Have STO’s Delivered on Their Promise?

Coinspeaker

Have STO’s Delivered on Their Promise?

Security Token Offerings (STOs) were believed by many to be supposed messiah for the Crypto space and the harbinger of adoption in traditional finance outlets. They were the next revolutionary step in Blockchain-based fundraising, and who could blame them?

STOs, in essence, offered increased cost efficiency than conventional securities while at the same time enabling improved access and liquidity, even the creation of an entirely new market through tokenization of assets.

Hence, the hype around STOs was with sound financial reasoning but…

Has Adoption of Security Token Offerings Taken Off?

Looking back at data on Blockchain-based fundraising is in, and it reveals a rather grim story about STOs.

Number of Token Offerings

Source: Source: Blockchain and crypto H1 2019 report

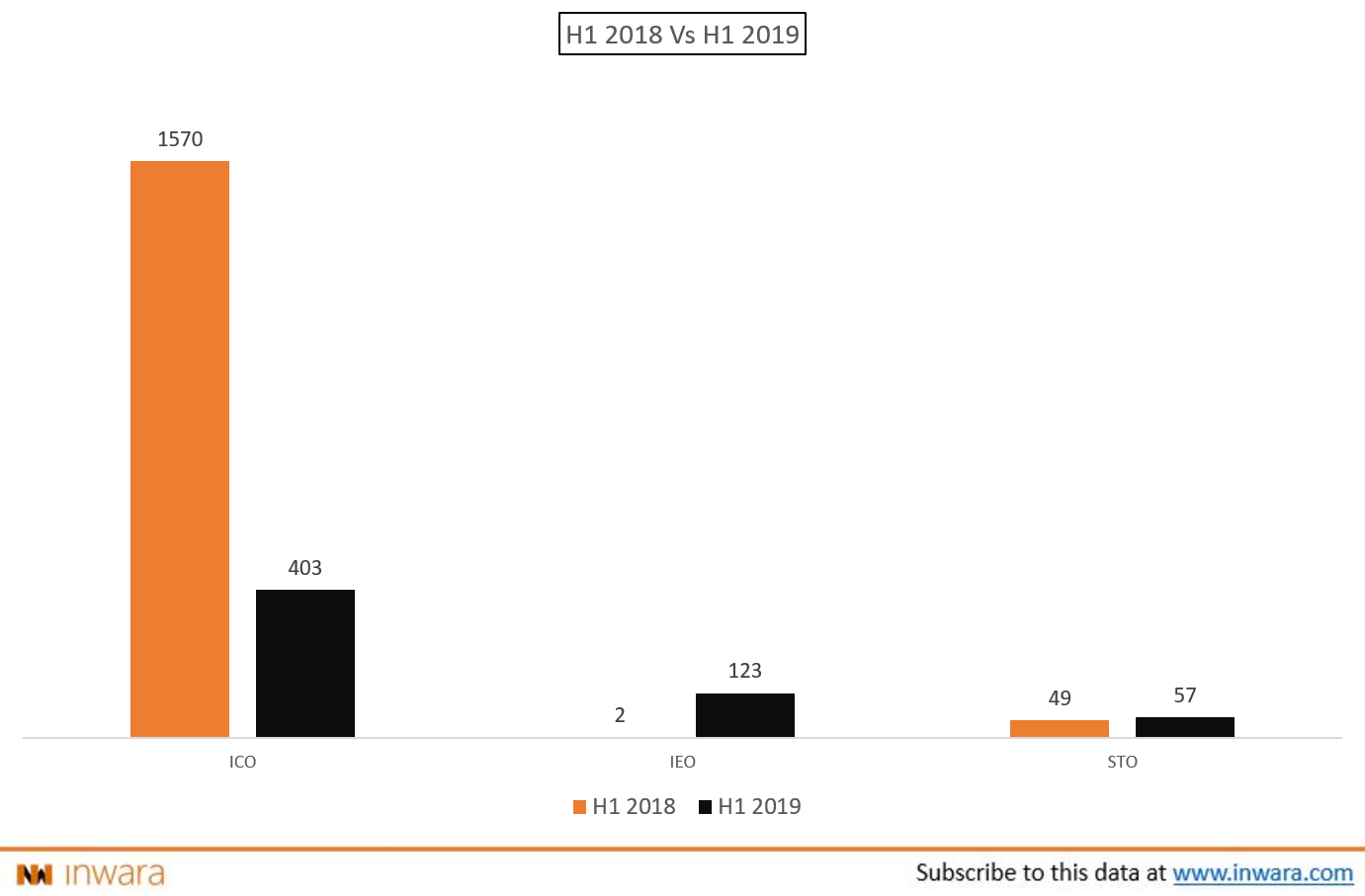

Early 2018, witnessed the demise of the ICO, as investors were exposed to the extreme downsides of ICOs as a fundraising tool, many losing millions in funding and no legal resort to take action. In H1 2018, as many as 1570 Initial Coin Offering projects (that’s almost 10 a day, every day!) were launched but in a year’s time, this number has shrunk by as much as 74.3% to 403 token offerings in H1 2019 (which is still over 2 token sales a day!).

Despite having these added advantages, STO numbers remained almost the same with just 57 token offerings during H1 2019 against 49 being launched in H1 2018 – an increase of just 16% YoY. While this is conventionally viewed as a major improvement, this growth doesn’t match up to the excitement around STOs or for that matter those around IEOs (the beast we can no longer ignore!).

STOs, clearly, have obvious benefits over ICOs, so what’s stopping their mass adoption?

Here are some of the key challenges:

- One of the biggest challenges that Security offerings face is compliance within jurisdictional laws or frameworks. For example, a project-based in Estonia launches an STO and makes the token-purchase available in the USA. But without ensuring compliance with US securities laws the company runs the risk of being hauled up by the SEC.

- STOs can be very expensive to launch when compared to an ICO, primarily because of the need to include a slew of stakeholders that are critical to the process from under-writers to legal experts to sometimes even financial institutions!

- ICOs were a huge success from an adoption PoV fundamentally due to the low barrier of entry for investors but the same can’t be claimed of STOs. Many jurisdictions require investors in STOs to be accredited to be able to take part in the token offering.

Promised a lot, delivered a little. The is the tune that Blockchain projects have danced to and STOs are no different.

Have STO’s Delivered on Their Promise?

OhNoCrypto

via https://www.ohnocrypto.com

CoinSpeaker Staff, Khareem Sudlow