Maidsafe Price Analysis: Challenges building a decentralized internet

MaidSafeCoin (MAID), is the current native token of the SAFE network (it will eventually be replaced 1-for-1 for the yet to be created Safecoin). The token is the 59th largest digital asset in the world by market capitalization. It currently trades at $0.247 and the market cap of the token is ~68 million USD. The price of the token has risen ~12% year-to-date but has fallen ~8% in the last week.

The MaidSafeCoin ICO presale occurred on April 22, 2014. 10 percent of the total MAID supply was released to the public, raising $8 million worth of BTC. An additional 15 percent was withheld by the founding development team. In January 2015, MAID was the 6th largest token in the crypto ecosystem but over time it has lost its position of prominence.

The SAFE network aims to be a sharing economy for digital resources in a similar vein to the Torrent network, Napster or Gnutella. Decentralized data networks have gained popularity as secure alternatives to Yahoo or Facebook, which can leave users vulnerable to hackers, or having their data used without clear consent. There are several other distributed data storage solutions that use blockchain based monetary incentives to secure their networks. These include Siacoin, Golem, Filecoin and the Tron-hosted Bittorrent token network.

The SAFE network and MaidSafecoin have an unusually long development history. The vision for MaidSafe was initially conceived by Scottish Engineer David Irvine in 2006, predating the Bitcoin whitepaper. Despite this head start, the Maidsafe project is still in alpha development stage 13 years later. It gained some notoriety in nerd culture circles for inspiring the ‘decentralized internet’ solution pitched by Richard Hendricks in later seasons of Silicon Valley.

Within the SAFE network, there are two main participants. Clients, who access features of SAFE such as data browsing, data storage, and money transfers; and Farmers who look after client data until it is requested, and then disseminate it when required for a Safecoin reward.

The basic mechanism of the MaidSafe distributed data storage solution is simply: users upload a file such as a piece of music or a photo, and it is then broken up into interconnected chunks before being hash encrypted and distributed across the network. Redundant copies of the data are also created so that clients can still access the data when farmers are offline.

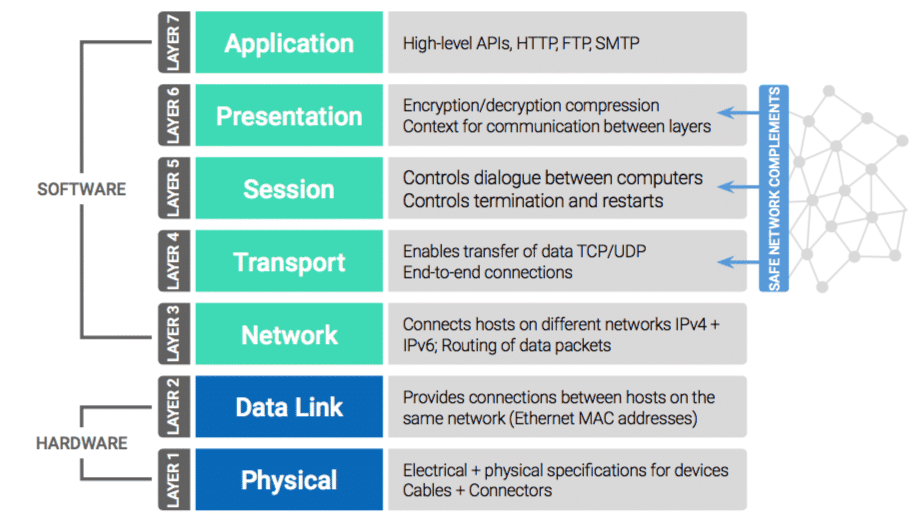

The SAFE network will be deployed as an encryption layer that sits on top of the current internet structure. It allows for autonomous data storage and networking by replacing 3 of the OSI networking layers; Presentation, Session and Transport.

Data on the SAFE network is stored on vaults, managed by the Farmers. This requires bandwidth and CPU power, and because of this, MaidSafe farmers go through a proof-of-resource process to determine their capability to provide for the network.

When users upload a file to the network, such as a photo, it is automatically pieced, hashed, and encrypted. This data is then randomly distributed across the network. Redundant copies of the data are created as well so that if a farmer storing a file turns off their computer acting as a server, users still have access to their data.

When a user wants to access a piece of data on the SAFE network, such as a website or a file, Farmers compete to find the relevant pieces of data and deliver them to the client. If a node is the first Farmer to deliver the goods, then they may be in the running to earn a Safecoin. When a proof-of-resource operation is completed, the name of a random Safecoin appears on the network and can potentially be claimed by the Farmer. If that coin is already owned by someone, then the Farmer receives no coins. However, if the generated coin has no owner, it becomes the Farmer’s reward for their services.

MaidSafe's decentralized data model offers several advantages over traditional data storage solutions. Data is fully encrypted and stored across multiple servers for increased security, users have an added level of anonymity enabled by the encrypted outputs, communication is censorship resistant, and a native currency allows for a straightforward method to funnel data handler rewards, circumventing external factors like permissioned banking systems.

The SAFE network consensus model

The concept for the Protocol for Asynchronous, Reliable, Secure and Efficient Consensus (PARSEC) was released by the MaidSafe team in Q2 2018. Similar to consensus models in networks like Ripple and Hashgraph, PARSEC challenges the Byzantine failure present in traditional PoW networks such as Bitcoin, where there is always a temptation for miners to accumulate enough processing power to attack the networks they operate within, for personal profits, and to the detriment of every other operator in the ecosystem.

The core of the PARSEC model is the use of a ‘gossip’ based mechanism. Nodes gossip/share detailed information about the transaction, and gossip about the gossip, creating a detailed web of historical information regarding transactions running through the network.

The nodes then vote to achieve consensus based on the web of gossip. Gossip-based systems have an advantage in that they minimize interaction between nodes, because it is primarily historical, static data (‘a reputation score’) that is used for the consensus decision.

PARSEC adds elements on top of existing gossip-based fault-tolerant models such as the closed network used by Hashgraph. Mechanisms such as synchronization between an information receiving node, and some other random node in the network, provide an extra security blanket to protect the network against bad actor nodes.

This style of consensus, while providing extra safety to protect against bad actors, has several limitations. It requires the use of ‘well-reputed nodes’, that have been verified to operate on the network. This means that to a certain extent, censorship resistance and decentralization are weakened within SAFE. This is reflected in the ‘vault’ and ‘elder vault’ model used within PARSEC.

As a SAFE network Farmer, a user maintains a ‘vault’ which begins at level 1 and looks after the data of a random group of other users. As a farmer moves from group-to-group, managing different types of data, the level, also known as node age, increases. Proof-of-resource tests the Farmer by storing random pieces of data on their computers. If a Farmer cannot store them properly, the level will be reduced.

The SAFE naturally begins to trust older vaults and once a user’s vault reaches a certain level it can start making decisions within assigned groups.

SAFE network hashing can result in the task assignment ot 2^256 different addresses. These addresses are split into sections and managed by different groups of vaults. The most trusted vaults in the group, the Elders, are required for forming a consensus on important decisions such as splitting up groups, merging with other groups, or handling Safecoin transactions.

Additionally, unlike traditional PoW networks that broadcast a public ledger of how many tokens each wallet owns, Safecoins are actual files on the network. Each Safecoin file contains information on its current owner, but not the entire history of the coin. To change the owner of a file, consensus from a majority of vaults handling that Safecoin file is needed.

Additionally, consensus only needs to be achieved within smaller Quorum slices, containing subgroups of the entire distributed ledger network. This design choice is in place to retain efficiency, scalability and to prevent network bottlenecks, but again leads to ideological challenges because of the inherent centralization this style of consensus creates.

However, PARSEC also appears to operate without a ‘leader’ based system as used by algorithms for networks like Ripple and ICON, meaning power is distributed equally between nodes.

PARSEC, like other elements of the SAFE network, exists primarily as a concept. It remains to be seen the extent to which the consensus model will allow the SAFE network to address challenges like throughput, stable governance and scaling.

https://twitter.com/VladZamfir/status/1001600061107777536 Vlad Zamfir is one of Ethereum’s most recognized and respected developers.

Considerations

It is important to note that external investors looking to buy into the Maidsafe network now do so through buying Maidsafe tokens, the alpha token solution for the SAFE network. MaidSafeCoin (MAID) is a token that was created in a crowdsale in 2014 to support the project. Each MAID will be exchanged for a Safecoin (the token provided to Farmers for their services securing data) when the network launches.

This means that the only utility of the currently buyable Maidsafe coin is as a coupon that can eventually be redeemed for the yet to be issued SAFEcoin. This model also favors early token buyers as there is very little value within the MAID coin once it is bought, so tokens are designed to be bought and held. Demand for the token is driven by the opportunity to ‘lock-in’ a price to buy into the SAFE network once it moves beyond Alpha stages and live Farming launches.

Travis Kling, Chief Investment Officer of Ikigai Capital said, “Owning Ethereum today is a call option on what you think the network is going to be in the future.” MAID offers a similar value proposition, however, the Ethereum ecosystem is far more developed than the SAFE network at this stage and seems like a much safer ‘Call option’ based on current market signals.

The project’s extended development history and inability to create a tangible MVP solution affects the demand for today’s marketplace to put ‘call options’ on the SAFE network. The daily trading volume of MAID tokens on secondary crypto market exchanges is ~USD 400,000, a relatively low amount. Token’s with similar market caps like Aelf, Golem and Enjin-coin tend to have much higher daily trading volumes on exchanges. MAID’s low numbers may suggest illiquidity and challenges around fair pricing.

The builders of the SAFE network have provided its token holding community with development updates to alleviate concerns around the current state of the project and potentially create some fuel for speculative gains.

The latest build of the SAFE network browser, v.014.1 was released on July 11th. The current alpha 2 version of SAFE lets users experiment with features, by first downloading the SAFE browser, like Self authentication (removal of middlemen and external approvals) and Self encryption (no keys or passwords ever leave your machine). It also utilizes features like Disjoint sections, a mechanism similar to sharding, which optimizes scaling the network through splitting responsibility for network functions across multiple nodes.

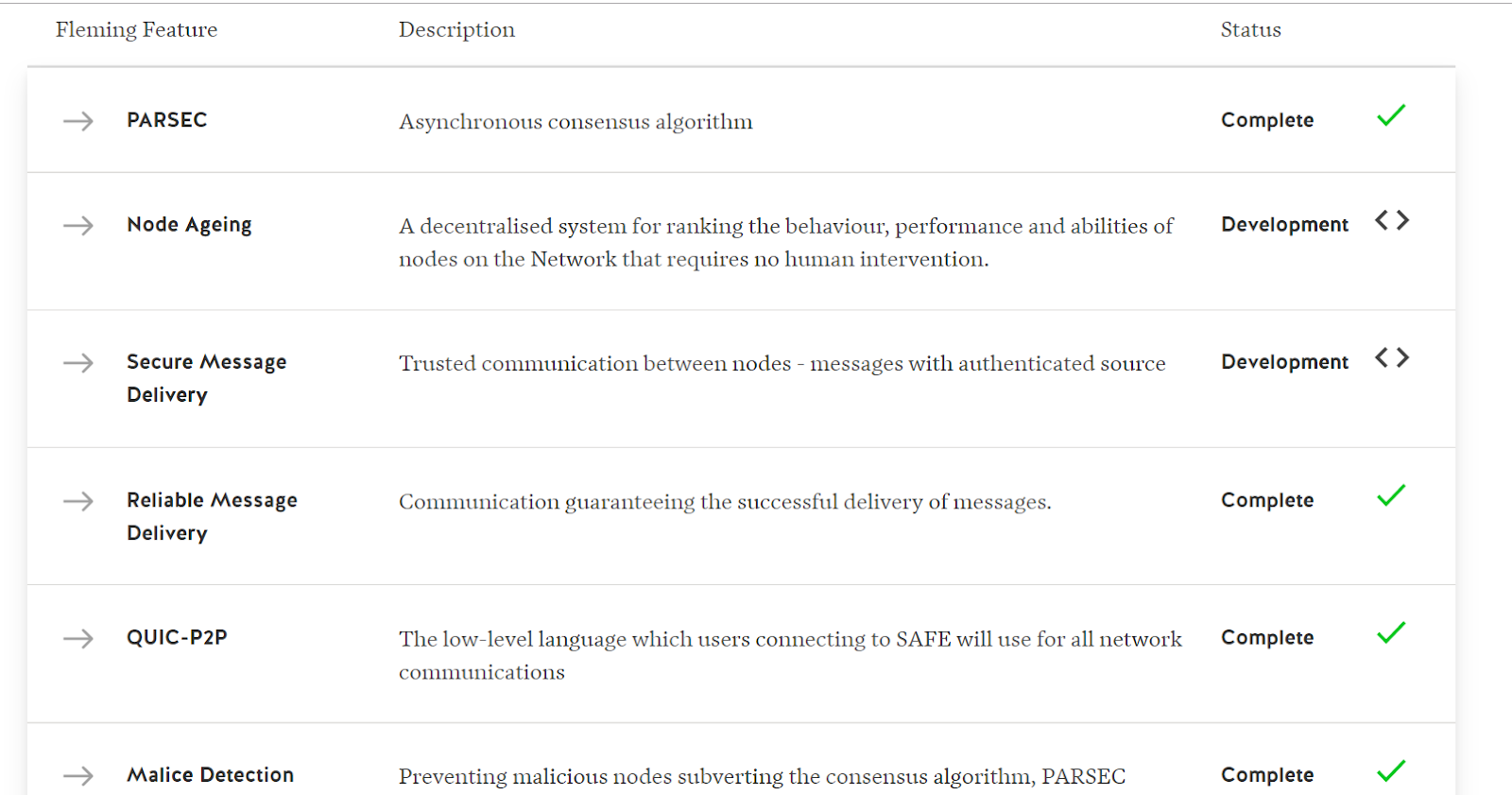

The next major update for the SAFE network will be the release of the Fleming network. This update will not include Farming and the Alpha 2 Network will continue to function alongside the new Fleming network. The new network will allow individuals to run decentralized routing nodes from home.

Fleming will be the first trial implementation of Parsec and the vault quorum-elder vault model. It will also trial the node age model and assignment of nodes to Disjoint Sections, where within them, most senior nodes (elders) are entitled to vote during the PARSEC consensus algorithm.

Source: https://safenetwork.tech/roadmap/

Objective on-chain indicators

NVT signal

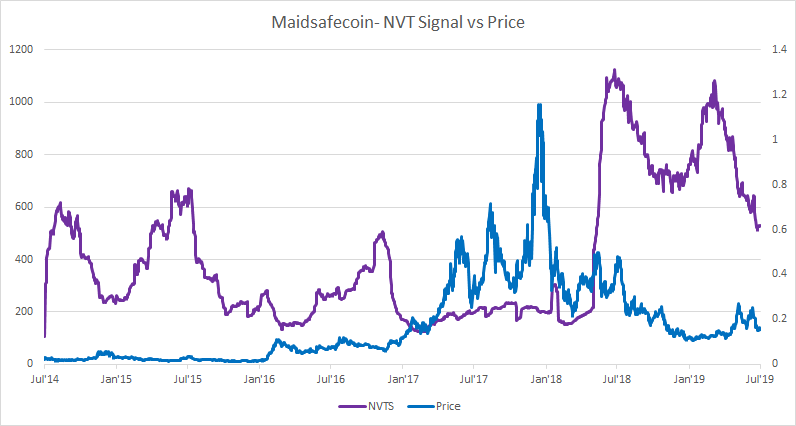

Derived from the NVT (Network Value to Transactions) ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin. It is akin to the price/earnings ratio signals used in traditional equity markets. Crypto markets are prone to bubbles of speculative purchasing, that are not reflective of underlying network performance and activity. The NVT signal is a tool to assess drivers of these patterns.

The NVT signal provides some insight into what stage of a price cycle a token is at. A high NVT signal is indicative of a network that is going through one of these bubble periods and may move towards a position of becoming overbought/overvalued, as market speculation runs out of steam.

The NVT signal for Maidsafe is extremely high suggesting long term overvaluation. This is somewhat unsurprising given that there is no real incentive to use the token on-chain (or off-chain). MAID safe is still a token hosted on top of Bitcoin’s OMNI layer and can be used for value transfers between users, so a falling NVT signal may be a sign of increasing demand to accumulate MAID tokens as a call option.

The NVT signal for the network is trending sharply downwards which leans bearish, however, because most of the token’s value is based on speculation of future utility this may not be a strong indicator. Until the SAFE network is launched it is unlikely that the network’s fundamentals will come close to aligning with the MAID token’s external value.

PMR

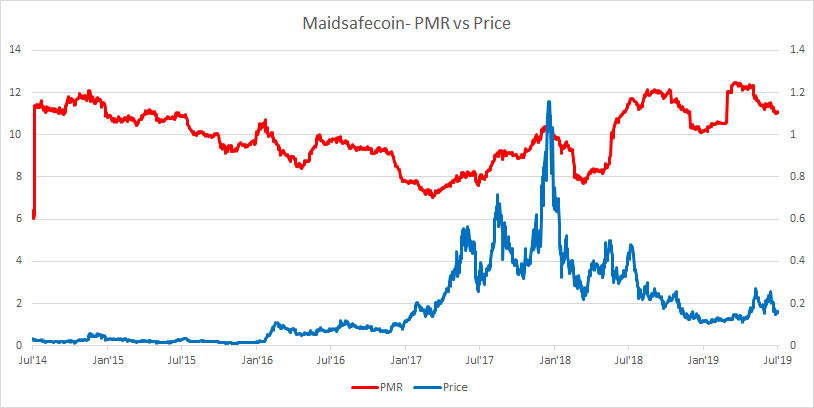

Metcalfe's law is a measure of the connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

The PMR for the MAID token is high and trended between 10-12 points for most of the network’s existence. This, like the NVT signal, suggests that the network is long term overvalued.

As a two-sided marketplace, incentives are required for both vault nodes and data storage users. Both players in the ecosystem will need to be active in large groups when the network launches to create organic value and network effects for the token. Cryptocurrency network effects increase when new users join and strengthen the network, making it more valuable for existing users. The most direct network effects are improved liquidity and utility. More daily active users can be indicative of increased demand for data storage and increased demand to earn Farming rewards. Factors like the expansion of counterparties to store and confirm data may be a driver of short term user adoption and active address growth.

Exchanges and trading pairs

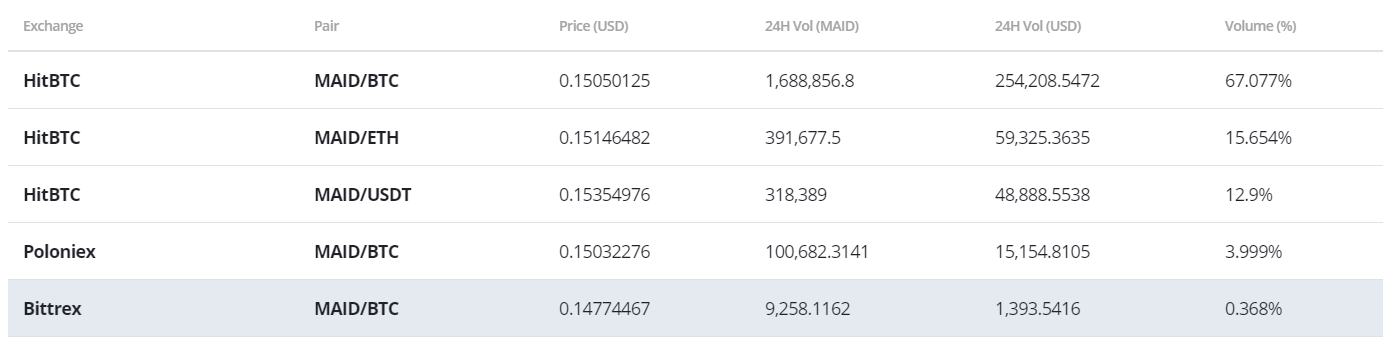

The most popular trading option for MAID is BTC with the pair handling ~71% of the daily trading volume. The second most popular market is the MAID/ETH pair. Together the top two pairs make up over 87% of the daily trading volume. The total USD value of the daily volume of the entire MAID trading market is just ~USD 382,000.

There are only 6 active trading market places to buy and sell MAID coins, suggesting a lack of active trading. HitBTC dominates MAID trading handling the top 3 pairs for the token. It is also available for trading on well-established altcoin platforms Poloniex and Bittrex.

Technical Analysis

Moving Averages and Price Momentum

Sitting at $0.148, MAID has practically given away all its 2019 gains. On the 1D chart, MAID’s golden cross, which occurred in late-May, is in real danger of reversing into a death cross (black circle). Additionally, price is firmly below both 50 and 200 day EMAs, which supports the notion of an impending death cross. Such a reversal is likely to see price retest previous lows of $0.12 in the coming weeks.

Since the bottom, price has followed Fibonacci retracement levels fairly closely. Since late-May, price has failed to recover key Fibonacci levels, which has resulted in price drifting downward in a linear trend. Given the current momentum, a retest of the 0.786 level or $0.142 seems inevitable in the near future. If the negative tide is to subside, price will need to recover the 0.618 level of $0.169.

On the 1D chart, the volume flow indicator (VFI) has pierced beneath 0 and trending downward. Additionally, the VFI level of -5 (black line) has acted as historical support, but has been breached as well. This trend is likely to continue until price reaches the 0.786 level of $0.142.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are bearish: price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Currently, price is demonstrably beneath the Kumo cloud and showing few signs of reversing the trend. However, one hope is that RSI is currently oversold and attempting to bounce (black circle) from these levels. If MAID can use a bounce to recover the 0.618 Fibonacci level of $0.169, then price would be better positioned for a legitimate Kumo breakout re-attempt. A key level to watch for a new breakout attempt is $0.195. Support levels are $0.145 and $0.134.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are bearish: price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and price.

The slower settings offer a very similar picture for MAID.

Conclusion

The MAID token is attached to one of the oldest and decentralized projects in the distributed ledger space. At one point it was a top 10 digital asset by market cap, but it has lost traction in recent times, as competitors have overtaken it.

It is difficult to fully assess the potential of the SAFE network project because it remains in alpha with no monetary incentives to secure or participate in the network. The development of an MVP seems to be progressing slowly. Consistent updates from the team suggest that a tangible, and not conceptual, version of the SAFE network may yet launch.

The technicals for MAID are very bearish and offer few signs of revival beyond selling relief bounces from oversold RSIs and Fibonacci support levels. Without a demonstrable improvement, a new Kumo breakout is highly unlikely over the coming weeks. Key support levels to enable the aforementioned “long shot” Kumo breakout are $0.145, $0.142, and $0.134.

OhNoCrypto

via https://www.ohnocrypto.com

Aditya Das, Khareem Sudlow