Stocks, bonds, property or crypto: Which market is riskier?

As the Fed cut rates this week for the first time since 2008 in spite of relatively strong domestic data there are reasons to believe it’s not for the health of the economy. Europe is set for another round of quantitative easing in 2020 and New Zealand has just slashed its official cash rate 50 basis points to 1% to alleviate debt servicing in the dairy and housing industries.

The official narrative for the U.S. cuts is slowing global growth but in reality, there are many angles to it, not least pressure from the US President to devalue the dollar to stay competitive and to make it easier for the US, one of the most indebted empires in history, to continue funding its deficit.

Adjusting interest rates for reasons outside the ‘mandate’ of controlling economic inflation and employment to inflate asset prices or corporate balance sheets is central bank manipulation. There are mounting reasons to believe that is what is occurring around the world. The dynamics created by quantitative easing (a transfer of wealth from creditors to debtors) was dubbed ‘the new normal’ after being introduced during the GFC and it looks set to continue in legacy markets beyond 2020.

A contrarian’s safe haven

Bitcoin has long been made out as the boogieman of finance by the mainstream media. As the narrative goes, volatile cryptocurrency markets are manipulated by the shadowy presence of ‘whales’ (large holders of a crypto asset, often among the early adopters) who lurk in the shallow markets.

Although not ideal, is this any more of a Ponzi Scheme than what we have - 70% of global assets, held by 1% of the global population in debt-manipulated markets? Perhaps due to this slow realization of monetary manipulation by central banks, Bitcoin is starting to be used as it was first intended: a safe haven from the manipulation of legacy markets.

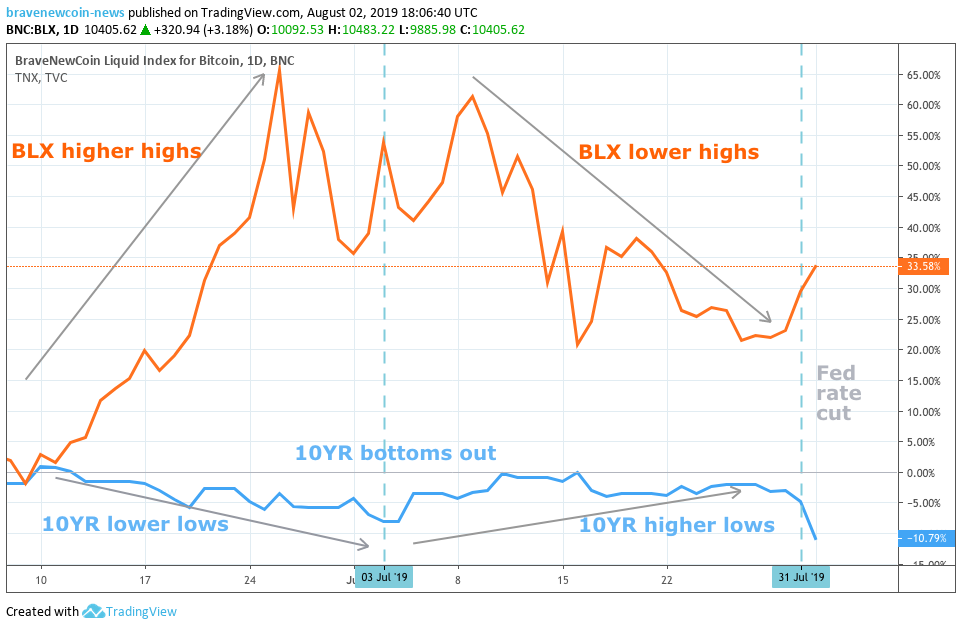

Since the Fed cut the funds rate by 25 basis points down to 2.25% on Wednesday, Bitcoin has rallied by ~10%. This price action follows other safe-haven assets such as gold, the Japanese Yen and Swiss Franc which all got a kick on the announcement, although nothing as big. Although far from perfect, Bitcoin looks like the cleanest dirty shirt in the laundry compared to many other markets.

Legacy Ponzi schemes and the great transfer of wealth

Central banks from the Antipodes to Brussels are fast turning to a monetary policy of financial repression, bringing interest and bond rates down to historic lows and even negative which has the effect of transferring wealth from creditors (savers) to debtors (borrowers). Ray Dalio believes looking at who holds the debts and credits can give us insight into what he calls, paradigm shifts.

"By looking at who has what assets and liabilities, asking yourself who the central bank needs to help most, and figuring out what they are most likely to do given the tools they have at their disposal, you can get at the most likely monetary policy shifts, which are the main drivers of paradigm shifts.”

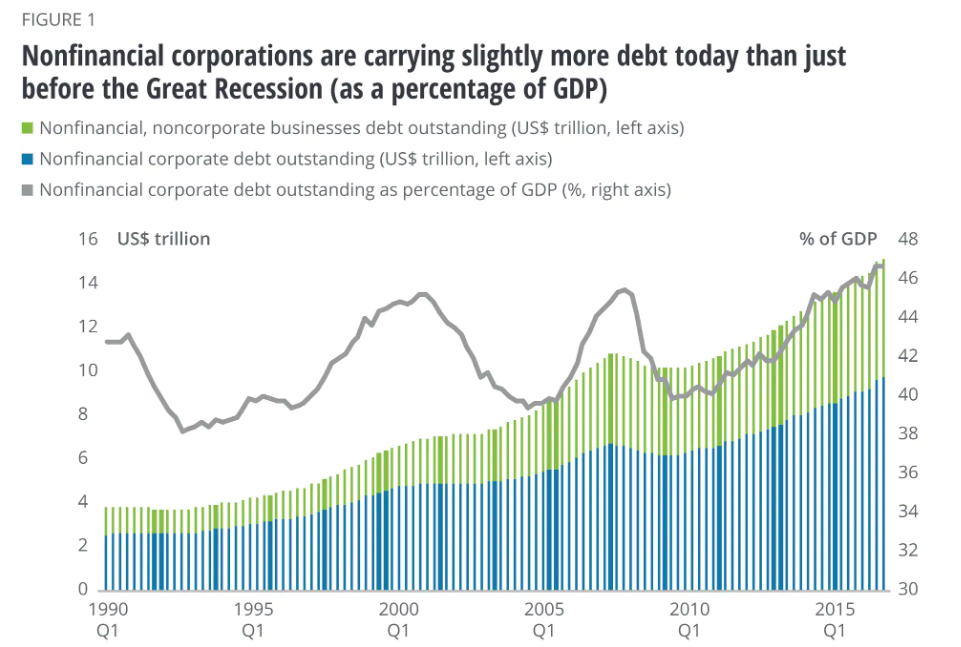

The biggest debtors are corporations.

As a percentage of GDP US corporate debt is the highest in history, using Fed data (chart above) at 47% of GDP (using IMF data the number is close to 75%). Globally there is almost $13 trillion of negative-yielding debt (corporate and national) and many more trillions in debt just above zero.

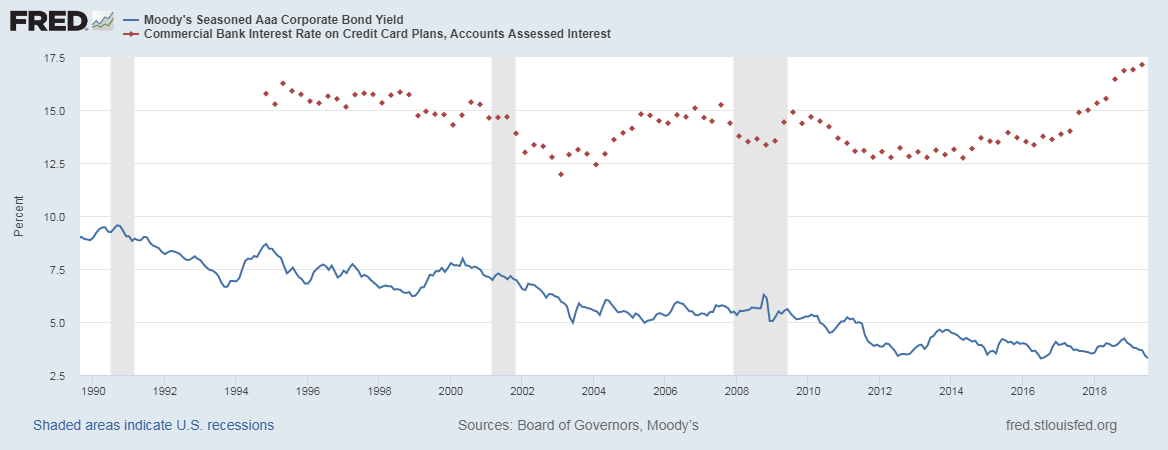

Corporate debt — which has leveraged much of US stock buybacks — is at historic levels due to borrowing interest rates being so low. Meanwhile, consumer borrowing is almost at a record high on credit cards, rising steadily while corporate rates continue to fall.

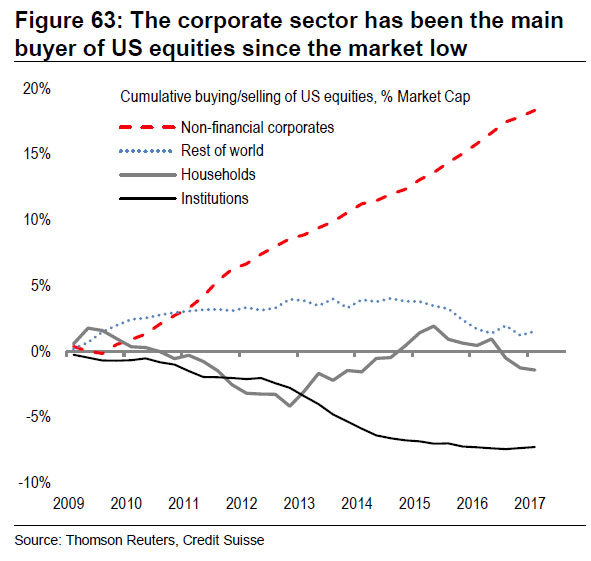

While the private sector has been easing out of debt for the past decade, the corporate sector has been gorging and crucially this has been feeding back into acquisitions and rising asset prices since most government debt has been bought back by the central bank through quantitive easing.

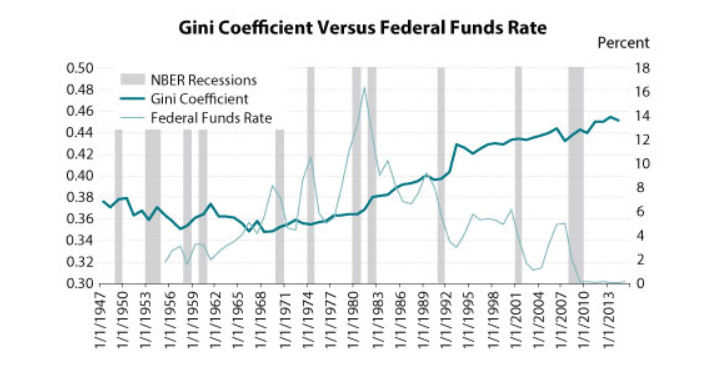

The transfer of wealth in the US brought about by low-interest rates can be seen in the growing inequality gap. The Gini Index is used to measure inequality in a country and it has become highly negatively correlated with the Fed funds rate since the 1980s. In other words, when the interest rate goes down it buoys asset prices owned by the rich and increases inequality.

Negative rates: Open market manipulation

In Europe, over 40%, or €1.4 trillion of corporate bonds now have negative yields and more than 50% of government bonds have negative yields; in effect, being paid to borrow.

These negative yields change the nature of what a bond is. Traditionally a debt instrument in which a government or corporation agrees to pay the holder an annual positive return over the duration of the bond’s lifetime (typically ranging between 2, 5, 10, 20 or 30 years) and the worse the credit rating of the issuer the higher its bond yield to compensate for risk and vice versa.

But if safe sovereign bonds don’t offer a positive yield and risky corporate yields are just slightly more they’re no longer fixed income instruments. Bonds have instead become tools of balance sheet accounting, representing the transfer money between central banks, commercial banks and corporations.

As witnessed in Japan, the first country to experiment with negative interest rates these negative yielding bond markets can endure for decades without any return of significant inflation and without a total collapse of the debt markets.

Housing market manipulation

The primary housing markets in the US, Canada, Ireland, Australia, and New Zealand have been warped by record-low interest rates and the inflow of foreign money, pushing property prices to record multiples of the average income and beyond the reach of the majority of young locals.

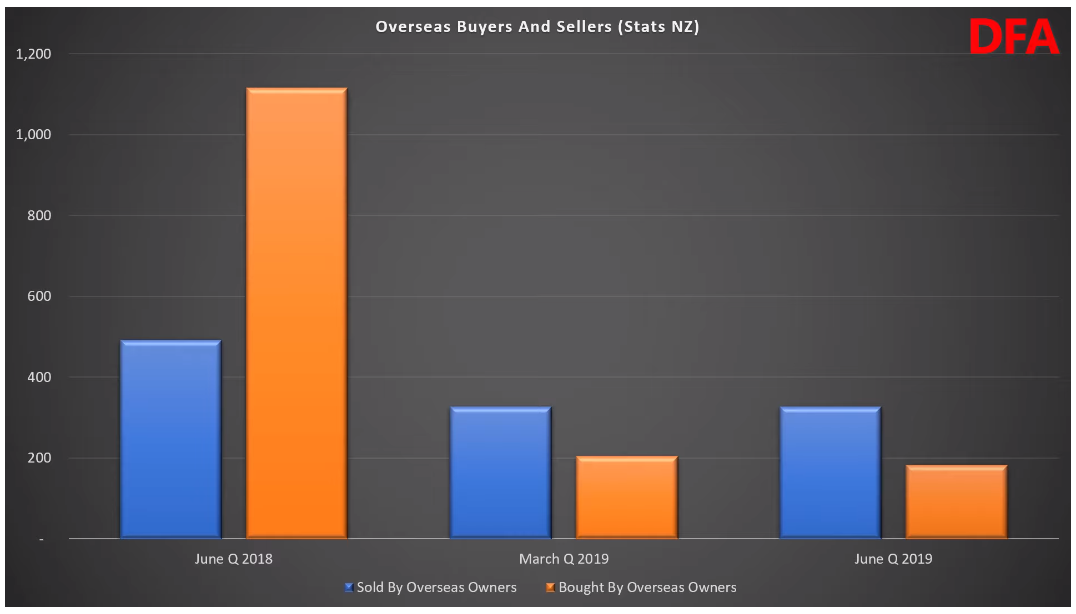

Despite a decade of warning signs, governments in Australia, New Zealand and Canada have just recently introduced higher AML and foreign buyer rules to fend off speculators and money laundering from China which was overheating property markets in their biggest cities. However, these overseas flows provided much of the liquidity in those markets.

Since New Zealand introduced legislation last year that requires non-citizens to apply to buy property the numbers from Statistics New Zealand show an 81 percent drop in overseas buyers in the first three months of 2019 compared to a year ago. Traditionally, many of the overseas buyers in Auckland have been from China, which is ramping up its capital controls and AML monitoring.

Similarly, since introducing an ‘empty home tax’ to ward off foreign speculators house sales volumes in Vancouver plummeted 90% month-on-month in May. The New Zealand, Australian and Canadian primary city housing markets are among the world’s most expensive with values around 9-times the average income.

Property market propaganda

The Reserve Bank of New Zealand and the Reserve Bank of Australia were the first among OECD countries to cut interest rates this year. The banking industry is heavily exposed to the property market in both countries (in NZ it is over 60%) and the major banks in both countries share the same parent companies (the Big Four banks).

Mortage arrears and stress are on the rise in Australia and to alleviate the debt servicing and encourage more borrowing the RBNZ and RBA have brought rates are at record lows in both countries, 1% in NZ and 1.25% in Australia, lower than the emergency levels during the global financial crisis and the possibility of further cuts this year.

To prop up the property market first-time buyers are often encouraged to take 5:1 leverage on a $160,000 position in a housing market (the median Auckland house price is over $800k) they have no experience in and the data on which is skewed by vested interests of media, real estate agents, developers and manipulated by interest rates, debt growth, and offshore capital flows.

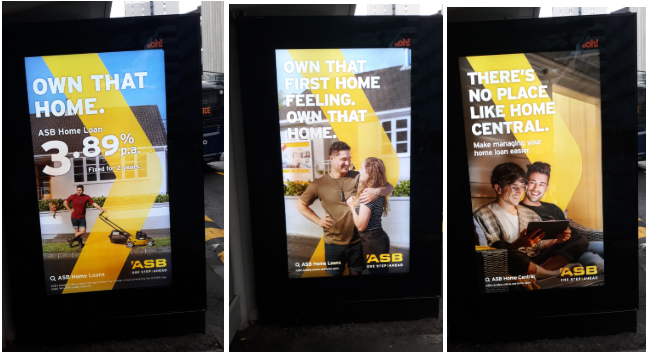

To stop the spread between the prices at the top and bottom ends of the market from closing further commercial banks in New Zealand have engaged aggressive advertising campaigns to lure in first-home buyers to the market to bolster the sales numbers and sustain faith in the market. Using the bait of record-low interest rates the banks are clambering over each other with ads and offers as credit growth slows in New Zealand.

Despite the mainstream media narrative in New Zealand of a housing shortage crisis, especially in Auckland, the opposite is, in fact, true: there is a record overstock of housing inventories and building consents are at all-time highs. However, there is a shortage of affordable homes for first-time buyers.

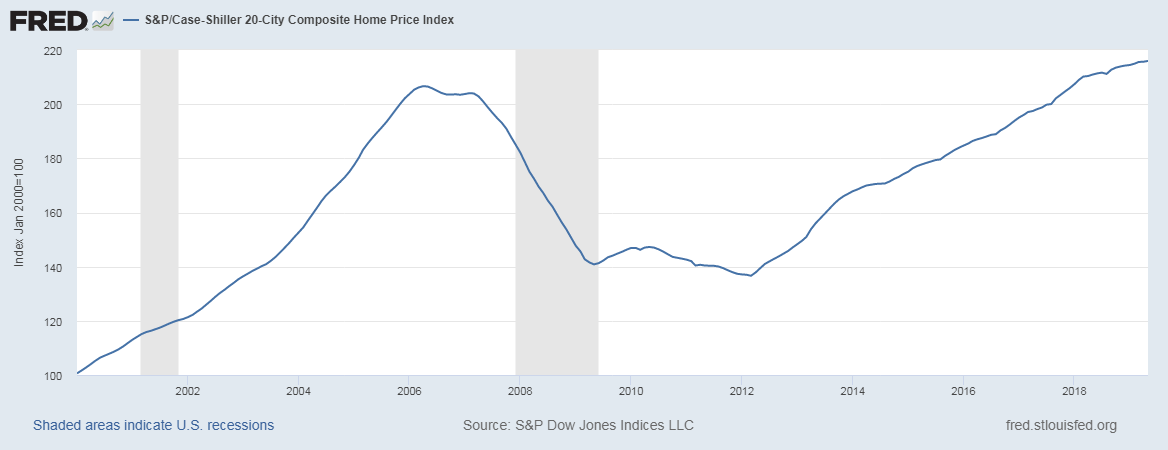

Also, home prices in the US, which led the country into its worst financial crisis since the Depression, are now well above the previous all-time highs of the subprime crisis.

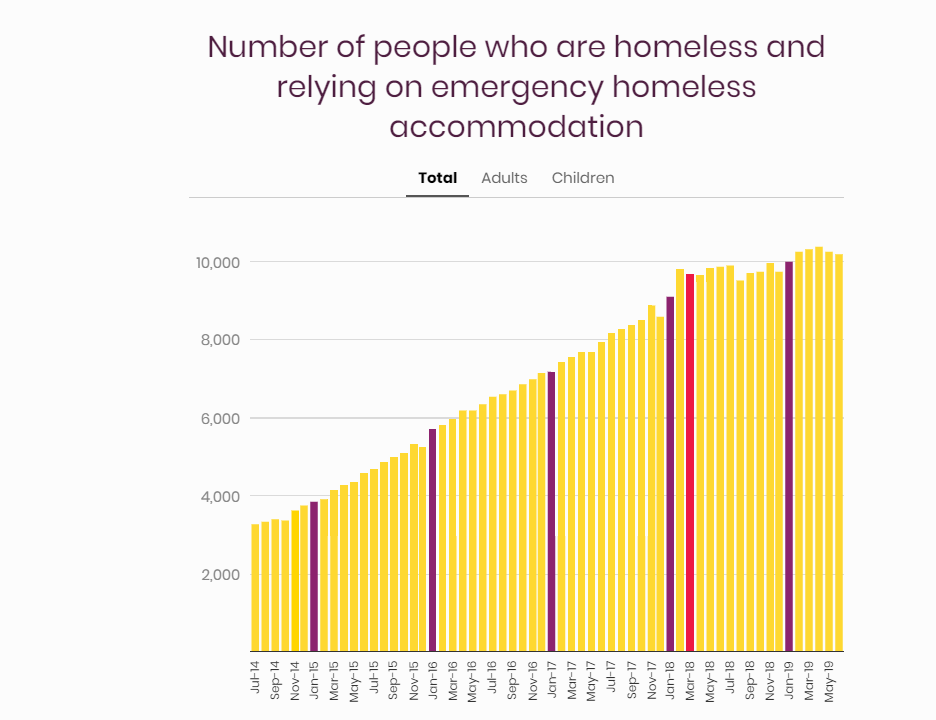

A new kind of Irish property crisis

To see how this might play in New Zealand and Australia we only have to look as far as Ireland before and after its ‘Celtic Tiger’ building boom (2000–07). The burst of the Celtic Tiger bubble left tens of thousands of unfinished houses and apartments across the country, but particularly in Dublin. After the GFC and with interest rates at record lows, venture capital and hedge funds scooped up distressed assets across the world, including many property blocks in Dublin. They sat on the unfinished projects for years, waited for prices and rent to pick back up and slowly drip-fed the supply.

A decade after recovering from the shock of a property boom and bust Ireland now finds itself with a housing crisis of a different kind — undersupply — especially in its capital city Dublin which has pushed competition for property and rents to newly unaffordable levels and resulted in record homeless. In 2018 alone, almost 1,000 families became homeless in Dublin. In 2018 alone, funds spent €1.1b buying up nearly 3,000 residential properties in Ireland which accounted for almost 30% of total property investment that year.

Stock market manipulation

Just as central banks became the largest owners of government bonds in the era of zero-interest, US corporations have become the biggest owners of stock (largely their own) in the stock market.

Most of the cheap credit QE injected into corporations has gone into buying back their shares — to the point where companies have become the biggest holders, or ‘the whales’, in the equity markets. As recently as 1982 it was illegal for companies to buy back their stock, but this was reversed under the Reagan deregulation era. Share buybacks have been attributed to the growing wealth inequality within countries.

Instead of corporate profits going to productive causes, from 2007 through 2016 stock buybacks by 461 companies listed on the S&P 500 totaled $4 trillion, or 54% of total profits. Annual mean remuneration for CEOs doubled in the same period. Share buybacks skew the health of a company as it lifts earnings per share (EPS) even when corporate earnings may have actually declined. Buybacks have been described as a legal form of market manipulation. Next, we will look at the volatility beyond just variance from the mean and how volatility and risk is being masked in the share markets.

Volatility belies risk in stock market

The perceived risk in bitcoin and crypto assets is always attributed to their high volatility. As the finance world bases risk on retrospective VAR (Value at Risk) metrics, which equates high volatility with high risk, crypto assets are off most fund managers’ radars. However, Bitcoin has had a higher Sharpe ratio than any of the FANG stocks since Facebook's IPO in 2012.

Shorting the VIX has been the most popular trade of the decade, with dedicated ETFs even catering to retail traders — this has artificially suppressed the VIX and it sits 13.9 and is over two standard deviations below its long-term average 18.3. However, this low volatility may belie risk. Economist Hyman Minsky’s financial instability hypothesis that “stability can be destabilizing” — or long periods of low volatility induce more debt and risk taking leading to a crisis — was recently empirically backed up by the London School of Economics research:

“The level of volatility is not a good indicator of a crisis, but that relatively high or low volatility is. Low volatility increases the probability of a banking crisis, both high and low volatility matter for stock market crises, whereas volatility–in any form–does not seem to explain currency crises.”>

Crypto assets are undeniably a more volatile asset class than stocks (the thinner the market the more volatile) but that doesn’t underline any imminent market capitulation, unlike the global share markets and even housing markets which are built upon private debt, corporate debt, and share buybacks.

The Sharpe Ratio is a metric closely watched by investors to gauge the return on an asset for the risk taken and, on that metric, Bitcoin has outperformed the FANG stocks since 2012 — smoothing the ups and downs of volatility over the years has yielded twice the returns for the risk taken compared to Facebook. This is opposed to the mainstream narrative of Bitcoin being too risky an asset that investors should be protected from.

Blockchain finance improves transparency

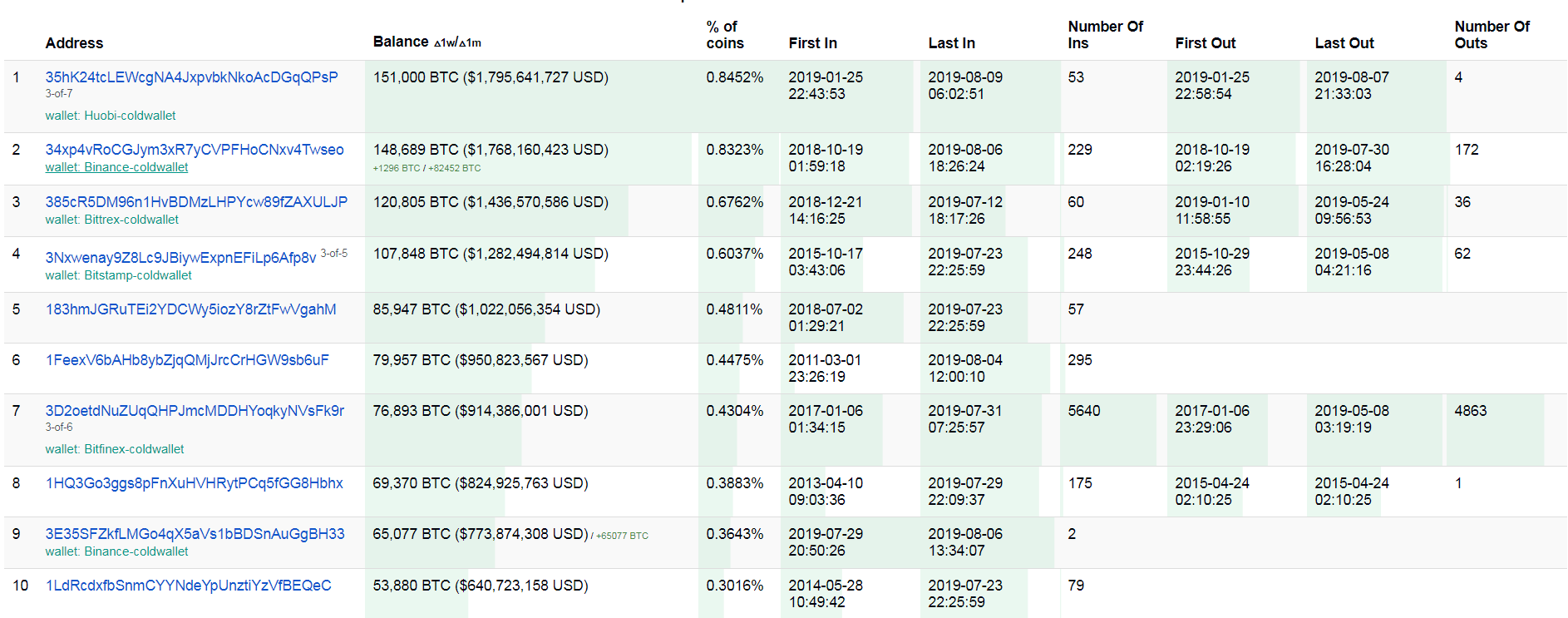

Concern around ‘crypto whales’ (many of whom are early adopters or developers who bootstrapped the project) pushing the market around is justified. Of the top 10 richest bitcoin wallets, 6 of those can be identified as belonging to global exchanges. There are likely more exchanges and over-the-counter (OTC) dealers in the top 20 that are currently unidentified. These exchanges have become the biggest players of BTC, now akin to 'blockchain banks' and they do warrant higher standards and scrutiny than is currently the case.

The open-source nature of blockchain finance is already an improvement on transparency in the legacy markets with open APIs and block explorers allowing a public view into all wallet transactions and holdings. As Bitcoin becomes more 'institutional' the standards of transparency that governments and financial institutions require for auditing cryptocurrency will increase and we may even see all transactions becoming fully identifiable (currently pseudonymous in Bitcoin). We have already seen a move to higher KYC and verification at all reputable exchanges, even the privacy-focused Shapeshift, over the past year.

Investors (and traders) are often put off by the mainstream narrative that bitcoin and other crypto asset markets are manipulated, or a Ponzi scheme that could go to zero. This compares to the housing market and corporate profits which are predicated on the rate of credit growth in economies growing faster than debt servicing indefinitely — and with it exponential GDP growth — so that the new debt coming into the system can pay for the debt outstanding.

Conclusion

For those of the millennial generation and younger the next decade is going to be epoch-defining. We are in the midst of what looks more like a globally interconnected Ponzi scheme and we can either take part or resist and experiment with an alternatives With stocks and property at all-time highs in many OECD countries and bonds with negative yields the implied future returns in these assets over the medium term is negative.

We are still in the early days of blockchain and Bitcoin and yes, there are hidden movements that ideally wouldn’t be there, but do they pose a greater risk to the retail investor than competing with trillion-dollar fund managers and the vested interests of multinational corporations which are aligned with government?

OhNoCrypto

via https://www.ohnocrypto.com

Andrew Gillick, Khareem Sudlow