Deal Flow - Q3 report

In Q3 there were approximately 143 investments made in blockchain/cryptocurrency companies totaling to US$632.5M, a 68% decrease compared to Q2.

Of the 143 investments, 22 were token sales and 121 were equity investments. There were more equity investments made compared to Q2 and slightly less token investments. Of the twenty-two token sales, twenty were IEOs, two more than Q2. This confirms our hypothesis from the Q2 report that there will be a fairly consistent number of IEOs rather than a significant increase.

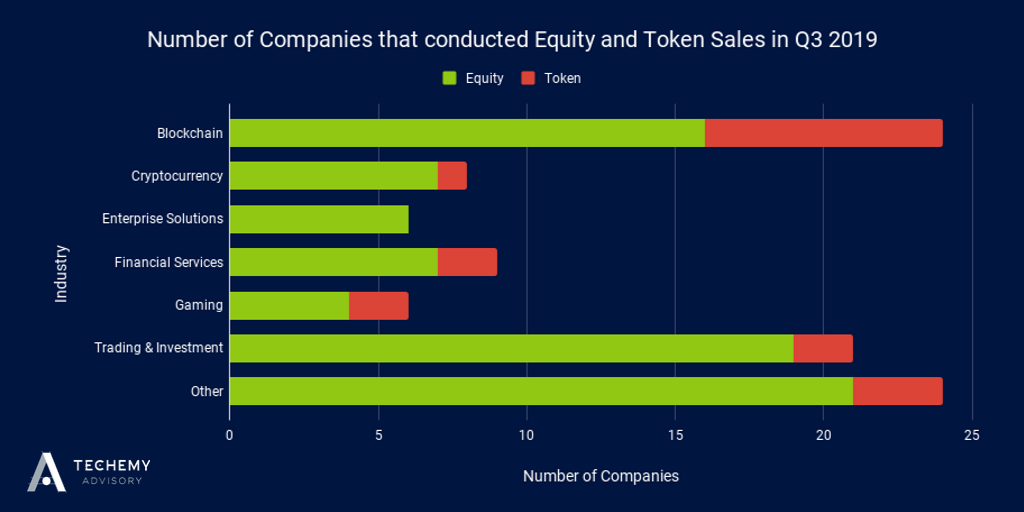

As seen in figure 1 above, the Blockchain sector and Other category both had twenty-four companies raising capital. The “Other” category had the largest number of equity raises at twenty-four, and consisted of companies in fourteen industries including Supply Chain, Data, Property, Ticketing and more. The Trading & Investment sector had the most companies raising equity capital in a single sector at nineteen. The Blockchain sector had the most companies conducting token sales. Eight companies from the Blockchain sector conducted token sales, which is more than companies that did equity raises in the Cryptocurrency, Enterprise Solutions, Financial Services and Gaming sectors.

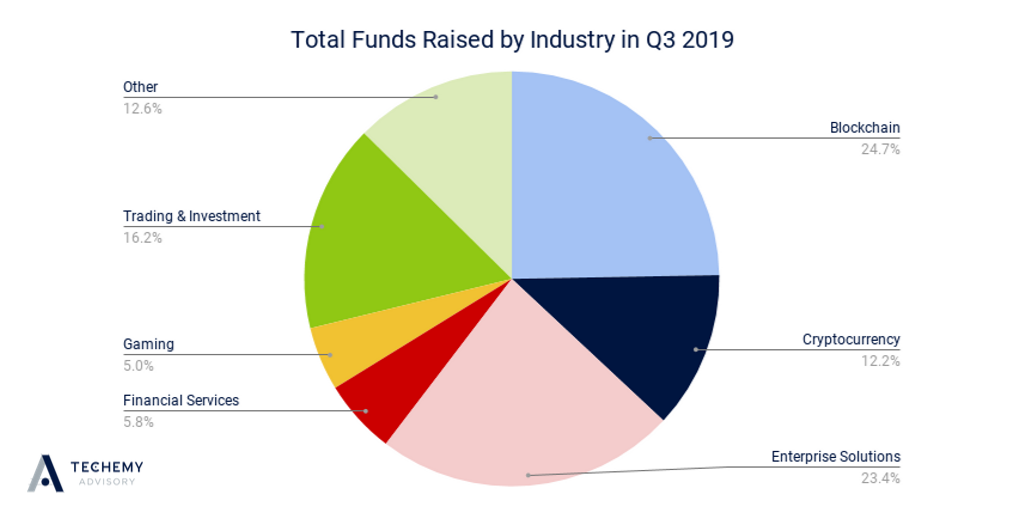

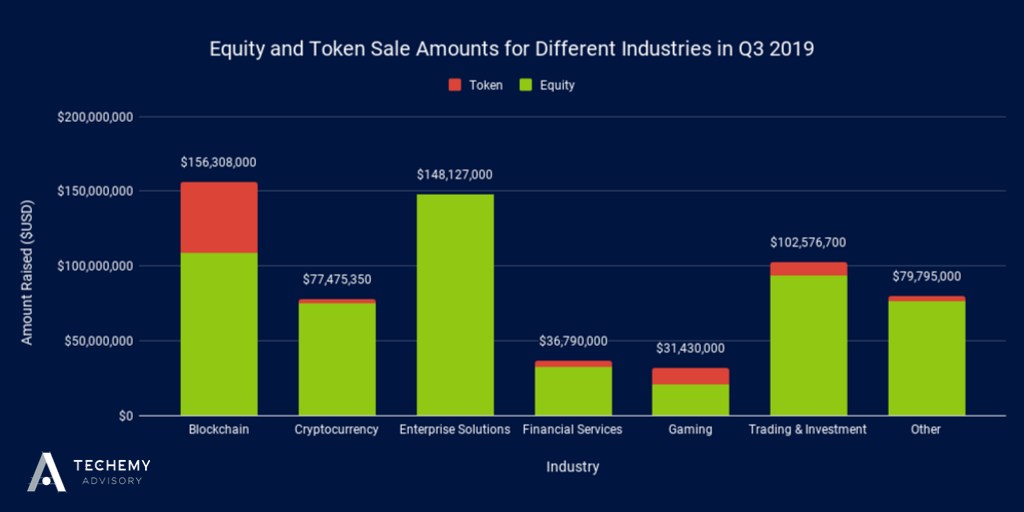

Even though a large proportion of companies that conducted raises in Q3 were spread across various industries and grouped as “Other”, they only represent 12.6% of total funds raised in Q3 as seen in Fig 2. The Blockchain sector represented just under a quarter of all capital raised, while the Trading and Investment sector, the sector with the most companies conducting equity raises represented only 12.2% of all capital raised. As seen in Fig 3, 30% of capital raised in the Blockchain sector was by token sales.

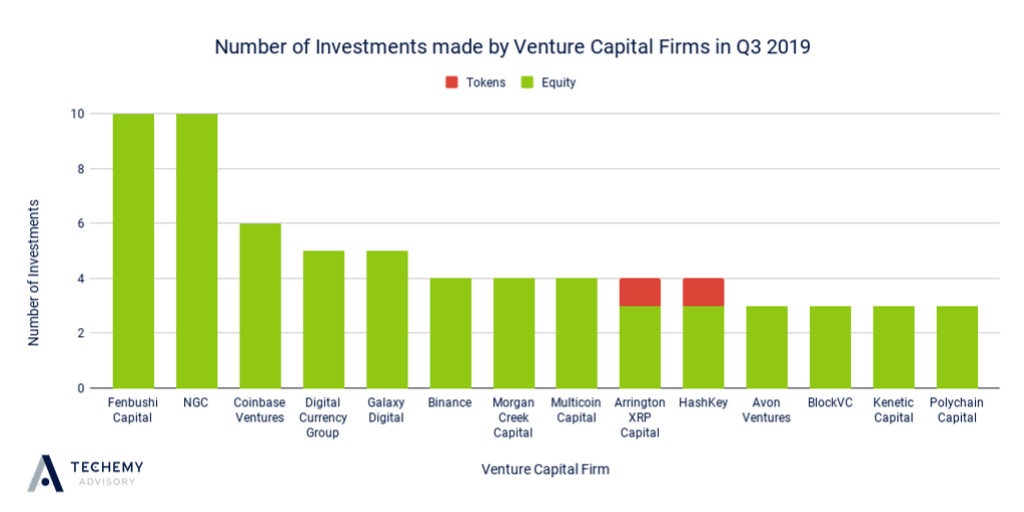

A few of the major blockchain/crypto investors were identified to have made more than one investment in Q3 2019 as seen in Fig 4, Fenbushi Capital and NEO Global Capital (NGC) made ten investments each, Coinbase Ventures made six investments, Binance, Morgan Creek Capital, Multicoin Capital, Arrington XRP Capital, and HashKey made four investments each. BlockVC, Kenetic Capital, and Polychain made three investments each.

There were a range of other crypto/blockchain investors that made at least one investment in Q3 and they include, Xpring, ConsenSys, Bain Capital Partners, gumi Cryptos, Hashed, Dragonfly Capital Partners, NEM Ventures, Coinshares, Medici Ventures, Winklevoss Capital, Pantera Capital, Alphabit Fund, and Placeholder. A few well known investors such as Union Square Ventures, Lux Capital, Arrington XRP Capital, Hashkey Group and Fenbushi Capital among others took part in the Blockstack token sale, which raised $23M from public and private investors.

Q3 2019 saw many traditional Venture Capital firms and institutions make investments, as seen above in Fig 5. Fidelity made two investments directly, and three investments via its subsidiary Avon Ventures. Tier one Venture Capital firms, Andreeseen Horowitz and Kleiner Perkins made two investments each, while Nomura and Naspers Ventures also made two investments each.

As can be seen in Fig 6 a few of the biggest names in crypto made acquisitions in Q3. Kraken, acquired Interchange, an accounting, reconciliation and reporting service provider for cryptocurrency hedge funds, asset managers and fund administrators. Bittrex acquired Tradedash, a trading tool that offers customers a customisable trading experience. Binance acquired JEX, a crypto-asset trading platform offering spot and derivatives trading services. Ripples Xpring, acquired Logos Network, a startup developing payments solutions focused on speed and scalability and Ripple acqui-hired Algrim, a Iceland based crypto trading firm and experienced developer of crypto trading platforms.

For the full report and Deal Flow's outlook for Q4, follow the link below.

OhNoCrypto

via https://www.ohnocrypto.com

Nawaz Ahmed, Khareem Sudlow