Crypto Market Forecast: 28th October

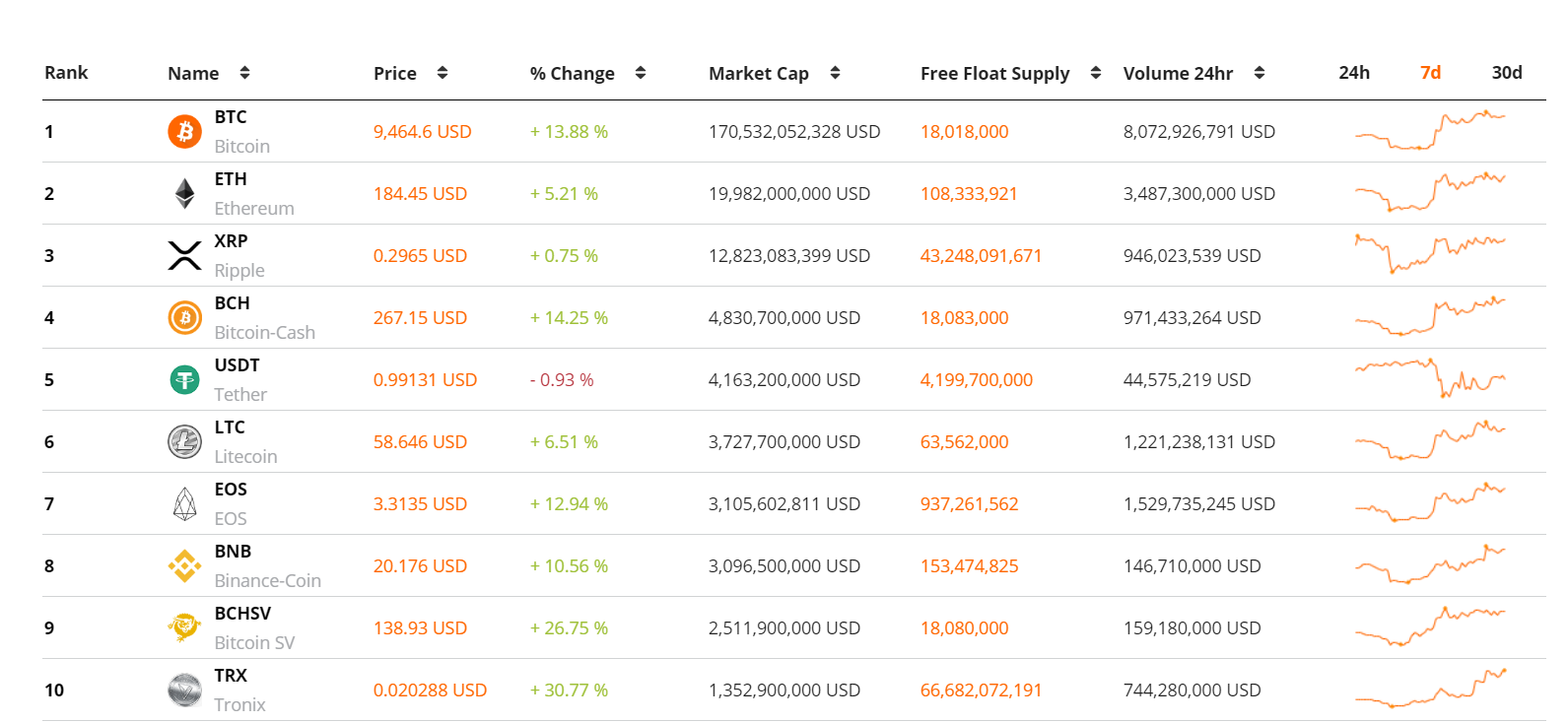

It was an exciting end to the week in the crypto markets. Following a ~$500 price drop on Wednesday that saw the price of BTC touch a 5 month low, Bitcoin surged upward before pulling back. The explosive Bitcoin move led to wide gains across the digital asset markets. The week ended with market benchmark BTC up 13%, while Asian altcoin projects such as TRX, NEO, and QTUM finished the week with gains of ~33%, ~52%, and ~36% respectively.

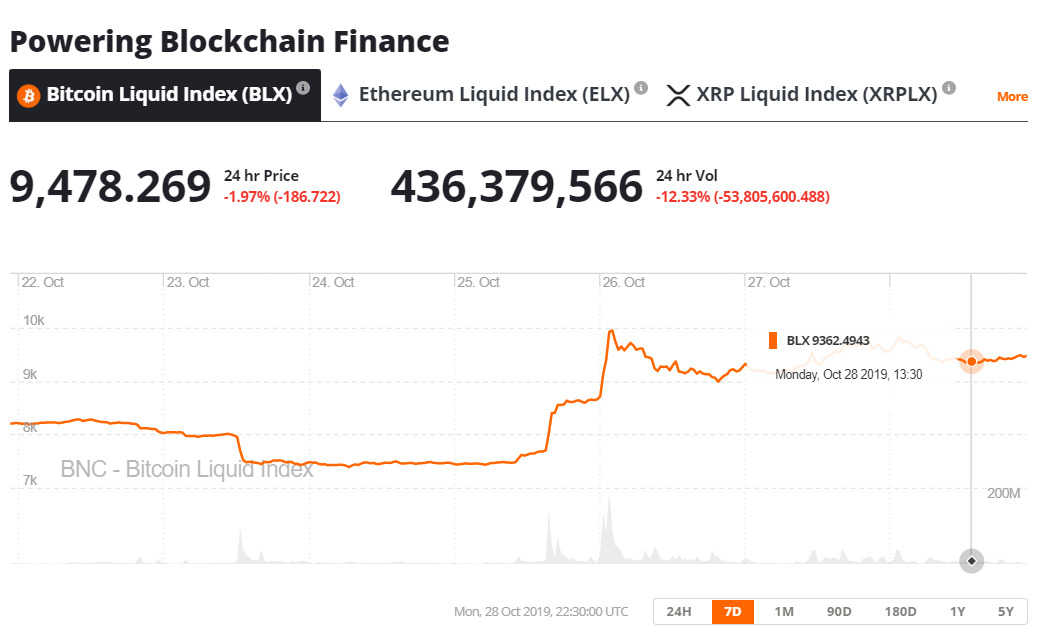

The Bitcoin surge of ~33% in under 24 hours was one of the largest one-day gains in BLX history. Q4 has typically been a volatile period for cryptocurrency traders, and a number of macro factors combined last week to ensure that Q4 2019 continued this pattern.

Many analysts have pointed to statements made by Chinese Prime Minister Xi Jingping on Thursday. He called for China to boost its adoption of blockchain, and to increase its use within China’s government, industry, and technology sectors. The comments appeared to trigger a wave of positive speculation amongst crypto market participants with some even suggesting the Chinese government is planning to accumulate Bitcoin, and others expecting a wave of new investment into Chinese blockchain companies.

Commentators have pointed out that President Xi’s comments referred specifically to blockchain technology - there was no mention of Chinese government interest in public blockchains like Bitcoin. This implies that the move was primarily driven by trader speculation as opposed to fundamentally led investors.

It appears that it wasn’t only the Chinese news event driving the bullish price activity. The BAKKT futures market hit an all-time volume high on October 26th. On the same day, over US$ 300 million in Bitcoin short contracts were liquidated on Bitmex. This suggests a cascading price effect on crypto derivatives markets, and a strong short squeeze as short-sellers were forced to cover their positions.

Many appeared to be caught off guard by the move. Following the mid-week price falls that preceded the weekend’s gains, sentiment in crypto markets appeared low while indicators like the ‘crypto feed and greed index’ leaned bearish.

The thin nature of the Bitcoin derivatives market and lack of protections offered on most trading platforms exposed many bears when the markets switched to bullish. The price accelerated upwards as more bears scrambled to cover losing positions.

This week in crypto events

28th October- 3rd November-San Francisco Blockchain Week

The crypto community will gather in the West Coast tech capital in the United States to discuss blockchain opportunities for enterprise, developers, and investors this week. Speakers at the event include community heavyweights like Ethereum creator Vitalik Buterin, Placeholder VC Chris Burniske, and Pantera Capital founder Dan Morehead. Topics on the agenda include stablecoin instability and Blockchain economics.

29th October- Scheduled decentralization of ICON blockchain

Popular South Korean project ICON undergoes the next phase of its decentralization schedule this Tuesday. This week’s upgrade appears to be a major implementation that is being executed after multiple delays. The price of the platform’s native ICX token rose ~7% in the last week.

It was a strong week of trading for crypto large-cap assets with many up by over 10% in the last week. TRX reemerged in the top 10 of the rankings, rising over 30%. Over the weekend, the project’s CEO hinted at a soon-to-be announced partnership with a major US corporation and the TRON blockchain placed 2nd on the most recently released CCID public blockchain assessment index.

The end of week burst in crypto trading pushed BTC prices above $10,000 on some exchanges but prices have resettled around the $9500 level. A new round of Bitcoin Futures opens on the CME this Monday with a large weekend price gap to fill. Analysts expect price volatility in the BTC/USD market to start the week.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow