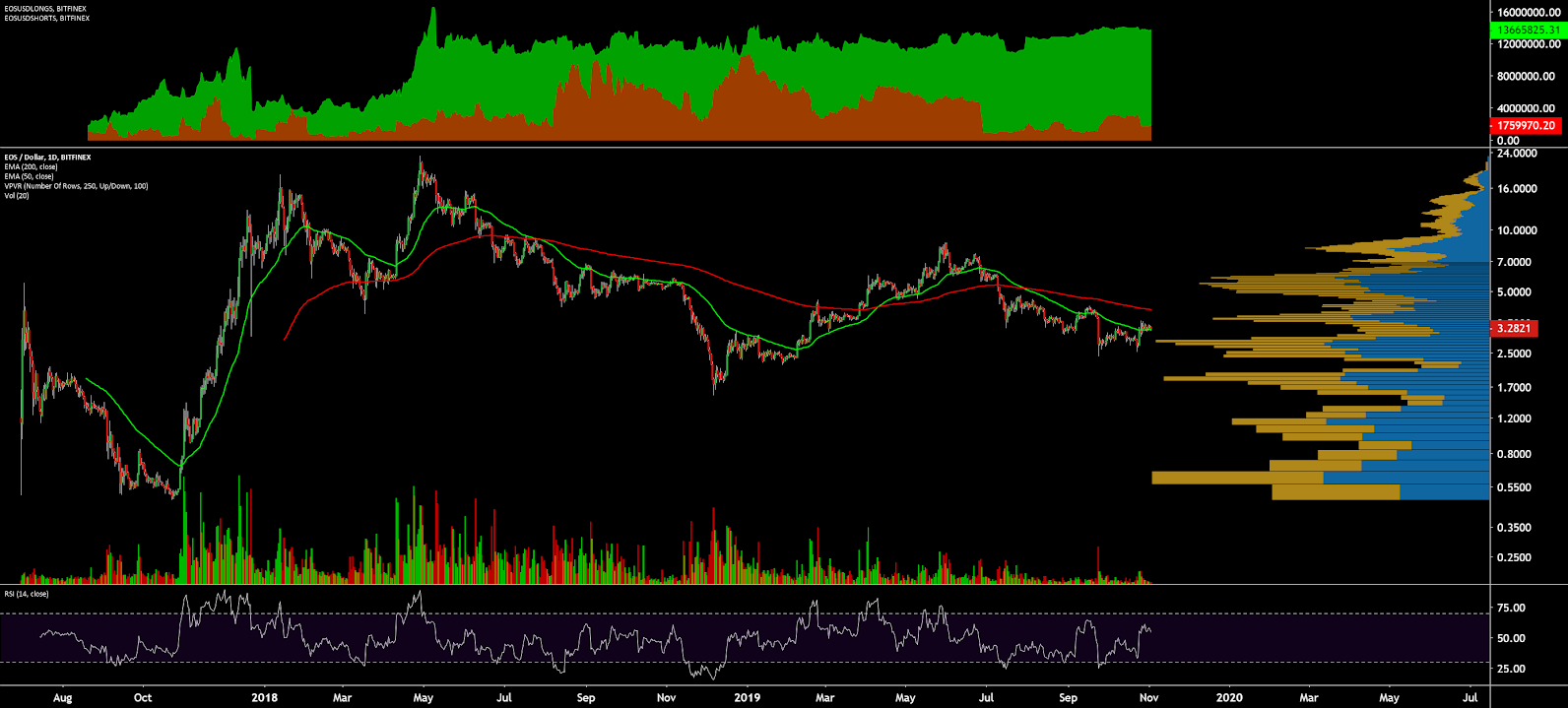

On the daily chart for EOS/USD, the 50-day and 200-day Exponential Moving Average (EMA) have been bearishly crossed since July 28th. This Death Cross signifies a higher likelihood of a continued drift lower, rather than any sustained bullish momentum. Both EMAs should now at as resistance.

The Volume Profile of the Visible Range (VPVR, horizontal bars chart below) shows a strong zone of support at US$2.80 with lower support at US$1.90. The December low of US$1.50 should also act as strong psychological support. Upside VPVR resistance sits at US$3.80 and US$5.00.

Bitfinex long/short positions are currently 88% long, with long interest ranging near record highs and shorts decreasing slightly over the past month (top panel, chart below). The late June reduction in short interest mirrors a reduction in short interest on Bitfinex for BTC on the same day. A significant price movement downwards will result in an exaggerated move as the long positions begin to unwind. Additionally, there are no volume or RSI divergences currently.

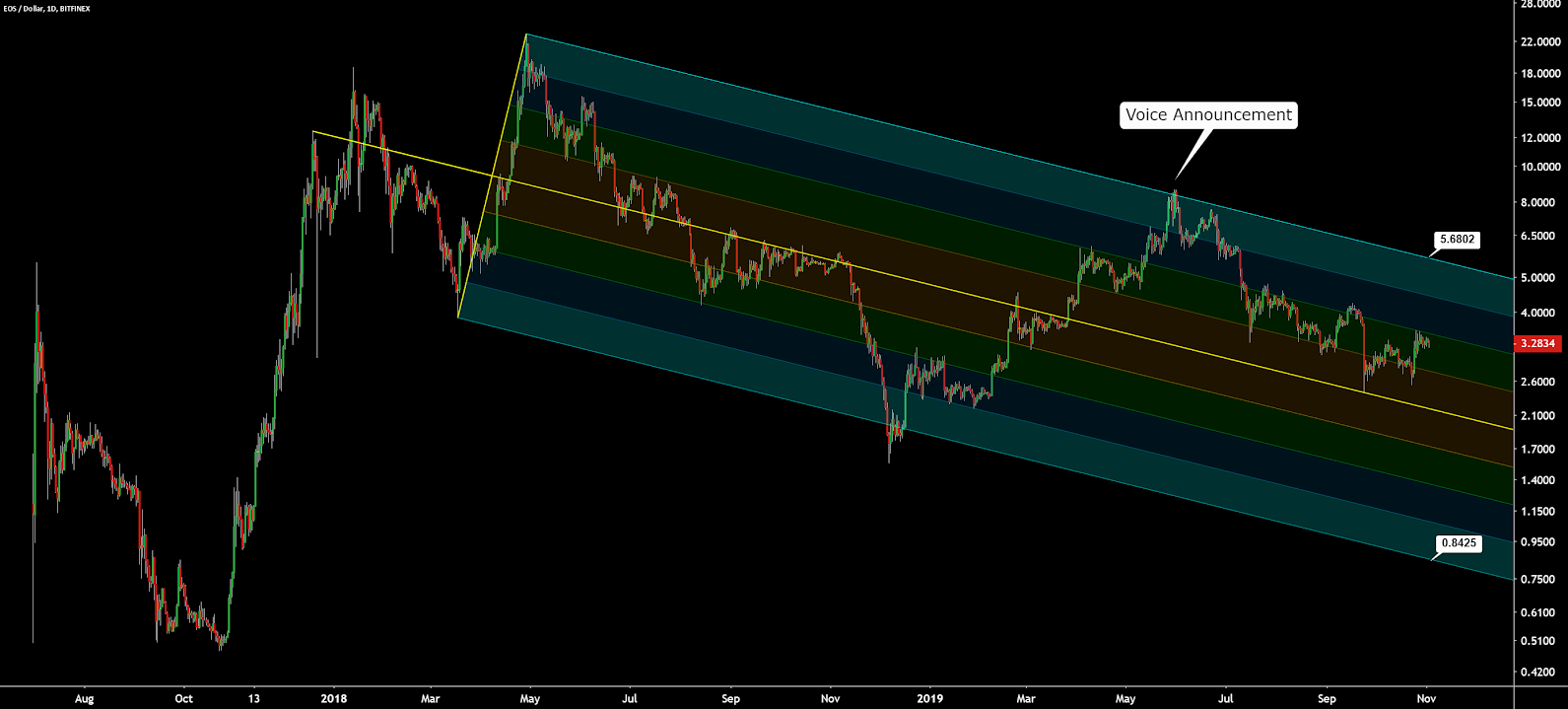

The current spot price continues to reside within the boundaries of a bearish Pitchfork (PF) with anchor points in December 2017, and March and April 2018. Price cleanly broke up from the median line (yellow) on March 27th, and reached the opposite edge of the PF on June 1st, coinciding with the Voice announcement. Price also recently rebounded from the median line, suggesting a move toward the upper resistance of the PF. The spot price will need to exceed US$5.50 to invalidate the now 550-day bearish PF.

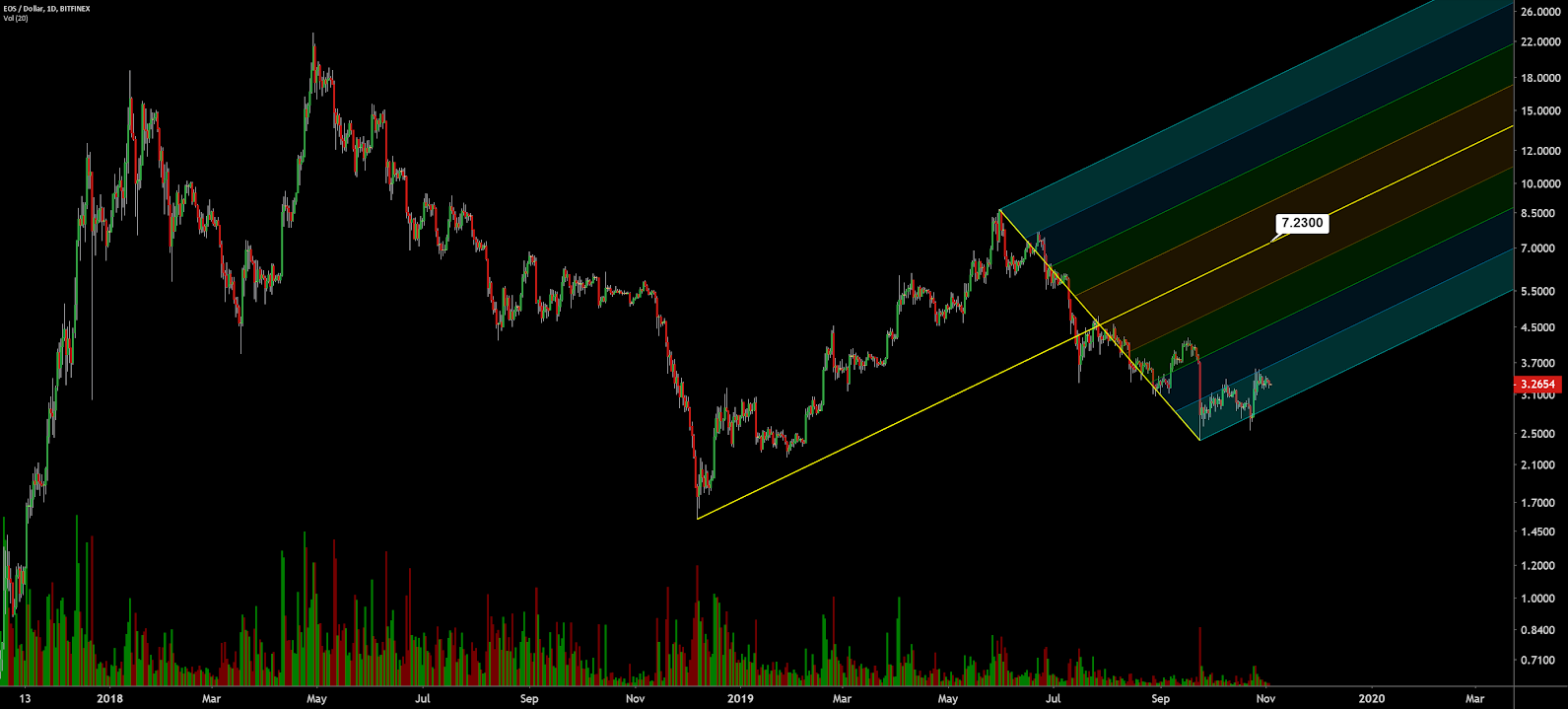

Alternatively, a bullish PF with anchor points in December, May, and September may also be in the early stages of formation. If the spot price makes a lower low, this PF will be negated. Otherwise, a return to the median line at US$7.23 is highly likely. The fate of this bull channel will likely be decided by December.

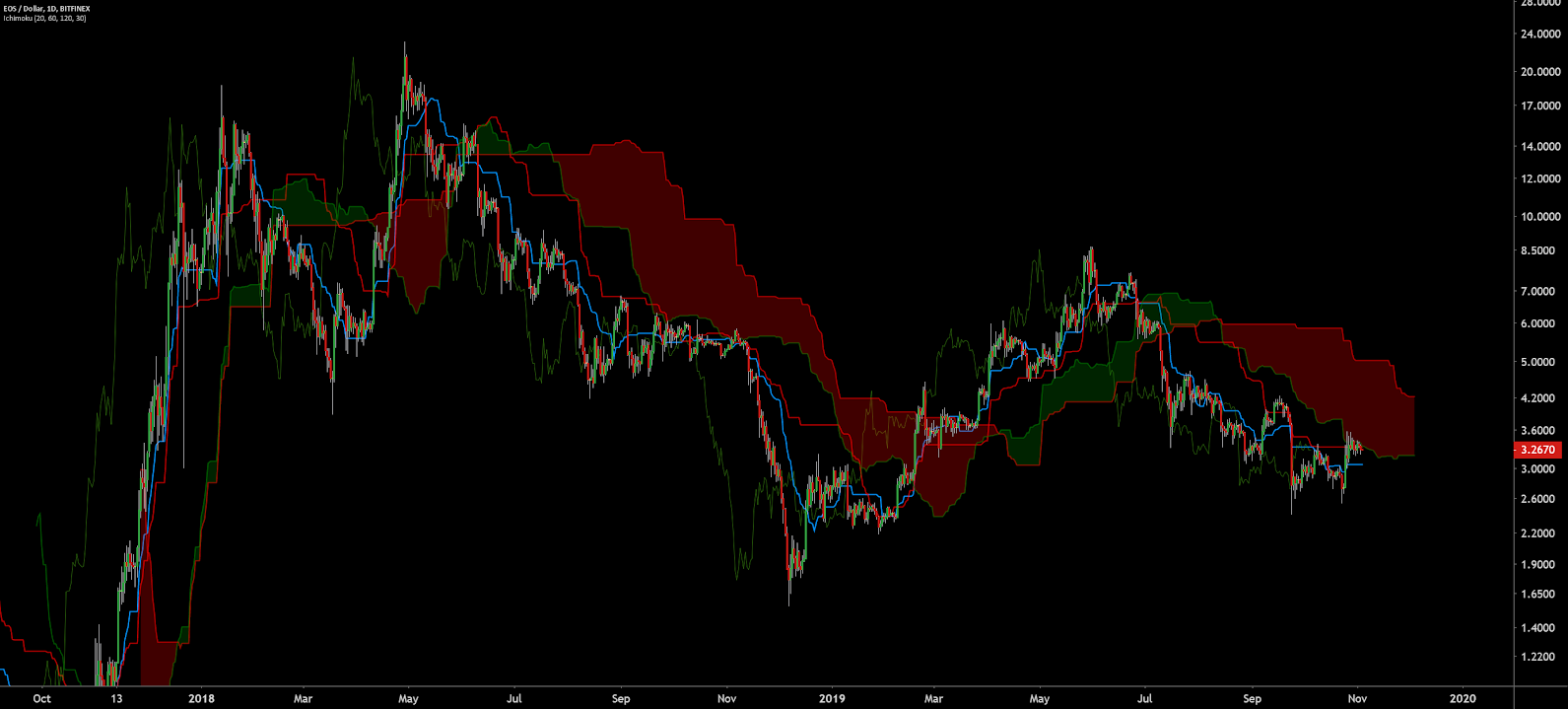

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

The status of the current Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are bearish; price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is below Cloud and in price.

A bear trend started on July 10th when the spot price broke below the Cloud. A traditional long entry signal will not trigger until the current spot price traverses the Cloud. The long flat Kumo at US$4.20 will act as a magnet for price so long as price does not make a lower low.

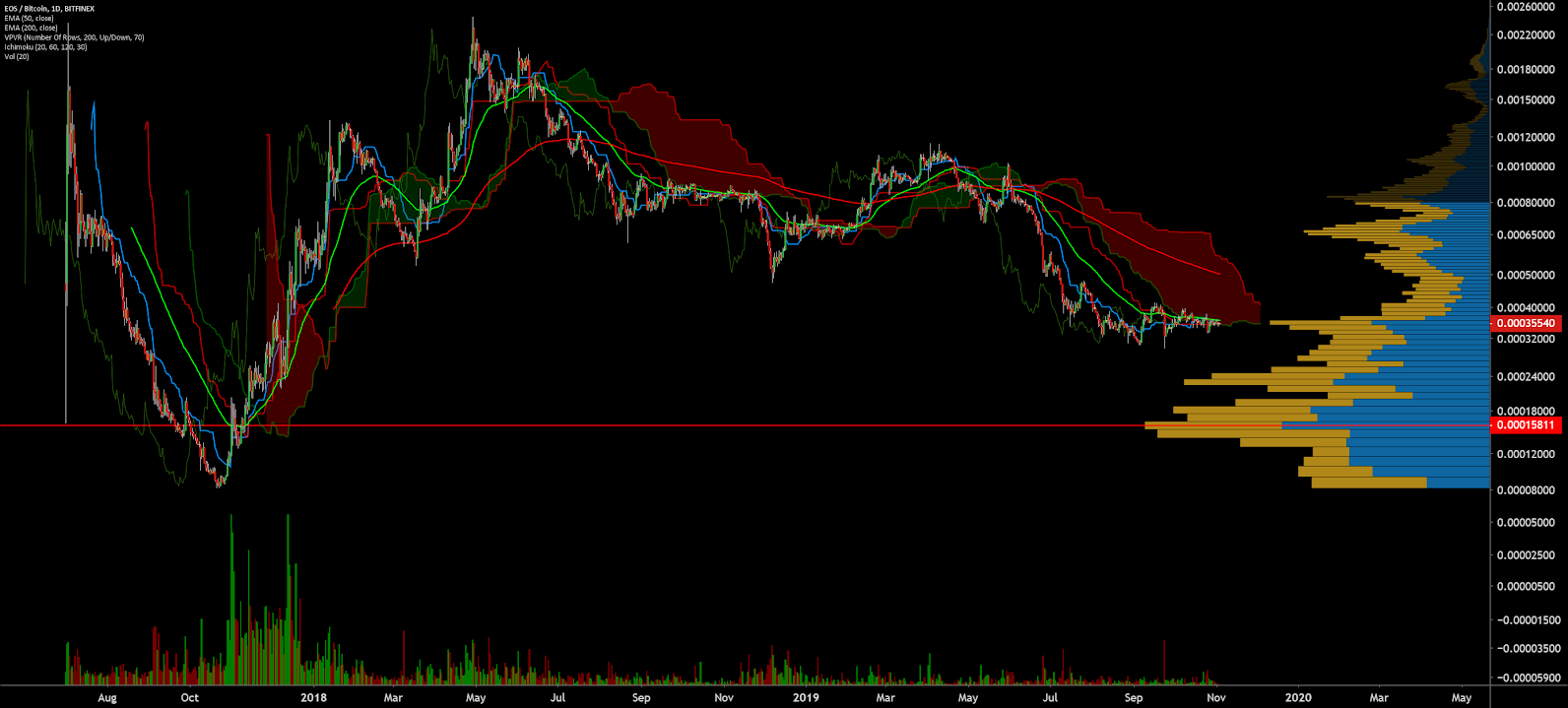

Lastly, trend metrics for the EOS/BTC pair continue to suggest a waning bearish trend; price has begun to enter the Cloud and the 50-day and 200-day EMAs have begun to flatten. Mean reversion to the 200-day EMA would also bring the spot price to the psychological resistance level of 50,000 sats.

A bullish Kumo breakout is also possible in the month of December, so long as the spot price does not make a lower low. VPVR suggests significant support at the 29,000 sat zone and resistance at the 55,000 sat zone. Bitfinex EOS/BTC long/short open interest is currently 58% net long (not shown). Additionally, there are no current RSI or volume divergences.

Conclusion

EOS has led the numbers game in terms of Dapp activity and transactions per day for many months, with transactions per day hitting an all-time high this week. However, further investigation has shown that 75% of these transactions may be bot activity. Total transactions per day on the EOS chain are likely a fifth of the reported ten million. This may not come as a surprise, as transaction costs are free on the EOS chain. Additionally, the current EOS full node size could not be determined, but the chain has very likely developed further blockchain bloat beyond the 4TB discussed earlier this year. Many functional full nodes are important for a network to maintain decentralization and to continue running smoothly. Sooner rather than later, EOS will need to deal with the growing burden of both blockchain size and bandwidth requirements.

Further risks of centralization on EOS comes in the form of the BP governance system, which is absent in many other blockchains and, for many, is antithetical to crypto ideology in general. Even when functioning as intended, unless all 21 of the BPs have an updated account blacklist, a compromised account can still slip through the cracks, and an automatically enforced blacklist could be described as censorship.

Technicals for both the EOS/USD and EOS/BTC pairs show an active but waning bearish trend. Mean reversion targets for both pairs are US$4.20 and 50,000 sats with any further bearish price action finding support at US$2.90 and 25,000 sats. The multi-month bearish Pitchfork will continue to hold on the EOS/USD pair until the spot price breaches the US$6.00 zone. If it does not make a new local low, a newly formed bullish Pitchfork suggests a price target of US$7.20.

OhNoCrypto

via https://www.ohnocrypto.com

Josh Olszewicz, Khareem Sudlow