Seeking Income In High Yield Bonds

Global high yield bonds sold off amid the latest spike in market volatility, along with other risk assets. Yet this does not change our view that exposure to the asset class is important for fixed income investors in an environment where carry, or coupon income, is becoming the main driver of bond returns.

Chart of the week

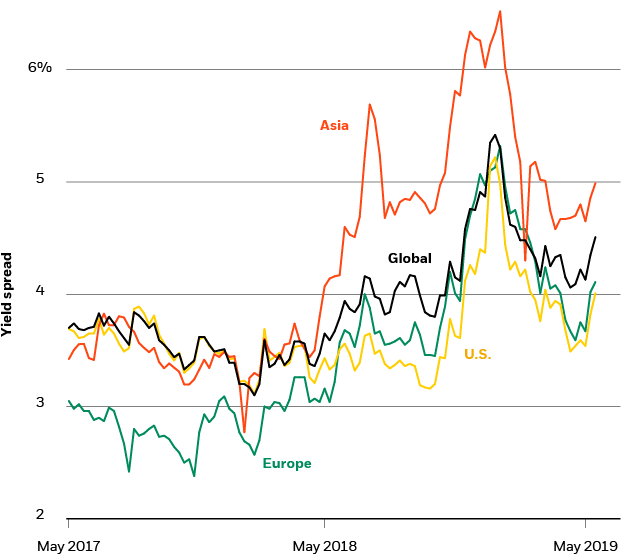

Global high yield bond spreads, 2017-2019

Past performance is not a reliable indicator of current or future results. It is not possible to invest directly in an index. Sources: BlackRock Investment Institute, with data from Bloomberg Barclays, May 2019. Notes: The spread is the difference between the yield of a certain index and that of corresponding comparable-duration government bonds. The indexes used are the Bloomberg Barclays Global High Yield, Asia High Yield, U.S. Corporate High Yield and Pan-European Corporate High Yield indexes.

The recent selloff in global high yield is evident in the small upticks in the far right of the chart above. High yield bond spreads - the difference in yields between high yield bonds and comparative government bonds - have widened, as perceived safe havens outperformed. These moves come amid a longer-term widening trend in credit spreads over the past couple of years. We see rates generally stable in the near term, with income taking back the reins from price changes as the key driver of credit returns in the quarters ahead, as we write in our latest Fixed income strategy update Carry is king. The patient stance of global monetary policymakers amid ongoing low inflation supports this view. A slowing, but still growing global economy - with recent data pointing to signs of European and Chinese growth pickups - does too.

How the regions stack up

A flare-up in U.S.-China trade tensions sparked recent market volatility - and the accompanying selloff in high yield bonds and other risk assets. We see a narrow path ahead for risk assets to move higher at this late stage of the business cycle, but escalating trade conflicts could make this path even narrower (see our geopolitical risk dashboard for more on trade tensions). We believe a balanced, diversified approach is key to investing in this environment. For fixed income investors in particular, we see high yield bonds as a key part of this approach, given their income-providing potential.

We see reasons to like U.S. high yield. First-quarter corporate earnings results pointed to healthier fundamentals in high yield issuers. These include signs of declining gross leverage and near-record high levels of interest coverage - a measure of issuers' ability to service their debt. In addition, the longer-term credit quality of the index has improved. Evidence includes a shift in issuance toward higher quality (less CCC-rated bonds), shorter maturities and larger individual issues. Fewer leveraged buyouts and an increase in the share of secured bonds are also positives. We believe this improved risk profile should support greater stability in the asset class's performance. We are more cautious on European high yield. Europe's relatively greater vulnerabilities to geopolitical risks and slower growth make for a less attractive risk/reward profile, in our view. Yet we see the asset class as attractive from a fixed income portfolio perspective, particularly for U.S. dollar-based investors. Spreads on euro high yield bonds are roughly 1 percentage point higher than their U.S. counterparts after adjusting for different ratings quality, we estimate. And interest rate differentials mean U.S. investors can gain an extra 3 percentage points in yield after hedging euro exposure back into dollars.

Lastly, we see attractive income potential in Asia high yield, despite the risk of a further deterioration in the U.S.-China trade relationship. Corporate fundamentals have improved since 2017 due to strong earnings, following years of deterioration. Bottom line: We see high yield bonds as an attractive source of income in a world where carry is king. And we advocate a balanced approach, given geopolitical risks such as global trade tensions - and potential for further late-cycle bouts of volatility.

Week In Review

- President Trump signed an executive order banning U.S. telecoms firms from installing foreign-made equipment that poses a threat to national security. The U.S. also added a key Chinese telecom firm to its "entity list," potentially barring U.S. companies from dealing with it. The White House delayed a decision on whether to impose tariffs on imported cars and parts to allow for more time for trade talks with the EU and Japan. And the U.S. said it would lift steel and aluminum tariffs on Mexico and Canada.

- Crude oil prices rallied on supply squeeze concerns ahead of OPEC discussions over the weekend, and energy stocks outperformed. Saudi Arabia said drones attacked its oil facilities and warned the attacks undermined efforts to resolve Gulf tensions.

- Economic data last week were mostly disappointing. April economic activity data in China surprised to the downside across indicators, while April U.S. retail sales and industrial production came in lower than expected. First-quarter gross domestic product (GDP) data for the eurozone and Germany were broadly in line with expectations and suggest a bottoming out of growth in Europe.

Global snapshot

Weekly and 12-month performance of selected assets

| Equities | Week (%) | YTD(%) | 12 Months (%) | Div. Yield |

|---|---|---|---|---|

| U.S. Large Caps | -0.7% | 15.0% | 7.3% | 2.0% |

| U.S. Small Caps | -2.3% | 14.4% | -4.2% | 1.6% |

| Non-U.S.World | -0.7% | 9.3% | -6.7% | 3.3% |

| Non-U.S.Developed | 0.2% | 10.6% | -5.8% | 3.5% |

| Japan | 0.0% | 5.6% | -9.6% | 2.5% |

| Emerging | -3.5% | 3.8% | -10.4% | 2.9% |

| Asia ex-Japan | -3.4% | 5.0% | -10.6% | 2.7% |

| Bonds | Week (%) | YTD (%) | 12 Months (%) | Yield (%) |

|---|---|---|---|---|

| U.S. Treasuries | 0.4% | 2.6% | 6.4% | 2.4% |

| U.S. TIPS | 0.3% | 3.7% | 4.3% | 2.5% |

| U.S. Investment Grade | 0.4% | 6.1% | 7.9% | 3.6% |

| U.S. High Yield | -0.1% | 8.2% | 6.1% | 6.4% |

| U.S. Municipals | 0.3% | 4.2% | 6.8% | 2.2% |

| Non-U.S. Developed | -0.5% | 1.1% | 0.0% | 0.8% |

| EM & Bonds | 0.1% | 7.2% | 7.7% | 6.0% |

| Commodities | Week | YTD (%) | 12 Months | Level |

|---|---|---|---|---|

| Brent Crude Oil | 2.3% | 34.2% | -8.9% | $72.21 |

| Gold | -0.7% | -0.4% | -1.0% | $1,278 |

| Copper | -1.1% | 1.5% | -12.0% | $6,056 |

| Currencies | Week | YTD (%) | 12 Months | Level |

|---|---|---|---|---|

| Euro/USD | -0.7% | -2.7% | -5.4% | 1.12 |

| USD/Yen | 0.1% | 0.5% | -0.6% | 110.09 |

| Pound/USD | -2.2% | -0.3% | -5.9% | 1.27 |

Past performance is not a reliable indicator of current or future results. It is not possible to invest directly in an index.

Source: Thomson Reuters DataStream. As of May 17, 2019.

Notes: Weekly data through Friday. Equity and bond performance are measured in total index returns in U.S. dollars. U.S. large caps are represented by the S&P 500 Index; U.S. small caps are represented by the Russell 2000 Index; Non-U.S. world equity by the MSCI ACWI ex U.S.; non-U.S. developed equity by the MSCI EAFE Index; Japan, Emerging and Asia ex-Japan by their respective MSCI Indexes; U.S. Treasuries by the Bloomberg Barclays U.S. Treasury Index; U.S. TIPS by the U.S. Treasury Inflation Notes Total Return Index; U.S. investment grade by the Bloomberg Barclays U.S. Corporate Index; U.S. high yield by the Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index; U.S. municipals by the Bloomberg Barclays Municipal Bond Index; non-U.S. developed bonds by the Bloomberg Barclays Global Aggregate ex USD; and emerging market $ bonds by the JPMorgan EMBI Global Diversified Index. Brent crude oil prices are in U.S. dollars per barrel, gold prices are in U.S. dollar per troy ounce and copper prices are in U.S. dollar per metric ton. The Euro/USD level is represented by U.S. dollar per euro, USD/JPY by yen per U.S. dollar and Pound/USD by U.S. dollar per pound.

Week Ahead

| Date: | Event |

|---|---|

| May 20 | Japan GDP |

| May 22 | FOMC minutes |

| May 23 | U.S., eurozone and Japan Purchasing Managers' Index (PMI) reports; Germany Ifo; India general election results |

| May 23-26 | European parliamentary elections |

Our attention this week is on the global growth picture. European business surveys will be crucial to watch this week, with the preliminary PMIs providing the first reading of economic activity in May. We expect European growth to stabilize and pick up in the second quarter, as Chinese economic activity finds firmer footing and as our nowcast of eurozone growth is showing signs of bottoming out. Also in focus this week: the European parliamentary elections. We expect a strong showing from populist parties, which may negatively impact the pan-European initiative (read more on the European fragmentation risk).

Asset class views

Views from a U.S. dollar perspective over a three-month horizon

| Asset Class | View | Comments | |

| Equities | U.S. | A slowing but still growing economy underlies our positive view. We prefer quality companies with strong balance sheets in a late-cycle environment. Health care and technology are among our favored sectors. | |

| Europe | Weak economic momentum and political risks are still challenges to earnings growth. A value bias makes Europe less attractive without a clear catalyst for value outperformance, such as a global growth rebound. We prefer higher-quality, globally oriented firms. | ||

| Japan | Cheap valuations are supportive, along with shareholder-friendly corporate behavior, central bank stock buying and political stability. Earnings uncertainty is a key risk. | ||

| EM | Economic reforms and policy stimulus support EM stocks. Improved consumption and economic activity from Chinese stimulus could help offset any trade-related weakness. We see the greatest opportunities in EM Asia. | ||

| Asia ex Japan | The economic backdrop is encouraging, with near-term resilience in China and solid corporate earnings. We like selected Southeast Asian markets but recognize a worse-than-expected Chinese slowdown or disruptions in global trade would pose risks to the entire region. | ||

| Fixed Income | U.S. government bonds | We are cautious on U.S. Treasury valuations, but still see the bonds as important portfolio diversifiers. We see recent moves lower in yields as excessive and advocate patience before increasing exposure. We prefer shorter-dated and inflation-linked bonds and expect a gradual yield curve steepening, driven by still-solid U.S. growth and the Fed's stated willingness to tolerate temporary inflation overshoots. | |

| U.S. municipals | We see coupon-like returns amid a benign interest rate backdrop and favorable supply-demand dynamics. New issuance is lagging the total amount of debt that is called, refunded or matures. The tax overhaul has made munis' tax-exempt status more attractive in many U.S. states, driving inflows. | ||

| U.S. credit | Increased demand for income amid stable monetary policy, signs of more conservative corporate behavior and constrained supply remain supportive. We prefer an up-in-quality stance overall, but recent spread widening may also offer an attractive opportunity in BBB-rated credits. We favor bonds over loans in high yield. | ||

| European sovereigns | Low yields, European political risks, and the potential for a market reassessment of pessimistic euro area growth expectations all make us wary on European sovereigns, particularly peripherals. European sovereign bonds offer an attractive income opportunity for U.S.-dollar -based investors on a currency-hedged basis. | ||

| European credit | "Low for longer" ECB policy should reduce market volatility and support credit as a source of income, yet valuations are relatively rich after a rally this year. We prefer high yield credits, supported by muted issuance and strong inflows. Euro high yield also offers a significant spread premium to its U.S. counterparts. | ||

| EM debt | Prospects for a Chinese growth turnaround and a pause in U.S. dollar strength support both local- and hard-currency markets. Valuations are attractive despite the recent rally, with limited issuance adding to positives. Risks include worsening U.S.-China relations and slower global growth. | ||

| Asia fixed income | We favor investment grade in India, China and parts of the Middle East, and high yield in Indonesia. Portfolio rebalancing could cause material capital inflows into China, as the country opens its markets to foreign capital. | ||

| Other | Commodities and currencies | * | A reversal of recent oversupply is likely to underpin oil prices. Any relaxation in trade tensions could boost industrial metal prices. We are neutral on the U.S. dollar. It has perceived "safe-haven" appeal but gains could be limited by a high valuation and a narrowing growth gap with the rest of the world. |

* Given the breadth of this category, we do not offer a consolidated view.

This post originally appeared on the BlackRock Blog.

via https://www.ohnocrypto.com/ @, @Khareem Sudlow