Cash App: Square Crypto Exchange User Review Guide

How to Use, Trade and Sign Up on Square Cash App Guide

Square Cash App is a peer-to-peer payment app aiming to make it easy to send money to anyone. The Cash App also lets you buy and sell bitcoin. Here’s our Twitter CEO Jack Dorsey-led Square Cash App review.

Features

- Buy, sell, and transfer bitcoin with no added fees

- Available for iOS or Android

- Send and receive payments from anyone

Deposit Methods

- Bitcoin (check live BTC price here)

- Fiat currencies

- Bank transfer

Pros

- Free payment service

- Simple, clear interface and setup

- Order a free debit card to spend Cash App funds anywhere

Cons

- Low daily payment limits

- Not as widely used as competitors like Venmo

- No international payments

Cash App Introduction

Square’s Cash App is a popular payment app available for free for iOS and Android. The app lets you send and receive money for free with a surprisingly simple user interface. You can connect a bank account, order a Visa debit card, and withdraw money to your bank at any time.

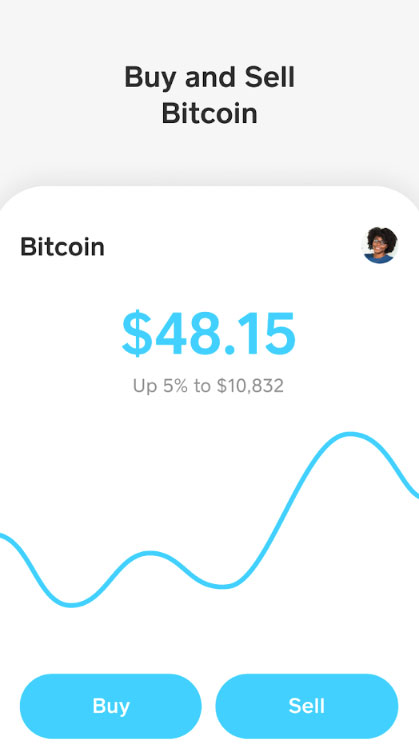

Cash App also supports bitcoin. You can buy and sell bitcoin directly within the app. You can buy bitcoin, then sell it for a profit and withdraw those profits to your bank account. You can also transfer bitcoin from your wallet to the Cash App to sell it or spend it.

Cash App doesn’t charge fees for most ordinary transactions, although businesses will pay a 2.75% fee when receiving payments. Personal transfers and standard withdrawals are free. You will not pay any added fees when buying bitcoin, although Square may make money off the spread.

The Cash App is only available in the United States to residents of the 50 states (territories are not included). Square recently launched a version of the Cash App in the United Kingdom as well.

There are several major advantages that Cash App has over the competition. It has the easiest payment interface you’ll see in the industry, for example, and it’s dead simple for anyone – even someone who’s technologically illiterate – to send and receive money through the Cash App. It’s also one of the few apps that supports bitcoin. The fees are competitive with other payment platforms, although the Cash App has slightly lower daily limits than competitors like Venmo.

Square is a San Francisco-based payment service provider led by CEO Jack Dorsey (who is also the co-founder and CEO of Twitter). The company provides a point of sale (POS) solutions to millions of businesses across the United States and worldwide.

Cash App Key Features

Key features of the Cash App by Square include:

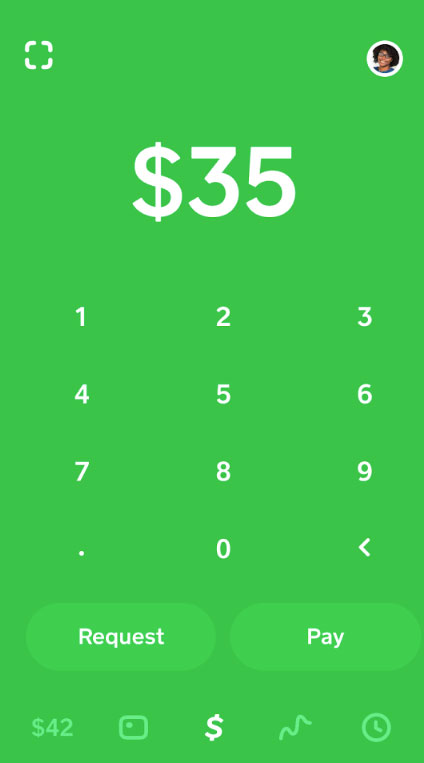

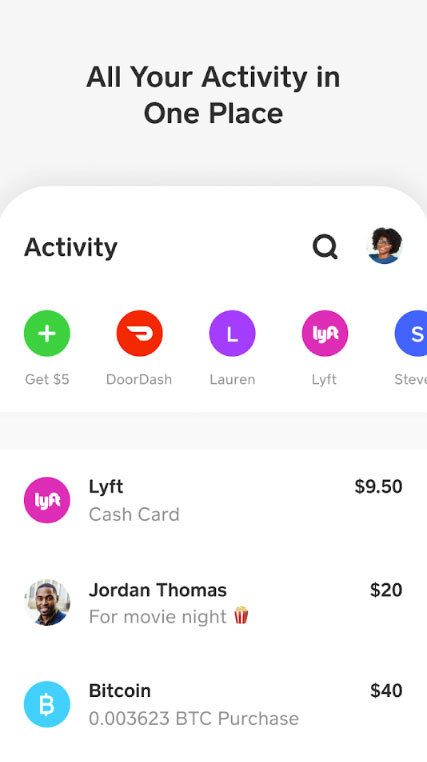

Easiest Payment App Interface: Venmo and Google Pay both have an easy-to-use interface, but none of them are as good as the Square Cash App’s UI. It’s dead simple for anyone to use.

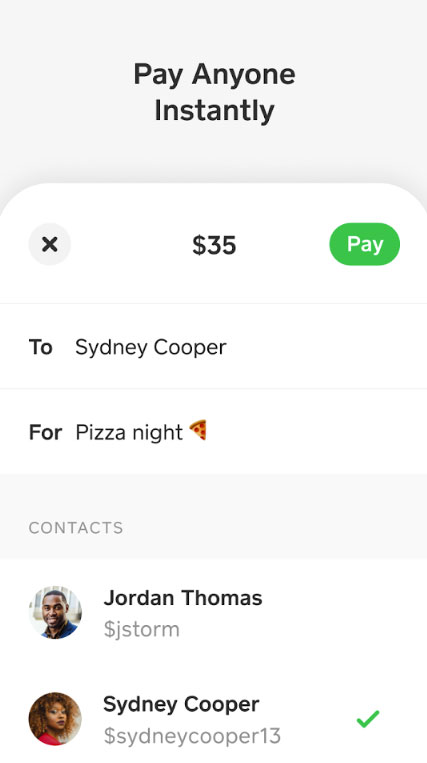

$Cashtags: Cash App has created something called ‘$Cashtags’. You can send money to someone using their Cashtag URL alone without asking for email addresses or phone numbers. You can also make your $Cashtag public, letting anyone send you money (say, for a donation).

Connect to Payees Via Bluetooth: The Square Cash App lets you scan for local payees and connect to them using Bluetooth LE.

Available for iOS and Android: The app is a free download from the iOS or Android app stores.

Spend with a Free Cash Card Visa Debit Card: The app lets you order a Cash Card Visa Debit card, then spend funds from your Cash App account at any store that accept Visa. It’s an easy way to access the money in your account. Some retailers also offer various “Boosts” (discounts) to Cash App users.

Personal or Business Use: When setting up the app for the first time, you’ll be asked to choose a personal or business option. If you plan to use the account for both, then Square recommends setting up two different accounts and switching between-n them for payments.

Send and Receive Money Through iMessage or Facebook Messenger: The Cash App integrates directly with iOS’s iMessages, letting Apple users send and receive funds just by sending a text. You can do the same with Facebook Messenger.

Send Money with Siri: Cash App even lets you send money with Siri. You can ask Siri to send money to anyone in your address book. You can say, “Hey Siri, send $50 to Dad using Cash”, for example.

Instant or Standard Bank Transfers: Square Cash can deposit funds into a bank account at two speeds: standard or instant. Standard transfers take up to three days to appear in your account. Instant transfers will arrive in your bank account immediately.

No Fees: The Cash App doesn’t charge money for standard money transfers from debit accounts. However, senders are charged a 3% fee if using a credit card. You will also be charged a 1.5% fee if you choose the “instant” fund deposit option instead of the “standard” option.

Higher Fees for Businesses: The Cash App doesn’t charge for standard money transfers between friends. Business users, however, will pay a 2.75% fee for each payment received, similar to PayPal.

Merchant Accounts: If you choose the ‘business’ option when signing up for the Cash App, then you can issue refunds. This is the only difference between a business and a personal Cash App account.

Low Daily Payment Limits: The Square Cash App has low daily limits compared to many of its competitors. You can send up to $250 within a seven day period and receive up to $1,000 per 30 day period. For comparison, Venmo has a $300 initial weekly cap that rises to $3,000 with further verification, while Google Pay has a $9,999 limit per transaction.

Higher Payment Limits After Verification: After you complete verification with the Cash App, your payment limits will rise, although Square still has lower limits than its competitors. With verification, you have a sending limit of $2,500 per week and no receiving limit.

Standard Verification Process: To verify your Cash App account and unlock higher spending limits, you will need to verify your name, date of birth, and the last four digits of your SSN.

No Social Networking Features: Venmo has a social feed that lets you see payments sent between friends. The Cash App has no social feed whatsoever.

No International Payments: The Cash App does not let you send payments internationally. As an American Cash App user, you cannot send money to your friend in Germany, for example.

Apple Watch Support: Square’s Cash App works well with the Apple Watch. You can perform simple tasks like accepting or rejecting payments and sending virtual stacks of cash to friends and family via Bluetooth, for example, all from your Apple Watch.

No Connection to Square POS Machines: Many small and medium-sized businesses use Square as their point of sale (POS) service. Unfortunately, there’s no way to connect the Cash App with the Square POS system, which means you can’t spend your Cash App money at retailers that use Square.

United Kingdom Version Available: Although the Cash App doesn’t support international payments, Square recently released a version of the Cash App for UK residents.

Buy Bitcoin: In January 2018, Square added bitcoin support to its Cash App, allowing users to buy and sell bitcoin within the app. You can buy bitcoin within the app, hold it, then sell it for profit and withdraw the profits to your bank account.

No Fees When Buying Bitcoin: The Cash App doesn’t charge any fees when buying or selling bitcoin. However, the app may apply an exchange rate based on the size of your transaction and a spread determined by volatility across US crypto exchanges.

Deposit Bitcoin: In June 2019, Square added the ability to deposit bitcoin into the app. Now, you can use the Cash App like a wallet, transferring funds from your existing bitcoin wallet into the Cash App.

Square Cash App Currencies and Pairs

Cash App currently only supports Bitcoin (BTC). You can buy and sell BTC for USD.

Square Cash App Supported Deposit and Withdrawal Methods

The Square Cash App connects to all major banks, letting you transfer money directly to and from your bank. You can choose a standard deposit or withdrawal, which is free and takes up to three days, or an instant deposit or withdrawal, which is instant and has a 1.5% fee.

Square Cash App Registration and Login Process

The Cash App has a straightforward registration and login process. You install the app for free from the Android or iOS app store. You can send and receive money immediately. To increase payment limits, you’ll need to verify your ID by providing your name, date of birth, and the last four digits of your SSN. You must be 18 years old and live in one of the 50 states to use the Cash App (international versions of the app are also available for residents of the UK).

Square Cash App Trading

The Square Cash App lets you buy and sell bitcoin with no added charge. You’re buying and selling bitcoin through Square. It’s not a P2P exchange.

Square Cash App Fees

Cash App doesn’t charge fees for sending debit payments. However, senders are charged a 3% fee for using a credit card. You will also pay a 1.5% fee if you’re transferring money to your bank using the “instant” option instead of the “standard” option. Business owners pay a 2.75% fee for each payment received:

Sending and Receiving Money: Free for personal use (2.75% fee for receiving business payments)

Withdrawal Fees: Free (for standard withdrawals) or 1.5% (for instant withdrawals)

Credit Card Fees: 3%

Buy and Sell Bitcoin: Free (exchange rate spread may be applied)

Square Cash App Security Issues and Downtime

The Cash App is well-respected in the payment industry. It’s made by Square, one of the industry’s largest payment providers. Square’s website describes how the Cash App uses the same fraud detection infrastructure and safety standards it uses for it's business customers completing point of sale transactions. Plus, when you send money through the Cash App, the information is encrypted before it’s sent to Square’s servers. Other security features include two-factor authentication (you can choose to enter a password before sending any payment) and integration with Touch ID and Face ID.

Square Cash App Ease of Use

The Cash App is the easiest payment app to use by far. It has a dead simple interface that requires no tutorial. Open the app and send money. It doesn’t get much easier than this.

Square Cash App Trust and Privacy

Square is a well-respected payment service provider, which means the Cash App is made by one of the most trusted names in the industry. Your information is encrypted before being sent to Square, and the Cash App uses PCI DSS (Payment Card Industry Data Security Standard) Level 1, which is the same security used by major credit cards. You can also enable Face ID or Touch ID verification for payments.

Square Cash App Customer Service

Square lets you contact customer support through the app (tap your profile, then scroll down and tap Cash Support). The Cash App has poor reviews for customer service. Many customers complain about receiving a message like this, and then struggling to enable their account afterwards: “After a recent review of your transfer of funds, we detected the use of Cash App for activity in violation of Square's Terms of Service. As a result, you will no longer be able to use Cash App to send or receive payments.” After getting this message, it may be difficult to re-enable your account.

Square Cash App User Guide: How to Setup and Use Cash App

1. Sign Up

Install the Cash App for iOS or Android.

2. Verification

You can send and receive money instantly within the app. You can add contacts, send money via iMessage or Facebook Messenger, or send and receive funds through a $Cashtag.

3. Two Factor Authentication

Without verification, the Square Cash App has low daily payment limits. You can send up to $250 within a seven day period and receive up to $1,000 within a 30 day period.

To raise your limits, you will need to complete verification by providing your name, date of birth, and the last four digits of your SSN.

4. Payment Method

You can link a bank account with Square Cash App to deposit and withdraw money directly from your bank.

You can also order a free physical debit card that lets you spend your Cash App funds at any store that accepts Visa.

5. Trading Cryptocurrency

You can buy and sell bitcoin within the Cash App with no added fees (although Square may make money off the spread).

You can buy as little as $1 of bitcoin, and the BTC arrives in the app instantly. You can also transfer BTC from your wallet to the Cash App.

6. Withdrawal

You can withdraw your money from the Cash App at any time. Two withdrawal options are available, including standard withdrawals, which are free and take up to three days, and instant withdrawals, which are instant and have a 1.5% fee.

Final Word

The Square Cash App is one of the most popular payment apps available today. It’s currently competing with Venmo, Google Pay, and Apple Pay for market share.

The Cash App is similar to its competitors in a lot of ways. It has similar fees, payment limits, and usability.

The Cash App, however, has the best and easiest UI in the industry. It also has the best bitcoin support of its competitors, allowing you to buy, sell, transfer, and hold bitcoin all from directly within the app. It’s available as a free download for iOS and Android today with extensive bitcoin support options.

The post Cash App: Square Crypto Exchange User Review Guide appeared first on Master The Crypto.

OhNoCrypto

via https://www.ohnocrypto.com

Aziz, Master the Crypto Founder, Khareem Sudlow